Almost there.  nostr:note1ceueq93emryj64q8twxsttjsdqj8l09pun6w2fnnkj0tuzg99nwsx5vkvd

nostr:note1ceueq93emryj64q8twxsttjsdqj8l09pun6w2fnnkj0tuzg99nwsx5vkvd

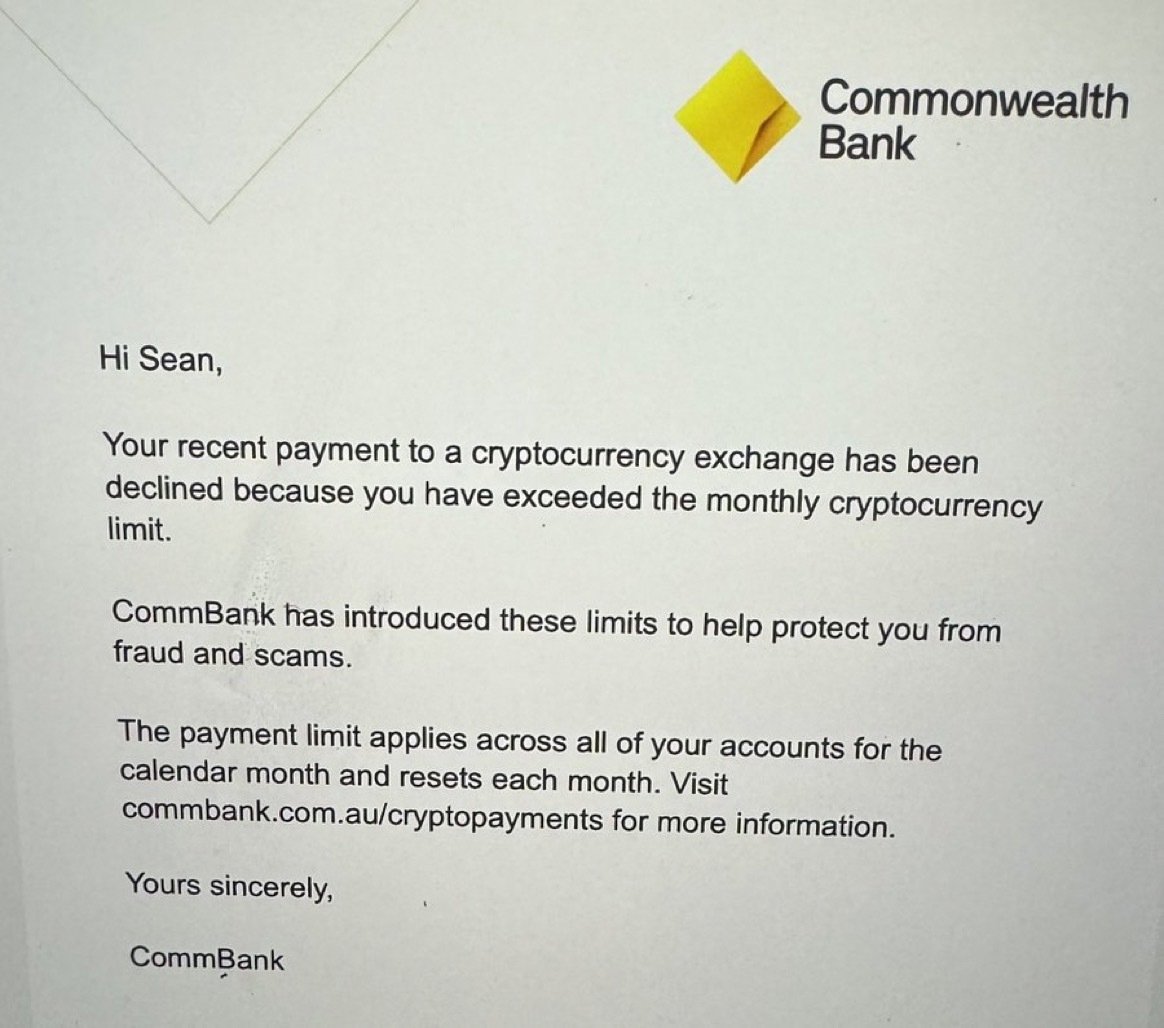

Same thing as that guy's mom happened to me with two banks in Spain. They even block card payments. Worse, now even Wise blocks transfers to exchanges (cards still allowed).

