Ross broke the Law. He stays in jail. Should have only stacked bitcoin and not messed around with narcotics and armaments.

Lesson in there

I might also add that a wallet containing utxos and public keys should be added to the list. Not just the public keys because you have to sync with other nodes to reclaim that history. If bitcoin is to live for thousands of years, you have to assume pruned nodes will dominate the network at some point. Either combine utxos to be less than a decade old or keep them in a watch only wallet file. Mayne that's overkill but that's my two sats.

Was looking into Bluesky to see if I could curate my environment. Not so much for me but for my kids. Very glad ODELL posted this. Curate does not mean censor. Nostr only for me.

Finally, an interesting Bitcoin podcast!

It’s been a while since I’ve seen people argue in Bitcoin but nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak managed to pull Saylor into an interesting conversation about credit and lending in Bitcoin.

Saylor apparently hasn’t fully thought through the implications of 21M and remains wedded to his fiat ideas.

He expects there to be yield on Bitcoin in future, but never says where it will come from in a completely fixed supply money.. “They’ll have to sell their assets to finance themselves!” - yeah no shit Michael!

The only way to generate yield in Bitcoin terms is to mismatch duration - literally run a Ponzi scheme. But Saylor expects that because the US Government will back the banks that this can’t go wrong 🤣🤣

Saif takes nostr:npub1sfhflz2msx45rfzjyf5tyj0x35pv4qtq3hh4v2jf8nhrtl79cavsl2ymqt line that capital will flow but HODLers will take equity rather than yield. This is the correct logical conclusion.

I’m not saying Saylor is completely wrong - I do see a future where banks will get into this space and lend and pay yield on Bitcoin.

But they WILL blow up. I don’t give a fuck if they’ve got their own nuclear arsenal let alone the full faith and credit of the US Government behind them, they WILL get out over their skis and they WILL be unable to fulfill their obligations at some point because they WILL greedily try to rehypothecate it in the meantime and no Government will be able to save them.

Saif and Allen both know the economy doesn’t require interest to function, that the world won’t grind to a halt without it - people will still spend money. Saylor just isn’t ready to let go of his statism (as evidenced earlier in the conversation) because he’s become accustomed to Billionaire privileges.

This is why I love #Bitcoin. You can be the CEO of the most successful public company of the past 4 years, all thanks to Bitcoin, and you will still be totally humbled by it unless you fully embrace the system as it is because it won’t be changing for your fiat games!

This was a very interesting podcast. A personal favorite despite the uncomfortable exchange between two great thinkers.

To be fair to both sides, I think the BTC lending debate was viewed with different lenses. Saylor, viewing Bitcoin as collateral for fiat lending and Chase somehow providing a 5% yield that can be immediately converted to BTC. Sounds great to me, but without risk I don't see an incentive for a big, government backed bank to ever offer a generous yield to its creditors (depositors). I challenge anyone to borrow in BTC even at zero.

Saifedean's comment about little to interest on Loans in a low time preference society is 100% my interpretation of Austrian economics. True, there will always be broke entrepreneurs who might want some cash, but the aggregate savings from low time preference in a fixed money supply will significantly outnumber the demand. The only way to earn a decent interest rate would be with risk, and that means occasional setbacks reducing the overall return (in some cases total wipeout). To eliminate the risk would require socialist protectionist policies or rehypothication.

Key takeaways...don't borrow in BTC unless there is a high negative interest rate and if loans are made in fiat, don't expect a generous yield on Bitcoin to last more than a few years after initial launch.

You are 100% on the money. Bitcoin started where every wallet was a node. The Electrum server/client model brought many to the space, but the financial incentives was bitcoin. Nostr cannot succeed without each client as a relay because ultimately there is no financial incentive to operate one. Private and secure bitcoin transaction use was an incentive to run a node. There is nothing for nostr...and it is much more costly. Any device working on this?

Keep stacking. Keep guiding.

