2025 broke a lot of models.

Bitcoin made new ATHs… yet finished the year lower.

Stocks ripped. Gold surged. Bitcoin chopped.

A frustrating year for price—but an important one for thinking clearly about FIRE, risk, and assumptions.

The FIRE BTC year-end review is live.

🧵👇

Your brain runs on less power than a dim light bulb—about 20 watts.

Yet that tiny energy budget supports a level of cognition that megawatt-scale AI clusters still struggle to match.

This contrast reveals a fundamental design principle: The most capable systems are not the ones with the most resources. They are the ones with the best constraints.

We see this same divide in the monetary world:

🔸 Fiat Money behaves like a massive AI cluster. It relies on complexity, constant intervention, and brute force scale. It is expansion-driven, mirroring bureaucracy.

🔸 Bitcoin behaves like the human brain. It operates within hard limits, simple rules, and decentralized validation. It is constraint-driven, mirroring biology.

One design leads to noise and fragility. The other leads to signal and stability.

In my latest piece for FIRE BTC, I explore why nature’s most efficient systems reveal Bitcoin’s deepest strength—and why architecture matters more than energy consumption.

Read the full article here: https://firebtc.substack.com/p/brains-bitcoin-and-the-power-of-constraints

Cutting $800/month erases $240,000 from your FIRE number and can add millions to your future stack when redirected into assets. Most people never see the leverage hiding in their expenses.

nostr:nprofile1qqsy7nuzs3nf3lmx4e06n7k5crzwk7pr47c8l204f65azhcjz7hfdnqpz4mhxue69uhhyetvv9ujumt0wd68ytnsw43qzyrhwden5te0dehhxarj9emkjmn9z4p34a I assume you know I can’t give you tax advice, but I can point you to the resources for you to DYOR and understand our position and how we approach it:

https://help.unchained.com/what-is-loan-collateral-and-what-does-unchained-do-with-it

And yet you can’t control policy. All you can control is you.

I actually agree with you, but just recognize the world as it is, not how I want it to be.

It may be insane and retarded for it to exist, but that doesn’t mean you can’t benefit from it.

And apparently a 50 year mortgage is sinful usury, but a 30 year isn’t? So where’s the line then?

Most people think a 50-year mortgage is insane. But when you actually run the numbers, the math tells a very different story.

Liquidity + compounding beats faster payoff—and the gap is bigger than you think.

Full breakdown here 👇

Elon Musk and me have combined pay packages over $1 trillion.

Wild.

The economy isn’t just unequal — it’s split in two.

One side owns assets, leverages credit, and rides the wave of monetary expansion. The other works harder each year just to stand still.

That’s the K-shaped economy. And it’s not new — it’s the natural outcome of fiat money.

Your future doesn’t have to follow the lower arm.

Learn how to climb the upper one

It’s definitely an option worth exploring if you’re self-employed

Sorry, not sure what you mean. IRAs are individual accounts by definition.

We do offer SEP IRAs, if that’s what you mean.

They say fortune favors the bold—but it’s deeper than that.

Every intentional action we take tilts the odds of our future. Over time, those small ripples compound into a new reality.

Bitcoin works in much the same way. It replaces uncertainty with certainty—giving us the foundation to act boldly toward financial independence.

This week’s FIRE BTC explores how bold action shapes your universe (and how Bitcoin amplifies it).

👉 Read the full post: https://firebtc.substack.com/p/favorable-fortunes

Gold’s utility makes it worse money.

Do you know why?

Most people don’t have an “emergency fund.” They have a fear fund — cash that melts while inflation compounds against them.

In Emergency Economics, I break down why the “safe” choice of holding cash might be your biggest financial mistake — and how to build true resilience through rational, compounding assets instead of fear-based ones.

Read it here 👇

On a day like yesterday, there’s only one thing to do

https://blossom.primal.net/78f1b8abc1c0235a7db12bc72e42eb3ede15409eb76fc50327aeee4903351fbc.mp4

Most people plan their finances FORWARD. But the Stoics would tell you to plan BACKWARD from death. It’s a bit morbid — but it can help you buy your life back, one year at a time.

💀 “Working Backward from Death” — new FIRE BTC drop.

👉 https://firebtc.substack.com/p/working-backward-from-death

If you can…

👶 raise a child

🚘 drive a car

📖 read this post

…you can self-custody your bitcoin.

One re-frame that can make your FIRE journey easier: Fund your last year first!

If you’re 40 and expect to live until age 95, you only need to save ~$5k at 5% real annual return to cover $80k of expenses.

That’s bite-sized savings.

The golf price was artificially fixed at $35/oz in 1971 but was $180 in 1974 when it was freely traded. That’s probably a better number to start from, which would imply more like 0.85 oz gold ~$3,300

Global debt keeps climbing.

Bitcoin’s supply stays fixed at 21 million.

All you need to know.

