Profile: a1db7ead...

香港。有的人很有钱,却把自己送进监狱;蔡澜有钱,却活成了神仙。你说是钱的事吗?蔡澜在太太离世后,认为人生已到晚年,不想有太多负担,故决定将所有收藏品送人。蔡澜目前住酒店。8人团队中,从助理管家,到医生护士全天待命,当中更包括秘书、助手及司机,每月出粮最少50万。蔡澜每天阅读、旅行、聊天行程满档,让无儿无女的他,天天生活充实,过上很多年轻人梦寐以求的养老生活,更获赞人间清醒。

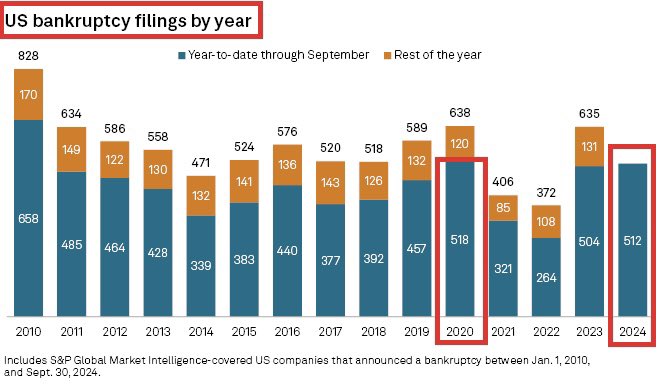

美国如何被视为“强劲”经济?美国正面临重大经济挑战,最近破产案件激增就是明证。今年迄今,美国破产案件已达512起,创下2020年新冠疫情危机以来的最高纪录,当时有518起申请破产。除2020年外,这一数字是自2010年以来,破产案件数量第二高。这些统计数据,引发了人们对美国经济整体实力的质疑,尤其是在破产率如此之高的情况下。

How is the U.S. Considered a 'Strong' Economy?The U.S. is facing significant economic challenges, as evidenced by the recent surge in bankruptcies. Year-to-date, U.S. bankruptcies have reached 512, marking the highest number since the COVID-19 crisis in 2020, when there were 518 filings. Excluding 2020, this figure represents the second-highest level of bankruptcies since 2010.