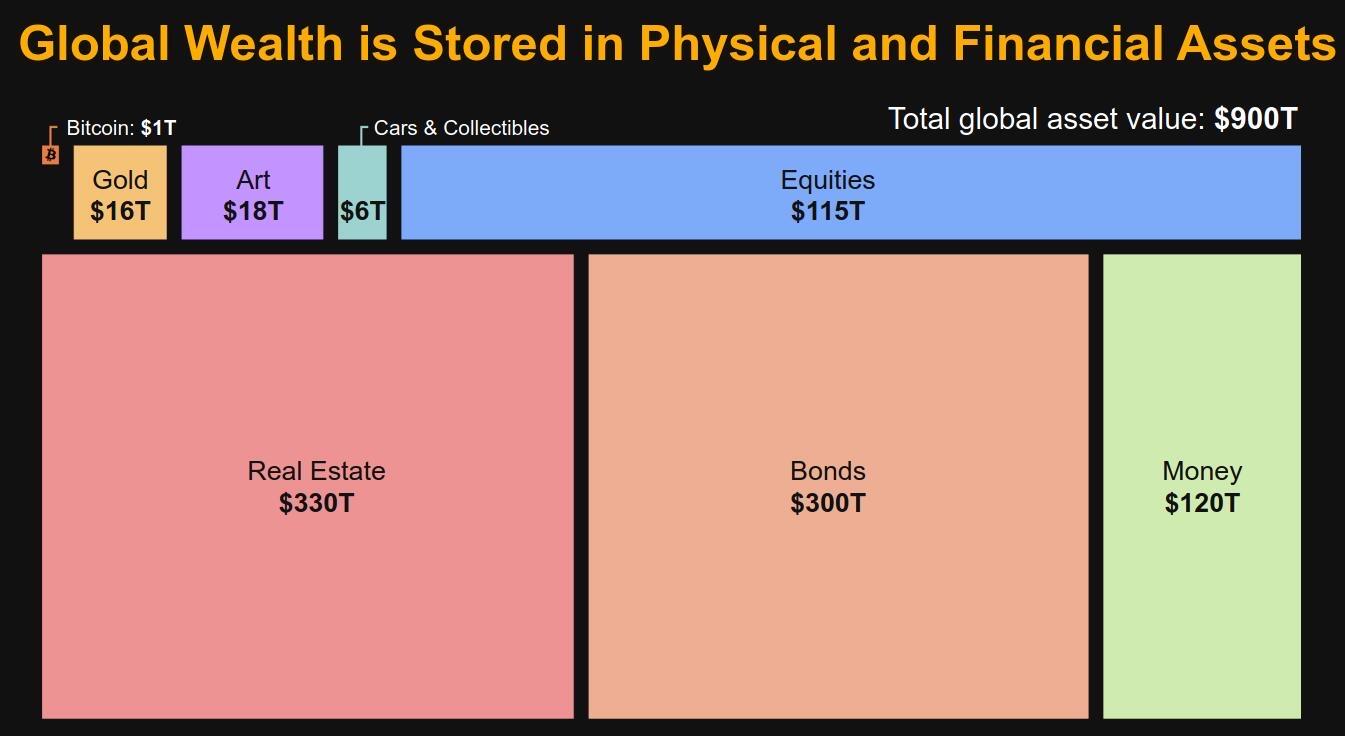

Excellent chart. Assuming these estimates are accurate, the visual really puts gold's market cap at our doorstep. This is an inevitability at this point. I suspect matching that would bring us to around 800k.

Keep calm and HODL #Bitcoin.

Everyone seems to be overreacting to the Samourai arrests, the FBI PSA, and Phoenix leaving the US. Here's my attempt to break it down.

Samourai

You have to unpack all of the different elements. Could this be a state attack on self-custody and privacy? Maybe. Probably not.

There are a few components here that need to be evaluated on their own.

1⃣ Samourai was a self-custodial wallet

2⃣ Samourai was a mixer

3⃣ Samourai was providing normal people with privacy

4⃣ Samourai were knowingly marketing the service to criminals and flaunting that fact

Reading the charges, it seems like #4 is pretty cut and dry for this case. Their getting arrested for #4, doesn't automatically mean #1, #2, #3 are under siege as well. If Samourai was a taco stand laundering money and bragging about it, I'm sure they would be taken down too.

