They are losing control of the narrative.

Separate money from the state by backing stablecoins with dollars, becoming the largest buyer of U.S. Treasuries, while simultaneously accumulating #Bitcoin to the point where #USD stablecoins will eventually be backed by #Bitcoin itself.

The following article is a response to a critic of #Bitcoin.

The critic compared Bitcoin to a religion and a cult, stating that Bitcoin will never replace traditional currencies and the state.

ARK TO DONATE A FIXED PERCENTAGE OF REVENUE TO OPEN SOURCE CONTRIBUTORS IN PERPETUITY.

https://cdn.satellite.earth/35a289ecf8a9514cf10cb548246fe6628ca5c9f8b301783ae79344e047c40134.mp4

I don't understand where their revenues are coming from, given their poor performance.

The future will be a dichotomy between those who use AI technologies and those who will be used by them.

I feel the same and have reached the conclusion that this is the price to pay for opening our eyes before others.

It allows us to weather a crisis in a way that positions us in the exclusive club of those who thrive instead of just survive.

"The individual has always had to struggle to keep from being overwhelmed by the tribe. If you try it, you will be lonely often, and sometimes frightened. But no price is too high to pay for the privilege of owning yourself."

F. Nietzsche

Lyn I would like to hear your opinion on Lutnick's speech.

Giancarlo Davasini, referred to as Giancarlo by Lutnick, lives in the same region as me, which is Lugano, where Tether and Bitcoin are heavily promoted.

It is a complex puzzle, from the US Treasuries owned by Tether to the $120 billion declared by Tether as collateral, to the fact that they are the seventh largest Bitcoin holders.

#Rome

"that the workmen of the mint had adulterated the COIN; and that the emperor restored the public credit, by delivering out good money in exchange for the bad, which the people was commanded to bring into the treasury. "

Edward Gibbon

"The people that throughout all history have the means to diminish the amount of metal in our coins, which is inflation,

simply by a different name."

#Bitcoin2024Conference

#Bitcoin https://video.nostr.build/699042895efa9e472b511c148bb1daf0772097b2260c6ddd0b8466e0be928a4f.mp4

Terrible.

I don't like the overly emotional crowd of excited cultists.

However, they are probably necessary at this stage since myths and cults have always coordinated our species.

The best speech so far was by Snowden.

I'm exploring use cases related to Coinjoin and improving privacy.

Western freedom,

being charged with 35 years in prison for downloading academic articles.

The USD is already collateralized by Bitcoin.

Tether is one of the largest holders of US Treasury bonds, currently ranking as the 22nd largest holder, surpassing countries like Australia, Spain, and Mexico.

Tether has also been increasing its Bitcoin holdings as collateral for its stablecoin, USDT, which operates on the Ethereum blockchain as a smart contract.Proof of Work has unique characteristics, and Bitcoin, especially, has the largest network among PoW infrastructures. It is neutral and global, and its scarcity ensures value in transferring data through cyberspace. Despite its opcode limitations preventing Turing complete scripts, Bitcoin is an ideal asset linked to physical energy, serving as a reserve and collateral.

Collateralizing currency with a hard asset is both inevitable and cyclical.

Bitcoin, being a digital native asset, is the best candidate for this role.

The USD is already collateralized by Bitcoin.

I totally agree;

it would be interesting to know what specifically triggered your thought.

The notable thing is that Bitcoin has become a topic worth political discussion.

It is being marketed to the mainstream population thanks to lobbying by a new aristocracy.

This is how the real world works.

"Sometimes one must act foolishly to get ahead, for great deeds are often only understood in retrospect."

F. Nietzsche

Explaining things that are rational but that are outside of the Overton Window, to people who are within the Overton Window (basically the “normies” in modern parlance), is a really important skill for Nostr-adjacent and Bitcoin-adjacent educators, as well as alternate nutrition, health, macro, politics, etc.

It’s kind of an exercise in cultural and language translation, bridging two worlds. Understanding two mindsets and carrying one over to the other.

https://en.wikipedia.org/wiki/Overton_window

For me a decade and a half ago, the fact that some people were writing about alternate nutrition in rational, evidenced ways, receptive to normies, was super helpful in breaking out of the retarded 6-11 servings of grain food pyramid paradigm.

The best way to teach is to show results. When you age healthier and wealthier, people start to take you more seriously.