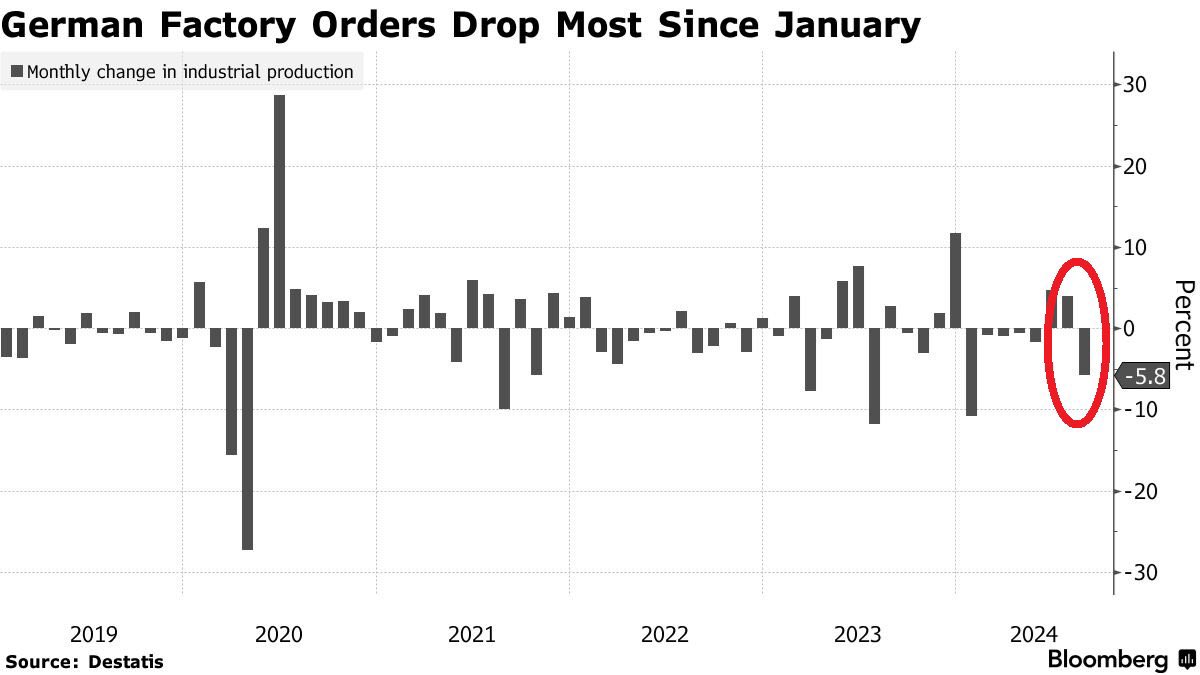

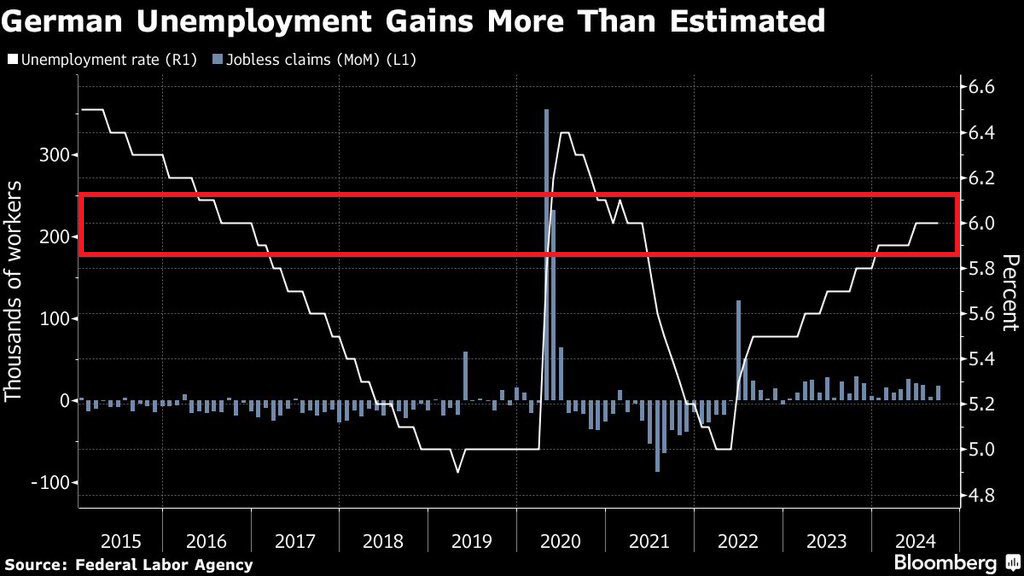

欧洲经济正在走弱。德国工厂订单出现自1月份以来的最大降幅,8月工业订单环比下降5.8%,降幅低于预期,是今年以来第二大降幅。全球第三大经济体仍有望连续第二年出现GDP萎缩。Europe's economy is weakening. German factory orders have experienced their largest decline since January, with industrial orders dropping by 5.8% month-over-month in August, which is lower than estimated and marks the second-biggest decline this year. The world's third-largest economy is still on track for a second consecutive year of GDP contraction.

恒大集团前总裁夏海钧:对公司财务不知情,申请解除600亿资产冻结令。恒大集团前行政总裁夏海钧,向法院申请解除冻结令,称自己没有参与公司财政,对公司财政不知情。2024年初,恒大集团被清盘人接管,3月入禀向恒大创办人许家印、前妻丁玉梅、前行政总裁夏海钧以及前CFO潘大荣等,追讨合共约468亿港元股息及酬金。

恒大集团今年6月再入禀成功申请禁制令,阻止许家印、丁玉梅、夏海钧等人处理名下全球600亿港元资产。在香港高等法院处理该案时,恒大要求延长禁制令,夏海钧、丁玉梅等人却要求法院撤销禁制令。恒大对许家印等人共提出两起诉讼,首起诉讼的七名被告为:许家印、夏海钧、潘大荣、丁玉梅和三家公司。恒大指许家印等人涉及违反责任、失实陈述等。

夏海钧的律师称,夏海钧没参与恒大的审计或薪酬委员会。代表恒大的律师则反驳道,涉案的财务报表有五项严重夸大之处,包括夸大公司收入6640亿元,而夏海钧在涉案期间是恒大行政总裁。代表恒大的律师称,夏海钧任职时收入是其他行政总裁的10倍之多,却声称对财政报告内容不知情,由此可认为案发因许家印及夏海钧等人失职,更可能涉及重大骗局。

夏海钧是恒大集团的原董事局副主席、总裁,曾因年薪高达2.7亿元人民币,而被称为“打工皇帝”。他出生于1964年,毕业于中南大学和暨南大学,并在2007年加入恒大集团。夏海钧因涉及恒大集团财务造假等违法行为,被中国证监会处以严厉的行政处罚。在恒大集团面临财务危机时,夏海钧选择了减持套现,2021年8月,他减持了恒大物业和恒大汽车的股票,套现约1.16亿港元。

