How much should we trust Saylor? That’s the question top of my mind tonight…

Tether, as the 7th largest holder of US treasuries, will be an incredibly credit worthy institution running the MSTR playbook. They’ll be able to buy as much bitcoin as they want, almost without an end to the investors willing to buy their bonds and equity. It would not surprise me if they stack 500,000 bitcoin in 2025. Especially if prices somehow remain ~$100k/btc.

Tether is the 7th largest holder of US treasuries. XXI is going to be a beast.

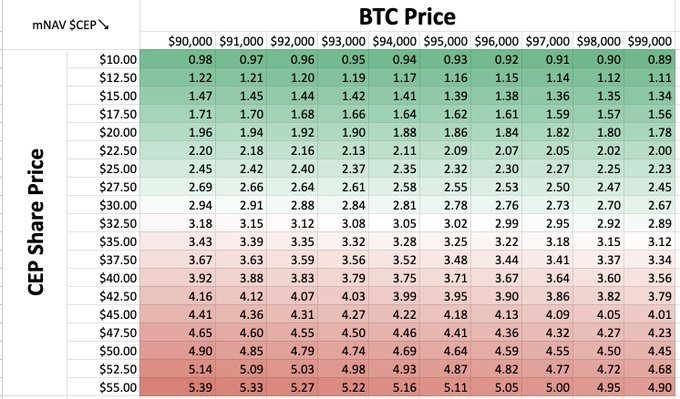

But if you bought CEP at $13 you did pretty good.

The way I see it, Bitcoin & tether will extend the USD as the preferred global medium of exchange for the next several decades. Will it be weaker than it has been in the past, yes; but it will still persist longer than it would have without Bitcoin.

Not advocated for bitcoin at all.

From my reading of the transaction, it already is, as CEP.

Yep. And the question is whether he will allowed to be himself or not. I guess we’ll see. In the short term, I fully expect that he will deliver. If nostr:nprofile1qqsvf646uxlreajhhsv9tms9u6w7nuzeedaqty38z69cpwyhv89ufcqprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqzynhwden5te0wp6hyurvv4cxzeewv4es0x9swg resigns or is fired, that’d be a red flag. But I feel like self interests are all aligned here. Whereas Saylor was a bitcoin skeptic whose headquarters are in DC with In-Q-Tel involved … lots of red flags there. There are fewer red flags with XXI. I think all parties involved with XXI benefit tremendously if Bitcoin jumps to $5M/btc … LFG

I’ve been looking for a company I could trust would actually run the MSTR playbook. In the short term, this checks all the boxes. Rooting so hard for nostr:nprofile1qqsvf646uxlreajhhsv9tms9u6w7nuzeedaqty38z69cpwyhv89ufcqprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqzynhwden5te0wp6hyurvv4cxzeewv4es0x9swg to freaking deliver in every single way. Super bullish.

Cantor Fitzgerald would without a second thought. Google Paybase, Paycoin, GAWminers, Zenpool. Enjoy

I don’t know, the upside for Lutnik to leverage bitty if he has $300M+ in pure bitcoin to take it from $90k to $5M is probably enough to offset the fiat risks. I’m hugely bullish on this announcement.

Nah, nostr:nprofile1qqsvf646uxlreajhhsv9tms9u6w7nuzeedaqty38z69cpwyhv89ufcqprfmhxue69uhkummnw3ezummjv9hxwetsd9kxctnyv4mqzynhwden5te0wp6hyurvv4cxzeewv4es0x9swg is as legit as they come. He 100% would not sell out. #accelerate

Capitalism works.

Holy crap this XXI might be the step that catalyzes the $1M Bitcoin bull run. True bitcoiners that we know will bitcoin the right way. Let’s see what Saylor does in response.

Game on.

Good people can do bad things.

Bad news: the 4-year bitcoin cycle is dead

Good news: the prevailing momentum will always be up.

This is going to be interesting to watch play out. On one hand, the covered call strategy does conservatively monetize the volatility of MSTR (and by extension Bitcoin if you believe they have all the Bitcoin they claim, which a lot of people don’t). On the other, nothing is better than bitcoin for absolute value appreciation, if you believe in Bitcoin.

I see the case for a portion of a bitcoiner’s wealth being “conservatively” exposed to bitcoin to enable the freedom of everyday living without having to sell your coin. Maybe even leveraging a loan in order to do it. Instead of exposing yourself to a disappointing “supercycle” like we’ve experienced.

I don’t know…a lot of the promises of the OG bitcoin influencer class - yourself included - have gone unfulfilled for the Class of 2021