nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx have you ever shared how you’ve set-up your podcasts? Hosting services, equipment, etc.? Or is there a post / contact out there summarizing how someone can get started? Thanks.

cc: nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy nostr:npub1sk7mtp67zy7uex2f3dr5vdjynzpwu9dpc7q4f2c8cpjmguee6eeq56jraw nostr:npub10uthwp4ddc9w5adfuv69m8la4enkwma07fymuetmt93htcww6wgs55xdlq

But the risk-adjusted returns for class of ‘21 are not very attractive relative to prior classes. Not even close.

And you rewarded with $65k within 4 years. So even your $20k buy more than tripled within 4 years. Class of ‘21 probably went all in around $50k…and here we languish at $88k more than 4 years later.

So I’ve been told. But it’s all faith in the unproven at this point. That’s what makes Class ‘21 the realest.

The 80% drawdown is critical. For the class of ‘21, who had their first large position established on the way up, held all the way down to $16k and stacked aggressively, every other class has experienced a euphoric return on those investments (even the initial ones). Class of ‘21 is barely above water on their first large allocations, after 4+ years. Totally different psyche than any other class.

Especially when considering hodling through the 80% drawdown.

Reading Founding Brothers by Joseph Ellis through the lens of bitcoin. There are fascinating parallels between the American Revolution and the bitcoin revolution. I fear many bitcoiners do not understand how and why the American Revolution was successful. And we seem to be getting outmaneuvered by the powers who do not want to see bitcoin succeed.

First lesson. Speed is critical to our success. We cannot be patient. We have (or at least had) momentum. We must not relent and be patient. Speed is an asset to our effort.

More to come. But first lesson:

Accelerate. Relentlessly.

nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx no bitcoiner in any prior bitcoin class has held this long without experiencing euphoria. We experienced the 80% drawdown. Class of 2021 hodlers are the real ones…here not for the gains but for the freedom.

Flew too close to the sun this cycle. Got a little greedy, forgot to be humble (or chose not to be), and now I am stressed for bitcoin to bail me out. Lessons learned, regardless how it turns out. But I’d really like for it to turn out a certain way.

My dad told me yesterday that bitcoin is worthless. Last time he said that was $16k. So we have that going for us.

But there is still a bull market ahead right…RIGHT!? lol …boohoo!

“Is the bull market in the room with us?”

JUST IN: 🇺🇸 President Trump's Crypto Czar says that crypto is the "industry of the future." 🚀 https://blossom.primal.net/33c086c3fbb1714093f05dc21f98599a101d4b75b583b9dc2f87a54197ac12d4.mp4

Shitcoiner(s).

Tom Lee tells CNBC he still sees #Bitcoin reaching $150K–$200K by year end.

Shared via https://pullthatupjamie.ai

Tom Lee is such a shitcoiner. How do these guys get an audience via MSM? SMH

Bitcoin’s felt “dumpiest” for a really long time. Waiting with increasing frustration for the “pumpiest” part of the meme…

When we went from 10k to 50k in less than a year and Elon adopted bitcoin for a week or two, yeah - things got pretty euphoric.

It’s a disaster over there. Just deleted my Twitter account (again). The dopamine hits are real.

I’m just really surprised we haven’t seen any supply shock. None. Bizarre.

The conversation with nostr:npub1ath4je07y7py74nvu044fum3f8hz3exc3dtcv782qg94w5gaddusl74k6d and nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy was odd and confusing …

(1) Networks and network effects are exponential and should not follow the power law.

(2) Debt is a priority claim on assets & associated cash flow. Equity is a residual claim.

(3) The interest rates for debt issued when bitcoin is successful would need to be equivalent to appreciation rate of bitcoin.

(4) When the capital comes for bitcoin, it won’t follow the power law. And it won’t happen gradually.

(5) Matthew has a lot of inconsistencies in his positioning. Anchoring on the Power Law but then struggling to reconcile and explain the implications of increased bitcoin adoption.

Felt FUD-y after listening to it.

if you get a chance, can you please provide an update on the availability of bitcoin collateralized loans in Alabama (and the remaining 23 states).

