Good Morning nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs

G as in GM

J as in Gif

THESE TWO ARE NOT THE SAME

GM

"I don't know where I'm going, but I know exactly how to get there"

Boyd Varty

Tuition fees.

Everyone pays them in one way or another .. it's not like governments have a solid demonstrable track record with making astute financial decisions is it?

They're at the FA stage of the FAFO lifecycle .. all normal and expected.

GM #Austriches ..

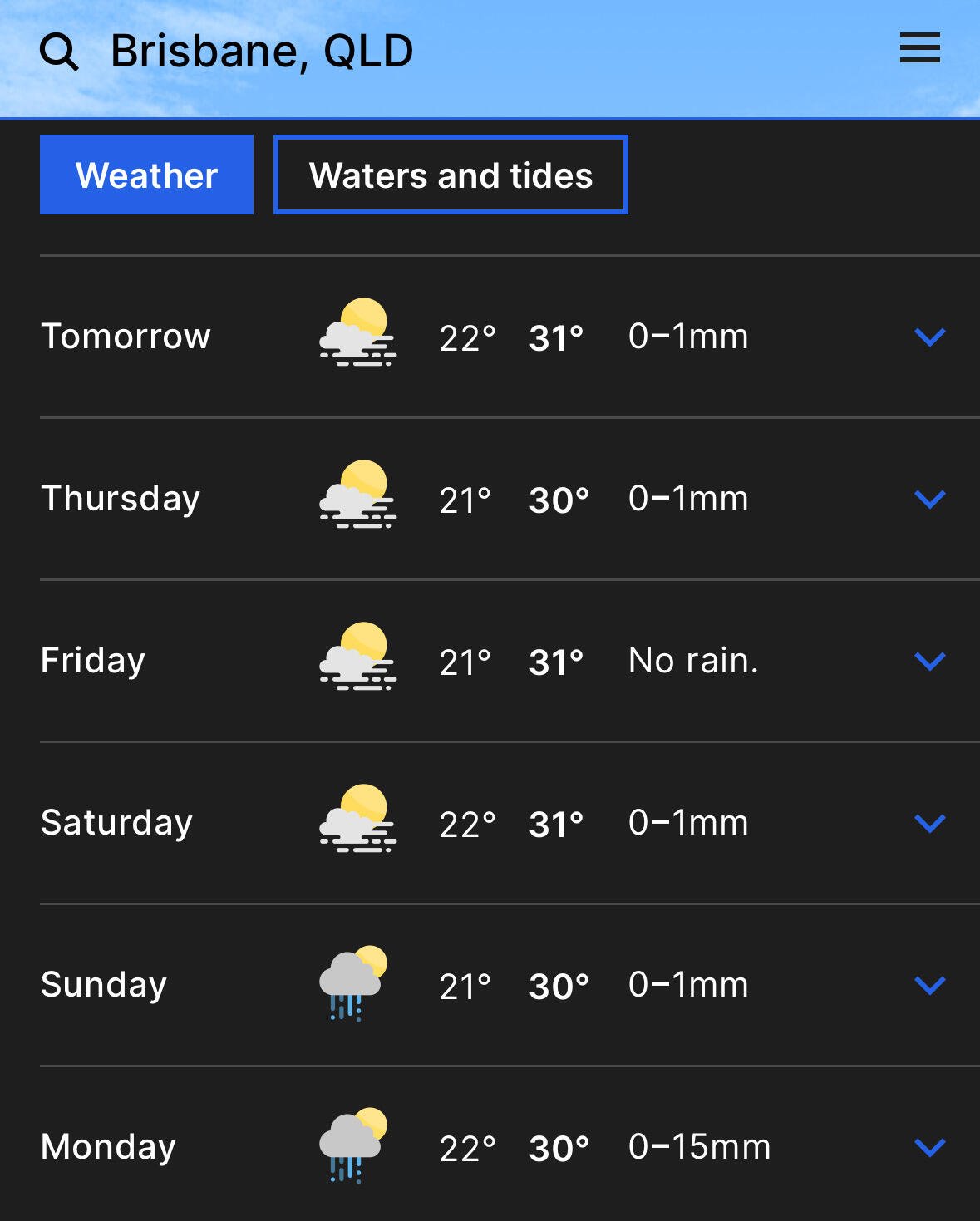

Big blow coming

Going to be a bit wet and windy

Not for years .. and then it’s going to be glorious to see their understanding dawn

Australia's headline Bitcoin event: BITCOIN ALIVE

Incredible speaker lineup

Countdown: 8 days! .. get on it!

GN

The thing about trade-offs ..

If you haven't identified trade-off you are making, then you probably shouldn’t be taking what looks like a shortcut

The goal is informed choices, where trade-offs are understood

Understand the trade-offs → Own the consequences/outcome.

GM #AUStriches

I like all sorts of cycles 😎

Mark to market .. or not

For those of you old enough to remember, that time after the GFC from 2007/2008 when house prices tanked were tough for many, dire for many and tragic for too many: jobs lost, income lost, homes lost, families torn asunder, suicides and misery ..

An avoidable cyclone of financial fuckery wrought on the plebs ..

What did the banks do? Well, they watched the property market like everyone else, and for everyone that owed them money .. they had the comfort of a security of a mortgage over their customers home ..

Many who lost their jobs had to eventually sell their houses .. at a loss .. and in the worst case that sale didn't cover the outstanding mortgage 😬 .. some declared bankruptcy, some shouldered the debt .. tragic

However .. for those who by hook or by crook (job or savings) continued to pay their monthly mortgage to the bank, the bank consequently gave zero fucks. They did NOT care that the EUR500k mortgage was now secured by a EUR300k property .. as long as those sweet monthly payments kept rolling in ..

So this idea of "loss" (or gain for that matter), is only one that is remotely relevant at a time when you sell .. which is traditionally when the asset is repriced/revalued/"marked to market"

Which brings us to debt:

So if you hold debt, then as long as you can service it, no problem. If you're "over your skis", or your circumstances change (and you can't), or you're a leveraged degenerate, then margin calls on assets that ARE dynamically marked to market are going to plague your sleep

Been thinking a lot about the *choice* of when security holders mark assets to market lately ;-)

.. and like #Bitcoin, Nostr is never down 😎

Own your money

Run your own node

Run your own relay

Encrypt your backups

Have redundancy where you can

Protect carefully where you cannot

🫂 🧡

GM #AUStriches ..

Which of you talented ‘tards can make the govt support for Nostr official? 😜

Oh alright then .. but just the one!