China Slashes Key Lending Rates in Bold Economic Rescue Move

China's central bank just dropped another monetary 'surprise' with a 25bp cut to both 1-year and 5-year loan prime rates. The move pushes rates to historic lows of 3.1% and 3.6%. PBoC Governor Pan telegraphed this on Friday, but the size of the cut still surprised markets.

Big question: Will banks actually lend more when the economy's struggling? Lower rates don't automatically mean more credit flowing. We are witnessing how stupid Keynesianism keeps ramming its head against the same wall, slowly destroying the very fabric of the economy.

Key points:

- Largest rate cut in recent memory

- Part of Beijing's aggressive economic stimulus

- Banks already cut deposit rates last week

- Standard Chartered sees this as policy pivot

#China #MonetaryPolicy #Economics #Banking

Global Debt Spiraling Out Of Control

One can only agree with Bloomberg's debt forecast. The trend in global government debt is clearly upwards. But the fact that, when it comes to Germany, they adopt the German approach of completely ignoring the reality of demographics, over-regulation, recession, de-industrialization and the exploding welfare state is incredibly grotesque.

And it is the European Union that is currently setting the direction in which politicians will react to the debt crisis that they themselves have caused: higher taxation, as Germany has raised five tax rates this year, capital controls and of course, you guessed it, even higher government spending, to confirm my suspicion that the current political caste is no longer capable of any learning process or intellectual evolution.

(Hodl #BTC)

#germany #eu #debt #inflation #ecb #debtcrisis #ampel #socialism

It came as it had to: #Germany is now blaming #Russia for its own economic catastrophe. Not a word about the green catastrophe agenda, the infantile climate apocalypse, the over-regulation, the open borders with a built-in implosion guarantee for the social funds, the demography for which no provision has been made - Germany is on the way to economic second-class status.

#wef #greendeal #recession #socialism

Oh, I'm looking forward to the (not so far) future when I can start shorting the sh.t out of the Euro. There is a little treasure waiting for those who have no problem listening to Chris Lagarde and watching her Adam's apple jumping around...

European Credit Ratings Shake-up: France Downgraded, Italy Gains Relief

Major shifts in European sovereign credit ratings today as Scope downgraded France while Fitch upgraded Italy's outlook. France takes a hit to AA- amid budget concerns and political uncertainty following early parliamentary elections. Meanwhile, Italy's outlook improved to positive, reflecting stronger fiscal discipline and EU compliance.

#EuropeFinance #CreditRatings #GlobalMarkets #MacroEconomics

To me it's enough seeing these parasites panicking

They are next level stubborn stupid. Maybe it's that easy. Look at freaks like Chrissie and You've seen it all

Nuclear power is experiencing a massive upswing

It cannot be emphasized often enough: the clever part of the global economy is investing massively in the latest innovations in nuclear power and is backing this ecologically clean technology of the future. Whatever is going on in the childish minds of German politicians, the bill for this catastrophic political failure to destroy nuclear power in the country is being paid by the people of Germany. This country has been economically sidelined by naive ideological seduction and it will take a long time to overcome the consequences of this catastrophe.

But it looks like Germany is not even prepared to make a diagnosis (what about the Russia sanctions??) in order to honestly work through what triggered the energy crisis and how far the de-industrialization that was initiated by the green transformation policy has already progressed.