I have witnessed pre-Olympics in several cities in the past, and was in Paris a couple of weeks ago, and I can tell you I've never seen such indifference among the very inhabitants. Imagine how little the rest of the world cares.

The Japanese did it before and better 😜

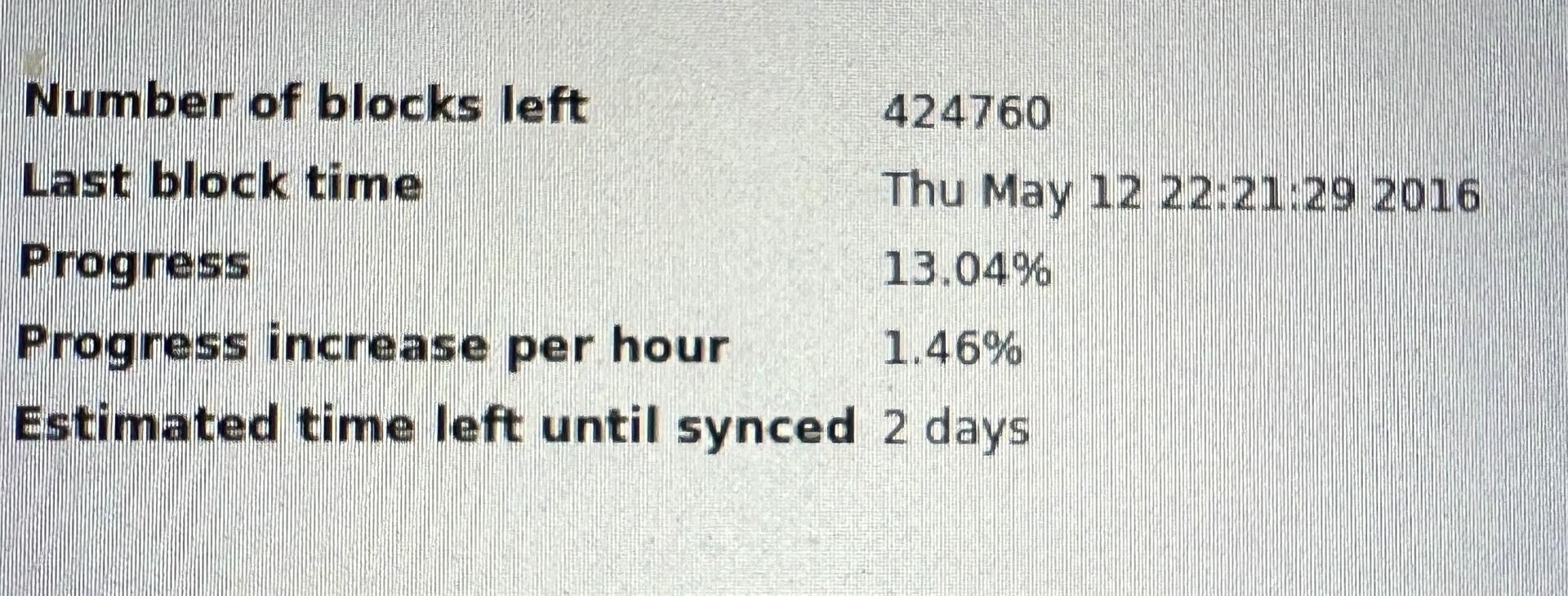

I was expecting a week really.