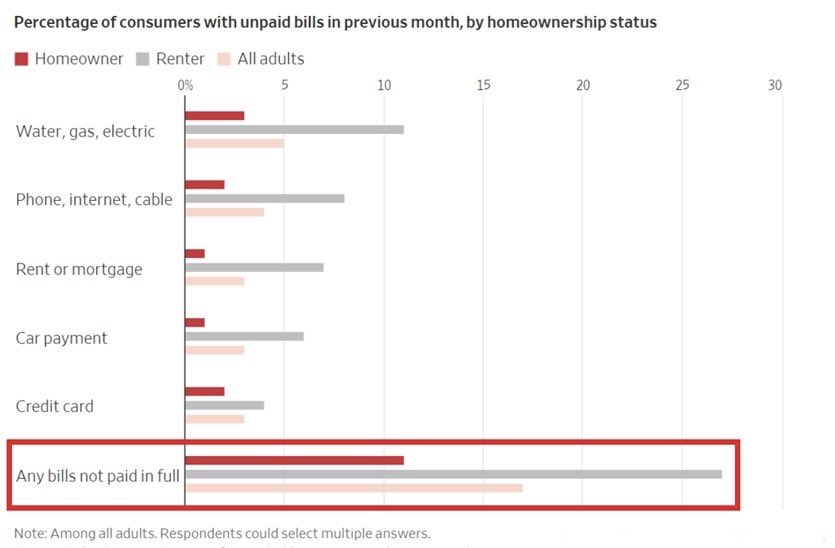

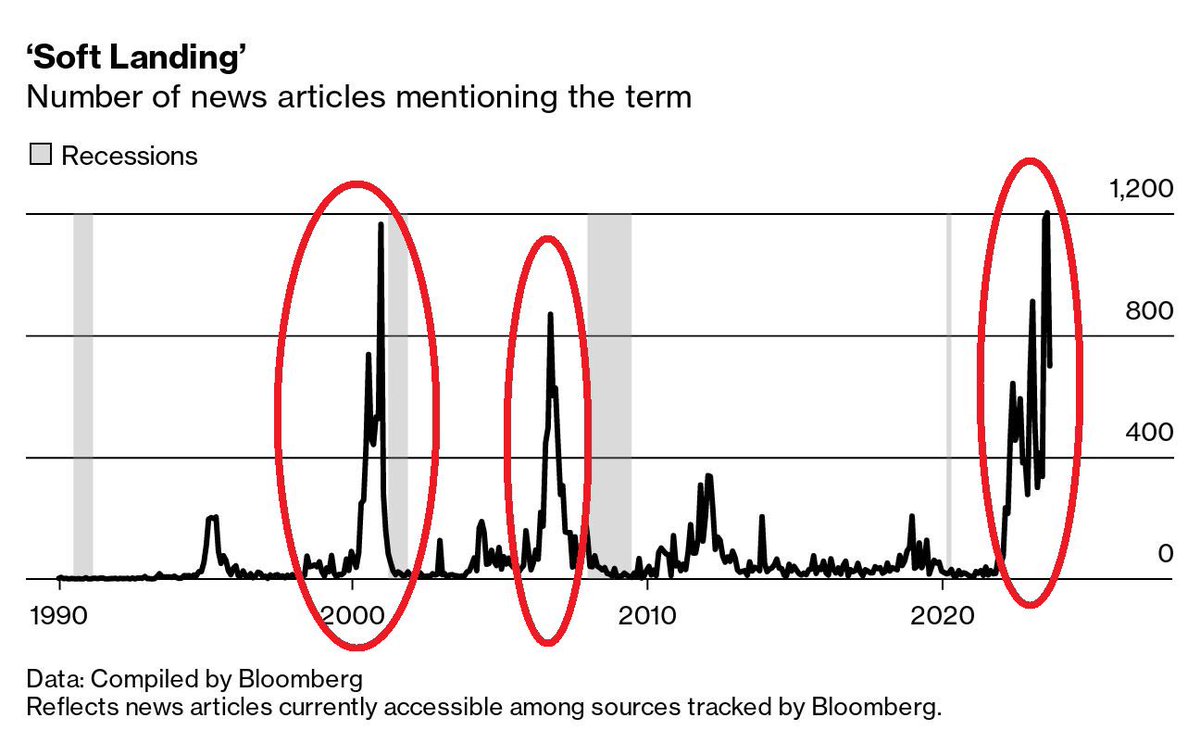

大量美国消费者,正为未付账单而苦苦挣扎。美联储最新的调查:17%的消费者在2023年有未付账单。在年收入低于25,000美元的低收入家庭中,36%的人没有支付所有账单。此外,近27%的租房者无法全额支付账单,11%的人未能支付水、煤气或电等基本服务费用,这在所有类别中最高。引发人们对经济“软着陆”的质疑。

A significant number of US consumers are struggling with unpaid bills. According to the latest Fed Survey, 17% of consumers had unpaid bills in 2023. Among lower-income households earning less than $25,000 annually, 36% did not pay all their bills. Additionally, nearly 27% of renters were unable to pay their bills in full, with 11% failing to pay for essential services like water, gas, or electricity—the highest among all categories.This raises questions about the notion of a "soft landing" in the economy.

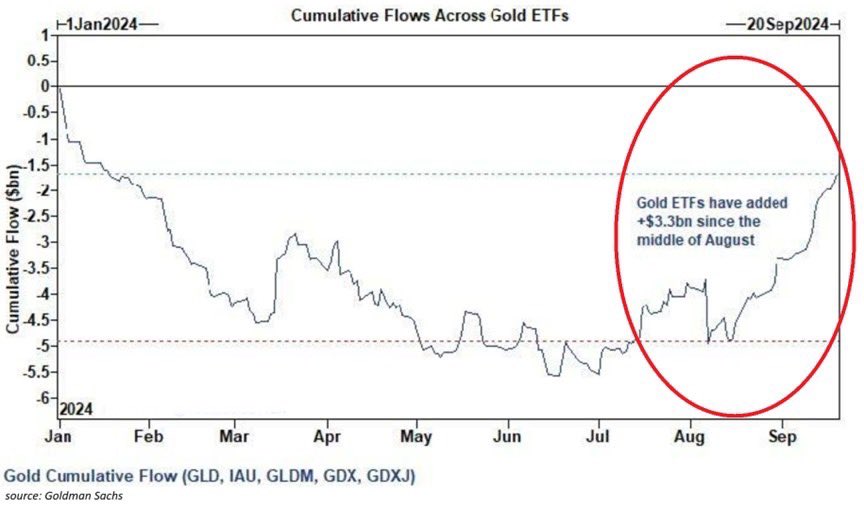

金价继续反映出危机般的交易环境?自8月以来,包括来自金矿商的资金在内,黄金ETF累计流入量已达到33亿美元。领先的黄金ETF(GLD)今年的流入量已达到6.44亿美元。黄金需求处于历史高位,有望创下1979年以来的最佳年度回报率,今年迄今已增长28%。超级财经(SuperFinance)发现,黄金矿商ETF(GDX)和GDXJ已上涨超过30%,创下2020年以来的最佳表现。

Gold prices continue to reflect a crisis-like trading environment. Cumulative gold ETF inflows, including those from gold miners, have reached $3.3 billion since August. The leading gold ETF, GLD, has seen 644 million in inflows this year. Demand for gold is historically high, positioning it for its best annual return since 1979, with a 28% increase year-to-date. According to SuperFinance, gold miners ETFs, GDX and GDXJ, have risen over 30%, marking their best performance since 2020.

