When people don't belive us when we say they're artificially keeping BTC down, show them this

https://watcher.guru/news/caroline-ellison-sbf-conspired-to-keep-bitcoin-under-20k

Now you know why the FED/SEC had such a cozy relationship.

Charts, macro, and intermarket relationships hinted the same in 2021 and heading into 2022.

https://x.com/kanemcgukin/status/1469148282836426757?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

Enjoyed another #Bitcoin monthly update with nostr:npub1m6y9qq06c74trgs60ya320pgmhz6099grra5lw04akyuxvcz7lvq9ue2p9

https://podcasts.apple.com/us/podcast/navigating-bitcoins-noise/id1583424361?i=1000630820765

In episode 50, we discussed the recent FASB accounting change where #btc and other digital assets should be accounted for at fair market value.

Thinking further, this plays well into #Bitcoin. Though the biggest challenges will be for US and developed nation citizens bc credit is the binge drug of choice.

The use of bitcoin, lightning and other forms of Bitcoin Standard (nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak) require users to come off the “credit standard”.

That’s a tall ask because it means a major lifestyle shift. A major shift in choice for which most have 25-50years of rooted experiences and behaviors that are all credit based. nostr:note1cvu42flgux0jxdru597dzrfqnll5vj6qd35qdelxd9vq0s8y7eesxvnkss

The world would be a drastically different place without Joe Rogan’s work the past few years.

The biggest headline no one blinked at and why it matters.

$1T in credit card debt becomes and issue when the switch flip.

When asking how we got here, this is a good reference. There’s plenty of other supporting evidence.

Claims aren’t needed any longer because the reshaping happened.

Book: 4th Turning is Here

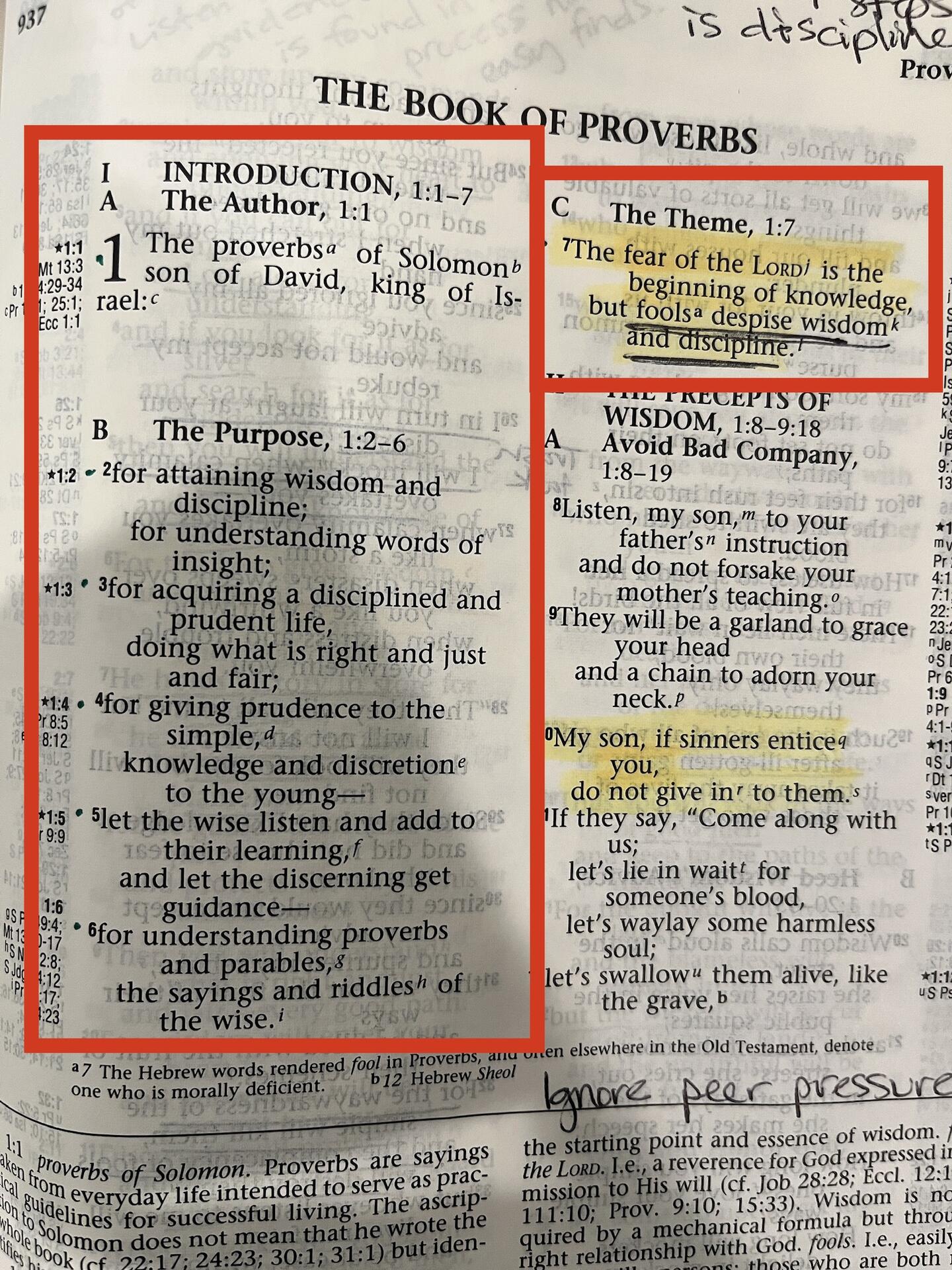

“By justice a king gives a country stability, but one who is greedy for bribes tears it down.” Proverbs 29:4

Hmmm… imagine that!

The most direct answer?

Network effects… though that’s changing.

We’re also still in the pay to play part of the cycle. To play with criminals, you have to use their form of currency.

Until these two things change the unit of denomination and MoE won’t change.

In due time…

Money and baseballs are simple on the outside but complex on the inside.

https://kanemcgukin.substack.com/p/baseball-and-money-are-americas-favorite?utm_campaign=post

File this under: You feel like you can trust Elon on Monday. By Friday, you know you can’t.

Ironically, it’s Monday.

What China knows about TikTok that we carelessly overlook.

Own the kids, own the future. Proverbs.

69% of all SDRs were printed in 2021 without a care in the world.

This is how the dollar hegemony stays in play as other fiats continue to collapse into dollars and stablecoins.

https://x.com/kanemcgukin/status/1707578134734803221?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

Stupidity centralizes around the lowest cost of production.

I’ve forgotten to hit record at the start, at least 3 times. One of them just this week!! 👉 nostr:npub1m6y9qq06c74trgs60ya320pgmhz6099grra5lw04akyuxvcz7lvq9ue2p9

This trade is shades of

🟢 $LUNA/yield farming

🟡 $GME

🔴 GBTC carry trade

Graphic and text snips 👇

https://x.com/peruvian_bull/status/1707117148374536510?s=46&t=BCZ86Q6VE35kiDHSK1Vf6w

The economy functions because of leveraged consumers - $1T credit card debt.

And markets function because of leveraged hedge funds and institutions.

Woa…

https://www-ft-com.ezp.lib.cam.ac.uk/content/a8348e2a-a90f-474c-baa6-8c2eb0e263c2