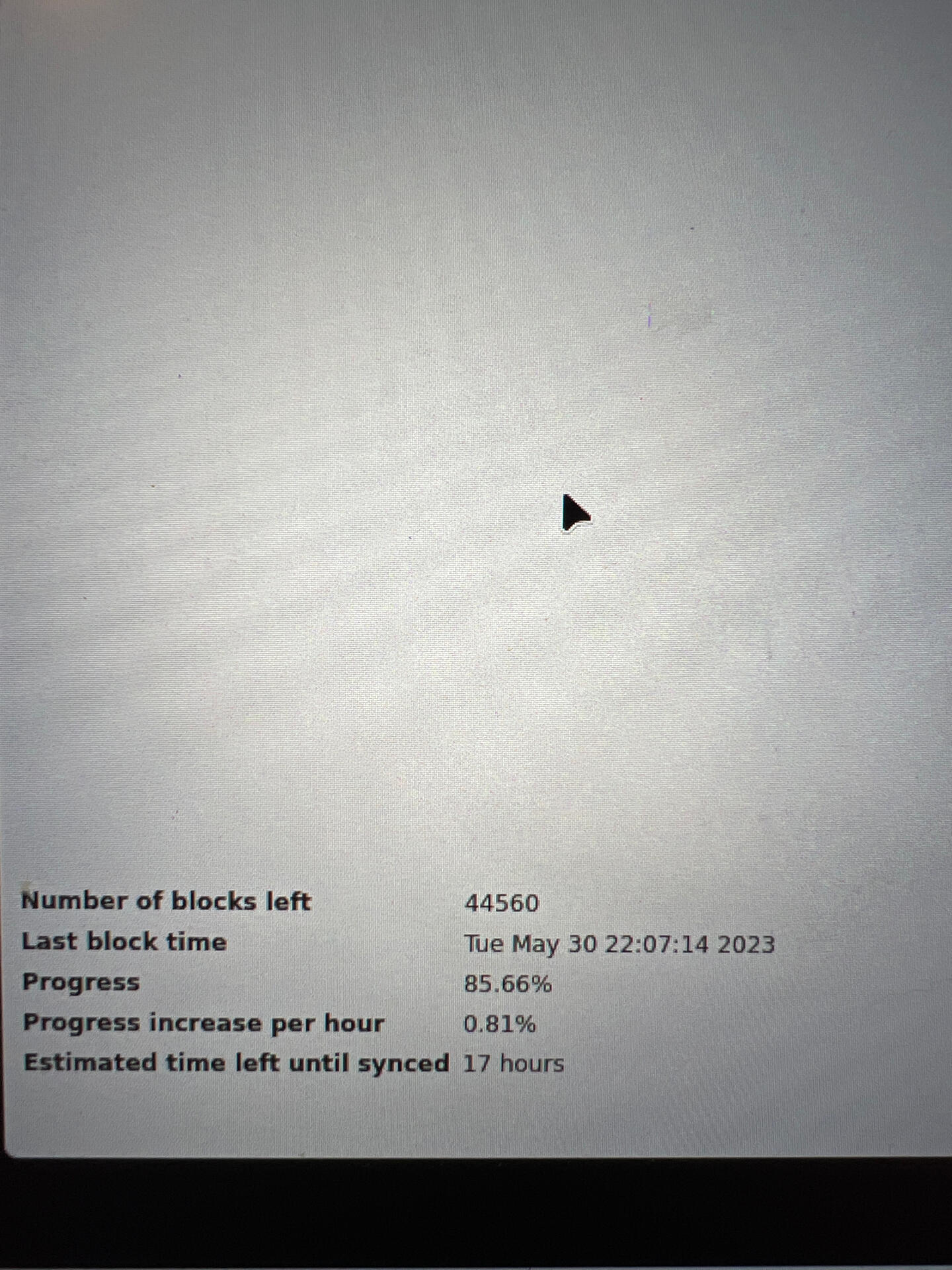

@fiatjaf was totally right that once it started with the SegWit blocks, the sync speed dropped by half, but it still seems to be chugging along.

Unless I'm missing something in the process after this step that takes massive amounts of resources that my laptop can't take. But this is it, right? This sync here already includes verification of the blocks, correct?

3 days and 20 hours in, almost done with August 2022.

