Lost my btc on my new boat in the ocean…

Will be eaten by whales 🥲

Heard that 😎

Same goes for ending the day

The fourth halving is approaching and I’m buzzing with excitement. I have no idea what comes next, but I have a good feeling.

Jim Cramer is getting bearish on #Bitcoin again, and it seems the herd is following suit. You know what that means!

The ETFs are still gobbling up #BTC. Smart money.

HUGE I TELL YOU HUGE. I got zaps back prepare to be azapped

#Bitcoin #Nostr nostr:note18fn2spsl2uu0e9zdrk00wp5ucjc7q6hec0x9sckw2cnljykaeu7seu7p2n

I like where you’re going with this, makes me wonder if #Bitcoin will have to stop being such a peaceful revolution…

I’d fight for my stack if it was necessary!!!

#Bitcoin

I don’t have a check engine light 😔

But I do have an orange pilled rotor 😀

#Bitcoin

A fat majority of alts will underperform #Bitcoin this cycle.

#BTC outperforming all alts is still on the table imo due to: greater institutional adoption, better regulatory clarity, more people building on top of #Bitcoin, altcoins reaching saturation (there’s 100,000+ alts, but only 1 #BTC.), and market sentiment (#Bitcoin is blue chip, alts are unregistered securities.)

People think “history will repeat itself” these people have the attention span of a gold fish. History to them is the past cycle or two.

Low time preference individuals ought to recognize that historically WINNER-TAKES-ALL. Especially in a free market, specifically in a global competition between currencies. Think US dollar vs. the Turkish Lira or any fiat currency. Sure the Turkish Lira might have made some decent runs against the dollar, but people who cherry picked these runs likely learned a valuable lesson. People who banked on the dollar outperformed all other fiat currencies.

BUT THE DOLLAR WAS ALREADY THE BIGGEST HOW CAN IT CONTINUE OUTPERFORMING.

Well…to put it simply: REAL history > degenerate speculation.

Be careful who you listen to anon!

Fiat and alts will never outperform the dollar because they are trying to play the same game on a smaller scale, less efficiently.

#Bitcoin does have a fighting chance, and in our current circumstances it definitely seems to be winning.

My guess is CBDC’s will be the nail in the dollars coffin. They will be rolled out to gain more control, and they will wind up with less than they started with.

THANKS #BTC!

Warren Buffett has exposure to #Bitcoin and crypto (🤢) through BH’s investment in Nu Holdings.

Their initial investment was $750 million and it’s currently sitting around $1.3 billion.

Hypocrisy and fiat go hand in hand and intellectual skepticism will bite you in the rear.

Describe this as a picture prompt: We live in a clown world where the President can say he’s capping rent increases at 10% and the Fed Chairman can say inflation is “Pretty much in line with expectations” at 2.5%…AT THE SAME TIME.

Having to put a 10% cap on rent tells my the shelter portion of cost of living is >10%, now I’m not sure how they weight their numbers, but imo shelter is an integral part of cost of living.

The average cost to rent a two bedroom apartment is up 13.7% YOY. This isn’t because of greedy landlords like Biden would like you to think. It’s from crack pipe monetary policy.

The price of a ribeye is up 10% YOY. This isn’t because the butchers are trying to bleed you dry, this is what it costs for them to get by. You can put a cap on anything, but it won’t solve the root issues, not until you fix the money, or better put, stop ABUSING the money.

What they have done to my dollar should be described as no less than assault.

Water has increased 11% and energy 5% in the last year.

Gasoline has increased 14% in the past year.

⬆️ THIS IS MY BASKET. It’s an 80iq basket at best, yet still 10 fold better than their BS filled basket!!!

The SMS dollar inflation rate is: 10.75%!!!

You ought to be able to feel it in your bones that my number is closer to the truth, especially if you’ve just been scraping by!

I DONT CARE WHY THEY LIE!!! Our whole system is based on trust. Our trust has been abused. Personally I’ve had enough. I can tell you right now things won’t get better without change.

Things won’t get better if we give them more power to abuse us. They made us cut back on spending, but did they? NO. They are still printing at pandemic rates. And they are using it to dig mass graves. Metaphorically of course. In reality they will assist with whatever they see fit to help you finance your loved one’s funeral, who died fighting a pointless war just to put some measly dollars in the pockets of defense contractors, oil companies, private security firms, financial institutions, and media companies.