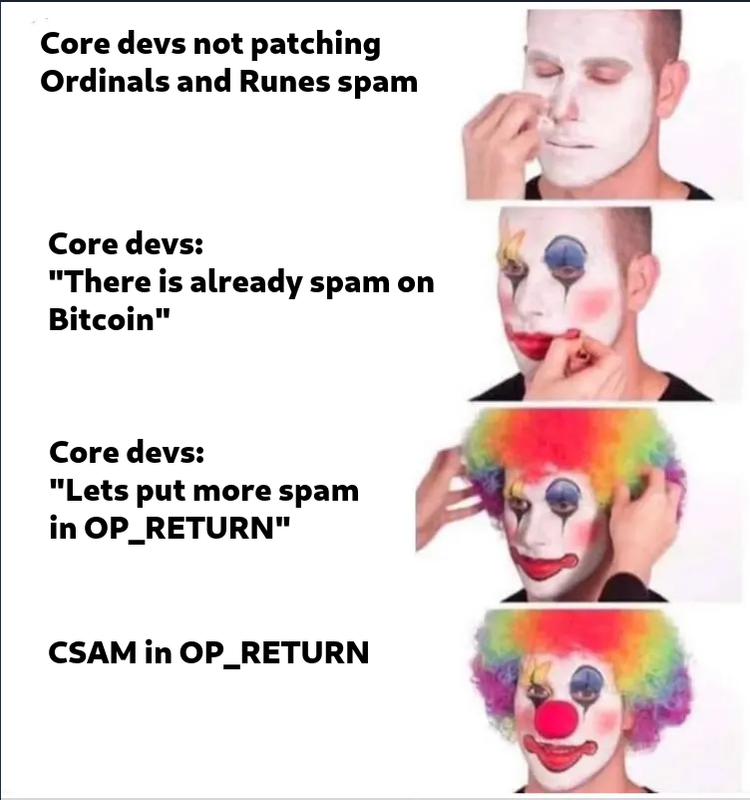

Ok great. I don’t disagree. But you are only chirping about this now, instead of two years ago when taproot was activated.

If that’s the main issue, why is nobody talking about it and only focusing on this op_return setting being changed?

Your argument rests on it being a legal liability to have CP on your node. Are you saying that SOME cp is OK and defensible but a lot of it is not Ok and indefensible?

Seems to me that it’s black or white. Either you have it on your node or not. And if that’s the case, then bitcoin is vulnerable to just a single instance.

Non-economic actors who want to destroy bitcoin will gladly pay a 4x higher fee for OP_RETURN, but they’re too lazy to bypass the mempool altogether.

Make it make sense.

The upside of this NPM vulnerability is that you can’t send BTC to exchanges to sell it 🙃

Random thought: the reason gold only trades for $3,500/oz is because there’s sooooooo much of it, and they’re constantly finding more.

AI could make Labor Day obsolete.

IBIT is BlackRock’s most profitable ETF ever, and Uncle Larry Fink LOVES it.

BlackRock makes more money when bitcoin pumps, and you’re bearish, anon?!?

Almost ready

How many of these people have the majority of their net worth tied up in their homes instead of in liquid assets? 🤔

A $9 TRILLION retirement system is about to collide with the hardest money on earth.

When 401(k) plans can buy bitcoin, the flow will be automatic. The bid will be steady.

And the effects could be massive.

The Trump administration just cleared the way for employers to offer bitcoin in 401(k) plans.

That means steady, automated contributions could start stacking sats every paycheck—whether the market’s up, down, or sideways.

Why does this matter?

401(k)s are a core pillar of retirement planning.

Tax advantages, employer matches, and high contribution limits make them powerful.

Now, those same mechanics could start funneling billions into bitcoin.

Quick 401(k) 101

✅ Tax perks (Traditional or Roth)

✅ Employer match (free money!)

✅ Higher contribution limits ($23,500 in 2025)

✅ Creditor protection

⚠️ Locked until 59½, limited investment choices, and fees to watch out for.

For people chasing FIRE, liquidity matters.

I grab the match (always), optimize taxes if it makes sense, and keep the rest flexible—usually in spot bitcoin I control.

Some 401(k)s offer a “brokerage window.”

If yours does, you can buy bitcoin ETFs or bitcoin treasury companies (MSTR, etc.)

It’s not cold storage, but it’s the next best thing.

Now imagine bitcoin isn’t just a hidden option.

It’s right there on the menu next to the S&P 500 fund and target date funds.

Most people will “set it and forget it.”

Contributions and company matches flow in—creating a constant, passive bid.

And there will be other second-order effects...

🔸 HR teams & plan admins have to learn about Bitcoin.

🔸 Some get orange-pilled just doing their jobs.

🔸 Seeing BTC outperform sparks personal buys in IRAs, brokerages, cold storage.

$9T sits in 401(k)s today with zero bitcoin exposure.

Even a 1% shift over time = $90B in new automated demand.

Week after week. Paycheck after paycheck.

Bitcoin in your 401(k) is yet another channel of bitcoin adoption playing out in real time.

Read the full breakdown + subscribe here:

The Scottie Scheffler <> bitcoin corollary continues.

Pure dominance.

How Bitcoin Purifies Our Money - FIRE BTC 37

This week in FIRE BTC, I dive into how bitcoin acts like a water purification system for money, unlocking a cleaner, more reliable future for our global economy.

After a recent trip to Italy, where I experienced a major heatwave in Rome, I started thinking about how water purification has unlocked civilization. Similarly, fiat money is contaminated, holding back progress. Bitcoin is our “filter” to clean it up.

For most of human history, water was contaminated, leading to disease and early death. Our money today suffers the same fate: inflation, debasement, and political manipulation quietly erode the value of our wealth and society.

Before purification, people relied on workarounds like boiling water or turning it into alcohol. Similarly, people use stocks, real estate, and other assets as alternatives to fiat money. But these come with volatility and risks. Bitcoin removes these trade-offs.

Just as ancient filtration techniques revolutionized public health, bitcoin acts as the filtration breakthrough for money. It eliminates inflation, risk, and manipulation, creating a pure, incorruptible monetary system.

Water purification drastically elevated human progress. Bitcoin’s role in purifying money does the same, unlocking new possibilities for trade, savings, and cooperation on a global scale. A true breakthrough for civilization.

🔗 Want to learn more?

Read the full piece, and subscribe to FIRE BTC for fresh, filtered insights on how bitcoin is reshaping the future of money. 👇

firebtc.substack.com/p/fiat-needs-filtering