The interesting thing about the current debt spiral is that it has a global character. In addition to the USA, which has dropped all fiscal discipline under Joe Biden's government, the chronically interventionist European Union and the fiasco that is Japan, it is striking that the debt of both the private and public sectors has also spiraled in China. The fiat devaluation is programmed, safe havens in Fiatlandia seem to have sunk! Find your lifeboats!

#bitcoin #gold #china #eu #usa #inflation #debtcrisis https://nostr.download/c94da4910b2430df98f07e50d08a0df979e55a921626c657ebd139b0029b9864

EU Targets Elon Musk’s Empire: Could SpaceX and Neuralink Face Fines Due to X?

European regulators may hit Elon Musk with substantial fines, as they explore including revenue from his other ventures like SpaceX and Neuralink in penalties against his social media platform X. Under the EU's Digital Services Act (DSA), firms failing to control illegal content and disinformation can face penalties of up to 6% of global turnover. While no final decision has been made, the EU seems determined to impose fines severe enough to prevent repeated violations.

The idea of freedom represented by the bureaucrats in Brussels is gradually being revealed. It's going to be a tough fight for our civil rights!

#ElonMusk #EU #SpaceX #Neuralink #DigitalServicesAct #Regulation #TechNews #SocialMedia

Fiat Money Accelerates Its Decline

The gold chart shows the slow and accelerating death of the euro. They won't tell you, but governments and central banks, even in the eurozone, are holding massive amounts of gold. They will use it to drop their last anchor while the population is forced to lose their purchasing power in the dying junk currency, confused by the media narrative. At a certain point, the news will spread that states are printing money and thus destroying the purchasing power of their citizens in order to secure this lifeboat for themselves. But there are other ways to escape the state intervention trap and creeping socialism...

In a few days, the big conference of the BRICS states will start in Kazan. The world will then see the unveiling of their currency plans, which are likely to imply a gold standard.

#bitcoin #gold #debt crisis #eu #euro #inflation #ecb https://nostr.download/d45c030b0be943dee9251ac92ac205f334fceefbcb63c94331cb407c57090e11

I am a big fan of redistribution. Remove all subsidies and end the parasitic rent seeking of welfare entrepreneurs!

#germany #greendeal #climatescam #socialism #ampel #ru

The fact that the #USA has canceled the #Ramstein meeting shows that the #Ukraine project is slowly being passed on to the #UK and the #EU. In view of their recession, they are now under massive pressure. This proxy is slowly coming to its final stage.

ECB's Strategic Rate Cut: Navigation Through Economic Headwinds

The European Central Bank executed its anticipated 25-basis-point rate reduction, marking a pivotal shift in monetary policy. The deposit facility rate now stands at 3.25%, with the main refinancing rate adjusted to 3.40%. While maintaining a meeting-by-meeting approach, the ECB forecasts a temporary inflation uptick before convergence to target levels. The bank's leadership confirms the disinflationary process remains on course.

#monetarypolicy #ECB #eurozone #inflation #ratecut

📊 KEY MARKET SIGNAL: Falling IG Credit Spreads - What It Means

US investment grade corporate bond spreads have tightened to 0.80%, reaching levels not seen since early 2022. This compression signals:

1. Lower perceived credit risk

2. Strong risk appetite from institutional investors

3. Growing confidence in corporate balance sheets

🔥 Risk Asset Implications:

- Supportive environment for equities

- Positive for high-yield bonds

- Favorable backdrop for assets like Bitcoin

Why? When IG spreads compress, investors typically:

- Search for higher yields

- Increase risk tolerance

- Move capital into growth assets

For Bitcoin specifically: Improved credit conditions + risk-on sentiment historically correlate with stronger crypto performance, as institutional capital becomes more comfortable with higher-risk allocations.

$BTC $SPX #markets #investing

Credits to: @SoberLook on 'X' https://nostrcheck.me/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/305c6634f1aae4a27dbe6969b4a1d048caaa77a55ab914287423d265dfdd0b19.webp

Eurozone Inflation Dips Below ECB Target: Money Printer Goes Brrr?

---

September inflation numbers show Eurozone cooling further than expected, hitting 1.7% YoY (vs 1.8% forecast). Monthly figures flat at -0.1%. With numbers dropping below ECB's 2% target, expect more monetary adventures ahead. The fiat fiesta continues...

#economics #ECB #inflation #euro https://nostrcheck.me/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/df4e501c00ddcceaa4e5c1dc4ae27c91710a2602061d91096b962c055868cdcb.webp

Japan's Economic Crisis Deepens: BOJ's Monetary Policy Trapped

As the Bank of Japan attempts to normalize interest rates and stabilize the yen, the world's third-largest economy slides deeper into recession, with industrial output showing alarming decline signals.

Japan's economic woes intensified in August 2024, with industrial production plummeting 3.3% month-over-month, marking the fifth monthly decline this year. The manufacturing sector's downturn was particularly evident in the automotive industry, which experienced a sharp 10.7% production drop.