This is their system and they’ve got to keep the machine lubed with the blood of oblivious young men. If the wars stop so does their system, we will never know peace with their system.

I opt out. I choose #Bitcoin. Not just because it will have <1% inflation after the halving, but because #Bitcoin will make war UNAFFORDABLE, especially drawn out wars.

Nobody can print #BTC, more importantly no one can print #BTC to fund mass destruction.

Are you not enraged at our current state?

I’m only toxic to the toxic system.

I’m #Bitcoin only because everything else seems too risky and not worth my time, energy, or even money.

I HODL because #BTC showed me that the immaterial things we cherish in life often hold greater value than material possessions. The best things in life aren’t things.

I’m convicted because I believe in giving the power back to the individual. Because I want to see a world where the strength of our connections and knowledge from experiences determines our value, not our proximity to the printer.

I #Bitcoin because I want to build a better future instead of mourning lost relics. #BTC will transform your life and the world around you for the better.

Opt in.

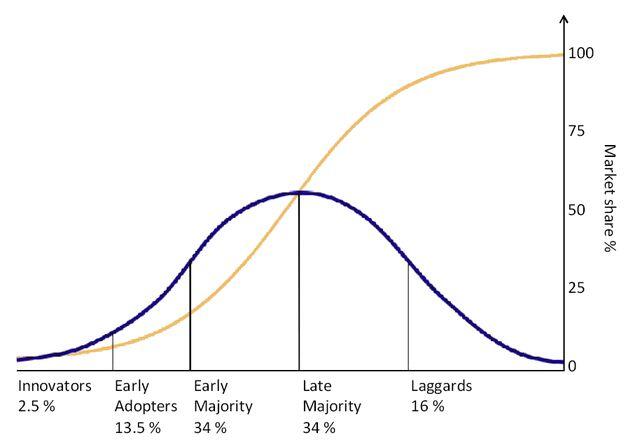

Exactly! Diminishing returns can be expected when we reach critical mass (a majority of the population)

14.1x is 80 iq mafs, but it’s my bare minimum threshold for all models and conceptions surrounding #BTC to be broken.

It was inspired after stacking through the longest bear that no one warned me about ahaha. I realized no one really knows, because there’s not enough data yet, and the data we do have is often cherry picked to fit somebody’s thesis.

I don’t think the halving events will have a diminishing effect. They are even more finite than #Bitcoin, there’s only 33 halvings! *puts tinfoil hat on*

I believe the last one will be the most celebrated as it’ll never be celebrated again.

It’s Satoshi’s digital comet and it won’t be around forever! 🥲

The #Bitcoin halving will not only be a major catalyst on its own; it will exacerbate catalysts that have been contributing to #BTC’s historic rise.

1. The global economic landscape is changing rapidly. The reasons vary: technological innovation, energy and natural resource issues/disputes, even geopolitical instability.

What an unpredictable environment! Becoming even more so as time progresses.

The least predictable thing about #Bitcoin is price. This is why it’s so fun to make predictions: NO ONE REALLY KNOWS. However, its issuance, policy, and decentralized nature are easily predictable.

#BTC’s predictable nature is one of the biggest assets that a fat majority of people are completely missing.

Fiat has unpredictability in all the wrong places while #Bitcoin has it in all the right.

2. $70k is pennies to a lot of companies. #BTC has to become more expensive to be taken seriously.

If you have taken the time to research the progression of events that will ultimately lead to the last halving event, it’s obvious that #Bitcoin already has an infinite stock to flow as stock will never double.

This halving will put #BTC at #1 when it comes to stores of value. Right now, on paper it’s barely behind gold.

Every halving from now on will make #Bitcoin exponentially better, each bringing absolute scarcity closer to fruition.

Predictability gives me certainty in 21,000,000…yet I, nor anyone else for that matter, knows what 21,000,000 really means. It’s the first of its kind!

3. Governmental game theory has yet to take form, it’s there, but it’s got a long way to go before it becomes a major catalyst.

Right now it mostly involves who will treat Bitcoiners the best through regulations. This trend will continue, but I believe the governments are bound to realize instead of just appealing to Bitcoiners they can BECOME Bitcoiners.

Do you realize how many chairs the government could sell to stack #Bitcoin? Not to mention that pretty printer.

4. Bitcoin’s utility as a monetary vehicle will go through a metamorphosis thanks to the ETFs, which will further incentivize mainstream adoption, which will spread awareness about the halving, which will enhance the effects of the halving, which will further exacerbate the catalysts we are already aware of and even create new catalysts to enjoy.