Better than expected. Maybe.  nostr:note1qwa27wdzxr8l9djmwvsy36gz3ckh25uy7npxwczet7wmv8t6etnspvphxq

nostr:note1qwa27wdzxr8l9djmwvsy36gz3ckh25uy7npxwczet7wmv8t6etnspvphxq

Exodus where? That's my point. Right now there are places I could go. But there isn't that much of a difference really even today, and in any case they will inevitably go the same road we've already gone.

Not true. There isn't one single country in the world, and I mean not one, where financial freedom (just to give one example) has expanded in the last quarter of a century or more. Instead, even countries like Switzerland have finally submitted and begun to apply the same AML and KYC regulations as the countries where those started. Likewise, every single country that has implemented things like national photo identification card systems has expanded them, not rolled them back. And the list goes on.

I'm 40 something, and I was old enough to remember perfectly when the debate broke out in my country about allowing cops to have speed radars, then to put fixed ones on the roads that take pictures of cars, then to have cameras recording open public spaces, then helicopters with special cameras that can see if you have your hands off the wheel or are looking at your cellphone from 300 meters above while flying at high speed, then to have tolls with cameras that scan your plate and your wind shield for a sticker that tells them if you paid for insurance this year or not and even if your car is authorized to enter the metro area surrounding the city or not (it's not if it's approx. 20 years old or more)...

And don't even get me started about the encroachment on telecommunications, internet, and banking privacy... completely gone and forgotten.

Every time, without fail, there is public uproar and people clearly express that they're against the new measure in polls. Nothing changes, the machine keeps going, relentless, with the certainty that people will submit and adapt, and submit again. And the same politicians that condemn these measure when they're in the opposition, never, not once, roll them back when they get to power. On the contrary, they pass new, more expansive ones.

Unfortunately no, there is no final punchline to this note. I'm not optimistic at all. The only way back to normalcy would be a consistent and persistent majority of the population voting adamantly to dismantle the monstrous State structure that has been superposed on them. But that will never happen, because those who have built it know that people value safety and comfort above personal responsibility and freedom, and they have built in plenty of mechanisms to bribe, cajole and threaten, as required to force each individual into submission.

Not just one store! This is my apartment, as you walk in (you may have to expand the image).

Catalans - we're proud of our... shit xD

Of course they are 🤡

I was watching Brett Weinstein on Jordan Petersom's channel this morning. They discuss immigration and an on-site visit Brett has done to Panama's southern region of Darien, where apparently organized masses of economic immigrants going north gather.

It's a wholly bizarre situation albeit one that we know and have seen and continue to see in the Mediterranean region of Europe.

But of all the bizarreness what struck me is the talk about a Chinese-only, segregate, no-access allowed camp.

What is the excuse to allow mass economic immigration from China to the US, I wonder? And why is it not possible to simply catch them and ship them back to whence they came? These are not Venezuelan, Haitians or people of any other nationality from places that are in complete economic collapse and poverty... right?

I gotta say, as much as I love using Sparrow+Whirpool, the coinjoin fees are quite brutal and offputting.

We're going toward device-level KYC to get online. Bookmark this note.

What is your personal preference as far as UTXO size goes? 1 million? Less? More?

While I agree, with the sentiment, there are caveats:

First, leverage. In most jurisdictions, you can borrow fiat and buy 10 units of real estate with an initial fiat investment equivalent to 1 or 2 units. 1 BTC costs 1 BTC in fiat.

Second, cashflow. Real estate can be rented out to create cash flow (and if you've done your homework, profit vs inflation). Bitcoin doesn't "do" anything. There is no use in borrowing it, so there is no profit in lending it.

BTC's utility is the absolute certainty that whatever value is stored in it is inviolable. Also, for the coming years at least, it will continue to appreciate at double digit yearly rates above the fiat inflation rate. Even once it reaches whatever order lf magnitude of market cap humans decide to assign to it and its upside is just above inflation, we can still be sure that it will continue to appreciate. So it makes for THE ultimate form of collateral.

But you still must borrow fiat against it to invest in other assets that can produce cash flow - like real estate. Otherwise, you will find yourself having to sell your BTC and eventually going back to being poor.