Hey Jack, following up on sweet home Alabama … any chance we’re up soon?

Ready for the ticker change to XXI 👍🏼👍🏼

Everyone seems onboard and the administration is presumably supportive so I’m confident that it eventually closes. I’m more interested in the timing. Like in the next month? 3Q25? 2026?

Thank you! Excited to be able to build our life on top of the hardest asset in the world.

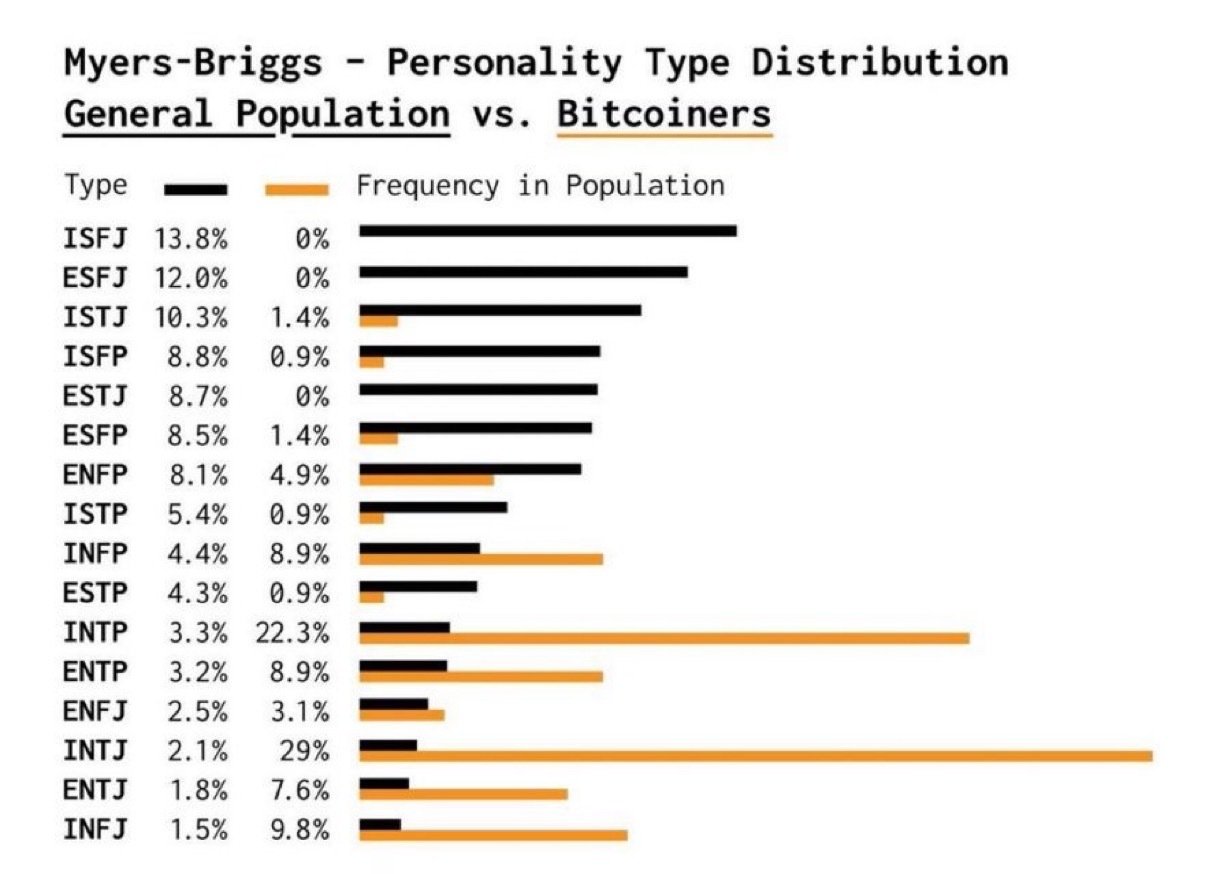

Don’t know where the data comes from but I want to believe.

I feel seen.