Isn't the strike in the US ports a fantastic opportunity to 'feed' the herd with printed bs fiat money again? In a way it has this cool covid flavor. We need to push inflation higher again!

#strike #usa #ports #inflation

I really don't think so. Maybe after some beer it's getting better... for You to listen to

You should hear me talking. A german that's living in Spain for 7 years...

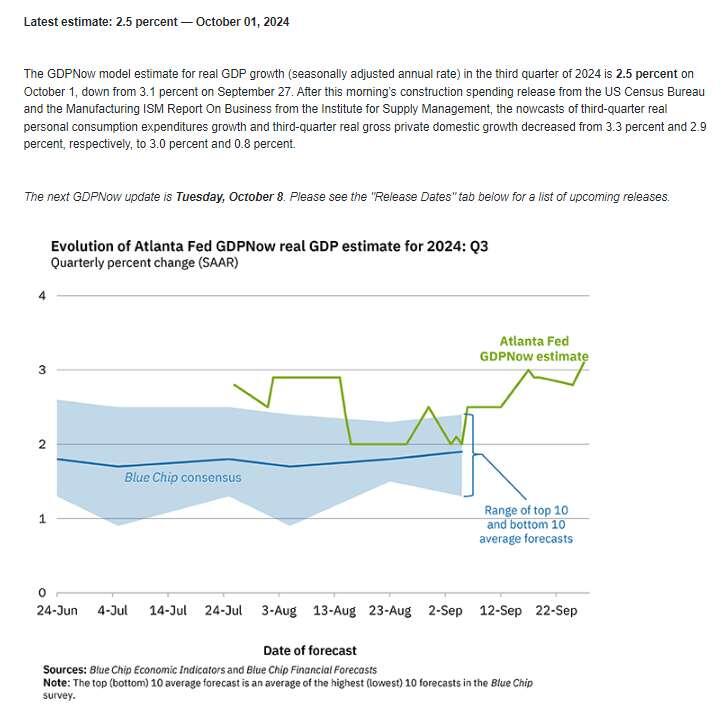

Economic Slowdown - Atlanta Fed Model Signals Cooling Growth

Q3 economic expansion projections take a hit as key forecast slashes expectations. The closely-watched GDPNow model now points to 2.5% growth, a significant drop from earlier 3.1% estimates. And now keep in mind how these keynesian fiat clowns are pumping out artificial demand and public debt to manipulate the elections. That's a terrible sign how far the central planers zombified the economy.

#EconomicIndicators #GDPForecast #MarketTrends #fed #us #btc

My English isn't the best...

🤣🤣🤣I'll change the title

Watch: Yemen’s Houthis Shoot Down Another $30 Million US Reaper Drone

From ZeroHedge

The Houthis have declared that they plan to intensify their ballistic missile attacks against Israel in light of the killing of Hezbollah’s Hassan Nasrallah and the new Israeli military ground assault on Lebanon. The Shia rebel group of Yemen has also of late been […]

Oct 1st 2024 9:25am EDT

Source Link: https://www.zerohedge.com/geopolitical/watch-yemens-houthis-shoot-down-another-30-million-us-reaper-drone

Share, promote & comment with Nostr: https://dissentwatch.com/boost/?boost_post_id=850689

Now You know why aircraft carriers are silently withdrawn off critical waters. #us #yemen #russia

Global Trade Shift: West's Growing Reliance on Chinese Goods

A recent MERICS study reveals a significant shift in global trade dynamics over the past two decades. The EU and US have become increasingly dependent on Chinese imports, particularly in machinery and electronics. Meanwhile, China has successfully reduced its reliance on Western industrial goods.

The study highlights a growing asymmetry in trade relationships, with the West maintaining high dependence on Chinese textiles and furniture. China's strategic diversification away from tech-intensive inputs from leading industrial nations is cited as the primary cause of this imbalance.

MERICS expert François Chimits emphasizes the need for European efforts to diversify imports and bolster domestic industry, calling for a targeted approach to address critical sectors.

https://merics.org/en/report/growing-asymmetry-mapping-import-dependencies-eu-and-us-trade-china

#GlobalTrade #China #eu #usa #Economy #TradeImbalance #geopolitics

GM, Dr. Jeff.

