For the time being, the bond market is saying 'Njet' to the immense debt plans of the incoming German government. Germany's creditworthiness is in for a revalorization if it really wants to saddle itself with around one trillion euros of new debt over the next four years, which would take the country into French territory.

https://nostr.download/2dbf9a016bc4e796c30ef666755c781ba4fbbd5e2110286981ead0249d8a31c3.webp

The real interest rates on ten-year German bonds already show where the journey is heading and politicians will soon be confronted with this reality: either yield curve control, leading to the debasement of the euro, or the bursting of the gigantic debt plans and thus the planned governing coalition, which would be held together solely by new debt.

#eu #germany #bonds #debtspiral #inflation #bitcoin #economy #nostr

Ekelerregender menschlicher Abschaum

Canada's new globalist-in-chief must ensure dollar liquidity

The appointment of Mark Carney as Canadian Prime Minister shows several things: firstly, the globalists are rotating their staff without any democratic legitimacy. Secondly, the fact that they have appointed a former governor of the Bang of England, of all people, shows that they have understood that the attack on the globalists' policy, which is essentially a Keynesian fiat policy with zero interest rates, is being launched via the money markets. Thirdly, the euro-dollar market, i.e. the USD credit market outside the US, is almost illiquid and now needs new stimulus. So let's watch who among the globalists will be the next to bring US dollar-denominated government bonds into the market. I suspect it will be Canada! Fourth, all fiat currencies from the globalist political spectrum may soon come under massive pressure

#Canada #wef #usa #EU #inflation #nostr #bitcoin #economy #carney

GM,

Enjoy this lovely Sunday and try to add a pinch of humor to the world. #gm #nostr #lol https://nostr.download/e715aa6740f41b5234d4b38fc21f5aa6b0945291b3ac25e595839229580d9ca1.mp4

Germany, little China

with its 500 billion euro credit-financed investment program, Germany is taking the place of the economic engines within the Keynesian belief system as a kind of little China. The next German Chancellor, Friedrich Merz of the CDU, who has been hyped up by the mainstream media as an economic expert after working some years at Blackrock, has fallen completely prey to this belief. In the economic dream world of these people, only the state has to create sufficient artificial demand to overcome the growth and productivity dilemma of the eurozone, as China did on a global scale during the great financial market crisis.

The bond market already shows where the journey is heading: even higher mountains of debt, no stimulus for real economic growth and rising inflation expectations.

#eu #germany #china #fiat #debtspiral #bitcoin #nostr #economy

This is such a great policy from the relatively unknown Australian Libertarian Party. Hopefully more people become aware of it. nostr:npub1f4uyypghstsd8l4sxng4ptwzk6awfm3mf9ux0yallfrgkm6mj6es50r407 nostr:npub1scljc42jwm576uufxwcwlmntqggy9utwz55a6a2hqjy9hpl7uxps4pzprv

Thank You for this. Interesting

It is truly frightening how the fiat standard is attacking our purchasing power and thus our civilization, as shown here using the example of Great Britain and the USA. 1971, the year in which the remnants of the gold standard were eliminated, will go down in history as the year of great destruction.

The fiat standard is an institutional power machine, a systematic redistribution black box from the productive parts of society to the parasitic.

#gold #bitcoin #fiat #nostr #grownostr

No es probable pero es posible. Nos vamos a Argentina via Maruecos el mismo día de una declaración de la guerra entre la UE y Rusia

Sounds realistic. Than You start flooding Your country with youngmen from the barbarian countries...

Then I have another interesting economic variable here, the interest rate spread between the US and ten-year German government bonds. If it collapses, this indicates a flight of capital from the eurozone to the US. so keep an eye on it if things get geopolitically hot in Europe in the coming months. On a side note: isn't it curious that interest rates on German bonds are 200 basis points lower than their American counterparts? Here we see the European central bank at work, intervening massively to prevent the spread from collapsing.

https://www.investing.com/rates-bonds/de-10y-vs-us-10y

#USA #eu #germany #bonds #nostr #bitcoin #economy

Just in case you don't know this site yet, but if you want to get brief and precise information about macroeconomic data, I recommend this one: https://tradingeconomics.com/calendar

#macro #economy #news

I have marked in red all the states that are waging a passive war against Russia, have cut off Russian cheap gas and destroyed their nuclear sector at the same time. If I've read this correctly, Spain is likely to join them in the next five years and also declare war on nuclear power - we have the stupidest population in the world here in Europe!

#germany #spain #europe #EU #Russia #nostr

Thank You. That's for tomorrow

Yes, that's true. But gopolitical risks in Ukraine are rising too

No no. They're doubling down now. Wait for the new german gov. They are planning to put another 50 bio eur for green bs on the line

IMO the whole agenda points at control and centralization, interventions in the economy and nudging more and more aggressively toward what they call green transformation. Now the cbdc, centralized investment fonds etc etc

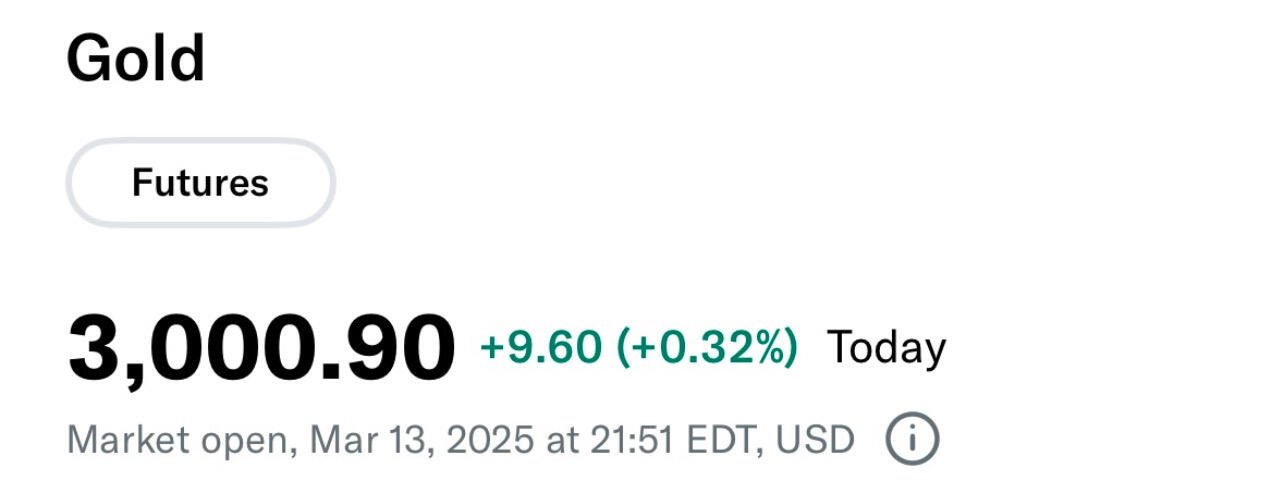

And the direction in which gold is fleeing is particularly interesting: from London and Switzerland directly to the USA. This is more than just telling, it is a terrible verdict on the policies of the European Union and the increasing control of its citizens. #gold #eu #usa