And Peter is raising money so he can remove even more spam protections.

I know you want to “do something” but reconsider spending dev time on pattern matching and other easily bypassed modifications. Best to focus limited time on a full solution.

nostr:note1km7a74j5dwf52r8gnzpyt4wvr39ya9smd3zuy5gxlcevxgnk270qea33ev

Yes, you raised two good points. The new supply and the fact that gold is physical and was warehoused / centralized.

Honestly, I can’t imagine parting with something irreplaceable for a fixed interest rate where they can go bankrupt and I lose everything. 🤷♂️

I could see myself funding inventory on a short term basis for product royalties, etc.

> I don’t see how that thread debunks because it assumes a choice between one or the other. Why not both?

So imagine you broadcast OOB to antpool which has 25% of the hashrate. That gives you an estimated average confirmation time of 40 minutes

You have a 25% chance of it being mined in 10 minutes

82.2% chance of it being mined within the hour (1-(1-0.25)^6 = 82.2)

However it could take longer than this. 96.8% chance of it being mined in 2 hours

This vs paying a high enough fee to ensure it gets in the next block.

Imagine OOB was 25% cheaper than CPFP. Would you wait longer than usual for your transaction to be mined or pay 25% more to ensure it gets in the next block? Also, if it doesn't get in within the hour, would you pay 1.5x the original cost to send it to another miner?

It seems rational actors will choose just to broadcast.

Also, in practicality, it likely wouldn't be 25% cheaper because every single OOB tx acceleration option I've seen has been substantially more expensive than just doing CPFP. Pools want to charge a premium for this service.

> I’m not concerned with P2P trading, with primary origination on-chain, or with secondary trading off-chain that happens independently of miners. I think the issue is secondary trading of options directly on chain.

> You can use this to trade options, make atomic swaps, etc.

I suspect you're referring to "decentralized options" from the utxos.org/uses/options page

To clarify, an atomic swap is a purely peer-to-peer contract

And the option contract described on the page is also peer-to-peer.

So it would not be possible for secondary trading of options directly on-chain, unless you knew the counterparties you wanted to trade with ahead of time

You would need to pre-define potential change of ownership of the sell or buy side of the contract, and specify the participants that could take the contract off your hands ahead of time, which leaves no opportunity for MEV

> I think you would need to show that all AMMs must have a fundamental marketplace or contractual state that cannot be modeled by Sapio. It seems to me that if there is any possibility that there could be any secondary on-chain trading, then we can’t rule out the potential for time-based centralizing MEV through arbitrage, front-running, etc.

The key thing with CTV, is you commit to ALL inputs, and ALL outputs

Which means all participants in a CTV commitment or string of CTV commitments, need to be known ahead of time.

By definition, an AMM needs to allow anyone to participate to take trades in either direction

Not to mention, AMM doesn't work for Runes or BRC20 tokens

There's a proposal for AMMs to work with new OP_CAT tokens, but this doesn't apply at all to CTV: https://x.com/rot13maxi/status/1833667750469804315

So in this regard CTV is extremely safe. It only enables use cases that are peer-to-peer or known-parties-to-known-parties

> MEV already exists elsewhere.

Actually with the point above that you need to specify all the parties ahead of time, I don't think MEV is a concern at all actually

If you can give me a counter-example regarding MEV I'm happy to reconsider

MEV is a concern with runes, because someone can snipe a rune in the mempool when it's being bought

But if you lock into a CTV covenant, only parties specified ahead of time in the CTV commitment can "snipe" or front-run something

➡️ “It seems rational actors will choose just to broadcast. […] Acceleration options are more expensive.”

That’s true, but I think you’re conflating two services. Well, technically, there are three services (fast, regular, and slow). “Fast” would be an acceleration service for those who want faster transactions and willing to pay for speed. Regular would be the normal CPFP transaction. “Slow” would be a cheaper, slower service for those who don’t want to pay higher CPFP fees and are willing to wait.

A rational miner would offer a cheaper solution to obtain additional revenue not otherwise available. To them, it would be an option, one they could fulfill if they wanted. A rational user may be willing to wait longer for a solution that is cheaper than the default option if their transaction is not time sensitive.

➡️ “So it would not be possible for secondary trading of options directly on-chain, unless you knew the counterparties you wanted to trade with ahead of time.”

What if there was a registration step where traders sent the coordinator or AMM a small amount to register their address, and the contracts published the next day by the AMM would include these registered addresses?

I’m not particularly clever and I can see simplistic ways it might be accomplished. If I’ve learned anything in this space it’s that people are incredibly resourceful, and will find a way if the incentives are high enough.

