There are many indications that it was Russian air defense systems that repelled so much of Israel's attack on Iran. The technological progress of the Russian army should give the West pause for thought. An escalation with the Russians should not even be a dream

#Russia #Iran #Israel #nato

BRICS: Hardly any media coverage in the West

The fact that the #BRICS meeting in #Kazan received little media coverage in the West tells me that people in the West have still not recognized the scope of this movement.

For outsiders it seems to be moving at a snail's pace, it takes time to establish permanent institutions, exchange clearing houses etc. that have the capacity and competence to handle such a gigantic trading volume of the participating states correctly.

I would like to point out once again that the BRICS and the associated states could be a gigantic, energy-strong political bloc that could exert massive pressure on those who are hostile and have few resources of their own.

But these are conjunctives for the time being and we will continue to keep a close eye on the progress from here.

https://fountain.fm/episode/0m9gCYX1Z0EUGQYXqch9

#geopolitics #energy #oil

China in a deflationary tailspin

The crash in the Chinese real estate market, at times the largest single sector of the global economy, has wiped out around 13 trillion dollars in credit. The fiat money system, which leverages deposits on a frictional basis, cannot compensate for such an immense correction of bank balance sheets on a biblical scale without entering a deflationary spiral.

Two years ago, the construction industry collapsed by around 40% year-on-year and a few weeks ago the CCP announced new financial injections of another USD 40 billion to support the struggling Chinese banks and regions that need to get rid of this stinking baskets of rotten credit. These subsidies were exclusive funds for Chinese institutions; the highly involved Japanese institutions (maybe it wasn't the yen carry trade after all?), which are now paying the price for their involvement in China, were spared state aid just like other foreign investors during the evergrande bankruptcy. The European banking sector is also likely to be affected, as it was also heavily involved in the eternally booming Chinese real estate market, which probably has around 90 million vacant apartments, through institutions such as Deutsche Bank.

A bravura piece of central planning madness that ultimately leads to a deflationary spiral, which the central planners are now trying to stop by loosening credit conditions and introducing massive fiscal support programs. China is likely to have abandoned its ambitious growth targets for the time being.

#china #realestate #fiatponzi #ccp #deflation #bitcoin

Ireland: Parliament Passes Country’s First Ever Hate Crime Legislation

From Daily Stormer

Helen McEntee, Ireland’s Minister of Unbearable Cuntness, was very happy about this This was one of the most extreme “hate speech” laws in the world – probably the single most, even worse than Germany’s – and it’s now be watered down to just be about “hate crimes.” I guess that’s a victory? Breitbart: The Irish […]

Oct 25th 2024 9:00pm EDT

Source Link: https://dailystormer.in/ireland-parliament-passes-countrys-first-ever-hate-crime-legislation/

Share, promote & comment with Nostr: https://dissentwatch.com/boost/?boost_post_id=864406

It is a disgrace how the globalists of the WEF are using the freedom-loving Irish people, of all people, for their dirty plans to undermine our civil rights. The response to the attack on our freedom of expression will be felt by these parasites!

Be ungovernable - Bitcoin!

#Ireland #eu #wef #freedom

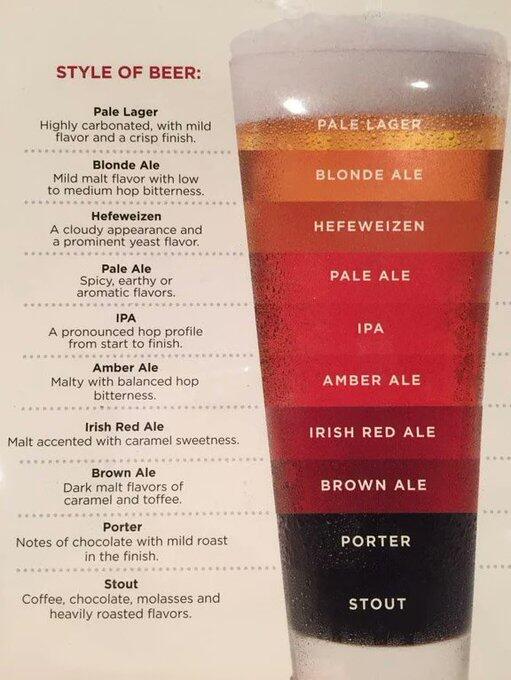

Interesting. Will test the pyramid this evening from bottom upwards

and it is moving after all, the mainstream press, moving as slowly as the continental drift, but at least it is moving.

Israel Conducts Limited Strategic Operation on Iranian Soil; US Confirms Non-Involvement

A strategic military operation targeting specific installations in Iran was confirmed today, marking a significant development in Middle Eastern security dynamics. US National Security Council spokesperson clarified America's position, emphasizing their non-participation while acknowledging Israel's right to defensive measures.

