Congrats Duro, I’m a year behind you and stacking hard so 2025 can be my turn. Your success is my encouragement. Cheers!

As time goes on there will always be more folks from two epochs prior that have big gains they are prepared to swap for lifestyle changes.

DM me if you are in the USA and I’ll send you mine that I just finished reading

Yes this is true, which is why five years ago I switched jobs to get access to my 401k and never started another one at my new job. At least in the USA you can opt out of these schemes, in places like Australia you are forced to contribute.

I keep about a months worth of salary in bitcoin on Strike. This will cover most of my foreseeable expenses and it’s an amount I am comfortable having at third part risk. Anything over that I withdraw to cold storage about once every two months so UTXO size is reasonable. So I have a months reserve plus my months pay in bitcoin on strike and a couple of days before the end of the month I sell on strike and transfer fiat to my bank just enough to cover my bills. This way once I move any to cold storage I don’t plan on selling it in the next couple of years.

Send 100% of paycheck to Strike, once a month sell just enough to cover your expenses

Yeah that’s me I take 100% of my pay in Bitcoin so I have no option other than sell some at the end of the month to cover expenses. I’ve made peace with spending bitcoin.

Well done Max. Really looking forward to listening to this.

As always I have copies of this book for sale on my bookstore. Now 50% off. Pay with bitcoin too.

https://thebitcoinshop.uk/product/a-lodging-of-wayfaring-men/

I just finished this book and it was a great read.

I’ve used Ledger in the past but prefer BitBox02 or ColdCard. I use Strike for buying and Aqua and Zeus for lightning.

Yup to get over the pain of buying a house I took a HELOC to buy bitcoin. I’m also selling my rental properties and converting that to bitcoin as well.

Want to understand how inflation impacts your purchasing power?

Let's look at The New Yorker, which publishes the price of each copy right on the front of the magazine.

1925: 15 cents

2024: $8.99

What the heck happened to make The New Yorker so much more expensive?

It's important to understand that technology is naturally DEFLATIONARY.

Everything should be getting cheaper over time, including The New Yorker.

Think about it: printing, writing, & editing technology has improved tremendously since 1925.

So, why is the magazine more expensive now?

From 1925 to 1971, The New Yorker increased in price from 15 cents to 50 cents, an increase of 233.33%.

That's pretty dramatic, but not THAT bad...

But from 1971 to 2024, price increased from 50 cents to $8.99, an increase of 1698%.

So, WTF happened in 1971?

In 1971, Richard Nixon "temporarily" suspended the convertibility of dollars to gold, ending the Gold Standard.

This meant that the Federal Reserve could now print dollars out of thin air without restriction.

Increasing the money supply by creating new money out of thin air is literally "inflation."

"Prices rising" is the result of inflation.

When more monetary units are created, the purchasing power of the monetary units that already exist decreases.

When the government/central bank prints money out of thin air, they are STEALING your purchasing power.

Here's The New Yorker over a few decades:

1971: $0.50

1980: $1.00

1990: $1.75

2000: $3.00

The magazine did not become more valuable, our MONEY became LESS valuable.

https://m.primal.net/KEpn.webp

https://m.primal.net/KEpo.webp

https://m.primal.net/KEpr.webp

https://m.primal.net/KEps.webp

By looking at this example of The New Yorker, which cost 15 cents in 1925 and costs $8.99 today, we see that the U.S. dollar has lost approximately 98.33% of its purchasing power in less than 100 years.

This is what happens when you print money out of thin air...

When money is controlled by the State, you are powerless to stop the destruction of your purchasing power.

Technology should be making everything LESS expensive over time, but even something as simple as a magazine gets more and more expensive over time.

So, what can you do to protect yourself from the government/central bank printing money out of thin air and destroying your purchasing power?

Study #Bitcoin with nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8

There will only ever be 21 million bitcoin and no government or central bank can print more.

So somewhat counter intuitive is the inflation rate decreases over time. From 1925-1971 price increase is on average 7.9% per year compounded. From 1971-2000 price increase is 6.5% per year and from 1971-2024 it’s 6.0% per year on average.

I think it’s more responsive to ‘inflation of the money supply’ than inflation indexes like ‘CPI’.

Any form of socialism is going to be hard because you can’t apply a high tax to Bitcoiners, they have the means not to pay. So good luck paying for all your free housing, education and medical.

G’day Neal, welcome, I’m sure you find many like minded and supportive folks here.

An easy way to ensure everyone gets their share is to make it an opt in system.

I took a loan against my life insurance policy, the bitcoin I bought is now worth more than the death benefit so I’m effectively self insured. I took a HELOC and that bitcoin will soon be worth more than the house that secured the loan. Now and again I think of selling some bitcoin to payoff the loans, but then I come to my senses and realize I should just let the government debase them to zero.

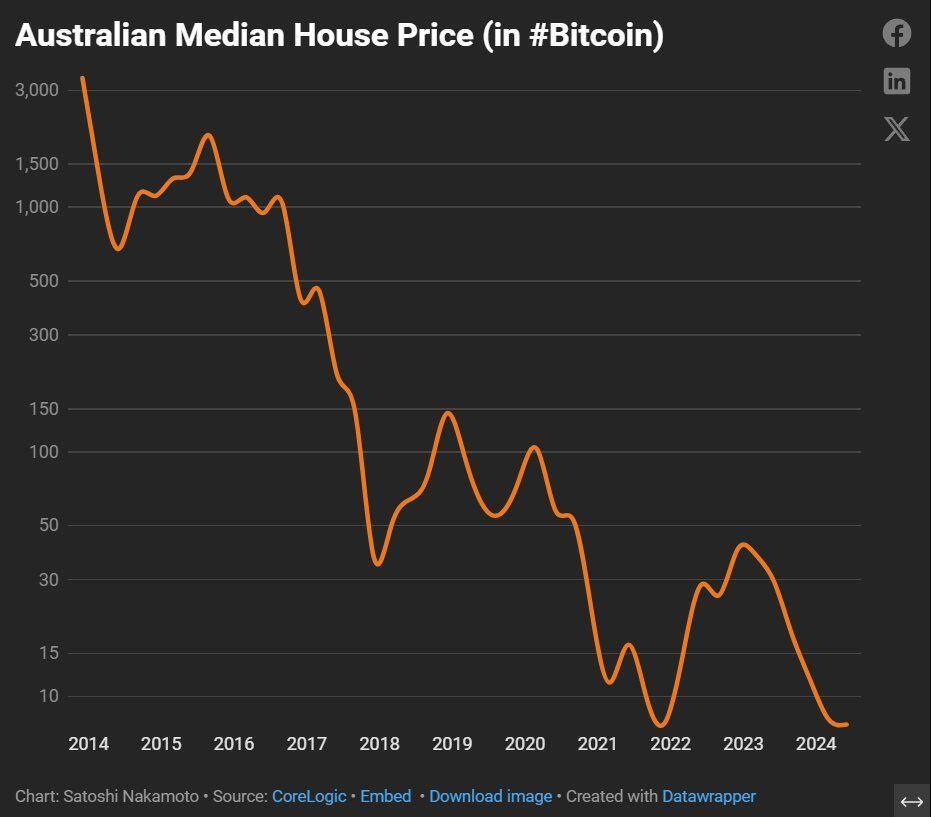

I think Aussies are in for a rude shock when house prices inevitably fall.