Happy 11:11

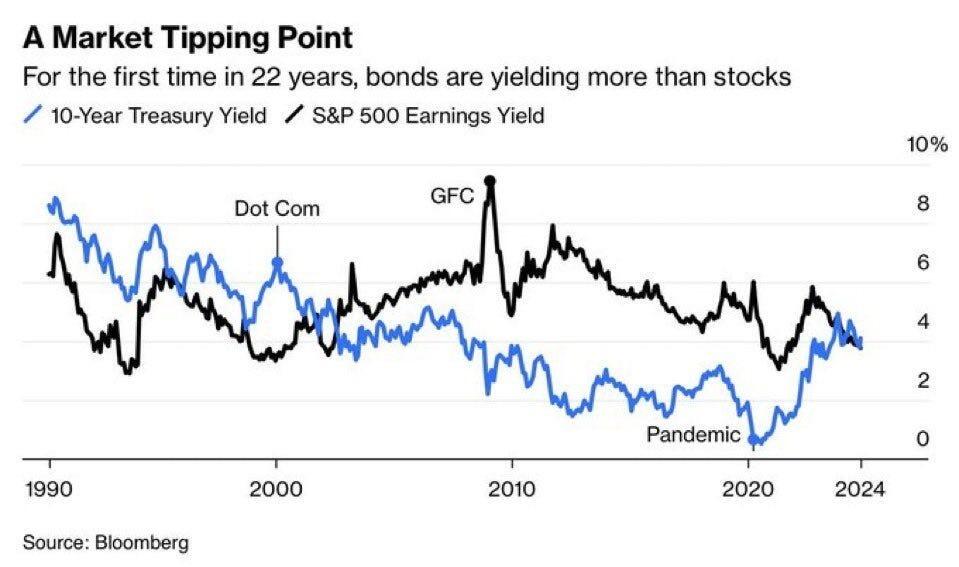

Stocks are historically and dangerously expensive. The chart below shows the spread between 10-year Treasury yield and the earnings yield on the S&P 500. The earnings yield is the inverse of the P/E ratio. You calculate it by dividing total earnings of the companies in the index by the total value of the index.

Put another way, for every $100 you invest in the index, the companies in it are going to generate $3.29 in earnings at these levels. Historically, the average earnings yield is 4.69% (or $4.29 in earnings for every $100 invested). And right now, the yield on the ‘risk free’ 10-year US Treasury note is 4.41%. What does that mean?

It means the equity risk premium–the extra return you’re supposed to get above the ‘risk free’ rate for buying more volatile stocks–is actually NEGATIVE. You’re not getting any extra return for the risk you take in stocks.

As you can see from the chart, there was a big divergence between the two yields in 2000. But back then the 10-year yield was 6.68% in January of 2000. The earnings yield on the S&P 500 hit a low of 2.17% in December of 2021. My point?

Yes, stocks could get even MORE expensive from here. But for stocks to go higher, it’s going to take one of two things. First, higher prices, which is just simple ‘multiple expansion’ and fear of missing out (FOMO). Or two, higher earnings.