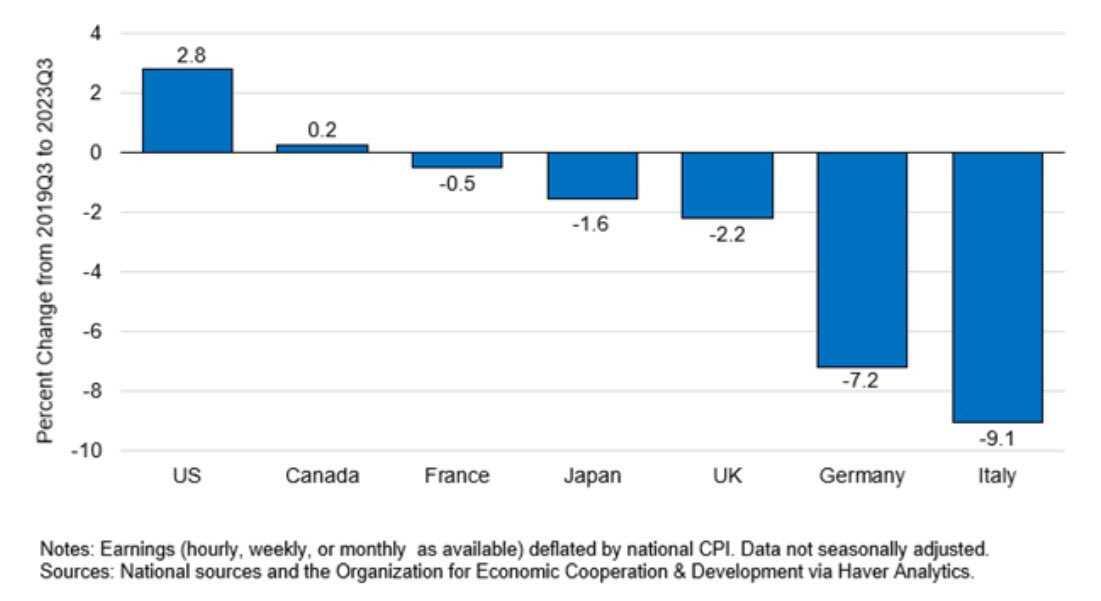

The loss of purchasing power of German households combined with the crumbling of the productivity of the German economy is an unprecedented development at this point in time. And with its ideological rampage, Germany is taking the European economy as a whole with it, like a gigantic tanker that has been deliberately sunk by a stubbornly drunk captain and is dragging the boats around it down with it in its downward pull. It's all a disaster from an ethical point of view too.

#nuclear #wef #socialism #greendeal #germany #ampel

Do you imagine that there is even one person in the ranks of the European Central Bank with a functioning brain cell who at this moment comes up with the idea: if this is how Bitcoin is now, why don't we buy it with our own shitcoin and then drive the herd into the price in order to deleverage ourselves in this way? Anything is possible in this universe, even that a rotten institution like the ECB will one day discover its survival instinct.

My family on my father's side came from the communist GDR, from East Germany. I am therefore very aware of the whole problem that socialism brings with it, whether on an economic, social, cultural or individual psycho-dynamic level.

Brussels' gestures of dominance, interventionism and attacks on the private sphere of the 'sovereign' are more than just infantile muscle-flexing by a degenerate caste of parasites.

It makes me almost shiver to fit these developments like pieces of a mosaic into an overall picture and subsequently to arrive at the thesis that this growing power agglomeration could actually lay claim to complete dominance. Over a continent of half a billion people and many different cultures with different histories. This is ludicrous and doomed to failure.

#eu #europeanunion #socialism #wef #globalists #freedom

There are some nice ones in the Mosella region. Good vine by the way

BRICS Currency Reality Check: Putin Hits Pause

No new currency coming from BRICS yet - Putin just called it "premature" at summit. Door stays open for future but don't hold your breath. Big implications for global trade dynamics.

#BRICSummit #GlobalEconomy #TradeWars #FinancialMarkets

ECB with declaration of war on Bitcoin

Those of us who live in the eurozone or within the European Union already suspected it beforehand: the European Central Bank, sensing a threat to its monopoly on money creation, is about to take up the fight against Bitcoin. And it will do so with all the illegal means it should not have at its disposal. Supported by the capitals of the eurozone, which have become completely dependent on the Frankfurt money printer, we will soon be in for a rough ride when the bridges and gates close and new tough fiscal rules are introduced.