The theory of a speculative attack on fiat currencies was born around 2014 (Marty Bent had a show on this topic yesterday but I haven’t watched it yet so consider listening to it). Bitcoin at the time had a very small cap and it was unreasonable to expect a corporation or government to buy and hodl as a reserve asset on their balance sheet. Individuals who have realized what bitcoin actually is were also few. Fast forward 10 years and we have initial steps in the realization of this theory. Companies like MicroStrategy, Tether, Block, MetaPlanet use various means such as retained earnings or issuing stock and bonds in order to purchase bitcoin. The government of El Salvador has even launched a website where we can track how many bitcoin they own. All of these to me are the initial steps on the road to hyperbitcoinization. But we could all be wrong...

My bet is certainly far smaller than that of the American entrepreneur and one of the founders of MicroStrategy - a business intelligence company - namely Michael Saylor. This move of his to be able to figure out what bitcoin is and at the same time sell the idea to the other c-suite and shareholders at MSTR could turn out to be one of the most significant actions of this century. That's because at the moment, with the exception of exchange-traded funds buying bitcoin, no other company owns 1% or more of the limited 21 million supply. And it cost them under $10 billion. There are quite a few companies that have larger cash holdings, one of which is Dell Technologies. I mention it for a reason, because its owner Michael Dell made waves on Twitter with 2 bitcoin posts. Their problem is that it takes time to accumulate 210,000 bitcoin, and if the price remains stable around $60,000 it would cost them almost $13 billion. But the price of something with limited supply and relatively stable or even rising demand can almost never be stable.

But let's go back to the other Michael. Because it is a publicly traded company, we have all the data we need for some simple calculations. Their first recorded purchase was in August 2020, when they paid $250 million for 21,454 bitcoin (an average price of almost $12,000). The surveilance sickness and lockdowns in 2020 caused Saylor to think about how to transform what he says a dying company referring to MSTR, and after an extensive search he comes across bitcoin. The source of funds for their initial purchase were retained earnings. So his goal was to transform the US dollar sitting as retained earnings on the company's balance sheet and depreciating slowly as time goes by into bitcoin. Over time, the conviction of everyone involved in this operation became greater and greater, and they decided to use other means - issuing convertible bonds and common stock. MicroStrategy transformed from a business intelligence software company into a bitcoin fund. Investors wanting exposure to bitcoin are happy to finance the company at super low interest rates of under 1%. Let's take a look at was this worth it? The most important thing for a company right after being profitable is to properly allocate capital. In the case of MicroStrategy, their strategy is quite simple – raise funds and purchase bitcoin.