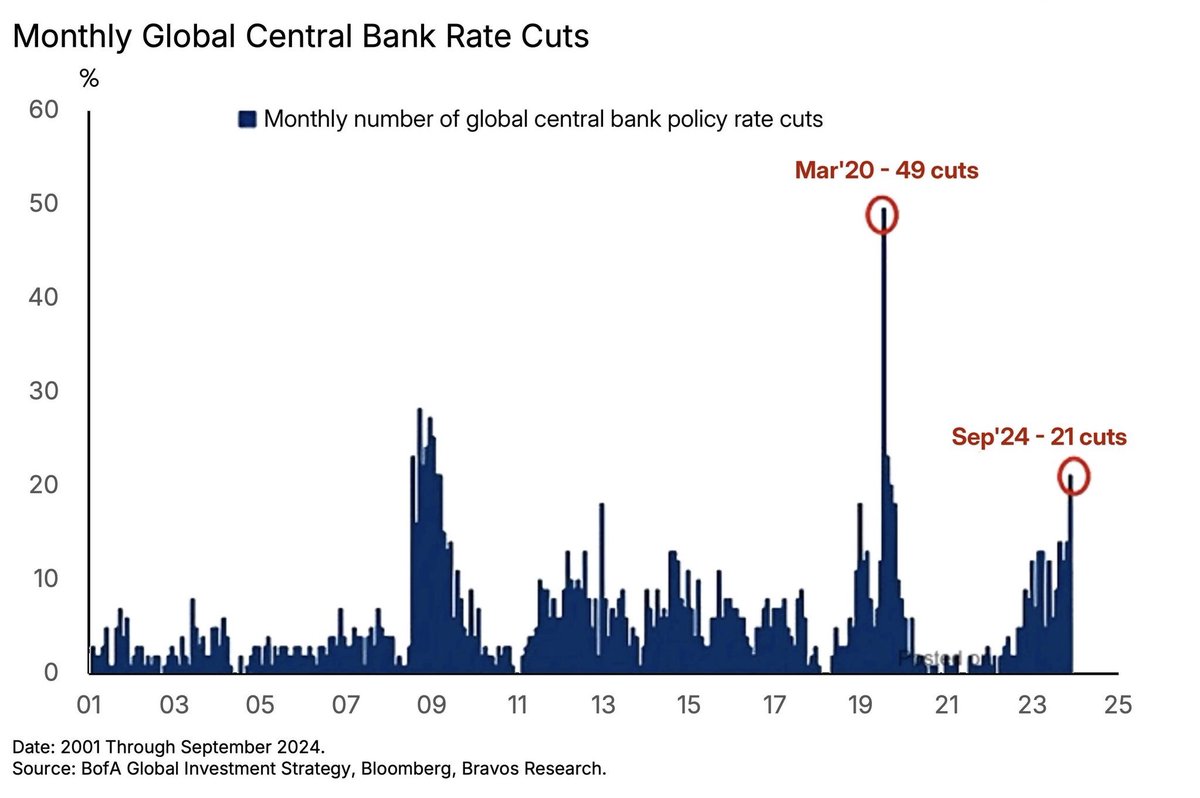

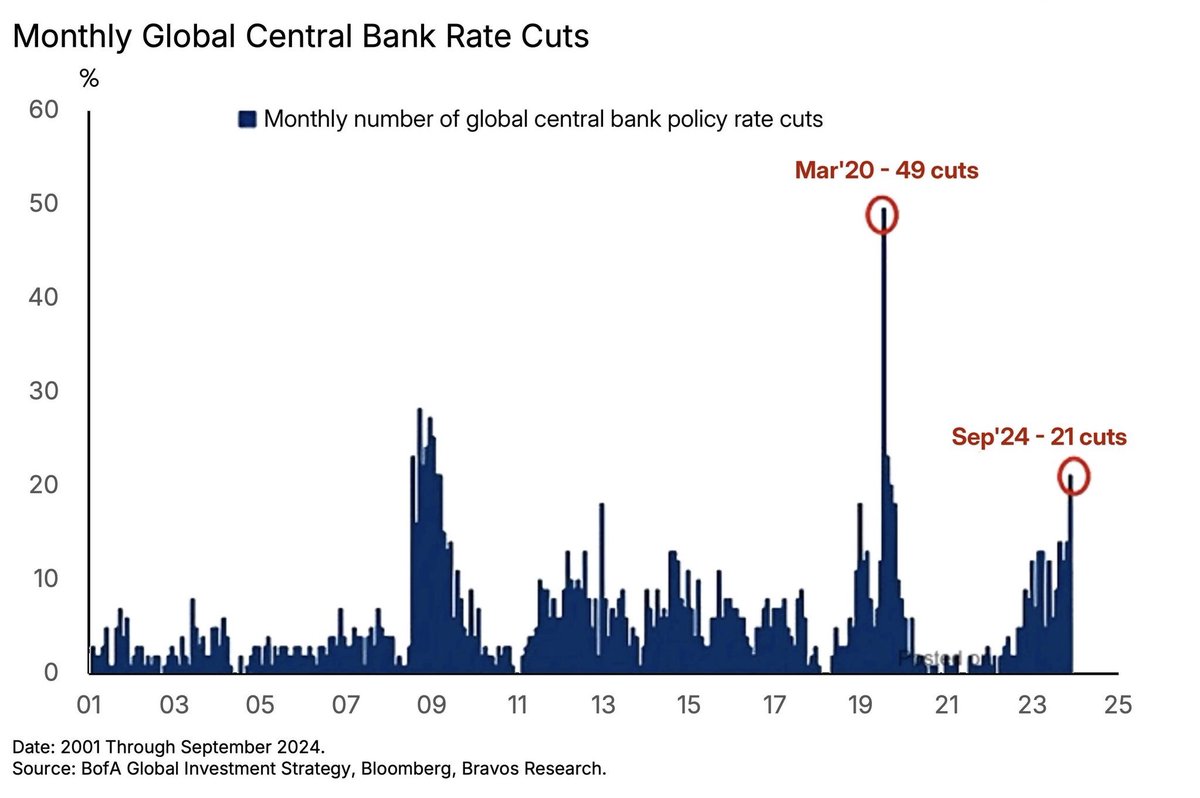

全球流动性在增加。上个月,美联储自2020年3月以来首次降息,将联邦基金利率下调0.50个百分点至4.75%-5%区间。2024年9月,全球央行实施了21次降息,而2020年3月则降息49次。如果能够避免经济衰退,这一趋势对市场有利。Global liquidity is on the rise. Last month, the Federal Reserve made its first rate cuts since March 2020, lowering the federal funds rate by 0.50 percentage points to a range of 4.75%-5% . In September 2024, global central banks implemented 21 rate cuts, compared to 49 cuts in March 2020. If a recession can be avoided, this trend is bullish for the markets.

上个月,美联储自2020年3月以来首次降息,将联邦基金利率下调0.50个百分点至4.75%-5%区间。2024年9月,全球央行实施了21次降息,而2020年3月则降息49次。如果能够避免经济衰退,这一趋势对市场有利。Last month, the Federal Reserve made its first rate cuts since March 2020, lowering the federal funds rate by 0.50 percentage points to a range of 4.75%-5% . In September 2024, global central banks implemented 21 rate cuts, compared to 49 cuts in March 2020. If a recession can be avoided, this trend is bullish for the markets.

