GM nature is healing.

Social contagion is a hell of a drug.

Someone please host these libraries and charge sats for downloads.

No junk and ads and delays and captchas to monetize. Just money.

You don’t have five seconds. You’re dead by the time you read the instructions.

My favorite conflicting advice;

1. Don’t fight the tape.

2. Be greedy when others are fearful and fearful when others are greedy.

Also, the two versions of the gambler’s fallacy. When you are on a winning streak you “have the hot hand” but when you are losing, you’re “due” for a win.

These things precisely cancel and we invoke them as needed to do what we want with a nice rationalization.

Silk Road hoodie arrived today from nostr:nprofile1qqsvn0dkjt80raqrxd470c98n7zrdehmcvj6p5hgw3kyku6zyd8z0fqqnrf3s.

True. The gold isn’t manufactured. But its rate of discovery is a function of technology and demand. Bitcoin’s is pre-set. That constantly trips people up when they think of mining. Dhruv’s way of thinking about it is better. The network already has the bitcoin: they just haven’t sold them to the miners yet in exchange for hash.

Analogy is good but I don’t like the idea that the value exists before issuance. The bitcoins exist, but their value is yet to be decided because they haven’t touched a market. But their quantity has already been fixed.

Yeah that’s exactly the kind of weird auction it is.

nostr:nprofile1qqs8753ha8mh5gky4ztzf3avx89w097c43q5fvpyjwys6487uuuehngynvytp you do allow that the fiction that determines the existence of the fictional stuff known as bitcoin… this fiction isn’t just the time chain, right? But the software too? So this fictional stuff can exist, according to the fiction, but be no one’s and nowhere on-chain? Is that consistent with your work? (Sorry I should just look it up.)

Been thinking about Dhruv Bansal’s idea that bitcoin are not produced or generated — wrong way of thinking about it induced by “mining” metaphor — but rather all bitcoin existed from the moment the network was launched, but are auctioned off to miners as a whole, in exchange for hashes (compute), on an auction schedule of 140 years or whatever it is.

Each miner decides to take the network’s offer or not, by running their machines or not. Collectively, they determine how much that latest round of auctioned bitcoin is worth, in hashes and/or in energy.

Then there’s another market on top of this one which is coincidental but distinct, and that’s the market for block space, where the sellers are individual miners and the buyers are would-be transactors and of course that’s sat/vbyte.

I really do think it’s more accurate than thinking of bitcoin miners as “producing” bitcoin the way a manufacturer produces a product like cars or even discovered like gold miners discover gold. The bitcoin, all 21 million exist, just not on the ledger, from the get go. They only need to be auctioned, like treasuries. We don’t think the bidders on treasuries produce the 10-year! It’s just a weird auction mechanism where you have to prove work and your odds of winning the auction are proportional to your work / the total work by bidders.

I do get it and I think it’s right and I think it helps with a lot of misconceptions once you grok it fully. And as Dhruv says it shows you the formula for how bitcoin disrupts everything which is by making markets where there weren’t any, and building layers of distinct markets, including lighting and eventually the internet.

So, good job Dhruv.

But… it is not so easy to communicate is it? This thing is bloody hard to explain, as someone said once.

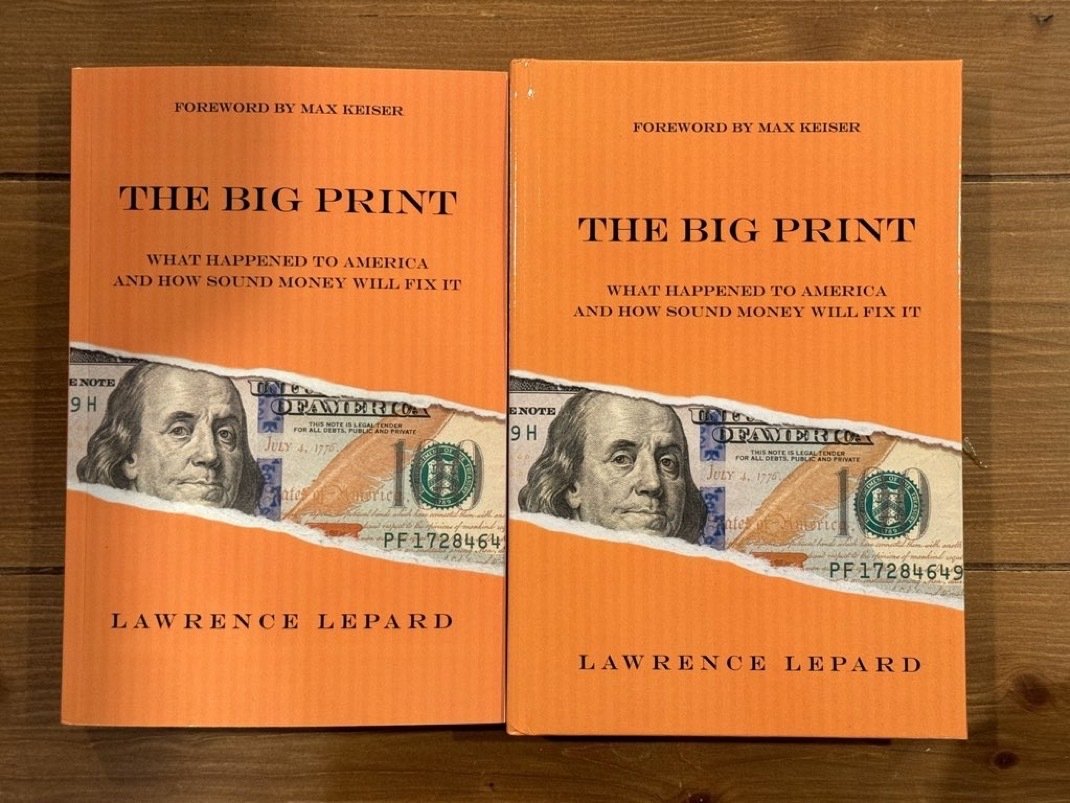

I got 3 copies but haven’t had the time to crack em open yet!

Yeah this but arranged by Kempff https://imslp.org/wiki/Wachet_auf,_ruft_uns_die_Stimme,_BWV_140_(Bach,_Johann_Sebastian)

Let’s get the former Mayor of Caracas a sizable following on here, yeah?

nostr:note1qdy4rm5jxz7mndmfkcnwdsvn4t2hr70d2mj6fhxcfum8k939cxgs3d0kxv

Welcome to my world

Extremely difficult habit to kick. Good luck and stick with it for awhile. It takes a long time to fully adjust.