Sources familiar with the matter revealed prior consultations between Pentagon officials and Israeli counterparts regarding target selection. The operation appears carefully calibrated, avoiding critical infrastructure and nuclear facilities.

This measured response follows earlier regional tensions, demonstrating the complex interplay of diplomatic and military considerations in the evolving Middle Eastern security landscape.

#MiddleEast #GlobalAffairs #iran #israel #InternationalRelations

What happened to woke #Bezos??

May the spirit of George Washington stand with us in the fight against the opinion suppressors and deranged socialists.

#freedom #socialism #eu #usa

Russia's central bank combats iflation with drastic interest rates

The partial restructuring of the economy in a war economy continues to drive up inflation in Russia. It is currently running at between 8 and 9%. As a result, the Russian central bank is combat  ing price rises with a key interest rate of 21 %, an increase of 100 basis points announced today. Will the rouble, as one of the most important currencies in the BRICS currency basket, become a burden right from the start?

ing price rises with a key interest rate of 21 %, an increase of 100 basis points announced today. Will the rouble, as one of the most important currencies in the BRICS currency basket, become a burden right from the start?

#russia #inflation #brics #economy

U.S. Manufacturing Shows Underlying Strength Despite Headline Weakness

September's durable goods data reveals a nuanced picture of American manufacturing resilience. While headline orders declined 0.8% month-over-month, core orders - excluding volatile transportation - increased by 0.4%, significantly outperforming consensus expectations of a 0.1% decline.

This divergence highlights the importance of looking beyond surface-level indicators. Business investment in capital equipment remains robust, suggesting continued confidence in future growth despite broader economic uncertainties.

The outperformance relative to expectations (-0.8% vs -1.1% forecast for headline numbers) indicates that manufacturing may be more resilient than many analysts anticipated, with potential positive implications for Q4 economic growth.

#ManufacturingIndustry #EconomicIndicators #BusinessInvestment #IndustrialOutput

If you still don't understand where the attack on our freedom is coming from, take a look at this video by the German Vice-Chancellor and leader of the Green Communist Party. It's unbelievable. #x #musk #trump #harris #communism

https://video.nostr.build/f4092ab3230cfd27d2575a3f3c6adf5b307ccee5d270e69735f7802cf23de32a.mp4

The ten-year government bonds of #Greece are quoted 100 basis points below those of the #USA. Welcome to Phantasialand. #ECB

Eurozone Consumer Confidence Rises as Inflation Expectations Hit 2-Year Low

The European Central Bank's latest survey reveals inflation expectations have dropped to their lowest level since September 2021, with consumers anticipating 2.4% inflation over the next year.

In a parallel development, business lending has gained momentum, with corporate credit growth accelerating to 1.1% in September. This uptick, coupled with a 3.2% expansion in the M3 money supply, suggests increased economic activity despite tight monetary conditions.

Household lending remains positive at 0.7%, while consumer credit shows robust 3.0% growth. Fiat expansion is exactly what we want to see to destroy out purchasing power even more!

#eurozone #inflation #banking #economics #bitcoin #ecb #euro

If you look at the excesses of power and the abuse of this power, the suppression of public opinion, the repression by the officials of the European Union, who have now also expressed their expansionist intentions towards Moldova and Georgia, it becomes clear why libertarians are calling for the division of power into the smallest possible units. Back to a multi-state system and maximum subsidiarity!

#EU #europe #freedom #mises #autonomy

In a completely sick world, the Europeans would now participate in a proxy war and try to escalate it and draw the USA on the battlefield in order to get cheap access to the opponent's raw materials in the end by winning. But of course that would only be possible in a world full of psychopaths and officialdom.

https://www.zerohedge.com/commodities/visualizing-eus-critical-minerals-gap-2030

#ukraine #russia #eu

Bank Of Japan: Fresh Arguments Against Further Tightening

The sigh of relief from the central bankers at the Bank of Japan was hard to ignore. The latest inflation figure from the Tokyo metropolitan area, a very relevant figure for the country's overall bill in October, was 1.8%, below the 2% purchasing power theft mark, which this central bank also follows. Although the rate rose by 2.1% compared to the previous month of September, Tokyo is desperately looking for reasons to bring the interest rate cycle, let's call this joke that, to a quick end. Japan's economy is not running smoothly, the interest burden of the completely over-indebted state would rise immeasurably with positive real interest rates - so everything is in the green, the fiat party continues, the raid on the wallets of the middle class can pick up speed again, as elsewhere.

#BoJ #inflation #japan #bitcoin #soundmoney #mises