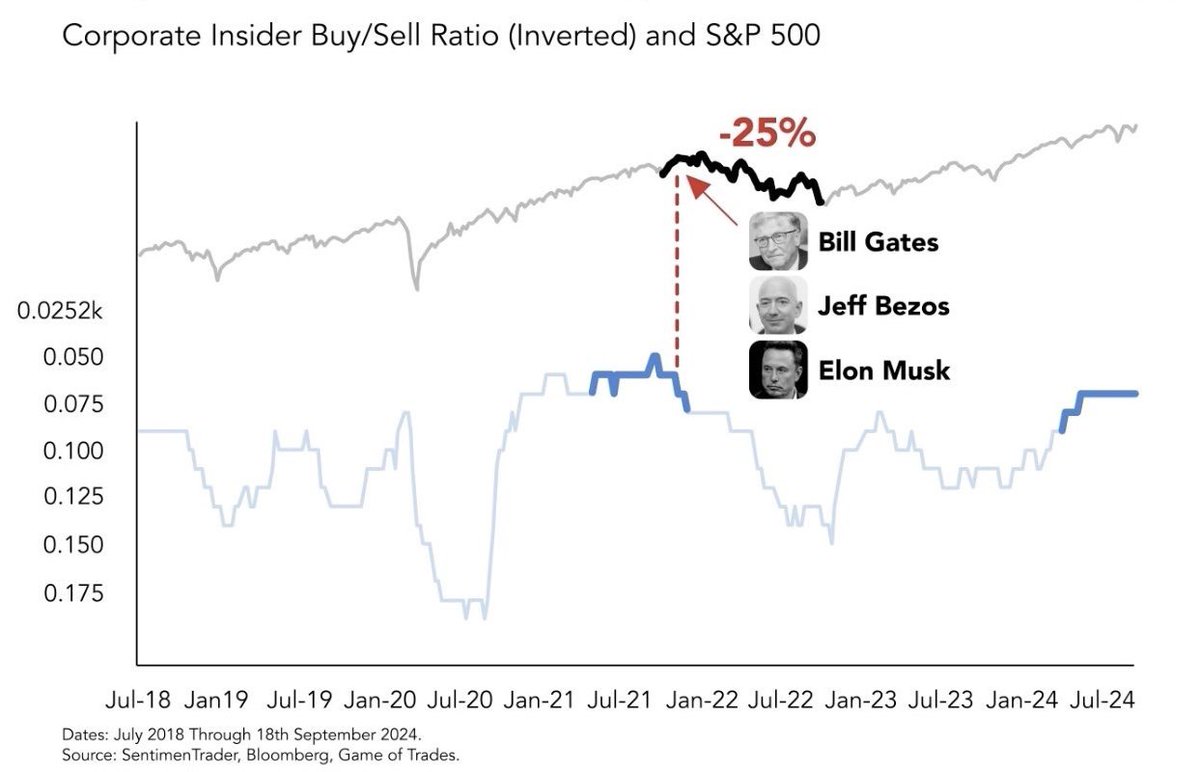

公司内部人士的卖出与买入比率,达到2021年底以来的最高水平,当时比尔·盖茨、杰夫·贝佐斯和埃隆·马斯克等亿万富翁CEO,出售了相当一部分持股,导致市场下跌25%。如今,类似的趋势正在出现,沃伦·巴菲特最近抛售了60亿美元的股票,迈克尔·伯里也削减了他的投资组合。这种情况对市场来说并不是好兆头。

The corporate insider sell-to-buy ratio is at its highest since late 2021, a period when billionaire CEOs like Bill Gates, Jeff Bezos, and Elon Musk sold significant portions of their holdings, leading to a 25% market decline. Today, a similar trend is emerging, with Warren Buffett recently selling $6 billion in stocks and Michael Burry also trimming his portfolio. This situation does not bode well for the market.

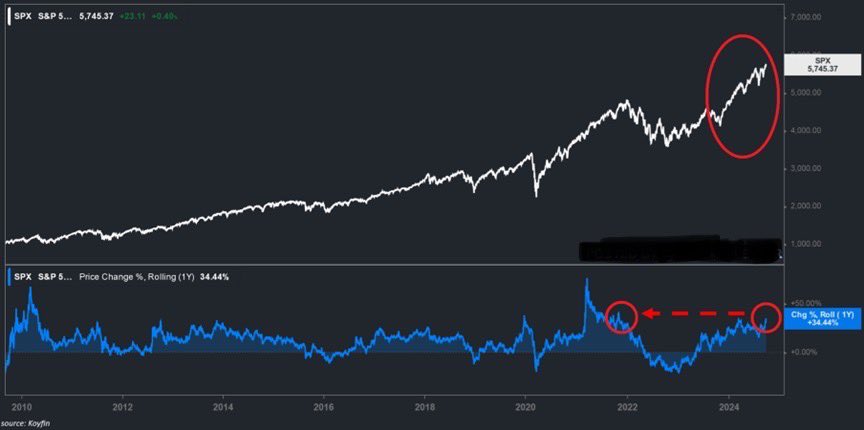

这是有史以来最好的市场反弹之一,标普500指数,在过去一年中上涨了34.4%,创下2021年10月以来的最高水平。在过去15年中,只有2010年和2021年的牛市表现比它更好,此前市场经历了2008年金融危机,和2020年疫情危机的复苏。2021年,标普500指数创下70个历史新高,为1995年以来的最高纪录。今年,该指数已经创下42个纪录,有望创下2017年以来第二好的纪录。

This has been one of the best market rallies ever, with the S&P 500 up 34.4% over the past year, the highest since October 2021. In the last 15 years, only the 2010 and 2021 bull markets performed better, following recoveries from the 2008 Financial Crisis and the 2020 pandemic crash. In 2021, the S&P 500 achieved 70 new all-time highs, the most since 1995. This year, it has already hit 42 records and is on track for the second-best streak since 2017.

现在是投资欧洲的好时机吗?德国失业率正在上升,9月份失业人数增加17,000人,超过预期的13,500人。失业率目前为6.0%,为三年来最高,反映出过去两年增加了1.0个百分点。这一趋势表明经济衰退仍在继续。超级财经(SuperFinance)分析,鉴于这些经济指标,现在可能不是投资欧洲(尤其是德国)的最佳时机,因为失业率上升表明未来经济面临挑战。

Is Now a Good Time to Invest in Europe? Unemployment in Germany is on the rise, with joblessness increasing by 17,000 in September, surpassing the expected 13,500. The unemployment rate now stands at 6.0%, the highest in over three years, reflecting a 1.0 percentage point increase over the past two years. This trend indicates that the recession is ongoing. According to SuperFinance, given these economic indicators, it may not be the best time to invest in Europe, particularly in Germany, as rising unemployment suggests economic challenges ahead.

