Nostr is a kid with only one year of life

Depends if there is war or not. I hope we have time to bring more people into the bitcoin ark for this flood of inflation

Uns alcançam mais cedo outros nunca alcança e morrem cedo

if i had 1 sat for everytime i wanted to do this id be rich

https://video.nostr.build/8387c8e82d9fdad380b6c638db23a11981a505a898c2b36c0205e6b5923ae493.mp4

1 sat will buy a house in the future be patient

The fed printed money because of the high % of interest of the Japan economy. For them high is above 0%

Both at the same time. The system is over saturate and the election is near plus the Japan 🇯🇵 stock market 📉 because of the % of the debt

The floor is none. They will put everyone to be a debt slave for a money that is not real

I make a cycle sats economy

mulher e síndrome do fim do mundo

become ungovernable 😂 😂 😂

https://video.nostr.build/69f9c7efb3501cff1a4e50cf50f0304f473fef47efbb3845e168975e7aa2e7dd.mp4

With btc

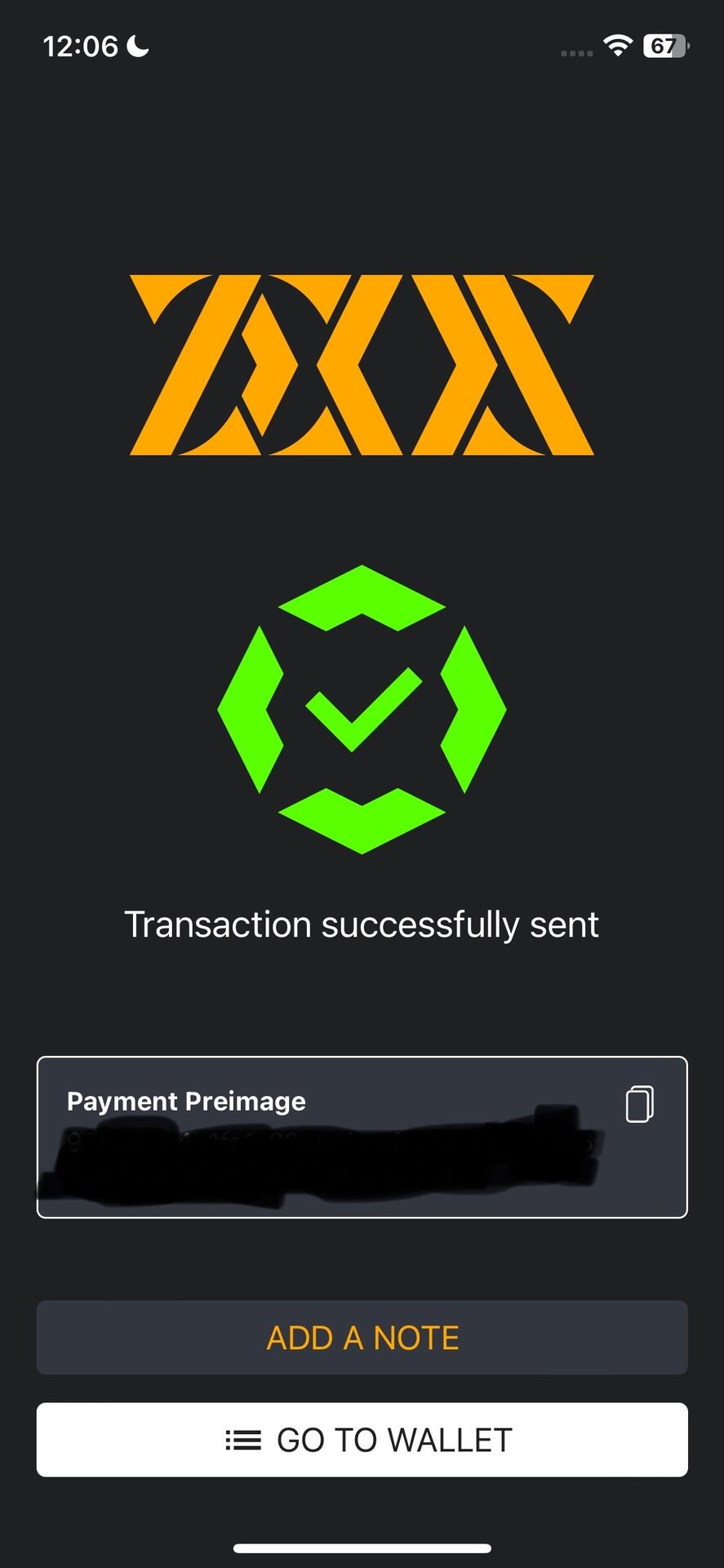

Paid for our seed oil free brunch today in #bitcoin over the Lightning Network from my own node 🤘🤠 amazing UX nostr:npub1xnf02f60r9v0e5kty33a404dm79zr7z2eepyrk5gsq3m7pwvsz2sazlpr5!

Thanks nostr:npub1spdnfacgsd7lk0nlqkq443tkq4jx9z6c6ksvaquuewmw7d3qltpslcq6j7 for the rec and onboarding merchants nostr:npub14f26g7dddy6dpltc70da3pg4e5w2p4apzzqjuugnsr2ema6e3y6s2xv7lu!!

Living in the future here in Costa Rica 🇨🇷🤙🏽⚡️

Great future incredible present