Bonner Research

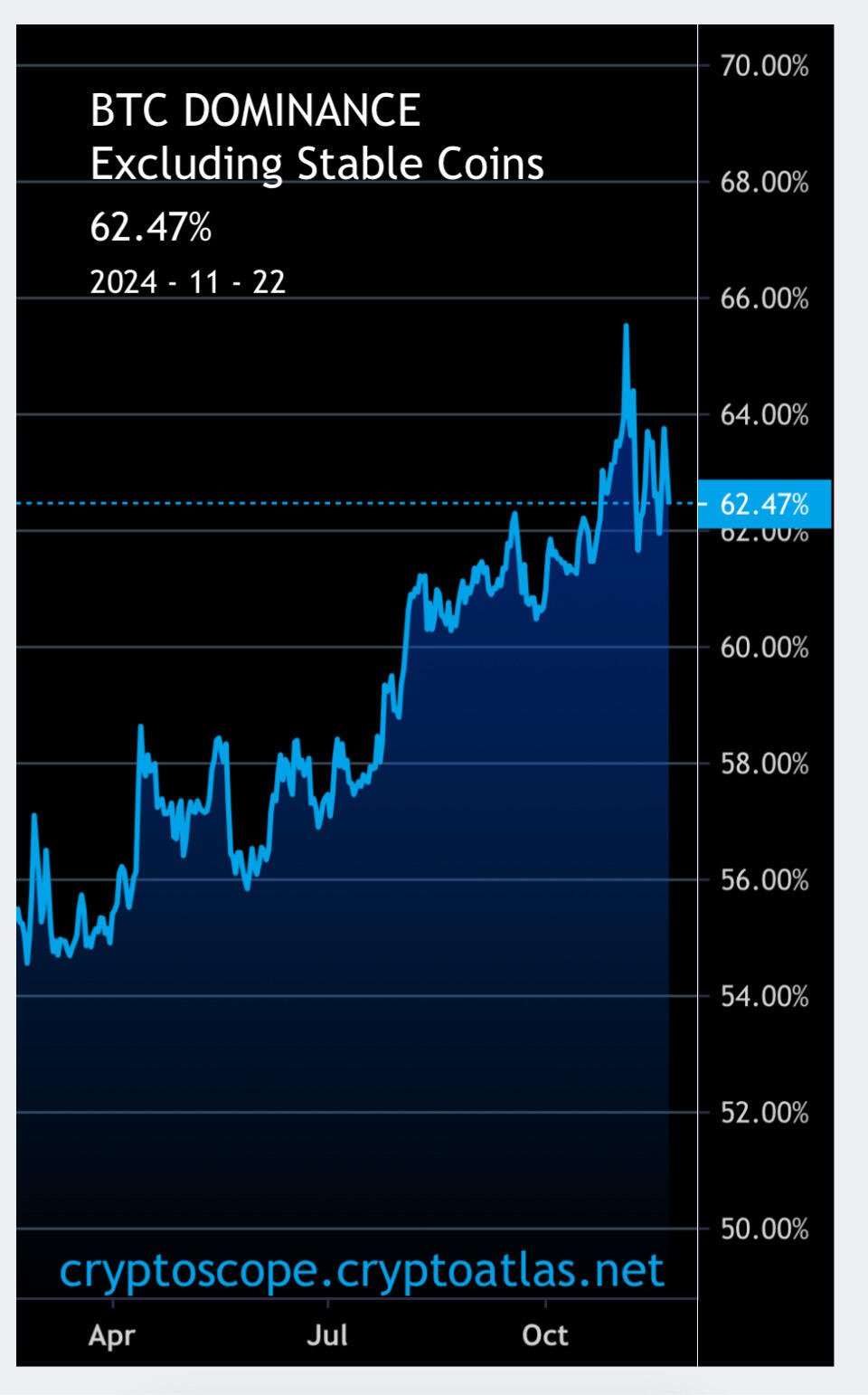

₿TC dominance without stablecoins 62.47%

Something is out of place there

An nostr:npub16secklpnqey3el04fy2drfftsz5k26zlwdsnz84wtul2luwj8fdsugjdxk Daily Dose going into a Friday night with a mellow mood 🌹

