I had a friend ask for a loan and I told him sure, interest rate is 100%. He was upset but I told him if he couldn’t beat bitcoin CAGR then lending to him was a losing proposition for me.

Just had the new withdrawal limits roll out in my Strike app. Great news now I’m taking 100% of my paycheck in Bitcoin these days.

Your point 2) is why I’ve switched to taking 100% of my paychecks in Bitcoin. I think in a bull market it will be worth the effort.

There is only ~2500 transactions per block. Divide world population by the number of transaction per block and the 10 minute block time it would take 36 years to make a transaction to everyone so they could receive a UTXO, assuming single output per transaction.

This is do true. How ever much you stack in your first epoch is about all you get if you’re in a fiat job and stacking your savings. Go hard early.

In 2019, a CNBC host said it's “crazy” to Tom Lee's advice to invest 1-2% of assets in #Bitcoin for $5,000 🤣

H/T- nostr:npub1ptvgcvtea5vrwkn2v7klqy9lcrf3k0fqlqkc2fwje45phgtn97kqrdnk9f https://video.nostr.build/67c9278ed9c31d45429b820571fba46b1ce7300d155ac19cf88fe3ca80dbafe3.mp4

Only saving 1-2% is crazy, you should be 80% at least.

You think some folks with a Masters are dumb wait till you meet a PhD.

Supply cap enforcement

Congrats on your conviction. Price in fiat don’t matter, your in front of 99% you’ll be fine.

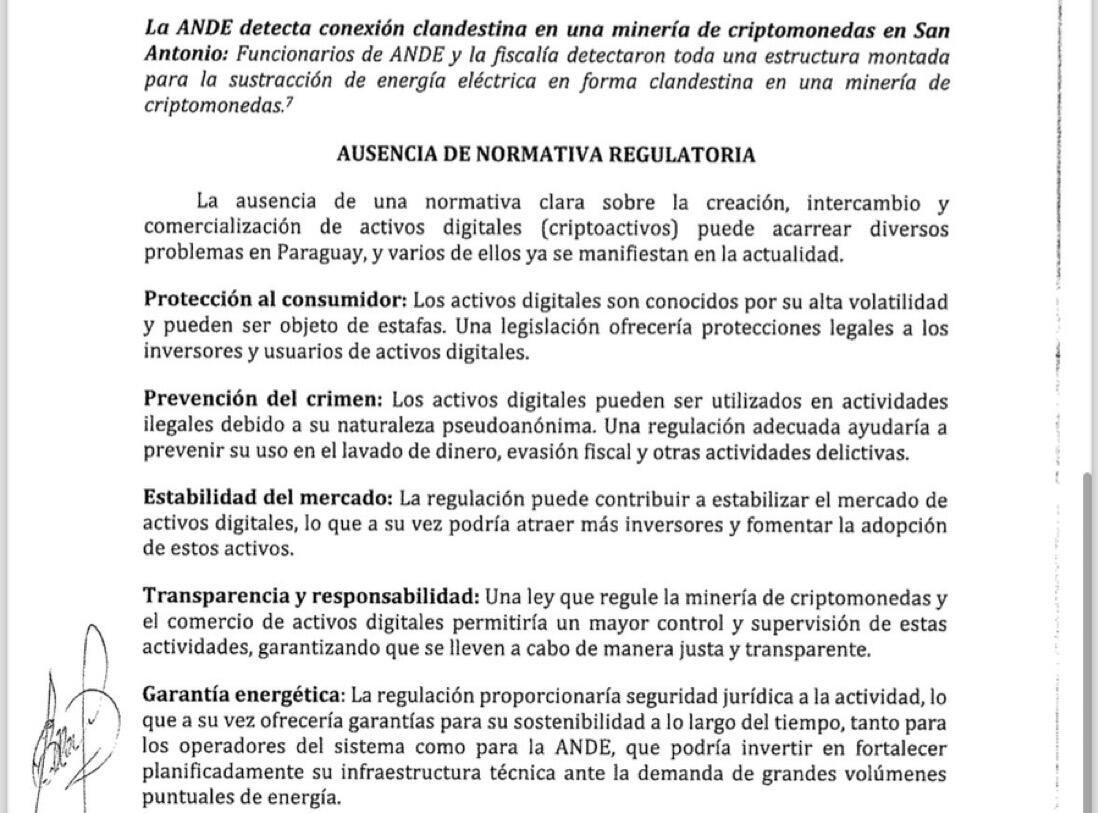

‚Parliamentarians in #Paraguay have proposed a temporary #ban on #Bitcoin #mining, which, according to them, is disrupting the nation's electricity supply.‘

https://www.nobsbitcoin.com/paraguay-mulls-temporary-bitcoin-mining-ban-citing-power-issues/

This is such a great A v B test. Bhutan doubles down and increases mining capacity 6x, Paraguay bans it. Who will emerge the victor? Which country will be more prosperous? I think the answer will be obvious in less than 18 months.

