Bitcoin is the only global free market.

This chart shows what happens when you let markets free.

The majority are still asleep, preferring 'stable' markets provided via government manipulation of interest rates, money supply and accounting.

"Volatility is vitality", nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m

If you know, you know.

My daughter thought a pomegranate was a Pop a Grenade.

Recently there are virtually no CoinJoin transactions shown by Mempool Goggles on https://mempool.space

Anyone want to venture a theory as to why this might be?

Are bitcoin privacy tools failing in terms of usage growth, or are people using other methods like Lightning/Liquid to improve chain obfuscation...

nostr:npub1vadcfln4ugt2h9ruwsuwu5vu5am4xaka7pw6m7axy79aqyhp6u5q9knuu7 nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx nostr:npub1tr4dstaptd2sp98h7hlysp8qle6mw7wmauhfkgz3rmxdd8ndprusnw2y5g

People are currently infatuated with Micro Strategy / MSTR "because it is a 1.5 leverage play on bitcoin", and are in (deserved) admiration of nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m for beating the S&P 500 so convincingly.

I know people close to me who have worked hard and saved bitcoin, but are now being tempted to exchange BTC for MSTR, spurred on by influencers like American nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs (I'm a fan) and his latest strong endorsement.

But, MSTR is nothing like BTC. You sell 1 BTC and buy the equivalent value MSTR. You now own a security that is holding ~0.35 BTC on your behalf. The 'BTC yield' isn't yield on your 1 BTC. It is growing the 0.35 BTC up a little higher each year, but nowhere near the original 1 BTC you had.

Yes, I understand Micro Strategy is offering a service that is of value "like an oil company" (see latest Micro Strategy Earnings Call) and therefore trades at a premium. But this is pure speculation just like buying any other company share. The calculation is whether MSTR will generate more value with his company on the 0.65 BTC (the non-BTC treasury part of your 1 BTC investment) than holding the 0.65 BTC would. And in Saylor's own words about other companies, that means MSTR needs to compound more than 29% a year going forwards in terms of company value. That's quite a hurdle - one that very few companies in history have achieved over the long term.

There are good arguments on both sides regarding MSTR, the value the company provides and therefore its premium.

BUT BEFORE SELLING THE SCARCEST FINANCIAL ASSET on earth, one with no counterparty or company director risk, for a speculative asset, one should just THINK VERY HARD.

You may never be able to get the BTC you sold back again.

(disclaimer: I hold both BTC and MSTR - but MSTR only where I can't hold BTC)

Welcome to Nostr, and the land of freedom.

I haven't been this optimistic for years (even though I'm not even in the US).

Free speech > Censorship

Independent media/thought > Mass media propoganda/psychosis

Economic politics > Identity politics

Hard money > Ponzi money

Individuals > State

Ability > Accreditation

Producing > Grifting

Peace > War

Forget the personalities and the name calling. Yesterday renewed my optimistic. Thank you USA!

Free speech > Censorship.

Real politics > Identity politics.

Hard money > Ponzi money.

Producing > Grifting.

Peace > WW3.

