Reminder: #Lightning security != #Bitcoin security

#BTC

https://lists.linuxfoundation.org/pipermail/lightning-dev/2023-October/004154.html

Today, the #goldback just hit an all-time high at $4.24. Why keep your cash in #fiat when you can hold cash in #gold? Plus #goldbacks are a good hedge against #inflation and #CBDC.

#money #currency

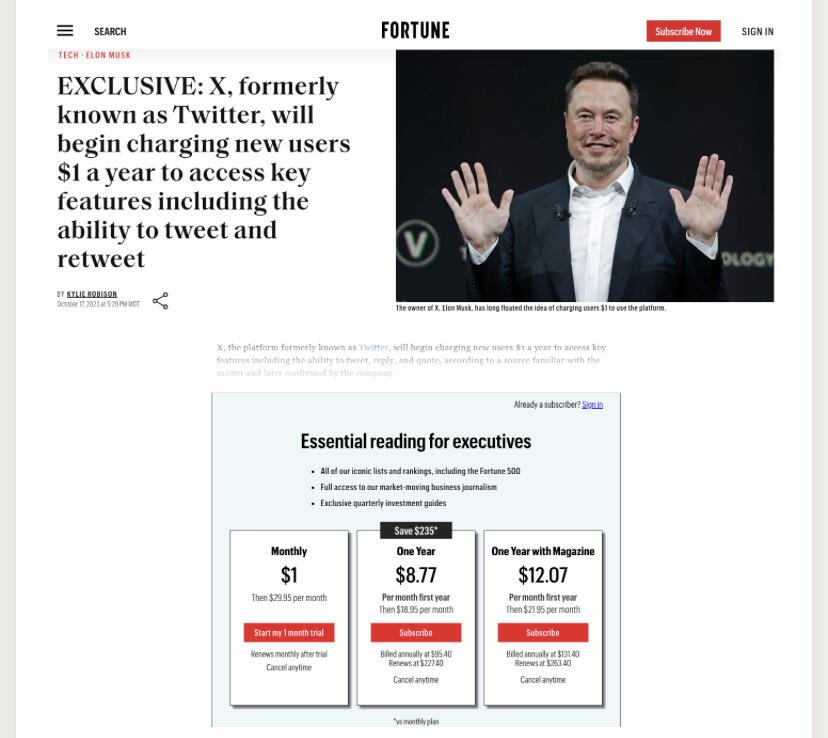

This makes me think that micropayments in sats to unlock features or articles may be more acceptable to most Internet users than monthly subscriptions. #Lightning #Bitcoin micropayments could be the new pay-per-use economic model for the #Internet!

Soon the #Internet will be nothing more than a GIANT paywall…

#X #Twitter #Musk

#Idena ceremony 121 is tomorrow! Pass a reverse #TuringTest to prove that you are not a machine and earn #iDNA.

#Crypto #Blockchain #AntiSybil #ProofOfPersonhood

40,000 years ago, humans were using boar teeth as #currency. It’s human nature to attribute a higher value to #money that had required actual work to be obtained. #Crypto that are only based on proof-of-stake, which favors rent seekers over workers, are doomed to be perceived as less desirable store of value.

#Bitcoin #BTC #Ethereum #ETH

What do you mean by “Bitcoin doesn’t have monetary inflation”? I couldn’t find the answer on the website.

Trying to get someone you know on the #bitcoin life boat?

Send them here: https://bitcoin.rocks/inflation

Of all the #Bitcoin Rocks slogans, the “Bitcoin doesn’t have inflation” is the one that I have seen stirring the most debates. Bitcoin has some #inflation but it doesn’t have unbounded inflation like your #money does.

Good morning!

Highly recommended reading by nostr:npub1lxktpvp5cnq3wl5ctu2x88e30mc0ahh8v47qvzc5dmneqqjrzlkqpm5xlc

IMO, it’s too late for a critical mass of people to understand then adopt #Bitcoin or other #crypto. Not that we shouldn’t continue educating people about it but #CBDC will be here before people are set up with their self-custody #BTC wallet ready to transact with other bitcoiners. I’m hopeful that #Goldbacks can be a shortcut though. It’s easier for people to understand and adopt.

Interesting perspective but my general impression leans more towards the US being set up (through elite capture) to lose a global conflict:

- The US is sending its stocks of weapons in the Ukraine for a war with no end in sight. Let’s not forget the catastrophic departure from Afghanistan as well.

- The US is depleting its strategic petroleum reserve supposedly to combat inflation.

- The US government is opposing oil and mining projects under the pretense of pursuing the green agenda (while this agenda would actually require more oil and metals) making the US dependent on China for strategic materials.