I believe we are reaching the pivotal, suddenly moment when it comes to using #Bitcoin as collateral, this will signify the hybridization of a fiat/bitcoin standard that I will consider a transitional period: think hyperbitcoinization without a fiat collapse.

Maybe #Bitcoin won’t end fiat, but rather keep it honest and in check.

Obviously this isn’t my best case as I’d like to see an end to fiat shenanigans, but I will admit even on a 100% #Bitcoin standard, there’s still going to be clowns desperate to play shenanigans.

This realization begs a question that I will ponder on: could a hybridization of systems be better than having 0 alternatives? Even if it’s a #BTC standard? Does this mean #Bitcoin incentivizes decentralization beyond the confines of its network?

It’s like communism and capitalism, they seem like opposites, yet we’ve never seen them in their true form because a hybridization is so beneficial.

My brain finds these unique symbiotic relationships between systems fascinating.

Mutually beneficial adversaries always makes for a great story. One day I’ll tell it.

I started a prediction 303 days ago that I’m eager to see take shape. I believe diminishing returns will be invalidated this cycle.

I believe that we are too early in #Bitcoin to see it. So early that what has seemed to be diminishing returns will turn out to be the small group of retail who were intelligent enough to stack and hodl without institutional endorsement reaching its saturation point.

I don’t believe these individuals are done stacking, rather they have increased their exposure significantly and need to generate more fiat/value to get more #BTC.

I believe the people who have reached their saturation point when it comes to #Bitcoin is less than a percentage of the global population. Most people who hold #Bitcoin don’t have a majority of their wealth in it and will probably sell before that changes.

However, the tables are turning and it’s becoming more and more socially acceptable to have increasing exposure to #BTC. (Not that it made a difference to us in the first place)

My current prediction that I’m sticking with and am curious to find the real number is a 14.1x from halving to a year after halving.

I’m not predicting the peak just what I expect to see if my thesis is correct. It’s basically my fasten seatbelt sign. It’s my winter ISN’T coming sign.

I think supercyclors were a cycle early, we didn’t have the demand, but now? Oh baby!

Imagine the Gold ETF if supply was truly fixed and predictable… if that lasted a decade, then #Bitcoin’s rise could last well beyond 2140.

With current prices my prediction would be $985k+, but I’m waiting until the exact point of halving to get my real number.

Surprisingly, this isn’t the most bullish prediction, and I wouldn’t be surprised if it’s too bearish. We will hit supply shocks that will boost demand and snowball into something never witnessed before.

Absolute scarcity is still a brand spanking new phenomenon to experience. We know closer to nothing than something about it and this will become blatant as time progresses.

It seems a pattern is developing where #Bitcoin is causing financial/technological innovation globally. Whether this has a direct impact on energy prices is unclear to me, but it is clear that #Bitcoin specifically #BTC miners are incentivized to seek out regions with low electricity costs.

New revenues means a stimulated economy which is followed by an upward spiral of innovation. #Bitcoin is helping places with minimal infrastructure, yet cheap energy, play catch up with the cutting edge of the world. #BTC is closing a global wealth gap on all scales, but only if you let it.

This pattern doesn’t just decentralize mining, it decentralizes global innovation. A beautiful process that will end with the new innovative technological epicenter of the world not being in the world at all but rather the internet making physical location almost irrelevant. This inspires hope for a utopian future through a Decentralized World Order, more so than the one we see today.

I imagine a volunteer based system where you pay taxes towards what you believe deserves your money, you have to pay a flat rate, but you get to choose where it goes. This creates Darwinism in the Decentralized World Order. We act as a creature with many brains, but no head.

WE DON’T NEED ELECTED OFFICIALS. They were needed before we had the technology for everyone to be heard around the globe, but to suggest they are needed afterwards is asinine. They never represented us, they never will represent us as long as they have something to gain from doing the contrary.

Maybe people who aren’t affected by certain issues shouldn’t be able to voice their opinions through votes. Maybe kids should be able to vote and old people shouldn’t, as voting can ONLY affect the future.

This country was founded by people who had a lot more in common with the average bitcoiner than the old as dirt, corrupt politicians we know today. America has gone senile, but if you put your ear to the ground you can hear the stampede of a liberating revival called #Bitcoin fast approaching.

#Bitcoin will make the world New America, or Super Earth for my fellow helldivers 🫡