Fink really got me scared🤣🤣🤣

US: Manufacturing Slows

Recent economic data reveals a complex landscape for the U.S. economy. Manufacturing activity continues to contract, with the September PMI holding steady at 47.2, slightly below expectations. However, the job market shows resilience, as August's job openings unexpectedly jumped to 8.04 million, surpassing forecasts.

Construction spending dipped marginally by 0.1% in August, defying predictions of growth. Manufacturing prices cooled significantly, dropping to 48.3 from 54.0, while employment in the sector fell sharply to 43.9. On a positive note, new orders in manufacturing saw a slight uptick to 46.1.

These figures suggest a delicate balance between economic headwinds and pockets of strength.

#EconomicIndicators #US #Manufacturing #JobMarket #ConstructionSector

Spain recovers the VAT on food and supermarkets in La Seu will have to raise prices between 2 and 10% https://www.byteseu.com/460458/ #Andorra #PrincipalityOfAndorra #PrincipatD'Andorra

The state and its bureaucracy will never be satisfied. The parasites grows until it implodes. #socialism #eu

After the elections in #Austria, #France and the state elections in #Germany, it is clear that the political center in Davos (#WEF) is still in full control of most of the old continent. So: continued uncontrolled mass invasion, climate bullshit, more control state, national debt and accelerated cultural and economic decay coming.

Eurozone Inflation Falls Below ECB Target (of theft)

Inflation in the Eurozone has declined for the first time in months, with the annual rate dropping to 1.8% in September, down from 2.2% in August. This puts inflation below the European Central Bank’s (ECB) target of just under 2%, according to preliminary data from Eurostat. The decrease matches the forecasts of economists and could signal easing price pressures across the region.

And now, Chrissie: Pump the sh.t out of this Euro-trashcoin!

#Inflation #Eurozone #ECB #Euro #Bitcoin #BTC #Economy #MonetaryPolicy #Eurostat

Eurozone Industry Slips Further into Recession: September PMI Declines

The Eurozone's industrial sector took a deeper plunge into recession in September, with the Purchasing Managers' Index (PMI) falling to 45.0 from 45.8 in August, according to S&P Global. A PMI below 50 signals contraction, and the drop highlights accelerating declines in production, new orders, employment, and purchasing volumes. Stocks also continued to deplete, while business expectations hit a 10-month low.

Germany's manufacturing woes deepened too, with its PMI slipping to 40.6, the lowest in a year. Companies face heightened uncertainty over demand, geopolitical tensions, and economic conditions, which led to negative outlooks for the first time in seven months. With this sharp decline, pressure is mounting on the European Central Bank to lower interest rates more quickly to support the faltering economy.

#Eurozone #PMI #ManufacturingRecession #IndustrialDecline #Germany #SPEconomy #GlobalEconomy #ECB #InterestRates

The look on my neighbor's face here in the country reminds me very much of the facial expression of the average central banker.

#spain #fiat #fed #ecb #centralbank #bitcoin

#Cádiz is a pearl!

#spain

Watch Live: Fed Chair Powell Speaks As Rate-Cut Euphoria Fades

Watch Live: Fed Chair Powell Speaks As Rate-Cut Euphoria Fades

Since the July FOMC meeting, US macro data has done nothing but surprise to the upside, but that didn't stop The Fed from slashing rates by a crisis-like 50bps on 9/18.

?itok=-9HnVVBU

?itok=-9HnVVBU

Source: Bloomberg

The strengthening economic data, 'soft' or 'no'-landing-esque, has prompted a hawkish decline in the market's expectations for rate-cuts in 2024 and 2025...

?itok=vopmXPAE

?itok=vopmXPAE

Source: Bloomberg

In light of all that, Fed Chair Powell is scheduled to address the National Association for Business Economics (NABE) at 1355ET in Nashville, Tennessee, and for the first time since the big cut, he is expected to elaborate on the Fed's decision and on the considerations that will frame an expected series of reductions in borrowing costs over the rest of this year and in 2025.