They may be accused of running a money transmitter now, but that may or may not stick. We'll find out in the trial.

All that said, we should always be vigilant to attempts to erode privacy and the ability to self-custody. It just does not seem that this fight is *that* fight.

FBI PSA

Seems pretty normal that the FBI would advise people to use compliant services, and the entire announcement seems to revolve around potential disruptions due to Samourai being taken down, and potentially others in the future. Given they took action, they have to post some bulletin about it.

Remember that when people lose funds or have funds stolen from them, they do go to the FBI for help. From their point of view, the best thing for people to do is use compliant services where they can potentially help.

The announcement concludes saying that services that purposely break the law will be investigated - so again we go back to #4 above. This is nothing new, and self-custody is not being criminalized.

Phoenix Leaving

As nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m said, it's feels completely unnecessary. Phoenix obviously is not a MSB and they are not doing anything illegal. In my view, their exit from the US app stores is a complete overreaction.

Keep Calm

Could "they" come after wallets, developers, mixers, nodes, LSPs, sidechains, eCash, VPNs, encryption, etc? It's totally possible. But if you're not breaking the law, you have nothing to worry about.

To my knowledge, there is still rule of law in the US, property rights are still protected, and privacy is enshrined in the Bill of Rights (nostr:npub1trr5r2nrpsk6xkjk5a7p6pfcryyt6yzsflwjmz6r7uj7lfkjxxtq78hdpu).

It would be very difficult to change the law or stretch it to incriminate these things because it's all just information and software, which is speech. Some will try. But as they are trying, #Bitcoin is becoming more and more mainstream and integral to the world's financial system.

#Bitcoin is freedom technology and it will continue on.

Go outside this weekend and think about why you're here.

Overreaction is right. Samurai not only broke the law, but treated bitcoin as a whore not a hoard. Glad to see the leeches leave the space.

Beyond any doubt.

So grateful to nostr:npub10pensatlcfwktnvjjw2dtem38n6rvw8g6fv73h84cuacxn4c28eqyfn34f for the opportunity to work on nostr full time. I could have never imagined this a year ago when I was working a normal desk job.

This nostr journey has truly been life changing.

But we are not done yet, we have so much left to build and experiment with in nostr and I'm so excited that ill be here to see it all and help out

Although the best part of this is probably the picture of a purple strudel 😀

Congratulations! Wishing you and nostr much success!

NEW TUTORIAL

Timechain Calendar: Your One-Stop Dashboard for Bitcoin Network Data

https://www.youtube.com/watch?v=CGkYesLtQC4

Subscribe for free weekly tutorials!

I love the name of this dashboard!

Can we trust Twitter to decern hate speech from speech that they hate?

