If she only was a synchronous swimmer all would be fine, unfortunately it’s much worse. She’s an outright criminal

2024 - only small hedgefunds invest in it

2023 - only unknown hedgefund managers recommend it

2022 - only small countries mine it

And how can Plebs invest in Ten31 ?

Nope, he totally rightly said, that if he would own ALL the #bitcoin in the world, then they would be worthless.

Did you ever play Monopoly where one player had ALL the money and the other have nothing? The game just ends

#bitcoin must be distributed, not equally, but to a certain extent

This is how you can be totally right and wrong at the same time

Woo-hoo, free money for all, we all gonna be rich and don’t need to work thanks to magic money printing 🤮

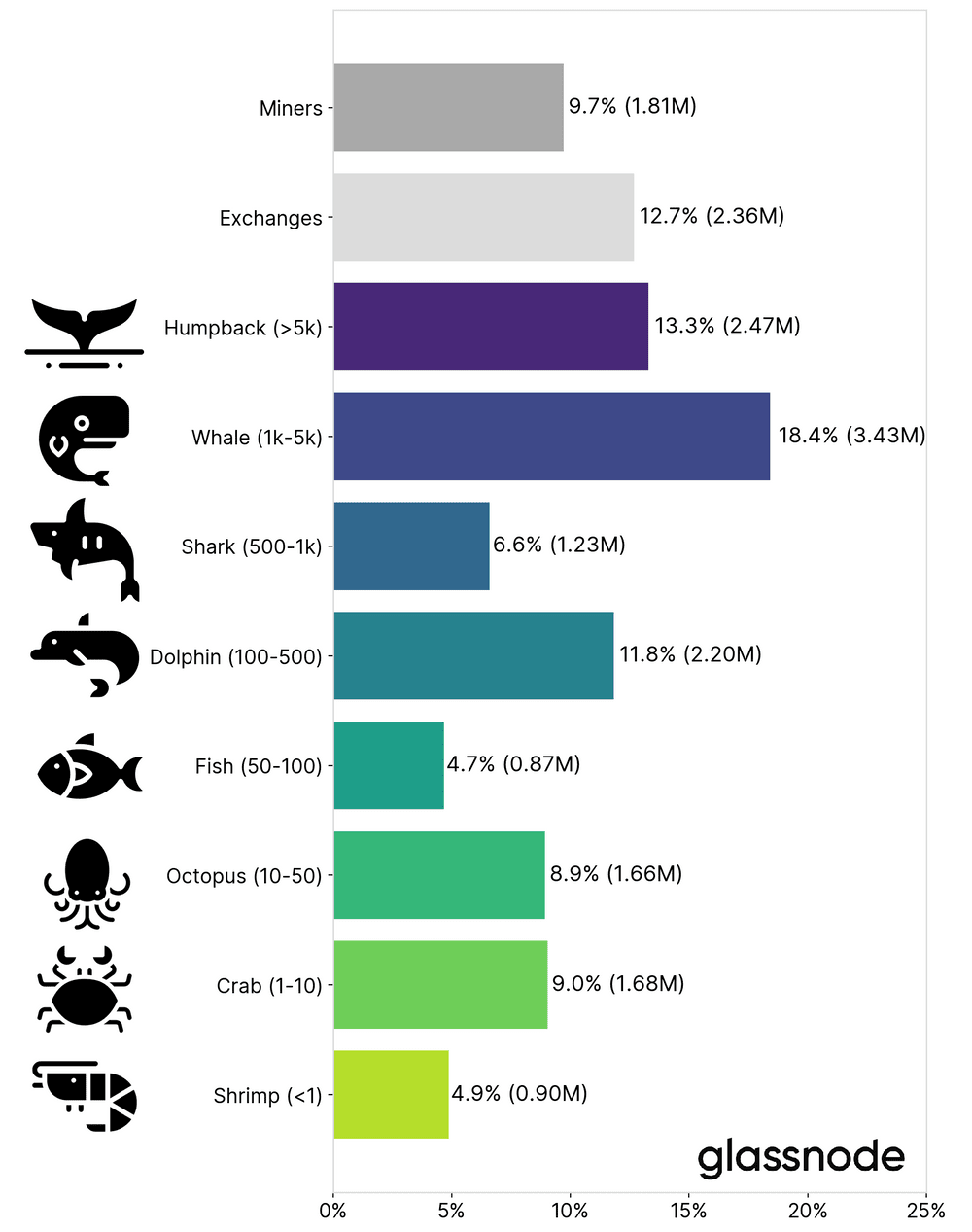

Much worse with #bitcoin

We’re the 1% and we own 100% of all current bitcoins.