?itok=2BCcPjk3

?itok=2BCcPjk3

Debate over that decision has already begun.

In remarks to a bank conference in South Carolina on Monday, https://www.federalreserve.gov/newsevents/speech/bowman20240930a.htm

who dissented against the half-percentage-point cut on Sept. 18 in favor of a quarter-percentage-point reduction, noted that the personal consumption expenditures price index stripped of food and energy costs had increased slightly in August.

Interestingly, Reuters reports that among 32 professional forecasters surveyed recently by the NABE, 39% cited a "monetary policy mistake" as the "greatest downside risk to the U.S. economy over the next 12 months." By contrast, 23% regarded the outcome of the Nov. 5 U.S. presidential election as the biggest downside risk and the same number cited an intensification of the conflicts in Ukraine and the Middle East.

So will the apolitical Powell jawbone the market's uber-dovishness back a smidge? Or play down just how strong recent macro data has been?

Watch Powell speak live here (due to start at 1355ET):

Read Powell's full prepared remarks below:

Developing...

https://cms.zerohedge.com/users/tyler-durden

Mon, 09/30/2024 - 13:45

https://www.zerohedge.com/markets/watch-live-fed-chair-powell-speaks-rate-cut-euphoria-fades

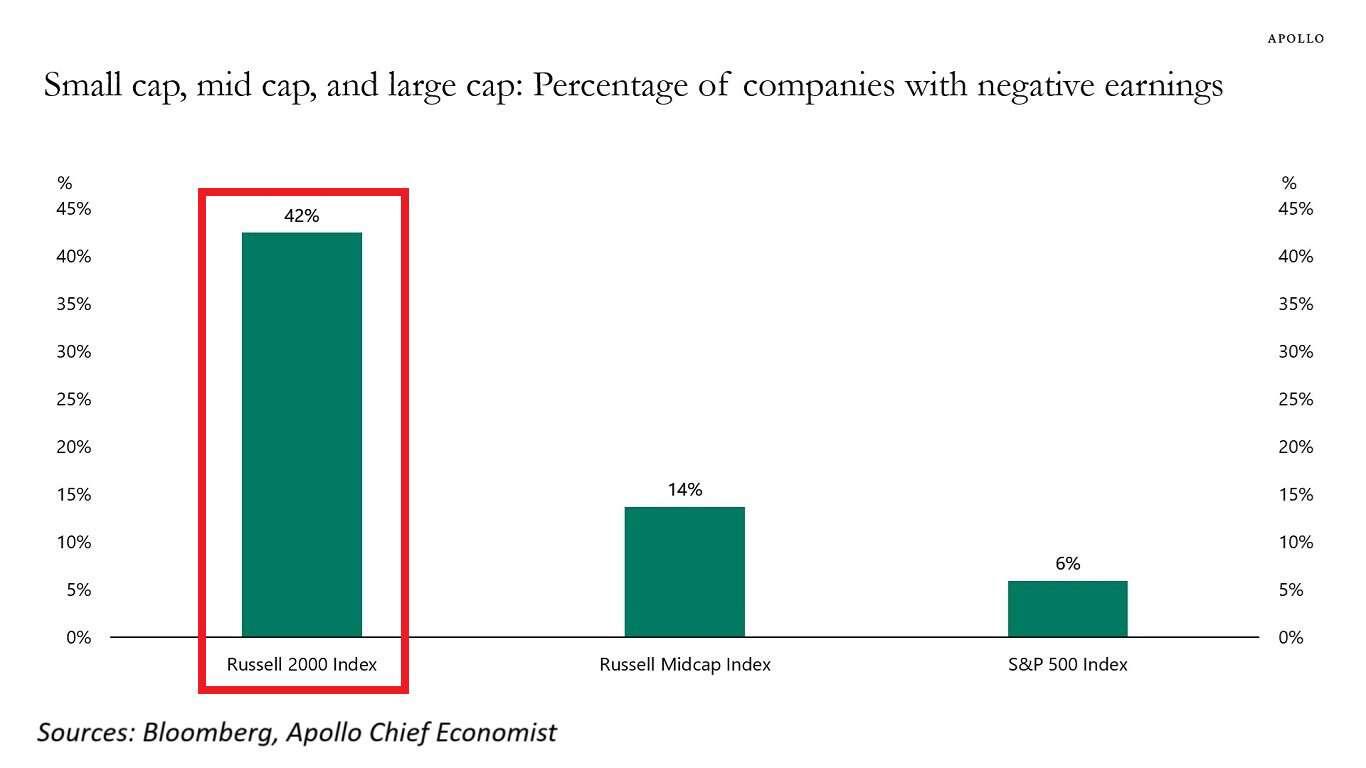

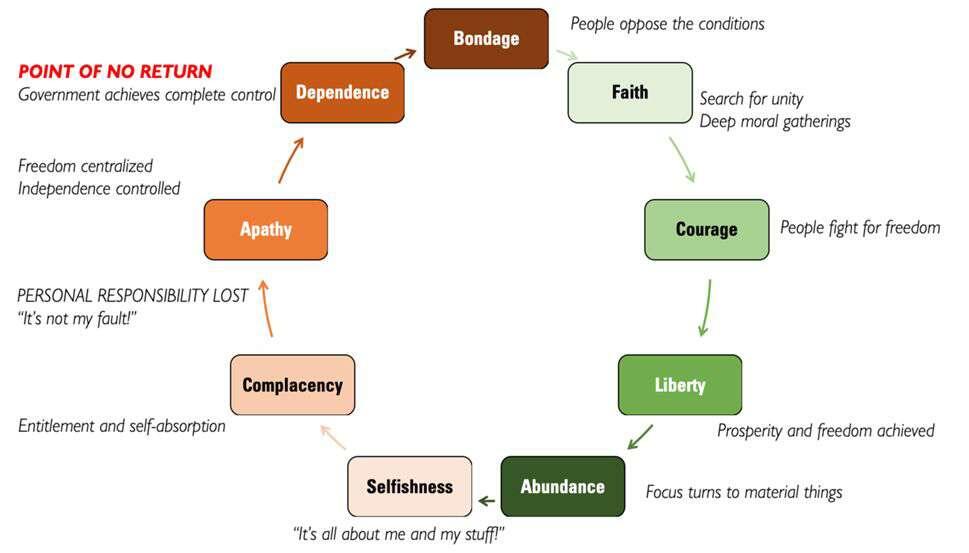

ZIRP, the Zombie Economy, and the Rise of State Power: A Dangerous Path to Socialism

In the aftermath of the financial crisis, central banks implemented Zero Interest Rate Policy (ZIRP) to prevent economic collapse. However, instead of fostering genuine growth, ZIRP has bred a "zombie economy," where 42% of companies in the Russell 2000 Index are operating at a loss, kept alive by easy access to cheap capital.

But the damage goes deeper than inefficient companies surviving. ZIRP laid the foundation for growing state power and interventionism, with governments stepping in to control markets, sectors, and industries more tightly. Under ZIRP, markets are no longer free, and the state takes on a paternalistic role, bailing out failures and redistributing wealth in ways that erode personal responsibility and innovation.

The consequences are far-reaching and destructive. As state power grows, society moves dangerously closer to socialism, where the government plays an ever-larger role in the economy, distorting the natural mechanisms of competition and market discipline. This leads to a stagnant economy, where true prosperity is replaced by dependency on government intervention.

Bitcoiners know that sound money, not debt, fuels a healthy economy. ZIRP has pushed us toward a socialist-like system, where intervention, not market forces, rules. It's time to push back before the foundations of a free economy are permanently eroded.

#ZIRP #ZombieEconomy #StatePower #Interventionism #Socialism #Bitcoin #SoundMoney

Those with even a modicum of economic expertise are truly not surprised by this chart. Germany's economic decline is home-made and the political caste with its media sector, which applies equally to large sections of the business community, are not prepared to drop the failed and infantile climate and world rescue agenda in order to return to free capital formation. Germany is turning into a stupid command economy before our eyes.

#germany #eu #climatescam #socialism #greennewdeal