- The US government is weakening armed forces by pushing the wok culture and mandating harmful injections.

These are some of the numerous signals I just can’t make sense of if the narrative you shared were to be accurate.

#Geopolitics #WIII

It’s not so much the number of forks that is an issue but rather the number of contentious forks that can cause the network to split in an uncertain state (Who gets the hashpower? Who gets the brand? Who gets the ecosystem support?). As far as I can tell, there is more drama going on in the #Bitcoin community than in the #Monero community and there had been more contentious forks with Bitcoin.

The mechanisms that lead to a network upgrade on Monero and Bitcoin are similar so I’m not sure why one would be more resistant to corruption than the other.

I think the finite supply argument being in favor of #Bitcoin is way overblown. Personally I don’t care much that #Monero has an infinite supply the way it is implemented. The inflation will be reduced each year and it’s an insurance for lasting security.

For Bitcoin although block rewards will be emitted until 2140 or so, it’s possible that we start seeing some cracks much earlier in how the current security budget is implemented. I don’t know if this will happen in our lifetime but this question will certainly stir a lot of infighting which could easily lead to a major fork event. The finite supply of Bitcoin is a reality until it is not.

Regardless of whether the supply of finite or not, the price is determined by offer and demand. For Bitcoin and Monero, the coin emission is a negligible part of this equation and you can see it in the price action from the last bull-bear cycle.

I agree that “level of security” is a crucial criteria to determine the #crypto in which you want to keep your capital. I don’t doubt that #Bitcoin is a more secure choice in terms of hashpower although I’m not sure how we can really compare it with #Monero which uses RandomX. It’s possible that Monero hashpower is more decentralized than Bitcoin hashpower. On the other hand, it would certainly take less capital to attack Monero but Monero could be easier to defend since everybody has a CPU at home.

Regarding long-term security, while Monero security budget is ensured by the tail emission, there is still a lot of question marks on how Bitcoin miners profitability will be provided in the future.

Finally, privacy is a component of security as well. The fungibility of your Bitcoin funds can be more easily attacked by governments through #KYC requirements like those being deployed through the #TravelRule.

Although, this question would need to be looked at more closely, I’m not convinced that your funds are absolutely more secure with Bitcoin than there are with Monero. Both have pros and cons on this matter.

I’m not sure I understand the math from your example but to your point “price movement in a larger asset takes more energy for less change”, while I agree in principle, #BTC and #XMR have seen about the same price movement in the last bull/bear cycle. Also, #Bitcoin is a lot more leveraged than #Monero which offsets the fact that Bitcoin takes more capital to be moved.

Also #SPY at around $450…

#Trading #ElliottWave

My long-term price predictions for 2030:

- #BTC at $180,000

- #GLD at $5,600

Am I too optimistic or pessimistic on #Bitcoin and #Gold?

#Trading #Crypto

I’ve heard many bitcoiners say that it’s okay to use #Monero to pay for things (because it’s private) but you shouldn’t hold #XMR and that you should hold #BTC instead because it’s a better store of value.

I disagree. If you look at the BTC/XMR chart in the last bull cycle, you’ll see that Monero has performed about the same as #Bitcoin as a store of value.

As such, I think a better strategy is to hold XMR and use it for payment while trading BTC which is likely to be an asset with more trading opportunities.

Why would you want to hold BTC rather than XMR when they both do about the same as a store of value while XMR is a superior medium for payment?

The only case I see for holding BTC rather than XMR is that a spot ETF will be approved which would likely bring a massive influx of capital into Bitcoin but even then, it’s unclear if BTC would end up being a better store of value (since we may see similar massive outflow during bear markets). It may still be a better strategy to mainly use BTC as a trading vehicle.

Interesting interview on American elite capture by the #CCP including #BlackRock.

#Geopolitics #Politics

> “When I stated I want my data on the longest running blockchain, I'm not saying lightning runs on the base layer as much as lightning functionality requires it. When a lightning channel opens, a base-layer transaction on the Bitcoin timechain is broadcast and verified - That's the crux here.”

>> Isn’t this similar to how #drivechains would interact with the $Bitcoin base layer, just to peg-in and peg-out funds between two networks? By your definition, how would #BIP300 be more a “Trojan horse” than the #lightning network?

> “Every day BIP300 is seeming more and more like […] a last-ditch effort from shitcoins to remain relevant”

>> I still don’t understand how drivechains would make other #crypto more relevant. It seems to me that drivechains have the potential to make other blockchains less relevant although I’m skeptical that drivechains will have this effect. Especially, you insinuate that people involved in other crypto are making an effort to push BIP300 but I haven’t seen any evidence that this is the case.

#blockchain #drivechain