Imagine how cheap Paraguay will be to Bitcoiners in the future

Good morning #Plebchain #Nostr

Happy blessed new day

#Bitcoin is the future

#Bitcoin #zap #plebs #nostr #plebchain #zapathon https://video.nostr.build/3497195adf50879eaad3ddf574c7eeaefd8c3b4f72ff5ed7366903414df5e87a.mp4

Choice bro. It’s hard to be humble after one or more cycles.

NOSTR and OPA are the only social media apps I use, I deleted Facebook and Twitter a year ago. Haven’t got a solution to the iPhone though.

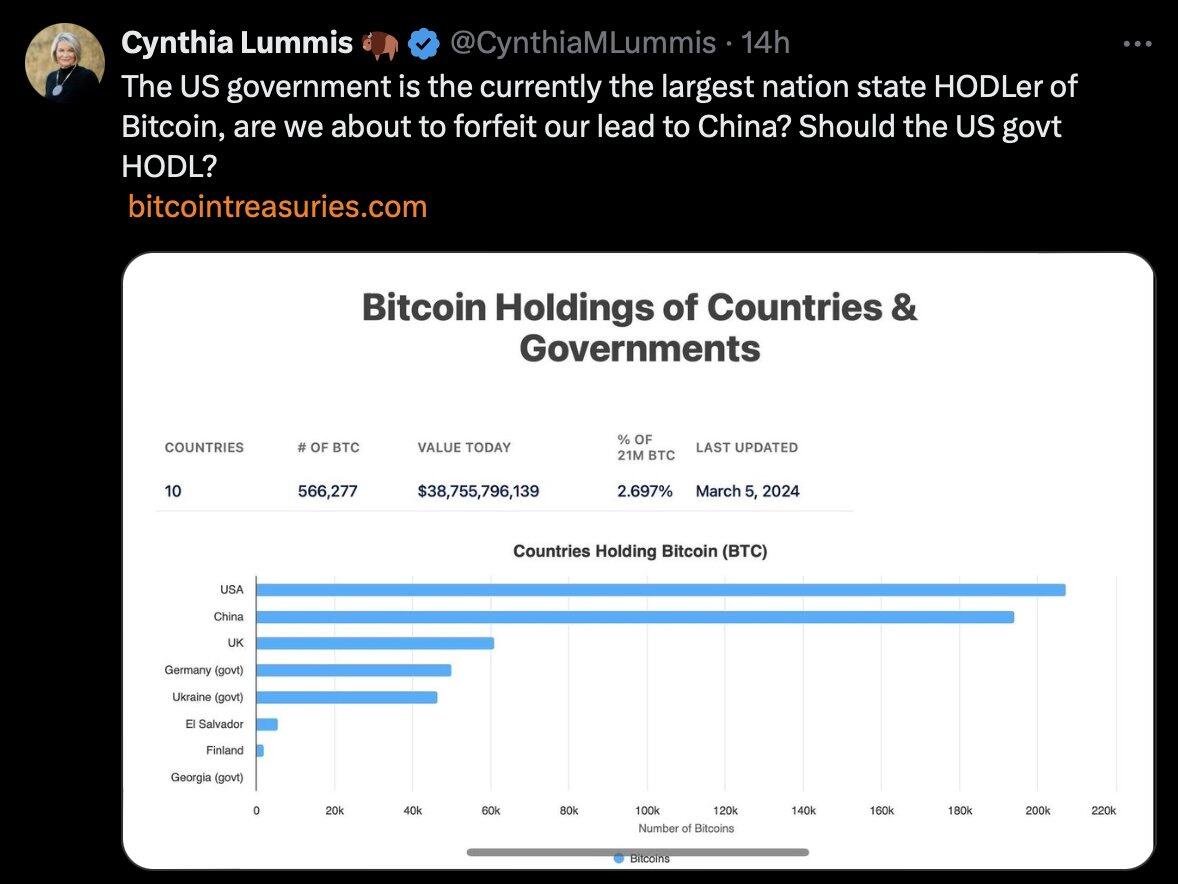

I think the government should sell them to individuals.

For sure I left that behind

I read TBS then TFS, but that’s just the order they were published. They stand alone so I think you can read them in either order without losing anything.

Took my first paycheck as 100% bitcoin today. Rather than converting fiat to bitcoin once a month I’ll now hold as much bitcoin as long as possible and convert living expenses from bitcoin to fiat once per month. This way I will be maximally exposed to the bull market. Have a good weekend.