三只羊的小杨哥,好像出事了?梨小娜爆料三只羊录音完整版。教人作伪证,妨碍司法公正。卢文庆和大小杨真是绝了,每次出事就找主播背锅,关键找人背锅还抠抠馊嗖?完了还要人倒给赔偿?小杨哥的人设,彻底崩塌了。这些年,围绕着小杨哥的也无外乎两个字:暴富。开上劳斯莱斯、全球限量25台的巴博斯G900。

小杨哥的暴富路径:更草根,更奇葩,也更自成一派。小杨哥的粉丝数9999万+,雷军是1800万,董宇辉是2498万,甚至超过刘德华的7300万粉丝。1995年出生的张庆杨(小杨哥),从一名安徽六安的乡村少年,逆袭成为一名有上亿网红,只是他在阳台偶然点燃爆竹,丢进墨水里,就在他想要逃跑的时候,室友关上了阳台的大门,墨水虽然炸黑了小杨哥的脸,但意外引爆了流量。

普通人的小杨哥,与哥哥张开杨,在草根兄弟们的助力下,逐步建立起了商业帝国。出现在小杨哥直播间里的场景,一切开始产生了变化:不再仅仅是三块钱的零食,五块钱的拖把,取而代之的是1999元的洗地机,2799元的按摩椅;不再仅仅是网红,更出现了篮球巨星奥尼尔、哈登、王宝强、周星驰...2022年,三只羊直播带货已经年入100亿。但网红赛道之饱和、竞争之凶残,只要你敢休息一天,就会被无数竞争对手吞噬。 https://video.twimg.com/amplify_video/1839143654046244864/vid/avc1/884x514/aX7IyB9_PEz2Eftr.mp4?tag=16

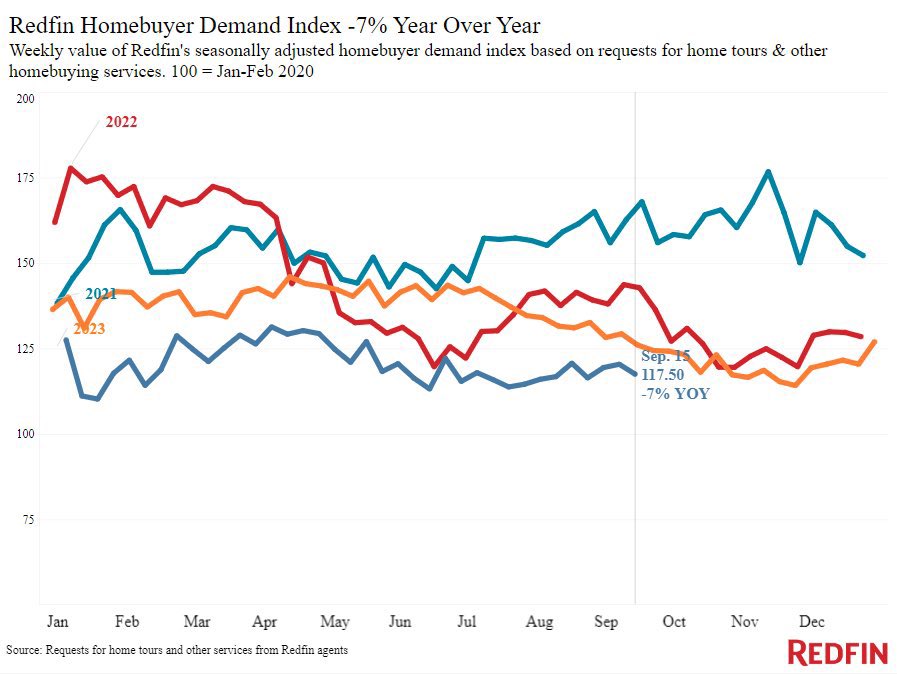

美国购房需求仍处于疲软趋势,2024年的情况将比前三年更糟。价格需要进一步下降。8月份现有住房月度供应量(未经季节性调整)小幅上升…目前已达到2020年5月以来的最高水平。U.S. homebuyer demand is still in a softening trend, with 2024 looking worse compared to the previous three years. Prices need to drop further. The monthly supply of existing homes, on a non-seasonally adjusted basis, ticked higher in August and is now at its highest level since May 2020.

什么是倒挂收益率曲线?经济萧条时,投资机会有限,企业家不敢冒险。所以长期利率可能会低于短期利率。叫做“逆转的收益曲线”(Inverted Yield Curve),或叫倒挂收益率曲线,这是经济衰退的可靠指标。中国也有这个问题。逆转的收益曲线是一个病的症状,而不是病本身。要治病,但不要花太多时间在症状上。 https://t.co/6BmWLwUvSo https://video.twimg.com/amplify_video/1837408953153867779/vid/avc1/828x472/x4mduTBkJ-ZAoMlH.mp4?tag=16

软着陆,能否实现?华尔街希望美国重现1995年软着陆。它总是以软着陆开始,然后该术语的提及次数激增。问题是,20世纪90年代中期,就业市场蓬勃发展,但现在却迅速恶化。即使巨额赤字,也无法阻止这一不可避免的结果。Still a soft landing? Wall Street hopes for a repeat of the 1995 U.S. soft landing. It always begins as a soft landing, and the term sees a spike in mentions. The issue is that in the mid-1990s, the job market was booming, while now it is deteriorating rapidly. Even significant deficits will not prevent the inevitable.