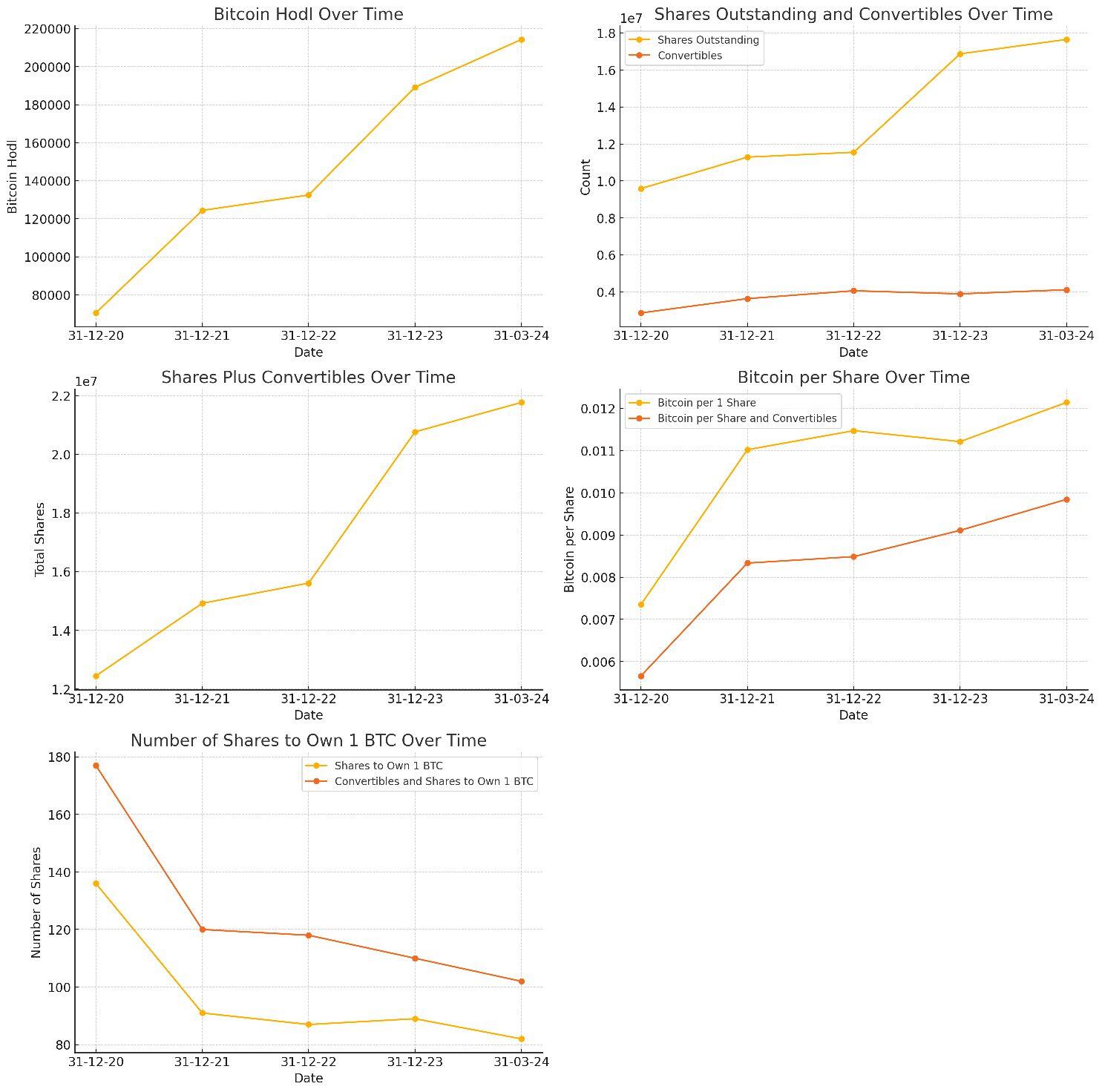

In the following Excel spreadsheet, we can analyze how successful they have been in their strategy to maximize the amount of bitcoin per share. If the bitcoin that 1 share buys steadily decreases, it means diluting the current shareholders, 1 share buys them less and less of the thing they want. This metric is also essential for a company operating in the fiat world where the end goal are things such as buildings, machinery, intellectual capital, cash. Some brief clarification on the columns - date, bitcoin hodl and number of shares need no explanation. Number of convertibles means all options/bonds that can be converted to shares in the future under certain conditions, i.e. they are not shares at the moment, but we have to take them into account in the calcs because they can dilute current shareholders and their shares in the company. That's what the next column is, it just adds up the previous two. The last 4 columns are the result of our analysis, namely how many bitcoin (or in this case satoshis) we own if we have 1 share of the company. The ideal scenario is that the number of sats increases over time. The same applies to the number of sats per convertible plus share. We can see that over a period of nearly 4 years this has been the case - with 1 share at the end of 2020 we could have held 735,058 sats, and by March 2024 this had increased to 1,214,246 (65% growth).

The number of shares or number of convertible instruments + shares to 1 bitcoin is also an interesting metric. As expected it is in a positive trend for the company's shareholders – as at 31 December 2020, 136 shares were needed to own 1 bitcoin, and by March 2024 they had dropped to 82.

The takeaway from this data, at least in my opinion, is that the strategy of using leverage in the form of bonds or shares in order to purchase bitcoin has been quite successful so far for MSTR. In almost 4 years they have managed to reach 1% of the total supply for just a 75% increase in stock and convertibles.

cc

nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy nostr:npub1cj8znuztfqkvq89pl8hceph0svvvqk0qay6nydgk9uyq7fhpfsgsqwrz4u nostr:npub1t8a7uumfmam38kal4xaakzyjccht4y5jxfs4cmlj0p768pxtwu8skh56yu nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m nostr:npub19jfsjxx7gtw2t52qepx93ek57fdstfwszct3qqwzns4zxmvsc5gswf8rx0 nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z nostr:npub14mcddvsjsflnhgw7vxykz0ndfqj0rq04v7cjq5nnc95ftld0pv3shcfrlx nostr:npub1r8l06leee9kjlam0slmky7h8j9zme9ca32erypgqtyu6t2gnhshs3jx5dk nostr:npub15vzuezfxscdamew8rwakl5u5hdxw5mh47huxgq4jf879e6cvugsqjck4um