Thereof 50% owned by less than 1% of the bitcoiners. Just do the math.

Last week a whale sold 100k bitcoins. Highly appreciated, we need a broader distribution.

So onboarding is the name of the game

Global Warming? North America Snow Coverage Hits "Decadal Highs"

https://www.zerohedge.com/weather/global-warming-north-america-snow-coverage-hits-decadal-highs

#Zap to support, DM to suggest new feeds.

It soon will change to Global Freezing

Ngl, Distribution is an issue for #bitcoin

Alex Soros controls $25 billion and 50% of his vocabulary is the word “um.”

The other 50% is empty platitudes about “democracy”. https://v.nostr.build/eMnX.mp4

This is the quality they have at the #WEF ? Embarrassing

Did they both survive or were they sacrificed to the gods?

Fast declining Roman Empire vibes

You can be all against vaccines, no issues, but better do not gaslight people with posting such things. Very easy to verify online in 1 minute. Don’t ruin your credibility

Come on, just checked the Red Cross website and obviously your claims are not true or deliberately twisted. It’s ok if you’re anti vaccine, but do not gaslight people. Not helpful

The exact opposite of #bitcoin

Enjoy reading, it’s a nightmare

———————————————-

money with an expiration date: Silvio Gesell's inspired idea of depreciating money meant to foster unimpeded circulation, to counter usury, and to benefit the common good.

'Money, you imagine, is the key that opens the gates of the market. That is not true — money is the bolt that bars them. The faults of money go further. When small businesses take out loans from banks, they must pay the banks interest on those loans, which means they must raise prices or cut wages. Thus, interest is a private gain at a public cost. In practice, those with money grow richer and those without grow poorer.

[...]

Gesell believed that the most-rewarded impulse in our present economy is to give as little as possible and to receive as much as possible, in every transaction. In doing so, he thought, we grow materially, morally and socially poorer.

[...]

To correct these economic and social ills, Gesell recommended we change the nature of money so it better reflects the goods for which it is exchanged. “We must make money worse as a commodity if we wish to make it better as a medium of exchange,” he wrote. To achieve this, he invented a form of expiring money called Freigeld, or Free Money. (Free because it would be freed from hoarding and interest.) The theory worked like this: A $100 bill of Freigeld would have 52 dated boxes on the back, where the holder must affix a 10-cent stamp every week for the bill to still be worth $100. If you kept the bill for an entire year, you would have to affix 52 stamps to the back of it — at a cost of $5.20 — for the bill to still be worth $100. Thus, the bill would depreciate 5.2% annually at the expense of its holder(s).

[...]

In Gesell’s system, the stamps would be an individual cost and the revenue they created would be a public gain, reducing the amount of additional taxes a government would need to collect and enabling it to support those unable to work. Money could be deposited in a bank, whereby it would retain its value because the bank would be responsible for the stamps. To avoid paying for the stamps, the bank would be incentivized to loan the money, passing on the holding expense to others. In Gesell’s vision, banks would loan so freely that their interest rates would eventually fall to zero, and they would collect only a small risk premium and an administration fee.

[...]

With the use of this stamp scrip currency, the full productive power of the economy would be unleashed. Capital would be accessible to everyone. A Currency Office, meanwhile, would maintain price stability by monitoring the amount of money in circulation. If prices go up, the office would destroy money. When prices fall, it would print more. In this economy, money would circulate with all the velocity of a game of hot potato. There would be no more “unearned income” of money lenders getting rich on interest. Instead, an individual’s economic success would be tied directly to the quality of their work and the strength of their ideas.'