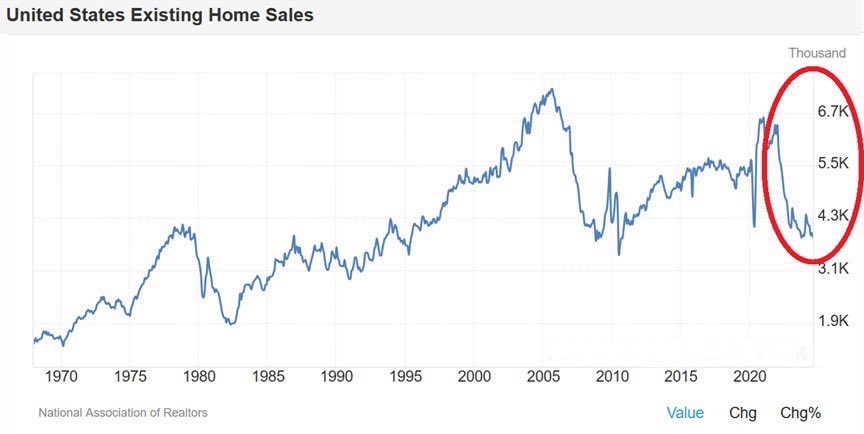

突发消息:美国房地产市场正在崩盘,明年刚需的也许可以进场。8月份美国现房销售量下降2.5%至386万套,为14年来第二低水平。房屋销售量下降近两倍,预计下降1.3%。首次购房者的购房份额下降至26%,与历史最低水平一致。自2021年1月高峰以来,现房销量现已下降42%,创下2006年房地产泡沫破裂以来的最大跌幅。

BREAKING: The U.S. housing market is collapsing. U.S. existing home sales fell by 2.5% to 3.86 million in August, marking the second-lowest level in 14 years. Home sales fell by nearly double the expected 1.3% decline. The share of purchases by first-time buyers decreased to 26%, aligning with the all-time low. Since the peak in January 2021, existing home sales have now declined by 42%, representing the largest drop since the 2006 housing bubble burst.

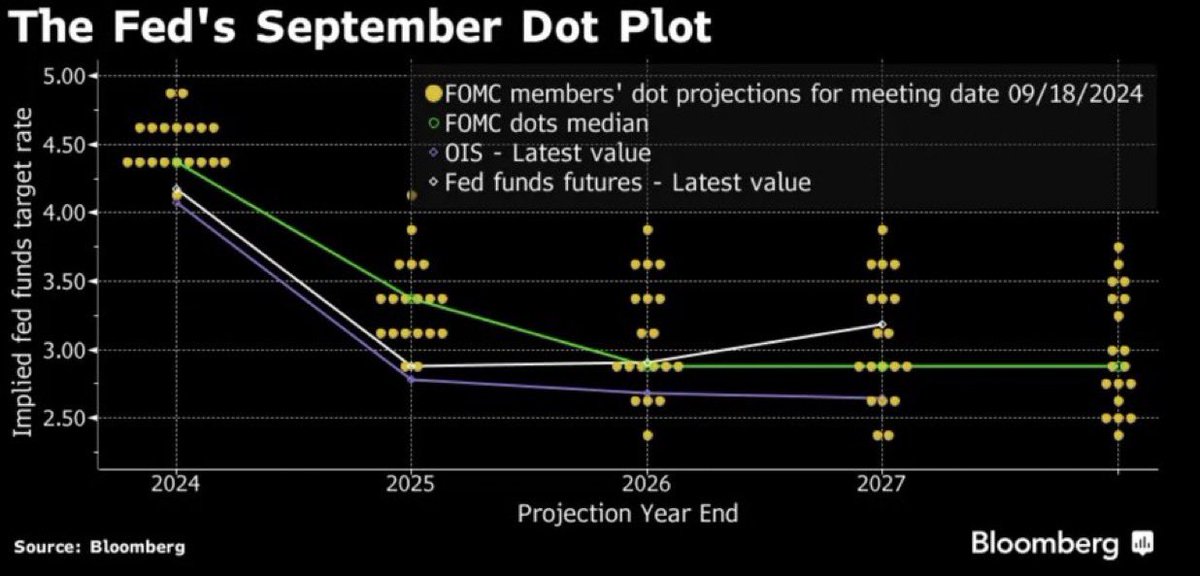

最新消息:美联储所谓的点图显示,美国央行用来表明其对利率走势的展望,年底联邦基金利率预测中值降至4.38%。NEW: The Fed’s so-called dot plot, which the US central bank uses to signal its outlook for the path of interest rates, shows the median year-end projection for the federal funds rate fell to 4.38%.