https://open.spotify.com/track/24vJ7xZcKMM3xTX5KNS8Rj?si=b1N-lLpaSPmihBooNgywWg

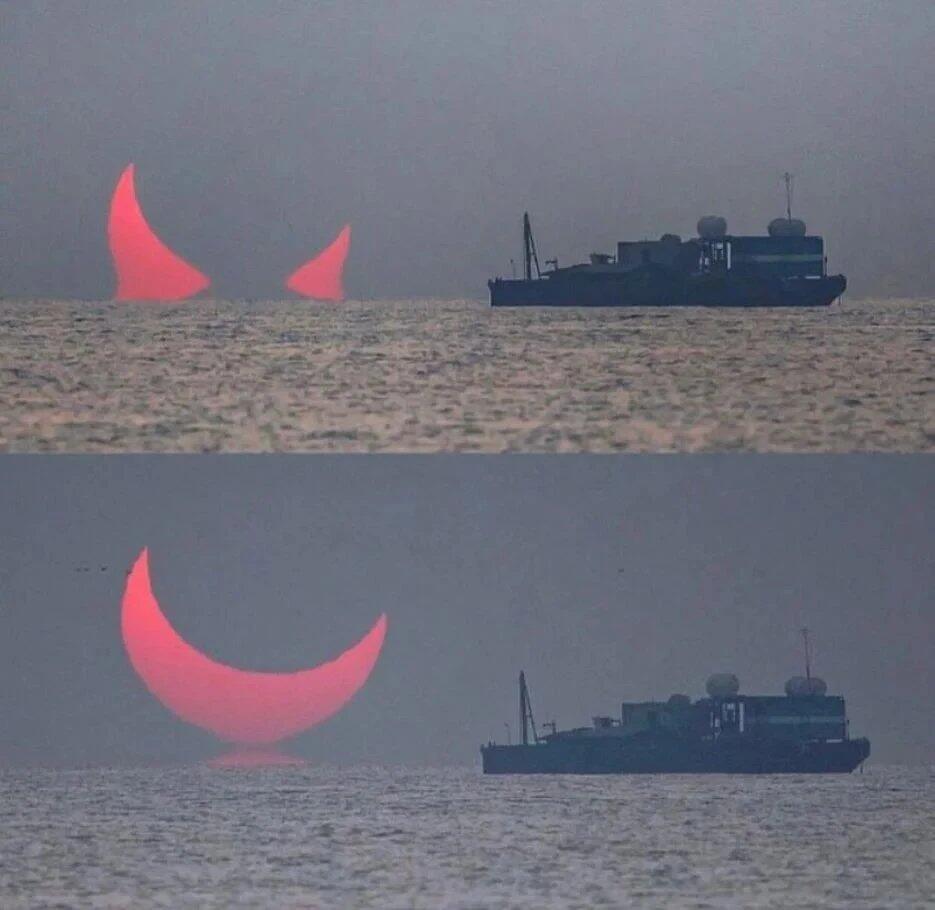

Fabulous

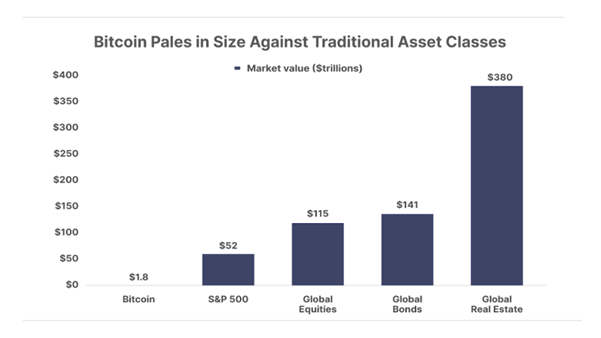

This is where we are at today. I just love being right and being early!!!

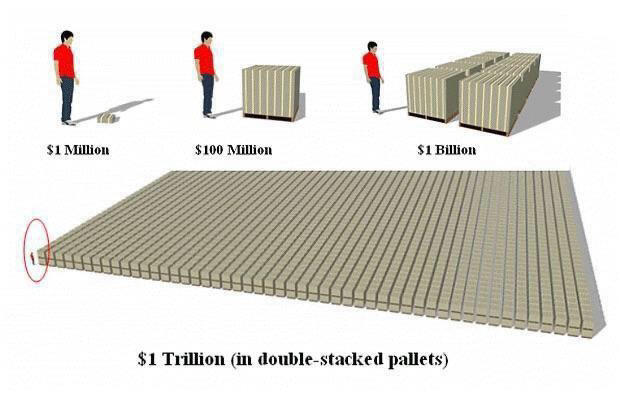

Visualization of a trillion dollars

Then recognize the government is 36 trillion in debt https://v.nostr.build/C5ptolYKTMoJA6I5.mp4

This was an awesome RHR!

Man this Bitcoin world and especially Nostr is still so unreal to me.

I as a small peb can share my curiosity and thoughts within the live-steam and ask nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx about the X blue chip and subscriptions now new on Primal and he just replies naturally!

You should always shit test your idols and I got the opportunity today! Thank you for that Odell! He definitely passed the test!

If I would ask Musk on X about anything he would never reply.

If I would ask the prime minister of my country about his policy, he wouldn't give shit.

Damn even my local major wouldn't give a shit about my thought.

But here I am, a small pleb, and the big guy is taking me as serious as I take my kids serious at school!

What a time to be alive! Never felt less like an NPC then today!

Thank you nostr!

#plebchain #proofofwork #nostr@

nostr:note1vz54vtjndspss3jz9rm2vlpap6p57f49d8dytvkksjr4zwxcamesyk8c7w

ODELL, THE NEW PRIME MINISTER!!!

Even the source I got this info from can't verify the info so at this point I am considering this fake news. If something changes I will let you know. Sorry for the confusion.

Even the source I got this info from can't verify the info so at this point I am considering this fake news. If something changes I will let you know. Sorry for the confusion.

