you win championships with defense

What kind of meat do priests eat on good Friday?

Nun.

🥁

Ha ha

#Quote #bitcoin

“if I give you a billion dollars, I have to lose it, I can’t give everybody a billion dollars, there has to be a conservation of energy here”

- @saylor

New cowboy in town!

🙌🤠

It looks like dad is coming from the basement.

He hacked all day some #nostr or #lightning libs for a few sats.

His main #bitcoin holding shot up another 5% on the day against its country fiat.

He bought a house with 5% cash down 2 years ago, leveraging on fiat debts and now it is worth 25% more.

What if we crash the server 🧐 nostr:note1ufzmzc3ux62yhq2p6vd3xgc5ltk3lrjsqqywgja3qq2dk5dnl08sg59a3r

I suspect these checks are dummys, always.

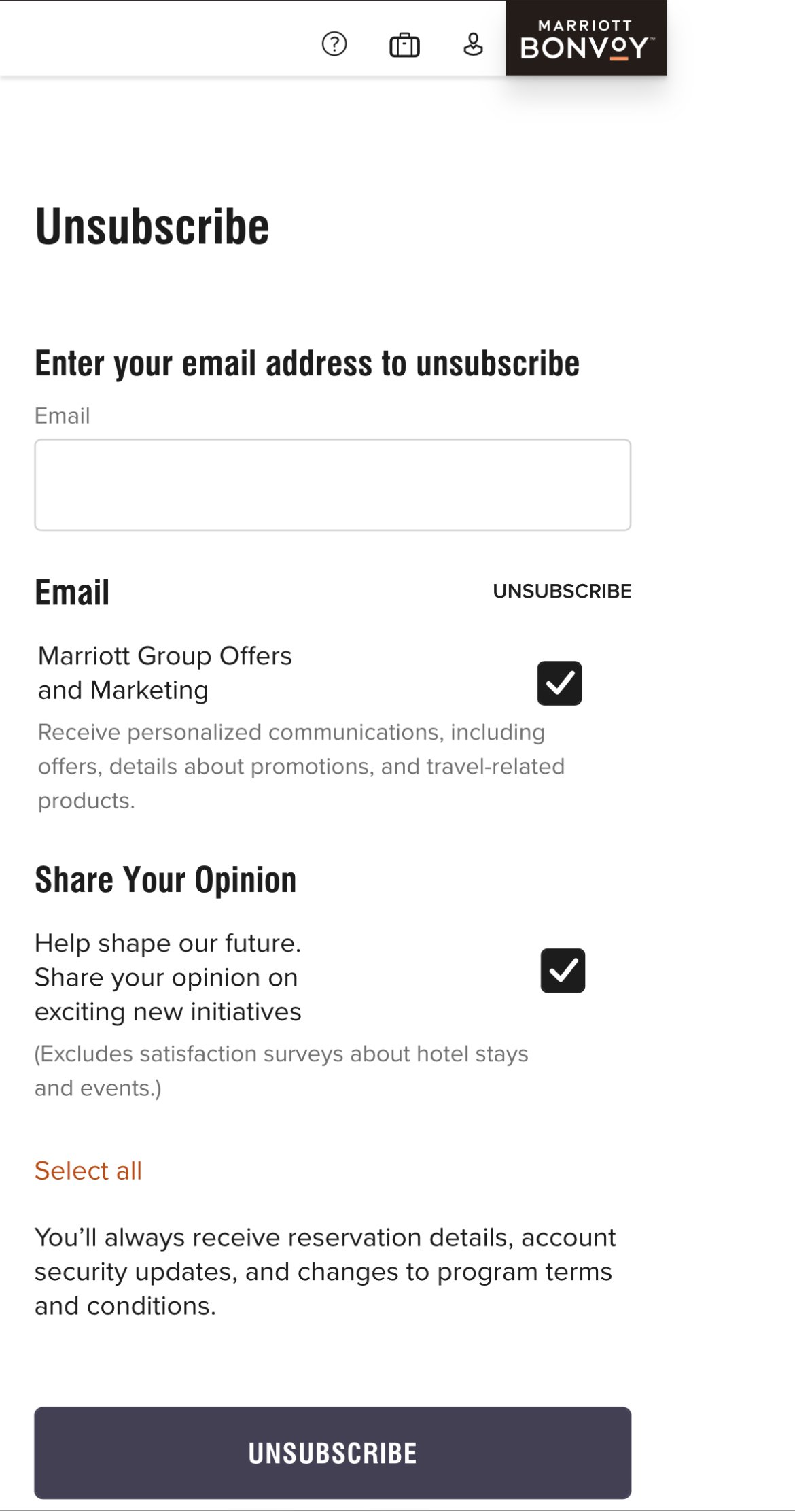

Yet another reason to kill email.

Is OnlyZaps a damus specific feature or other #nostr clients support this?

This is the way

#TeamSoundMoney nostr:note1y7advnnvjtq2qrzhaswyd7rmk88nnnfq90244phkk7ujwzemvf4s39svv2

That’s some serious HODLing…

Once Hamas top 1,2,3,4 are dead, will Hamas top 5 become top 1 and cycle continues?

#gaza #israel #palestine