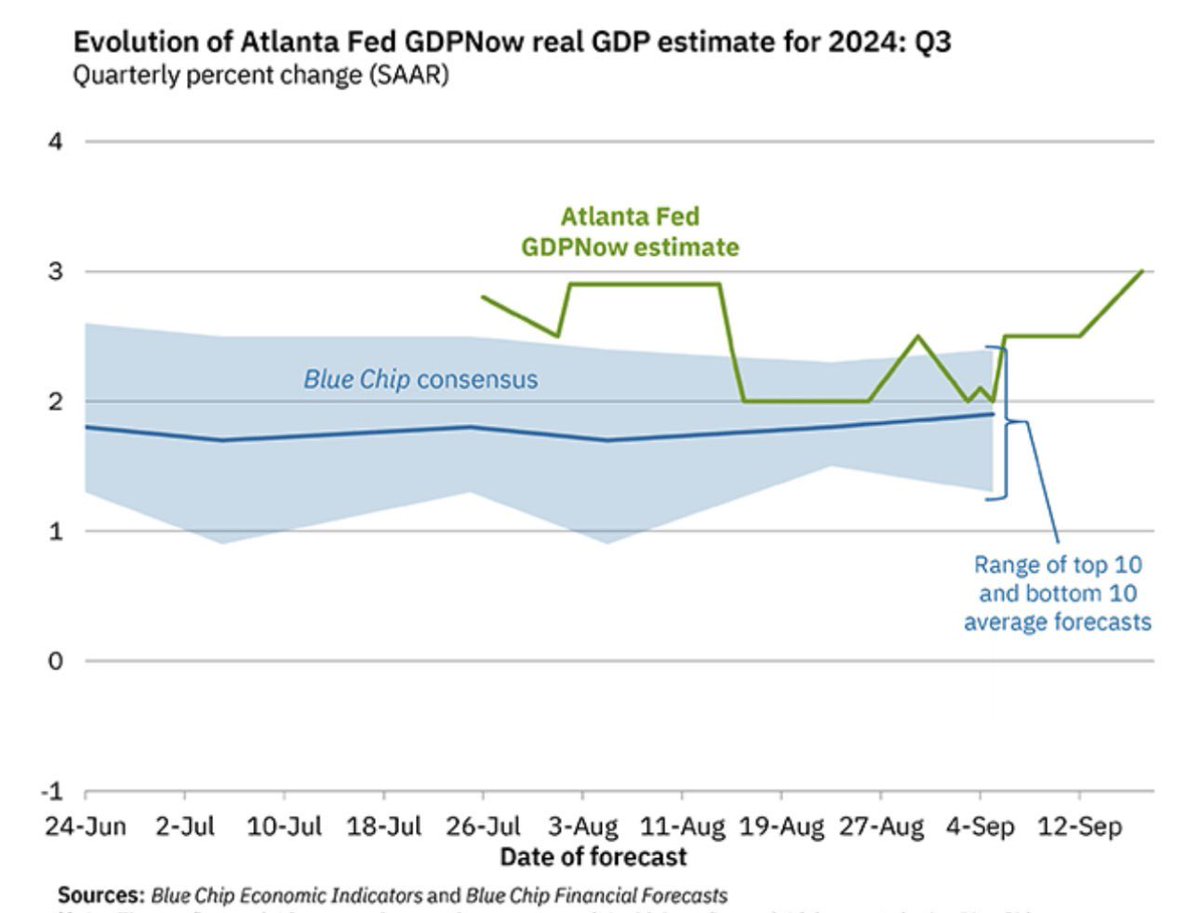

美联储会议从未有如此不确定的记录。无论美联储明天采取什么行动,一半的市场都会感到失望。系好安全带。自7月份以来,金融环境有所放松,使得降息25至50个基点变得无关紧要。第三季度GDP维持在3%左右的水平并不令人意外。未来一年的通货膨胀,有可能令很多人感到惊讶。

There has never been a more uncertain Fed meeting on record. Regardless of what the Fed does tomorrow, half of the market will be disappointed. Buckle up. The recent easing of financial conditions since July has rendered the 25-50 basis points cut inconsequential. It is unsurprising that Q3 GDP is maintaining a level of approximately 3%. There is a possibility of inflation surprising many in the coming year.

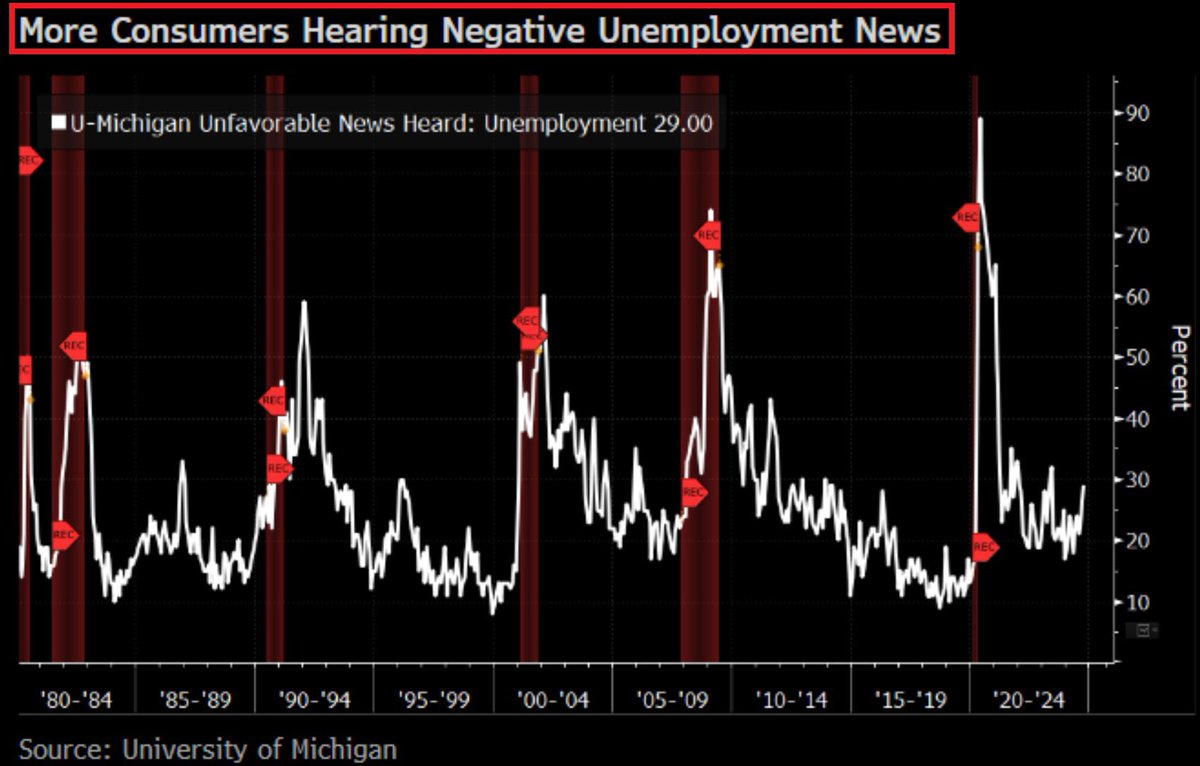

美国经济正在衰退。更多美国消费者,听到负面的失业消息。29%的美国人听到了有关失业的不利消息,这是自2023年5月以来的最高水平。8月份失业率达到4.2%,接近3年来最高水平。此外,去年有100万人失去了全职工作。The US economy is in recession. MORE US CONSUMERS ARE HEARING NEGATIVE UNEMPLOYMENT NEWS. 29% of Americans have heard unfavorable news about unemployment, the highest since May 2023. The unemployment rate hit 4.2% in August, near the highest level in 3 years. Additionally, 1 million people lost full-time jobs in the past year.

超微电脑(SMCI)看起来已经触底?不久前,兴登堡研究公司(Hindenburg)发布了一份针对SMCI的严厉做空报告。激进做空公司兴登堡的创始人Nate Anderson指控,NVDA的主要合作伙伴SMCI,存在财务欺诈、通过空壳公司逃避制裁,以及向秘密的俄罗斯超级计算机供应芯片等罪行。SMCI在过去两个月内下跌了50%。

$SMCI looking like it has bottomed. Hindenburg Research issued a scathing short report on Super Micro Computer(SMCI). Nate Anderson, the founder of the activist short-selling firm Hindenburg Research, alleges that major $NVDA partner $SMCI is guilty of fraudulent financials, evading sanctions via shell companies, and supplying chips to a secret Russian supercomputer. SMCI has declined by 50% in the past two months.