Really? Damn... :(

It's an old dual core i7 with 8 GB of memory, although I'm writing the blocks on an external SSD. I would have expected it to be enough, if people are doing this with Raspberry Pi's...

OK after 24 hours this is where I am. Is this pace OK or should I worry?  nostr:note1x0hl0wjulgwdhqjeef3exjt0d4vwtyra87d7wvvgtws8lde46hnqtpk0w6

nostr:note1x0hl0wjulgwdhqjeef3exjt0d4vwtyra87d7wvvgtws8lde46hnqtpk0w6

No pertenezco a ninguna comunidad española. Ni me relaciono con bitcoiners españoles, ni consumo contenido español o en castellano. Así que no se me ocurriría hablar por los bitcoiners españoles o castellanohablantes, ni puedo saber si coincido con la opinión general que tengan, o no.

Pero sí que tengo una opinión personal bastante firme, fruto de la simple observación y estudio.

Las propiedades que hacen que BTC sea un vehículo de ahorro perfecto son las que hacen que sea un mal medio de intercambio. El ejemplo que siempre da Michael Saylor de un solar en Manhattan lo resume perfectamente: liquidar una propiedad para adquirir "liabilities" (consumo) es absurdo. Cualquier actor económico mínimamente racional hará lo imposible para evitar hacerlo.

Un ejemplo que me gusta a mí personalmente es el de los lords británicos que pese a estar quebrados continúan aferrados a sus mansiones y fincas, y prefieren ser pobres en moneda pero ricos en patrimonio, y pasar estrecheces antes que venderlas, aunque sean insostenibles económicamente. Porque esperan que si ellos no logran rentabilizarlas hoy, tal vez en el futuro sus herederos lo logren.

Dejando de lado la escasez absoluta de BTC, que ya es un factor suficiente para desincentivar su circulación, además hay que entender que en el corto y medio plazo BTC es una clase de activo en plena fase de descubrimiento de precio. Nadie sabe cuánto vale un BTC todavía, y el mercado aún va a tardar bastantes años en asentarse en una franja de capitalización más o menos estable. Se estabilizará donde estamos ahora? Donde el oro (x10)? Como la bolsa (x100)?

Hasta que eso no suceda, BTC tiene una volatilidad AL ALZA excesiva, que hace que gastarlo tenga un coste de oportunidad desproporcionado.

Si hoy tengo en el bolsillo derecho 1 BTC y en el izquierdo su equivalente actual en fiat, que me permite comprar X bienes/servicios, y dentro de un año espero que 1 BTC equivalga a x1.3 el fiat, qué sentido tiene no gastar el fiat ahora, y gastar el BTC? Es completamente irracional. Especialmente si además mis ingresos ordinarios son en fiat.

Y cuando BTC se haya "estabilizado" y previsiblemente "sólo" suba de valor con la inflación/devaluación del fiat, o ligeramente más (por ser BTC deflacionario), además hay que tener en cuenta el coste de las transacciones. Tal como siempre decimos y presumimos, el código de BTC es la ley. Y el peso mínimo de una transacción en la red bitcoin son aprox. 110 vB. Eso es una sola UTXO moviéndose de A a B. Si hay más inputs o outputs, se multiplica.

Y después, el peso total se multiplica por el valor en sats que se ofrece para que la transacción pase al bloque. O sea, miles de sats como mínimo, y más habitualmente decenas de miles o cientos de miles. Dicho de otro modo, cuando BTC alcance su capitalización "final", estamos hablando de un coste de transacción en poder de compra completamente fuera de toda lógica para su uso como moneda. Aceptables seguramente para la transmisión de cantidades vastas de valor, entre individuos muy ricos, organizaciones grandes, estados, bancos centrales, etc. pero en ningún caso para el ciudadano de a pie.

nostr:note15wvy0htws9chq0jnzv9gvz3y0tv6msq7k49tdtntkh5yr4nap8gq2asc0v

nostr:note15wvy0htws9chq0jnzv9gvz3y0tv6msq7k49tdtntkh5yr4nap8gq2asc0v