Even the source I got this info from can't verify the info so at this point I am considering this fake news. If something changes I will let you know. Sorry for the confusion.

I am working on verifying the source. I am getting mixed signals now and the info could be a mistake or interpreted wrong. I will let you know as soon as I figure this out.

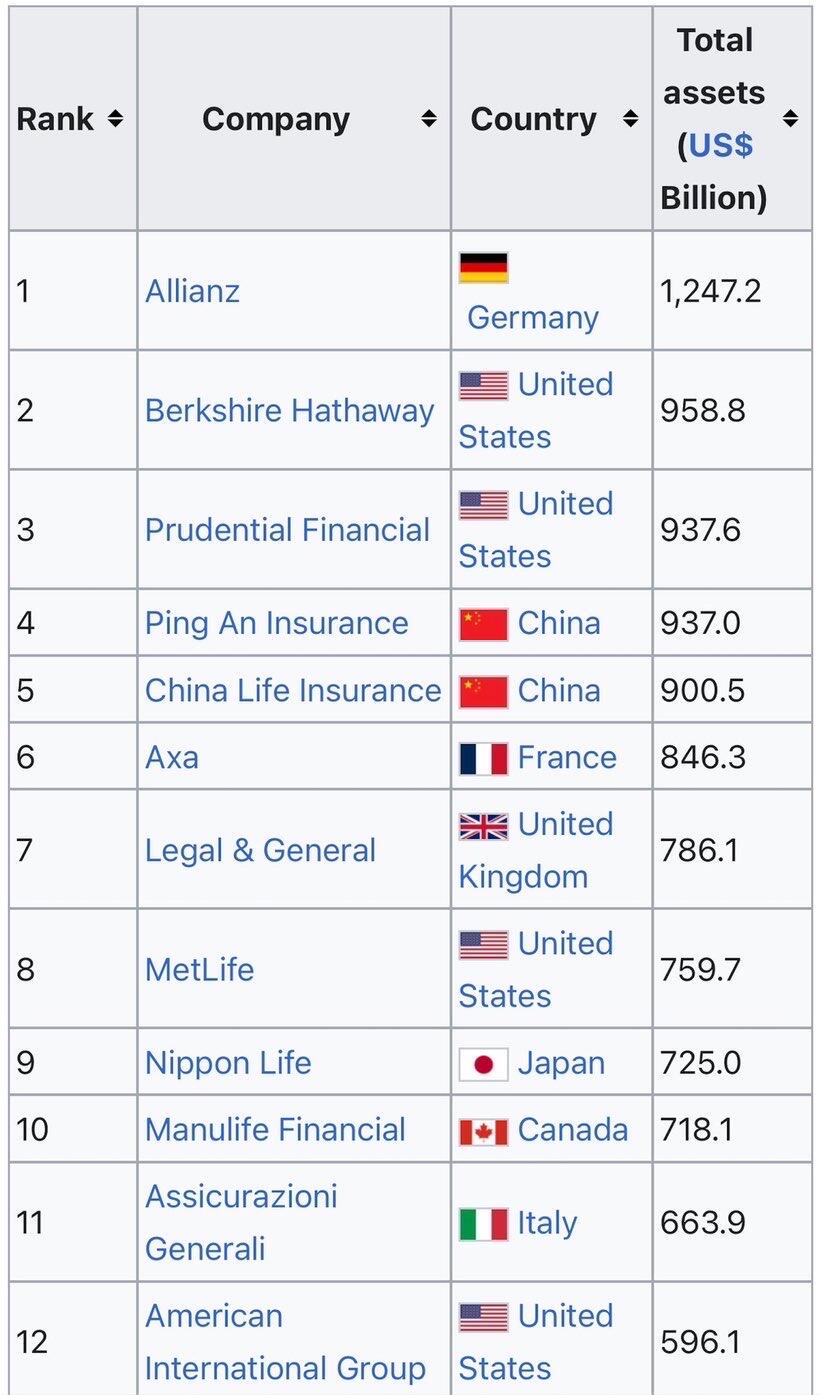

This just happened. Warren Buffett just YOLO'd into $1 billion of MicroStrategy (MSTR) bonds!Who would've thought the Oracle of Omaha would seek ₿itcoin exposure this way? This is just the start! And let's not forget, even the most conservative players, like insurance companies, are jumping on this bandwagon. FOMO (Fear Of Missing Out) is real! From InvestAnswers