Finally, an interesting Bitcoin podcast!

It’s been a while since I’ve seen people argue in Bitcoin but nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak managed to pull Saylor into an interesting conversation about credit and lending in Bitcoin.

Saylor apparently hasn’t fully thought through the implications of 21M and remains wedded to his fiat ideas.

He expects there to be yield on Bitcoin in future, but never says where it will come from in a completely fixed supply money.. “They’ll have to sell their assets to finance themselves!” - yeah no shit Michael!

The only way to generate yield in Bitcoin terms is to mismatch duration - literally run a Ponzi scheme. But Saylor expects that because the US Government will back the banks that this can’t go wrong 🤣🤣

Saif takes nostr:npub1sfhflz2msx45rfzjyf5tyj0x35pv4qtq3hh4v2jf8nhrtl79cavsl2ymqt line that capital will flow but HODLers will take equity rather than yield. This is the correct logical conclusion.

I’m not saying Saylor is completely wrong - I do see a future where banks will get into this space and lend and pay yield on Bitcoin.

But they WILL blow up. I don’t give a fuck if they’ve got their own nuclear arsenal let alone the full faith and credit of the US Government behind them, they WILL get out over their skis and they WILL be unable to fulfill their obligations at some point because they WILL greedily try to rehypothecate it in the meantime and no Government will be able to save them.

Saif and Allen both know the economy doesn’t require interest to function, that the world won’t grind to a halt without it - people will still spend money. Saylor just isn’t ready to let go of his statism (as evidenced earlier in the conversation) because he’s become accustomed to Billionaire privileges.

This is why I love #Bitcoin. You can be the CEO of the most successful public company of the past 4 years, all thanks to Bitcoin, and you will still be totally humbled by it unless you fully embrace the system as it is because it won’t be changing for your fiat games!

Yes, equity is the future. Not debt. Debt is a fiat concept. Ubiquitous debt is only possible because our money is inflationary.

You don’t have to look far in history to see that’s true. Under a gold based system, lending at interest was prohibited in many cultures.

A few issues. PoW doesn’t prevent targeted attacks. As an attacker, I could target all big accounts, or just new users. Or just their DMs.

Also hard to link PoW to visibility. Same hash cost whether a spam message is seen by one or 10,000.

I’m also worried about PoW and phone batteries. 🪫

I’ve been thinking whether we could create a sponsor model. Would there be a way to onboard new users into the WoT through an existing user (their sponsor). A one-time onboarding step may be better than ongoing PoW for every message.

Hey, you read Peter’s paper! Nice. You finally figured out that it wasn’t a podcast. 👍

Notice that Peter didn’t say “because it’s risk free”. Or maybe you didn’t? You got distracted on his comment regarding use cases. We weren’t even talking about that. 🤷♂️

Ah, you’re busy now. Still waiting for you to explain why Peter is wrong about the risk. I guess I’m going to be here a long time. 😴

PS. Remember, those who feel strongly about something they can’t defend…

It’s an interesting question. “Embrace and extend” was one of the techniques that Microsoft used to attack open protocols. They would make their implementation better and therefore create a new standard that only they controlled.

The risk would be if your relays extend the protocol, creating lock-in for the custom clients using it.

Colored hair now associated with mental illness 🤷♂️

It’s not the cheap money given to rich people and inflation.

It’s caused by dating apps!

Nostr devs! You can only pick two:

1) free to post

2) free of spam

3) free to connect with others

And hide the new users?

If all you do is separate them, then nobody will see them because there will be too much spam in the new user area.

Imagine that there are 1000 spam messages for every real new user. Why would anyone go in there?

I’m just pointing out without a visibility solution for new users, they are as good as gone. If we suppress new users, we kill the network.

It’s easy to get rid of spam. You just need to filter out all new users. The hard part is filtering out spam AND giving visibility to new users.

WoT solutions must be paired with visibility solutions for new users. If you don’t, you’ll fix spam but kill the system at the same time.

Don’t see how spam scores will work. Eventually all your relays, except WoT ones will be blocked.

The fundamental problem is that there is no difference between a spammer and a new user. LLMs will make them indistinguishable eventually.

What other solutions are there except to impose a significant onboarding or ongoing cost to new users? There could be many ways to impose this cost but it seems we have to do it.

Spam filters, pattern matching, manual blocking is all a waste of dev resources because attackers will just escalate over time.

nostr:note1vgvhwjn6ewsr7z4cq0qc4j4fpz0aqrc66u5xt7r7fat35p5s09uqlvggjv

California suppresses home insurance rates. So insurance companies leave. Then people are shocked that they can’t get insurance any more. 🤦♂️

https://www.zerohedge.com/political/california-homeowners-are-losing-their-insurance-heres-why

Oh, you’re not busy anymore! Hope you had the time to read the thread with Matt Black.

