A just money is one where the rules are known and don't change over time.

If you're upset by that, you probably have some sympathy to socialism.

The Fed added about $300 billion to its balance sheet this past week.

https://void.cat/d/UDKNKEAwg1f4bWkWxZrdL5.webp

This wasn't from buying bonds or ending QT, but rather from making loans. To the extent that they continue QT, they will likely need to keep providing this type of liquidity, so it's like the Fed is taking liquidity out of the financial system with one hand and putting it back with the other. They've basically hit the liquidity floor of the banking system, which seems to be around $3 trillion in bank reserves.

However, that doesn't mean the balance sheet will go straight up. The Fed will try to limit the balance sheet growth to whatever extent is possible.

After the September 2019 repo spike, the balance sheet stopped decreasing and started going up, and then it began to stabilize sideways by January 2020. It then got slammed by the COVID-19 and lockdown impacts in March 2020, and the money printers went into hyperdrive due to that.

This time, without such a crazy catalyst, the balance sheet will likely spend more of its time in that intermediate state, similar to what it did in that September 2019 to January 2020 period.

In other words, this is still going to be a bumpy process.

Or more... We don't really know since we can't audit the Fed.

The donation from the ordinals crew to HRF was for me, a huge orange-washing. They know they're doing something bad, which is why they felt a need to balance that out with a donation/virtue signal.

And that happens when the US central bank won't back said country's central bank. I'm convinced a lot of central banks have been bailed out over the years, but we don't get to find out much about it because we can't audit the Fed.

Now if you piss off the US, then all bets are off. Hence why Venezuela, Zimbabwe and Lebanon have central banks which are allowed to fail.

$2T is just the appetizer.

The Case for Apprenticeships

——————————————

The classroom setting is very unnatural. You sit there for an hour or two and just listen to someone talk while you dutifully take notes, or more likely, doom scroll your social media feed and maybe check your email. Learning by just sitting there and absorbing is against everything that we are as human beings. We are built for action. Moving our bodies around and imitating what others are doing is a much more natural way to learn.

The traditional way in which people learned was through apprenticeships. You went to train with another person that was an expert in their craft and you did what they did and learned through imitation. Instead of watching them for hours and then maybe practicing some of it at home right before an exam, you watched and did what they did with a much faster iterative loop. You got feedback and corrected and tried again.

The only thing that's like that in school today is with sports, where the movement of bodies and trial and error are unavoidable. They're also highly competitive with an objective metric of wins and losses, so they trend toward doing what works in practice rather than what should work in theory.

Theory versus Practice

———————————

And indeed, that's what we're talking about, the difference between theory and practice. Lectures and classrooms are all theory. There's way too little practice.

This is why theory has such pitiful production. Social sciences are pretty much all theory. They're usually some twisted rationalization of some political goal. Since it's not based on truth and has very little in terms of objective competition, it tends to stray far into political power games.

We've been seeing this trend in academia where even hard sciences get deep into theory with very little practice. For example, string theory has been around for over 20 years and hasn't produced any results. Yet it continues to be popular, largely because of the investments PhD's made decades ago that are being bailed out by universities. That is to say, it's a giant circle jerk subsidized by political power games.

The real work has always been done on the ground, by people who are building. And to learn what they do isn't easily taught in classrooms, it's taught in factories and garages and labs.

Unscaling Education

———————————

So why isn't apprenticeship more popular? The main reason is that it doesn't scale very well. Apprenticeship was mostly practiced within families where a parent would teach a child their trade. They had a natural incentive to make sure the child learned what they needed to as they shared a last name and would carry on a legacy.

To do that in a modern setting would be prohibitively expensive. There are way more people that want to get into certain trades than are spots available, so how do you choose them? We can see how restrictive this requirement is when looking at medical doctors. Part of why there are so few spots for doctors is the requirement of doing a residency, which is a form of apprenticeship. Medical schools typically have 5% or below acceptance rates, showing that there are way more people that want to be doctors than are doctors. In other words, apprenticeship is very hard to scale.

But nonetheless, I think it needs to be brought back, because we're losing a lot by not doing so. The best in a given field rarely pass on all of their tricks of the trade and sadly, they're re-learned through painful experience by others in the same trade. Diffusing that knowledge and experience is a way to not lose the progress we've made.

No. I refuse to pay for Blue when Nostr notes are superior. You can share a link to snort or something similar.

Discipline is Saving

--------------------

I’ve been taking cold showers for many years now. When I tell most people that, they think I’m crazy. Why subject myself to cold showers when warm showers are available? Why make the act of taking a shower so painful and unpleasurable?

I take cold showers because they’re uncomfortable. Discomfort is not a bad thing. It’s a good thing if it helps you grow. For me, cold showers are a way to test myself, to discipline myself.

Purposeful Pain

----------------

Discipline makes uncomfortable activities comfortable through purposeful pain. The first time taking a cold shower was horrible and my body was shocked from discomfort. Mentally, it was difficult to handle and I did everything as fast as possible. The next time wasn’t much better, but by the tenth time, it wasn’t so bad.

Each time I took a cold shower, I learned how to handle the cold. More than that, I was learning how to get used to uncomfortable situations. The discipline of handling the cold was creating in me the more meta skill of learning how to discipline myself. I was learning to learn.