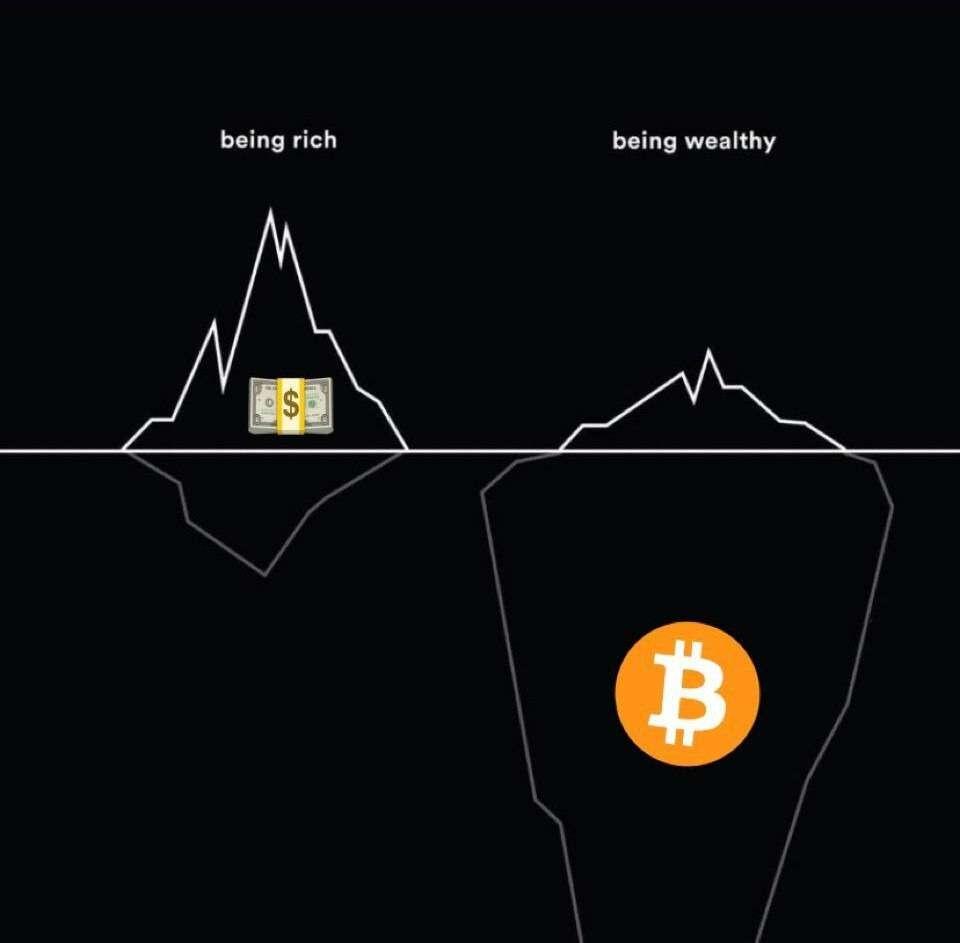

It is becoming increasingly obvious which of the sound monies is going to win.

JUST ADDED: “Bitcoin is Time” (2021) by nostr:npub1dergggklka99wwrs92yz8wdjs952h2ux2ha2ed598ngwu9w7a6fsh9xzpc

One of the best articles from one of the best thinkers in Bitcoin.

nostr:nprofile1qqsxu35yyt0mwjjh8pcz4zprhxegz69t4wr9t74vk6zne58wzh0waycpz9mhxue69uhkummnw3ezuamfdejj7qg4waehxw309ahx7um5wghx77r5wghxgetk9uq3samnwvaz7tmxd9k8getj9ehx7um5wgh8w6twv5hsj7hdd2, your place at the high table is well deserved. Thank you for all you do in this space.

.

h/t x.com/bitcoin__apex

Americans can't afford a house. Which of these is the reason?

- Houses have become more valuable

- Money has become less valuable (due to central bank inflating the money supply via printing/QE, with salary rises unable to keep up)

I've worked out the code that the institutions are using in their bitcoin trading algorithms. Here's the whole source code:

const price = 58000;

Welcome.

I like the nerd handle plus cool pic combo. 🙂

Vipassana meditation.

Look it up. Do one of their incredible (free, donate at the end if you get anything out of it) 10 day starter courses.

Very intense, but it literally changes your brain wiring and sets you up for your own mediation going forwards. I did the course 10 years ago, and I'm still practising every morning.

Good to have you on Nostr.

Got your details from nostr:npub13fz04jej7nktvtvg24dj926a5ctcmaw6ekp9028eux3pz3csxdrqgd77yu as a man who knows about tax AND bitcoin. A much needed combination as part of the orange pilling toolbox.

Chancellor of UK has come up with a genius plan for reducing the gigantic UK government debt.