Correction: you told me your opinion and couldn’t provide any logic or evidence. Everyone can see you didn’t answer anything. Btw, you know that only midwits believe strongly in something they can’t defend, right? Must have been a blow to your ego to discover you had nothing.

I know, I know. The answer is just that Peter Todd, Matt Corallo, everyone is wrong. But why? …And you can’t explain. 🤡😂

It’s funny how you keep responding to me with nothing. I must be living rent free in there.

So true, but so hard for most people to do. They prioritize what appears to be a steady paycheck over their family’s long term freedom.

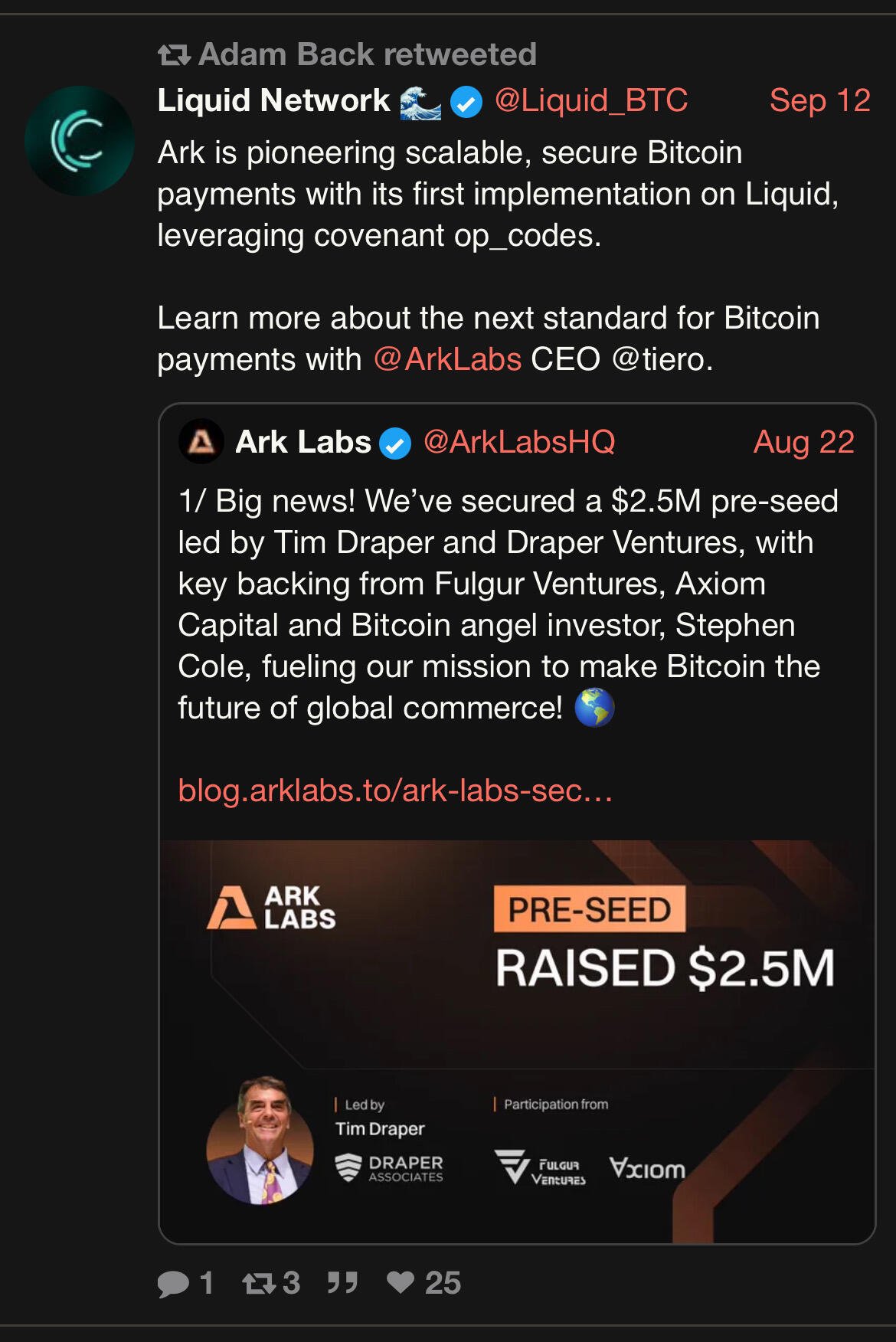

Covenants on bitcoin? This is the way👇