I learned for example that there’s joy in the journey. Every skill is frustrating to learn at first because you’re no good at it. But if it were easy at the beginning, it wouldn’t really be a skill. The real value comes at the end of discipline. Discipline, in other words, is saving or investing of time. The pain experienced in the process of learning is time spent now to make time more valuable later. A more disciplined and skillful person is more productive over the same unit of time than a lazy and unskillful person.

Consuming Pleasure

---------------------

Indulgence makes comfortable activities uncomfortable through desensitization. Porn, gambling and addictive substances are all more pleasurable at the beginning and have diminishing returns over time. By the end, other disciplines start suffering as laziness or impulsive behavior spreads. Indulgences destroy whatever disciplines you have.

The journey becomes hellish, especially as addiction takes over. The beginning of the journey may be fun, but by the end, addictions exact a heavy toll on your life. Indulgence, in other words, is incurring time debt. The pleasure experienced in the process of indulgence is time stolen from the future. An addicted and less disciplined person is less productive.

This is why for personal productivity, it’s much more useful to eliminate bad habits than to attempt creating good ones. The drain from an addiction of some kind is much more costly than a discipline is likely to help. Disciplines take a long time to mature so require years before the real value is gained. Stopping an addiction, especially cold turkey, is a huge boost to productivity because it pays off time debt.

As with finance, pay off the debt first and then think about savings. Indulgence is debt. Discipline is saving.

Not many direct BTC merchants, but plenty of traders that will convert to/from BTC for dollars or local currency. Some will even come straight to your house! Usually they have to carry a lot of the currency because the largest bill is only worth like $2.

They all adjust. Lebanon buildings all have their own generators. It just takes time.

It's counterintuitive, but the countries undergoing hyperinflation, are often more sound than other countries undergoing normal inflation.

Government, of course, is as fiat as they can be, printing money so they can squeeze out Cantillon benefits, but everyone else adjusts.

Individuals and businesses move to a dollar standard, which in those countries is much harder than their own currency and those on that standard have to create value. They can't just get dollar loans as the risk is too high. Hence, they have to operate from savings and the businesses are a lot more sound and focused on adding value.

For me, this is why Argentina and Lebanon were so pleasant to visit. They avoid as much as possible their governments' debasement and have to operate in a manner that's more legitimate.

The Fed, either intentionally or unintentionally is destroying small banks.

Intentionally means they're prepping for a CBDC.

Unintentionally means they're just trying to keep the system afloat a little longer.

What say you?

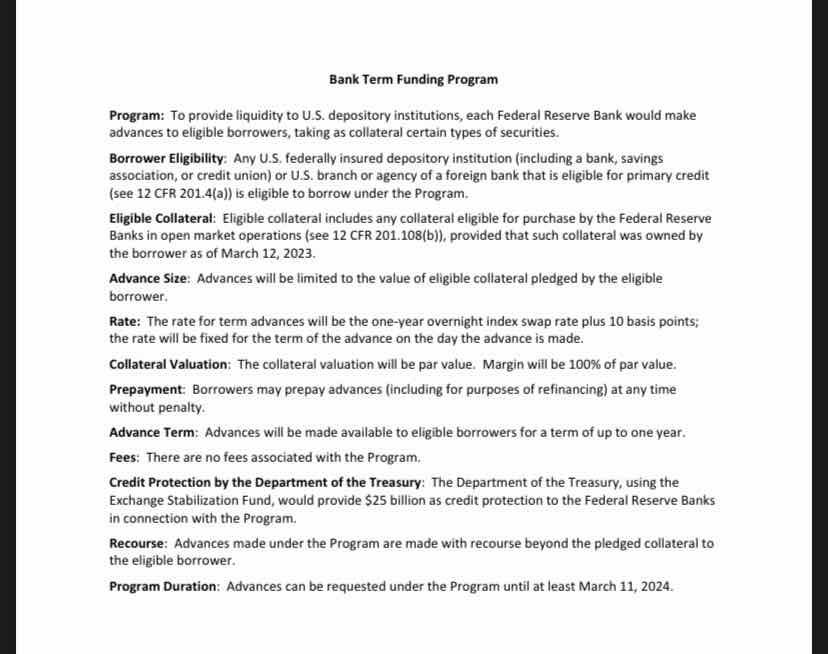

I'm aware that it's only for securities owned before 3/12/23 and limited to $25B. But that's not the point. It's now a precedent. And the market acts in anticipation of future moves like this.

If a bank gets in trouble because of treasuries that are underwater, the Fed is signaling it will do this again. Now every bank is going to load up so they can get the same treatment.

There's some uncertainty, of course, which is why yields are not 0%, but there's enough sentiment that this will be a new Fed policy tool that yields are going down fast.

Now that the Fed will lend cash for treasuries at par, there will be a lot more buying of treasuries.

This is why yields are going down.

We had a bail-in. It was equity holders that got the haircut, though.

We live in some interesting times, friends.

Nostr will be where it will be documented because it's going to be twisted everywhere else.

For Free Subscribers: Nihilistic Narcissism, eing known, overleveraging on housing, Da Nang Conference and more!

For Paid Subscribers: Mining Development Kit, Micropayment Taxonomy, Wallet STM32 exposure and more!

#Bitcoin Tech Talk #335

It's all based on promises and works fine when these promises are kept. It starts crumbling the moment the promises start being broken.

That's how you get material. I find that writing 500 words on anything will give you tons of ideas.