There is no magic finger snap that could change the world. But a finger snap can make some people raise their heads and look up.

All the best with whatever you do in the hospital. nostr:nprofile1qqsxu35yyt0mwjjh8pcz4zprhxegz69t4wr9t74vk6zne58wzh0waycprpmhxue69uhkv6tvw3jhytnwdaehgu3wwa5kuef0qy2hwumn8ghj7mn0wd68ytn00p68ytnyv4mz7qg3waehxw309ahx7um5wgh8w6twv5hsrp2qn4

Addictions Are Being Engineered

Link: https://masonyarbrough.substack.com/p/engineered-addictions

Discussion: https://news.ycombinator.com/item?id=44405057

Absolute must-read for #nostr devs and everybody wanting to build better societies.

The pull from the misaligned incentive structure is real. There will be eyeball extraction systems built on nostr, too!

Let's make sure that people can see the difference between the good stuff and the yet-another-platform roadmap.

Trump on Powell: "He’s a stupid person... Get this guy out. I'm going to put somebody that wants to cut rates. There are a lot of them out there."

Shared via https://pullthatupjamie.ai

Your daily reminder that the system of checks and balances in the US is being removed.

5 Beginners Steps for Privacy

If you are a normie but privacy curious, these #beginner steps will help you make a big difference in your #security and #privacy.

https://untraceabledigitaldissident.com/5-beginners-steps-for-privacy

Thank you for the summary! Definitely worth working on these aspects.

For beginners your recommendations probably still leave them with many questions how to do this exactly. I wonder if you did that on purpose, because you want them to take some of the steps themselves. Learning and executing on privacy is serious effort.

Privacy for the lazy could be another article. This is probably the hardest but largest audience.

Not future generations. The devaluation of the currency happens within months to a few years. Equity and real estate get more expensive. Savers, salaries, retirement contracts get devalued.

As soon as more people understand that it's already the current generations' problem there would be more pushback.

The noise changed from criminals to scammers to politicians.

The signal is still there. You find it deep down the rabbit hole.

It still requires proof of work to get there.

Another entrance to the rabbit hole has been openend, bringing a lot of noise.

However, as you venture deeper, the noise fades and the chanting unfolds its beauty.

I see. There's indeed a valuable point. It limits the applicability to mutual contracts, however.

I was thinking of cases without contract. Accidents, violation of property rights, children's rights, etc. There is still a need for a central law. And law enforcement. Or do you have ideas for that as well?

How to decide which court to judge a dispute? I assume both parties would want their own court that is in favor of them.

The term 'inflation' is weakly defined, often contradictory. Even Mises is struggling. I try to avoid it in building my economic theories.

Can you explain tail emission without this term?

What happens to the quantitiy of the money? And price valuation? Are there other important factors to consider?

Shitcoinery is the trojan horse in the trojan horse.