The latest data reveals a broader economic malaise, with capacity utilization falling 5.3% to 97.6 points, while year-over-year industrial production contracted by 4.9%. Key sectors including electrical machinery, information and communication electronics equipment (-6.2%), and production machinery (-4.6%) all registered significant declines.

The Bank of Japan's attempts to normalize interest rates and stabilize the yen appear to be backfiring. Analysts suggest that the recent modest rate hike cycle may have already reached its terminus, as the nation grapples with its massive debt burden. This monetary tightening strategy, aimed at ending the era of ultra-loose monetary policy, seems to be pushing Japan further into economic distress.

The confluence of declining industrial output, falling capacity utilization, and mounting debt concerns paints a troubling picture for Japan's economic recovery prospects, challenging the effectiveness of current monetary policy measures.

#Economy #MonetaryPolicy #Industry #EconomicData #AsianMarkets #GlobalEconomy #Japan

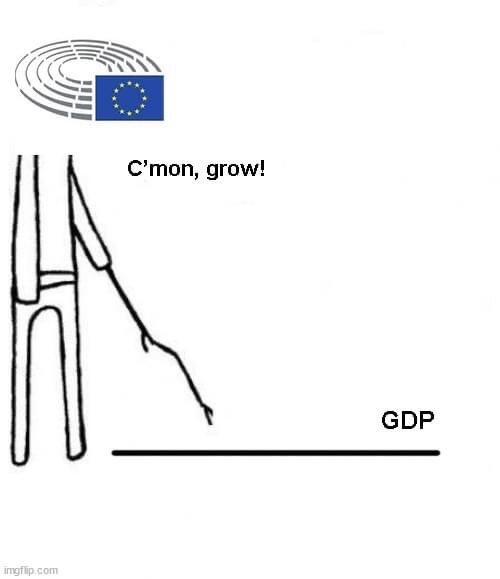

European Fiat Ponzi Gains Momentum

Across #europe, #inflation is falling. This opens the way for the key central banks, the #ECB, and the #BoE to cut rates even faster. The keynesian fiat ponzi is slowly picking up speed. Meanwhile, the real economy is in decay!

Now the window of opportunity for the interventionists and statists is opening. They will create as much cheap money through new debt as possible to fuel their pseudo-growth like the Green Deal. This, of course, crowds out productive investment and squeezes the capital needed to get out of the growth and demographic squeeze.0

Taxes are theft

United States Ny Empire State Manufacturing Index - back to normal level. We need another proxy war. Asap.

#usa #manufacturing https://nostrcheck.me/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/ba7130a2e7723cb7bc6a3940705fe48d5dfa530cbe611a323f84461d1fe4dfa2.webp

IMF Shocked as Keynesianism and Statism Magically Inflate Debt

In what can only be described as a revelation, the International Monetary Fund (IMF) now predicts that global public debt will balloon to match the world’s annual economic output by the decade’s end. Who could have seen this coming? The decades-long dance with Keynesianism and relentless statism somehow resulted in massive debt. With slower growth and rising interest rates, that threshold might even be crossed sooner than anticipated. According to the IMF’s latest report, governments must now embrace drastic spending cuts and tax hikes—something we’re hearing for the first time, right?

"It's time for governments to get their fiscal houses in order," says Era Dabla-Norris, Deputy Director of Fiscal Affairs at the IMF. But why bother when the same playbook has been dusted off for every economic hiccup?

The IMF expects global public debt to hit $100 trillion this year, almost 93% of the annual global economy. And as for future debt? Well, with America, China, and other major players ramping up borrowing, the IMF now admits that debt will keep soaring. A shocker.

In extreme scenarios, global debt could reach 115% of global output by 2026, with U.S. debt hitting 150% of GDP. Somehow, the U.S. debt, which was under 60% of GDP at the start of this century, didn’t stay there. Perhaps it’s time to rethink this Keynesian magic and get rid of parasitic instituions like the IMF itself? They could offer their 'service' on the free market to figure out who in his right mind would pay for this.

#IMF #DebtCrisis #Keynesianism #Statism #FiscalPolicy #Bitcoin #USA #EU https://nostrcheck.me/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/3274bb1ada61aab28524dbf3871fe926fa3c99259576ef741d215fd7576f96ba.webp

We'll have a seat in the first row (btc)

Germany is squandering its future

Over the past decades, the European Union has transformed itself into a gigantic subsidy and redistribution apparatus, at the end of which a gigantic bureaucracy siphons off its unwarranted share of the productive forces of the economy. What the EU declares as the Green Deal is nothing more than artificial GDP paid for with inflation money, a pathetic attempt supported by media apocalyptic narratives to implement permanent interventionism, following the classic Keynesian script.

It was clear to anyone who has studied the economic history of the second half of the 20th century that this 'strategy' had failed when it was launched.

The fact that Germany, of all countries, which is in a phase of de-industrialization, is now throwing billions in subsidies into subsidized companies against the backdrop of the so-called green transformation, is only worth a footnote. This economy is in a dramatic decline and its parasitic subsidy entrepreneurs will do everything they can to take what the subsidy machine still has to offer. Meanwhile, the productivity of the private sector is dying and everything is spiraling downwards.

