I would argue that natural law has a regressive tax structure: to the victor go the spoils. So the strongest, and most apt get paid tax and the losers pay heavily.

Tell a joke like your father's father eeyy?

Question for Sam: How many jews can you fit into a Volkswagen?

Answer: 2 in the front, 3 in the back, and 6 million in the ash tray.

Yeah... and building 7 was depressed and just decided to end it on building 7's own terms

Feel better man! I just got done watching last weekends World Cup finals... it was epic, you might like it.

https://m.youtube.com/watch?v=jY9Mzl4Lg1w&pp=ygUaMjAyMyB3b3JsZCBjdXAgZHJhZyByYWNpbmc%3D

Of course we (Americans) didn't win the War of 1812, the British burned that capital to the ground and it was French pirates that defeated the British Royal Navy in New Orleans

Payment failure is a major flaw in all account-based networks, such as Tron, Ethereum, and other alts. The sad irony is that this impacts the demographic most likely to use crypto rails to begin with—those in emerging markets suffering from currency debasement and hyperinflation. Fortunately, there is a better alternative on #Bitcoin. 🧵

Estimates of Ethereum's payment failure rate range, but there was a consistent rate of over 1 million transactions per month during peak periods. A quick search on reddit will garner hundreds of threads like the one below of users losing money due to failures.

https://www.reddit.com/r/ethereum/comments/qq5iin/failed_transactions_costing_250_is_not_fine/

Even Vitalik himself cites a ~2.3% failure rate. Note, we shouldn't fault those flocking to Tron or Ethereum with strong stablecoin network effects (there is clear use case) but, instead, encourage awareness of the downsides and the better alternatives that exist on #Bitcoin.

With what looks like the early beginnings of a bull market, users in places like LATAM, particularly in Argentina, where stablecoin usage is surging, should expect a similar spike in transaction failures and consider more architecturally sound chains like the Liquid Network.

In contrast to #Ethereum or Tron's account model, the Liquid Network, a Bitcoin layer-2, opts for Bitcoin's UTXO model. This enables an "all-or-nothing" transaction, avoiding the possibility of losing funds when sending a payment.

Liquid's fees are competitive with the aforementioned account-based models and stay reliably low. There is also the added feature of confidentiality (no one can see asset type or amount).

https://blog.liquid.net/guide-to-confidential-transactions/

Our CPO Jeff Booetz, recently detailed the tradeoffs between the UTXO and account models in an op-ed. The latter's lack of transaction reliability is only one example of the many downsides: it's also much harder to scale, less secure, and less private. Highly recommended:

Wait that Liquid network can be used for things other than LBTC?

Make the federal tax brackets based progressively on the Body Mass Index

Spanish-American War, all the wars under Smedly Butler (Phillipines War primarily), definitely the Civil War, 100% the Mexican-American War, the genocide of the Indians... wait so what war has ever been honest? I'd say... War of 1812

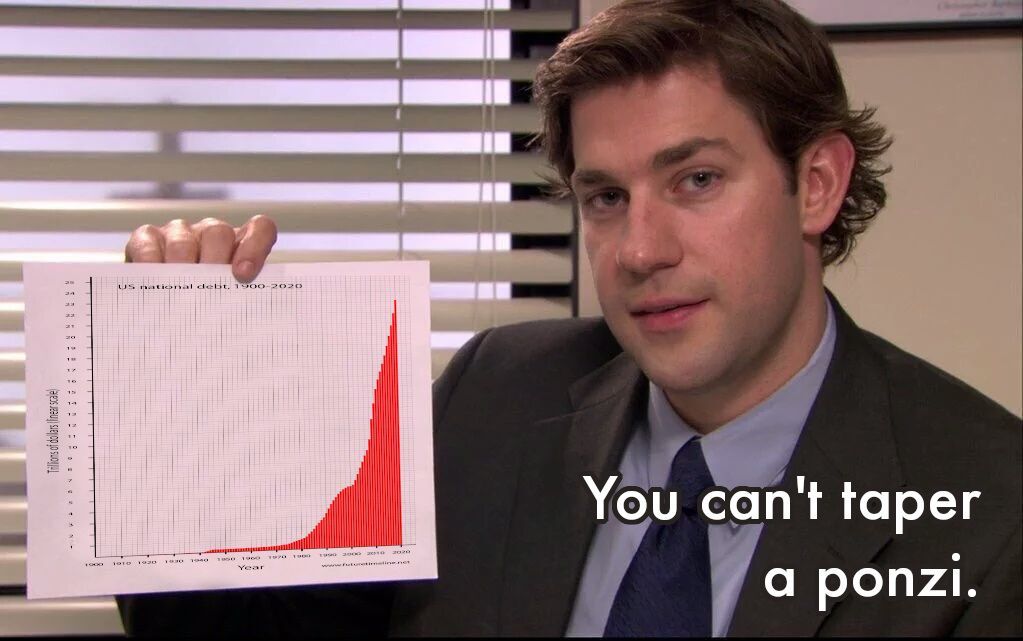

It really hit me this morning; raising rates is no longer tightening monetary policy! When the interest paid on the debt is $1 trillion per year, high interest rates are inflationary.

Wait... Ledn is still offering a yield product? How have they not blown up yet?