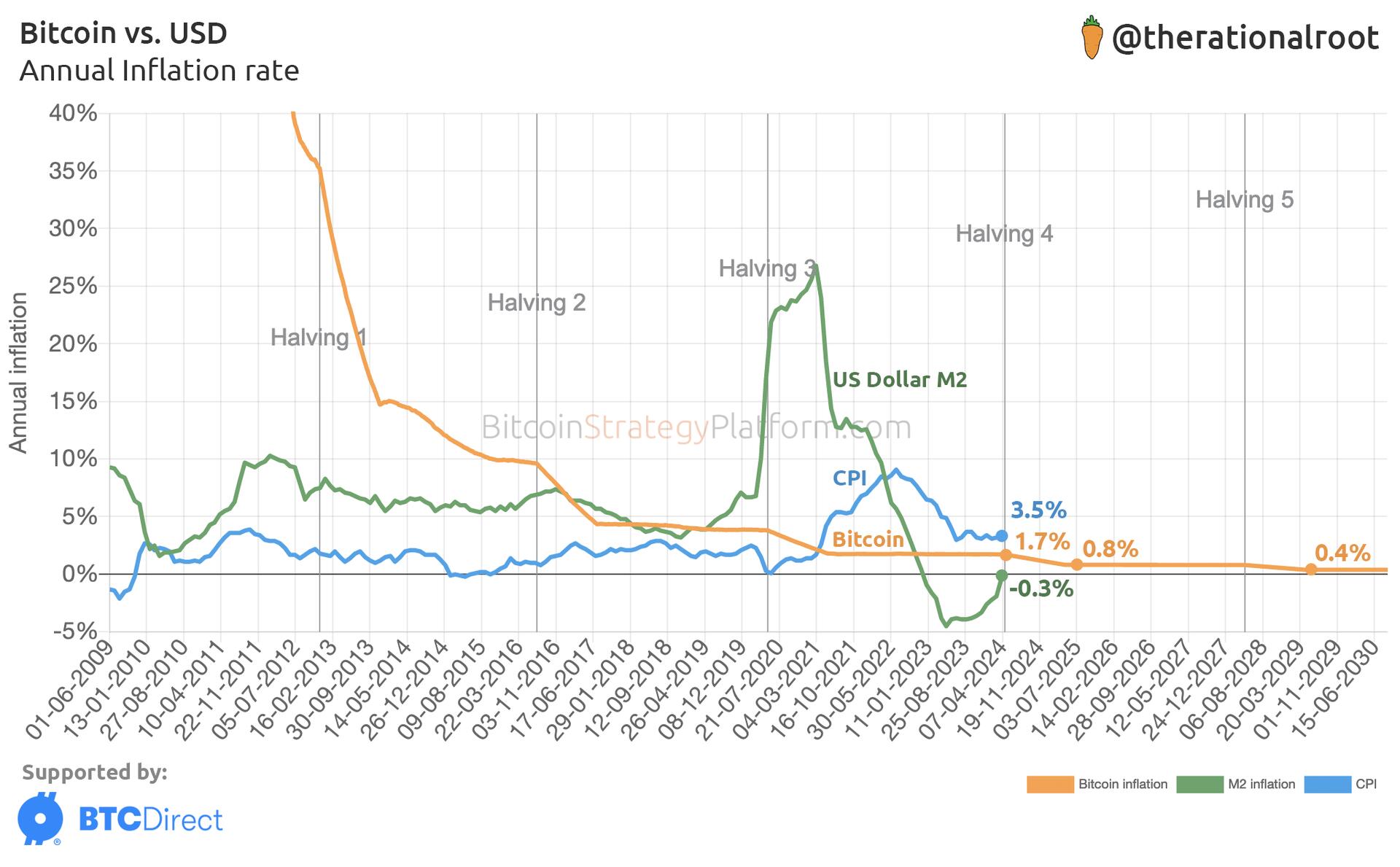

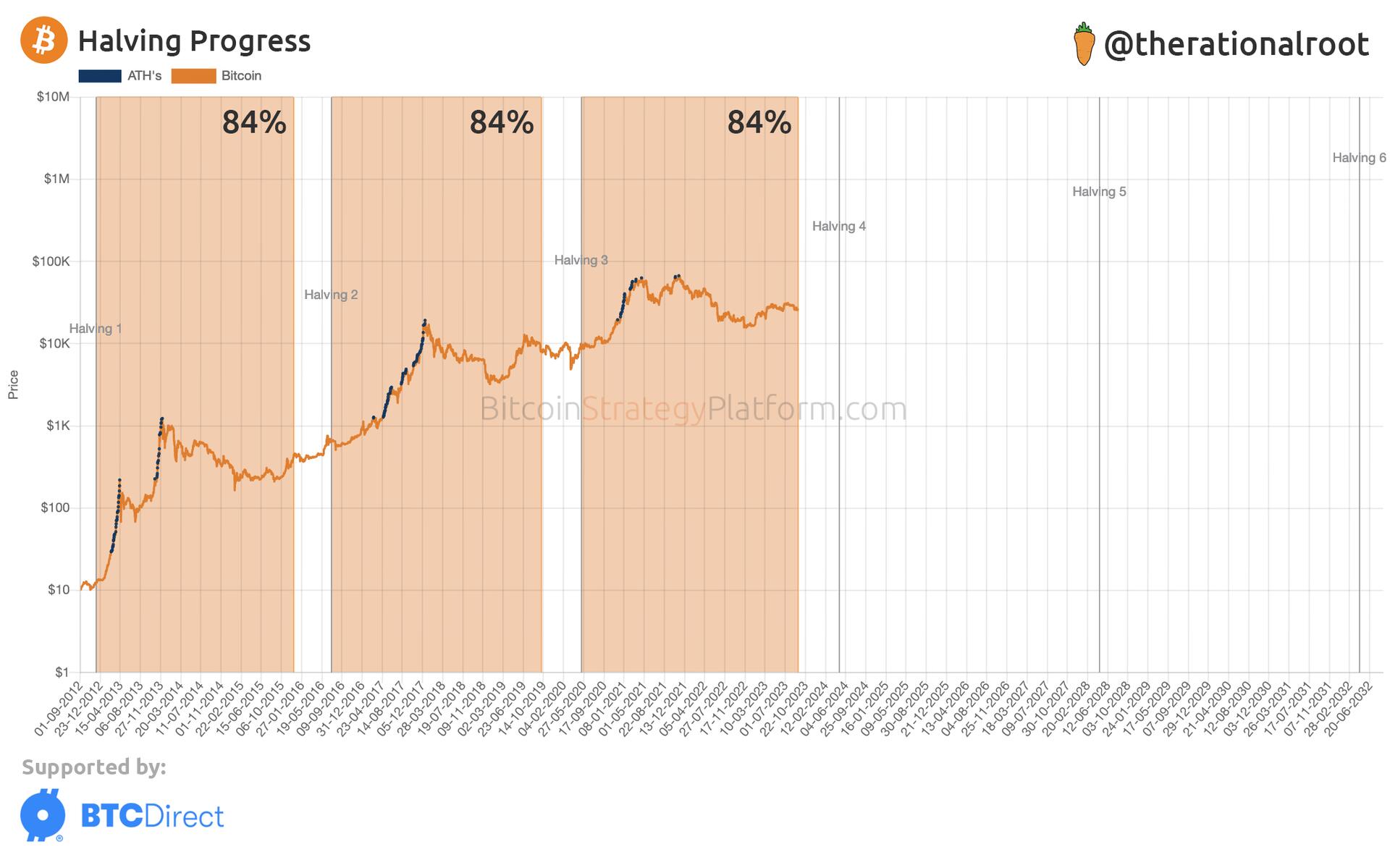

It appears the next 16% will be mixed in terms of price action? Or is the expectation a gradual increase?

With 402 + EH/s, the halving next year should increase the average cost of production dramatically next cycle. ~900 BTC each day to ~ 450 BTC is huge at the current hashrate. It is enough to spur massive CAPITALitulation and mass adoption.

Absolutely. It is for free people. Free in mind and in spirit. In time, more free people will oboard because it will become clear that it is the right approach to safeguard their voice.

This is almost perfect, but your HODL model is just way to conservative. The illiquid supply will rise very sharply when 450 BTC are mined each day. When liquid supply is trading at $50 per sat by 2030, then we will see the folly of this conservatism.

Can’t say I’m surprised. This only reinforces the fact that self custody of ethical digital money that is not based on credit is the only way to true individual sovereignty. Even if FDIC comes to the rescue, that means the bandits got off with stolen loot and the people pay for it one way or another.

“Each timestamp includes the previous timestamp in its hash, forming a chain, with each additional timestamp reinforcing the ones before it.” -Satoshi Nakamoto

Time chain not Blockchain 🍊

I use Muun to onboard onto Lightning and it works great. Excellent BTC only wallet. Best part is they treat bitcoin as bitcoin as it recognizes both on chain and lightning in the same balance.

Muun was a centralized wallet/service for onboarding Bitcoiners onto the LN. it has evolved into an open source project that sim to simply and integrate on chain and Lightning into one seem less interface. There is an open source backup recovery tool that is essential should Muun “disappear”. Assuming you run your own node with Lightning, you can easily recover all funds with the recovery backup tool. This takes the Casa implementation to a whole new level for mass adoption. Casa has a 2 of 3 multi sig where you hold 2. Muun has output descriptors that cover both on chain and LN with a 2 of 2 multisig where you have both and Muun has 1. Pretty awesome IMO and will take mass adoption to a whole new level.