Listened to Michael Saylor on the nostr:npub1r8l06leee9kjlam0slmky7h8j9zme9ca32erypgqtyu6t2gnhshs3jx5dk podcast. It's 3 months old, but sheds some light on the ARK funding story.

TL;DW: Saylor strongly believes in *OSSIFICATION NOW*. From that POV, protocol development is a liability.

Some quotes (and thoughts)👇

"You only get to play God once. And Satoshi played God. And you can say 'well Satoshi got to do it, why can't I?' Well the answer is Satoshi did it, the reason we're talking about Satoshi is 'cause the other 100,000 would-be Satoshis failed. If you read the history of the world, work your way through 10,000 pages of Western history, there will be thousands and thousands and thousands of episodes of 'alpha male thinks he was put on this earth, you know, to change everything', full of hubris [...] he's gotta do more, change more, etcetera.'" (53:34) "Bitcoin Core developers, or protocol developers, they want to fix something, or they want to make a contribution, because it's in their DNA, but developers are just the lawyers of cyberspace. When a lawyer shows up at the capital, they gotta make a law to save you from yourself, and the more laws they make, the more they cripple the economy, until eventually there's so many laws that the entire civilization collapses under its own weight." (58:06) "The world is full of people that need something to do. I would say, the real key to wisdom, channel your energy constructively. If you're gonna do something, improve Lightning, build an application, persuade someone to adopt Bitcoin as a reserve asset, educate someone… these are all constructive things. Destructive, dilutive, distractive things are: fight with random people 'cause they want to fight with you, attack the core network and make it confusing and introduce anxiety, and confusion and fear, uncertainty and doubt into the base layer. Right? And then attempt to imprint your ego, you know, on the base protocol, you know? Like, 'I gotta introduce this so my name will go down in history forever'." (2:38:55) My view: it's understandable to want Bitcoin to behave like the granite under Manhattan (his analogy); a solid bedrock that never changes. Especially if you truly believe Bitcoin will take over the world as SoV-only and "there is no second best". But IMO this is wishful thinking. While I agree it's near-impossible for an alt to overtake Bitcoin, I do think adoption could stall.

Luckily, Bitcoin isn't really a natural element. It's spontaneous order, more like language. Hard to change and no one can dictate changes, but if market wants it to change, it can.

Furthermore, despite Stephan asking a few questions in that direction, Saylor mostly failed to distinguish between protocol upgrades and general software maintenance.

Arguing against any hard/soft forks is one thing, but Bitcoin Core 26.0 can obviously not last for centuries...

Having said that, Saylor is of course free to not upgrade anymore and stick to Bitcoin Core 26.0 for as long as he lives.

Great post. Reading the genesis book currently it is awesome 🫡

😂

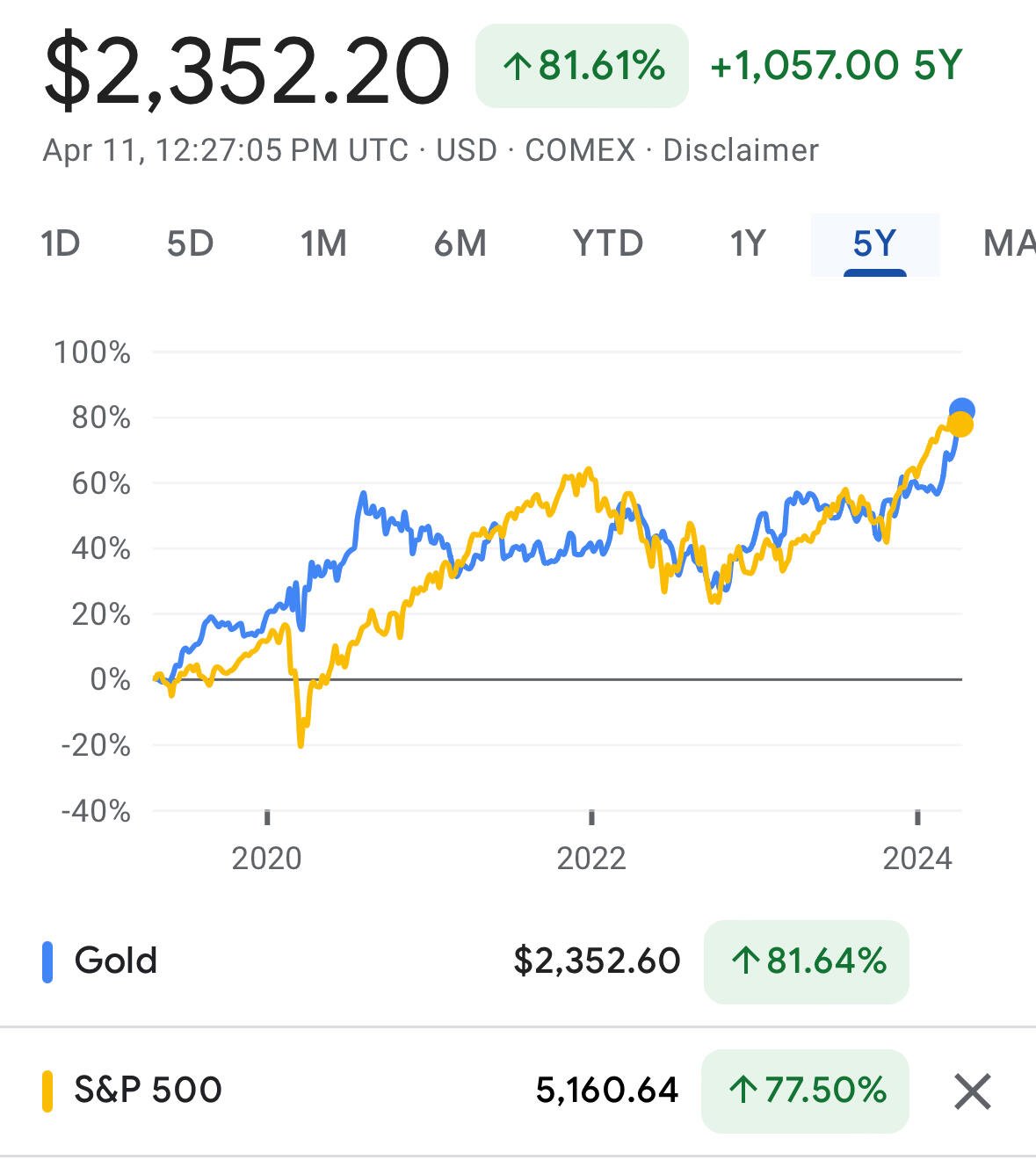

Bitcoin is digital gold and digital cash

https://tuurdemeester.medium.com/bitcoin-digital-gold-or-digital-cash-both-382a346e6c79

Working my way through it now

Subscriptions like Damus purple, Mutiny+

Amazing Dispatch from nostr:npub1mutnyacc9uc4t5mmxvpprwsauj5p2qxq95v4a9j0jxl8wnkfvuyque23vg team highlighting #fedimint, #nostr and nostr:npub19hg5pj5qmd3teumh6ld7drfz49d65sw3n3d5jud8sgz27avkq5dqm7yv9p

NWC is the biggest bitcoin UX improvement since lightning:

- NWC lets you send bitcoin in ANY app without opening your wallet

- NWC lets you send payments in the future (i.e. subscriptions)

It really is

Engagement farming has ruined Twitter