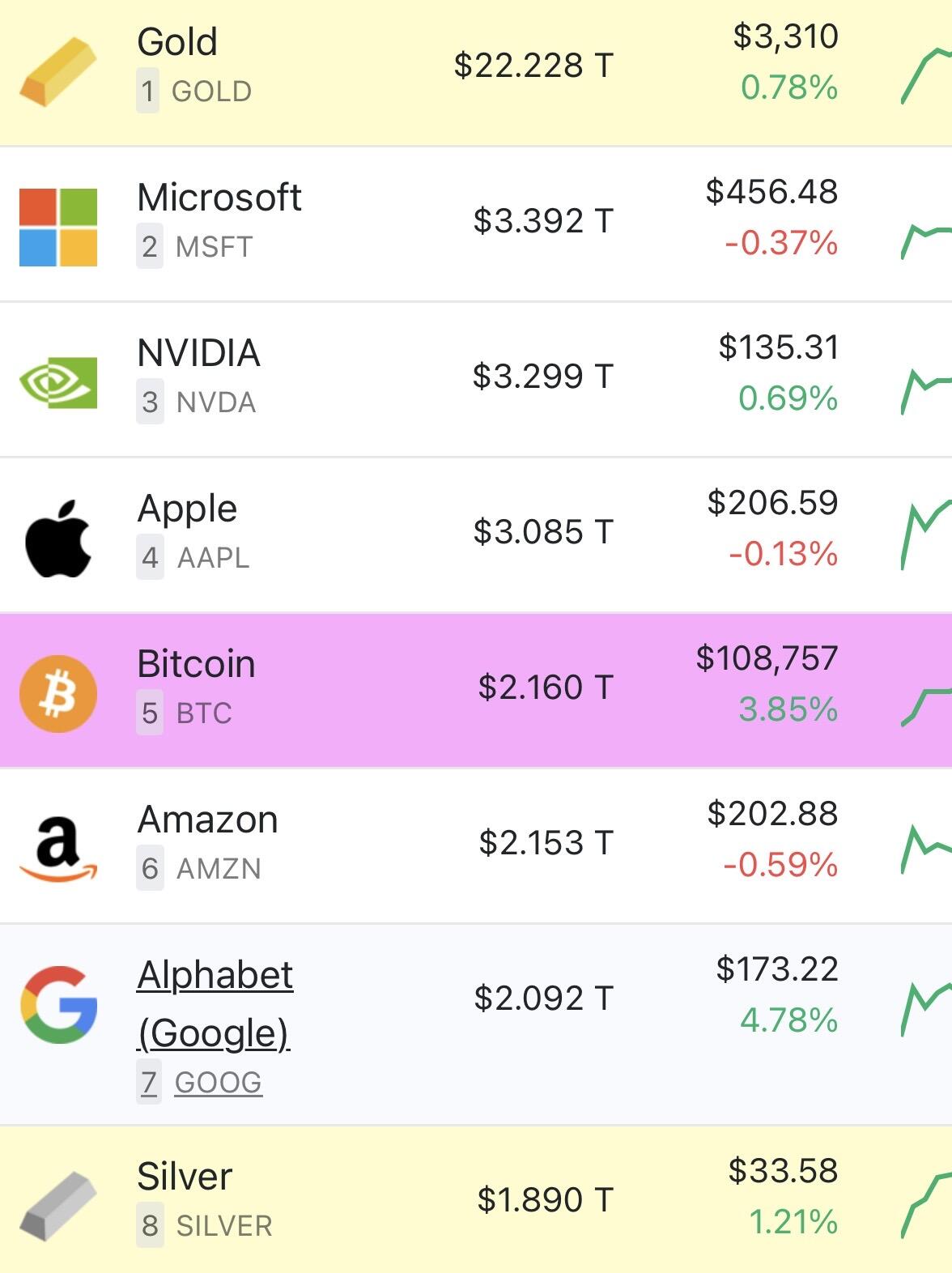

True. If you want to measure Bitcoin as an asset class, you can do that.

My main point with regard to nostr:nprofile1qqs9336p4f3sctdrtft2wlqaq5upjz9azpgylhfd3dplwf005mfrr9spzamhxue69uhkummnw3ezuendwsh8w6t69e3xj7spz3mhxue69uhkummnw3ezummcw3ezuer9wcq3qamnwvaz7tmwdaehgu3wwa5kueg6g89xw s note is that price-related metrics in general are the wrong focus.

He described Bitcoin as "A leaderless decentralized cypherpunk open source software project that secures property rights and free speech for anyone and destroys central banking and financial censorship". If that's what you care about in Bitcoin you should be looking at other metrics than market cap. IMHO focus on market cap or price and NGU mentality are one of the biggest threats for Bitcoin at the moment. They are delusionary and allure many people to follow the wrong leaders for the wrong reasons.

Number of transactions, fees paid, shops accepting bitcoin, mining centralization, ...

There are a number of metrics that tell you how well bitcoin is doing.

Market cap reflects only the speculative asset character. And even there it fails. Think of all the lost coins that still count towards market cap.

Actually, focussing on market cap IS losing sight.

A couple of points:

- I did not read Saifedean's texts. Cannot comment on that

- A fixed number of units does not lead to a constant supply (considering loss of keys or intentional destruction)

- Fixed supply does not lead to sustained recession.

The last point is often poorly understood. Do you assume that people will rather lock down their capital instead of investing because they expect higher purchasing power due to economic growth? But what if many people do so? Indeed economic decline, which would in turn lead to lower purchasing power instead of higher. So the assumption does not hold for the majority of people.

In the end, the prices will reflect these expectations and the rational decision is to invest if you can produce more value than you consume for production.

If you still think I am wrong, please let me know where. I have already learned something from you today.

The Schelling point is constant money supply.

Anything else is arbitrary.

Expected price appreciation or depreciation will be priced in by the markets. 🤯🤯🤯

Betting markets on political events like polymarket give insiders and people with power and influence a great lever to turn their power into monetary gains. Especially if they don't care about the consequences of these events.

We all know that money is power and power makes money. Don't make it too easy for them by placing your money on such markets.

What I observe is rather boys struggling with having no clear roles than adhering to outdated/gendered roles. Not sure if it makes sense to teach them to break out of something they don't have anymore. In my opinion it is important to convey an orientation and a sense of purpose. Positive examples instead of negative examples.

My May 2025 newsletter is out now.

It focuses on global trade, along with an assessment of this attempt to rebalance it, along with various investment implications of it.

https://www.lynalden.com/may-2025-newsletter/

Great article, Lyn! Thanks for the detailed explanations. I've been wondering about your position on the reserve currency status and think I am missing still one piece of the puzzle.

The world needs dollars - ok.

But why can this demand not be filled by printing dollars and buying gold or other assets instead of buying depreciating goods and services? It could counterbalance dollar overvaluation and keep the industrial base competitive.

From my perspective, the root cause of the socio-economic problems is not the trade deficit but the fractional reserve banking and the Cantillon effect, i.e. who profits from the newly created dollars.

This is not an assumption. It's the fundamental question!

Without block rewards and fees there will be no mining. (assuming a free market and purely economic incentives)

Without globally decentralized mining bitcoin will not be secure.

This is independent of prices and cost of energy.

"If you do not take an interest in the affairs of your government, then you are doomed to live under the rule of fools."

Plato