#germany #eu #greendeal #socialism #recession #ampel https://files.sovbit.host/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/289da3d5024539542823b23bd9e197370e6ab2af286fa6c2bf1623571ca0332b.webp

Nono. It's the liquidity map from 'crossbordercapital'. You can find it on 'X ' or on their webpage.

China's Deflationary Spiral: A Threat to Global Fiat Currency Systems?

China's economic woes deepen as deflationary trends intensify. September data reveals a sharp decline in producer prices, dropping 2.8% year-over-year. This marks two consecutive years of deflation, outpacing August's 1.8% fall and economist predictions.

Consumer prices barely cling to positive territory, rising just 0.4% annually. Core inflation hit a three-year low at 0.1%, signaling persistent weak demand. The property market slump continues to drag on the economy, prompting Beijing to consider further stimulus measures.

China's situation highlights a fundamental weakness in the global fiat currency system. Rising prices are crucial for governments to push debt burdens into the future, and deflation poses a significant threat to this model. With China's real estate market collapse, the country may need to generate unprecedented levels of stimulus and artificial state demand to counteract the deflationary spiral.

And Chinese politicians are reacting to this debacle by announcing new stimulus programs day after day, accelerating step by step, driving the volume of credit ever higher. China will not be able to avoid massively expanding its monetary and fiscal activities and devaluing its currency. The collapse of the real estate market could have been the key to understanding a deflationary shock in the medium term.

#China #Economy #Deflation #GlobalMarkets #FiatCurrencyCrisis #EconomicStimulus

Central Banks' Liquidity Map Turns Into 'Spring'

Nothing is more predictable than the fiat money printing spectacle! Excellently documented in the Austrian School of Economics in the so-called 'boom-bust cycles' since Luwig von Mises, the usual liquidity cycle is taking place before our eyes. The value of money is manipulated by global central banks via the interest rate mechanism, the existing time preference of economic subjects is ignored, and the next impetus for massive capital misallocation is already in the making.

In this environment economies are systematically losing their ability to efficiently build capital and generate productivity in free markets. Each of these cycles leaves a trail of destruction, poverty, and the typical theft from middle class purchasing power to the state and its proliferating bureaucracy.

Graphic: @crossbordercapital on 'X'

#liquidity #interest #fed #ecb #inflation #bitcoin https://nostpic.com/media/863f2c555276e9ed738933b0efee6b021042f16e1529dd755704885b87fee183/025611262cc4491723ad5d8af6f07371e99a4c9bfd3254b129e22f9668634b70.webp

Germany's Economic Tightrope: Balancing Debt, Defense, and Energy Policy Shifts

As Germany grapples with economic headwinds, Finance Minister Christian Lindner proposes increased borrowing, while NATO pushes for higher defense spending. Meanwhile, German consumers tighten their belts amidst financial uncertainty, and the opposition calls for a nuclear power revival.

In a bold move to address Germany's economic challenges, Finance Minister Christian Lindner plans to significantly increase new borrowing in 2025. The net borrowing is set to reach €56.5 billion, €5.2 billion higher than initially projected last summer. This increase comes as a response to weaker economic growth and is permissible under Germany's debt brake rules.

The additional funds aim to offset tax revenue shortfalls and cover increased unemployment-related expenses. However, this measure falls short of bridging the existing €12 billion gap in Lindner's budget draft.

As the government grapples with fiscal challenges, German consumers are feeling the pinch. A recent survey by EY reveals that more than one-third of Germans (37%) now only purchase essentials. Luxury items top the list of spending cuts (58%), followed by delivery services (49%), prepared meals (48%), and gym memberships (43%).

Adding to the financial pressure, NATO is calling for a substantial increase in Germany's defense spending. The highest-ranking German NATO general, Christian Badia, argues that the current 2% GDP target is insufficient, urging Germany to aim for 3%. This would translate to an additional €40 billion annually for defense, based on Germany's current GDP of around €4 trillion.

NATO's new plans call for an increase in combat troop brigades from 82 to 131 across the alliance. As Germany is expected to contribute about 10% of NATO capabilities, this would require an additional 5 to 6 combat troop brigades on top of the 10 existing and planned ones.

Nuclear Comeback?

In a significant policy shift, the Christian Democratic Union (CDU), Germany's largest opposition party, has announced its intention to return to nuclear power. The party is advocating for the reactivation of recently decommissioned nuclear power plants, a move they claim could be implemented without major obstacles. This stance represents a dramatic reversal in German energy policy, which had previously committed to phasing out nuclear power. The CDU's position raises questions about whether a broader reconsideration of nuclear energy might be slowly taking hold in German political discourse, especially in light of ongoing energy security concerns and climate change mitigation efforts.

#Germany #Economy #NATOSpending #ConsumerTrends #EuropeanDefense #GlobalEconomics #NuclearEnergy #EU