As I have been describing for months, the eurozone, the European Union is facing difficult fiscal years in view of its disastrous regulatory policy, the infantile climate policy and its Russia policy - it will do everything it can to eliminate signals that could indicate a crisis in the monetary system, such as a steadily rising Bitcoin price.

Click here for the paper, with all the details: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4985877

#btc #bitcoin #eu #europeanunion

#Canada must have declared its accession to the #EU sometime 10 years ago. What a debacle! #Socialism https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/3ea2218c47011ad2c141abee749f9a3d0f6d30bf098fe30b6d1313f632483f7c.webp

Bureaucracy: The Illusion Of Eternal 'Growth'

This is the path society takes when it increasingly nationalizes tasks: once created, bureaucracy justifies its existence by creating new demand for its services and thus emanating more bureaucracy from itself. You can observe this phenomenon quite well in the steady growth of the welfare state in general.

It is therefore relatively easy to answer the question of how it is possible for educational or social costs and treatment costs to become ever more expensive despite technological progress. Bureaucratic large-scale institutional apparatuses are not only the apron organizations of political science, which will generate, consolidate their power and error potentials are the maxip material justification of existence.

It is therefore relatively easy to answer the question of how it is possible that, despite technological progress, educational and social costs and treatment costs continue to rise. Large bureaucratic institutions are the front organizations of the political parties within the social force field. With their drive for internal growth, politics fulfils its own goal of transferring power to the product sector openly to itself and its own organizational structure.

How long will this continue? That depends to a large extent on the extent to which the bond markets are saturated and whether politicians succeed in 'rolling' the mountain of debt intertemporarily and at the same time forcing the freshly issued delta into the increasingly clogged channels of banks, insurance companies and parastatal bond dumps in order to maintain the illusion that parasitic bureaucracies can be expanded at will until the end of time.

#ampel #eu #usa #socialism #inflation #freedom #mises https://nostrcheck.me/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/53704a66529ac8d2b5301fbc8b67677a4dd3ba9ddadb83b7797627a10bd5de7d.webp

As long as You know what You're doing without touching Your saved btc stack You should be fine.

Central Banking: The Root Of All Evil

If, according to the Keynesians and Säocialists, lowering interest rates leads to economic growth, why doesn't the central planner in charge, the central bank, set the interest rate permanently negative, at -35% for example?

That should then generate a boom, jobs (this always comes up in infantile politicians' speeches, as they pretend being responsible for every employment contract) and paradisiacal prosperity.

No, it's just that socialist politics, or the actively pursued transfer of power from the productive sector of society to parasitic rent-seekers (who might that be?) has merged with the fiat money printer and in this way all the darkroom ideology of resurrected socialists, this time weird woke and in green grubby garb, is printing the necessary cash. Naturally, as the state economists will always deny, knowing better, because they are paid to look the other way, this destroys our purchasing power and pumps the pockets of those close to the money printer.

Doesn't it seem suspicious and strange to you that no important politician ever debates the central bank? That monetary policy is never critically scrutinized by the mass media?

Central banking is a redistribution mechanism and a vehicle to centralize economic and political power. That works so well for so long until we start pulling back the curtain to reveal the scary theater!

By the way: You should read Griffin's 'The Creature From Jekyll Island'. That helps opening Your eyes.

https://youtu.be/lu_VqX6J93k?si=oxeR5dhrz6tDrbau

#centralbank #fed #ecb #greendeal #eu #euro #inflation #socialism #bitcoin https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/c3b1ce7b891f8cbe7e65fe19b435863db2a92e26aabfe4d17fe4c26947db1ba3.webp

#SEC approves options on #Bitcoin ETFs. Nice, but I'm a simple man. Buy and hodl elevated my life financially, emotionally and in a way culturally too (inner peace, more focus on literature again after the clown flue shock).

But those who need to hunt 'yield'... I wish You all the nerves and luck it needs in the long run!