Thankful for all the work the both of you have done and are doing for Bitcoin.

https://fountain.fm/episode/M6mjLRxABkNmeXKHHdIo

nostr:nevent1qvzqqqpxquqzpcf9q6laz76cq6w6hxapn76yum0myja955w256sc4sy2lc2hfjhdw997rd

Great episode. Great topics. Thank you!

https://fountain.fm/episode/S2PjfYKdF9ixmKDkRFGd

nostr:nevent1qvzqqqpxquqzqxvqum6uu9vvqmet4vrc4sd2rf4xwr4nmx5gynr83u0zwuxcf33menm23h

This podcast was extremely eye opening. To the point of almost unbelievable. Now I need to research how it applies in Canada.

https://fountain.fm/episode/38bUAZr7kUhyT1MqalpD

nostr:nevent1qvzqqqpxquqzqrdcsnjzyhg5a6q6mw26866ufsl49jfk6y0h3xwvkrz7zl9c59s2dpu0ld

Well presented on Why Bitcoin vs Real Estate and also a good overview on Michael Saylor’s Strategy.

Thank you Leon& Scott.

https://fountain.fm/episode/HO2Sgfs8lY1DmWUpJ2oR

nostr:nevent1qvzqqqpxquqzqusyqhvcw7txqsns79s0dsvaz5v3qx908v9p7c5zg6t4pc0fdc0k3tgn65

The Bushido of Bitcoin by Aleksandar Svetski. Not your typical bitcoin book. Here is a summary created by Grok:

"The Bushido of Bitcoin" by Aleksandar Svetski is not a technical guide to Bitcoin or a history of money, but rather a philosophical exploration of what happens when Bitcoin succeeds and its adopters become a new societal elite. Drawing inspiration from the samurai code of Bushido, the book proposes a new moral and virtuous framework for this emerging class. Svetski argues that simply achieving Bitcoin's dominance isn’t enough—those who rise to power must embody virtues like honor, discipline, and excellence to avoid replicating the corruption of past elites. The book outlines ten key virtues, tracing their historical and etymological roots, and connects them to a future shaped by a Bitcoin standard. It blends historical analysis with a vision for a civilization rebuilt on integrity and strength, offering a hopeful, action-oriented guide for individuals and society in a decentralized economic era.

When I quit after smoking for 20+ years I kept and unopened pack of cigarettes in my car’s glove box. There was something about knowing they were accessible that kept me calm enough not to smoke them. I quit a 1 to 2 pack a day habit cold turkey. It was the hardest thing I’ve done. They were in the car for over two years after I quit.

Call your parents. Tell them that you love them. Do it now.

https://dergigi.com/2024/11/15/he-hanged-himself-in-the-morning/

May the peace of God carry your through this valley. ♥️

Using old miner such as an underclocked S9 in place of a cheap electric space heater is ok if you’re just curious about mining. If you’re going to use an electric heater at least you’re earning a minuscule amount of sats when connected to a mining pool or you can take the chance and play the solo mining to find a block by yourself.

Bitcoin Price 1 BTC = 1 BTC

However, Bitcoin Dominance just broke 60% !!!

Why #Bitcoin ?

Take the time to study Bitcoin. May I recommend the book Broken Money by @LynAldenContact.

Yes, there other books on the same topic but Lyn’s book is more in depth and results in a better understanding of money. Only then can you fully appreciate: Why Bitcoin.

When you look at this chart below keep in mind the M2 money supply is a better indicator of real inflation as CPI is manipulated.

Then ask yourself “Will they stop printing Fiat currencies?” The correct answer is “No” and your response should be “Buy #Bitcoin” because it doesn’t have inflation and you can’t print Bitcoin! nostr:note1xq4l7emxetvd6mehqr3x4px4f0y7luszaftn4m03zer82q8c6gds7qelju

Why #Bitcoin?

Bitcoin doesn’t have inflation.

Purchasing power plummets https://www.castanet.net/news/Canada/510713/Purchasing-power-plummets

I just enjoyed an amazing book of prophecy published in 1949. You may have heard of it. It is written by George Orwell. Yep, you guessed it. It was titled 1984. It was written as fiction but many ideas and concepts from the book can be seen in today’s political, social, and corporate frameworks. Bitcoin is the peaceful revolution that has the ability to stop this oppressing future.

Bitcoin is Hope.

Thank God for Bitcoin.

FEMA’s budget is $30 billion.

We sent $175 billion to Ukraine.

nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev nostr:npub10qrssqjsydd38j8mv7h27dq0ynpns3djgu88mhr7cr2qcqrgyezspkxqj8

Fountain: https://fountain.fm/episode/ghR1ZM4Nh4NC25houGdP

YouTube: https://youtu.be/tGoQSt_o2p0

This conversation was great! A lot of nuggets of wisdom throughout the episode that touched on multiple topics. A lot of expletives when identifying mind blowing examples of what is happening all around us right now. Thank you Guy Swan and Walker.

I’m reading this amazing book of prophecy published in 1949. You may have heard about. It is bT George Orwell and the name of the book is 1984. 😉

For a detailed understanding of the answer May I suggest your read Broken Money by Lyn Alden and/or The Creature from Jekyl Island by G. Edward Griffin.

I was looking into this yesterday to share with a fellow pleb. I think it could be a lot sooner due to game theory, network effects and FOMO.

Why Bitcoin ?

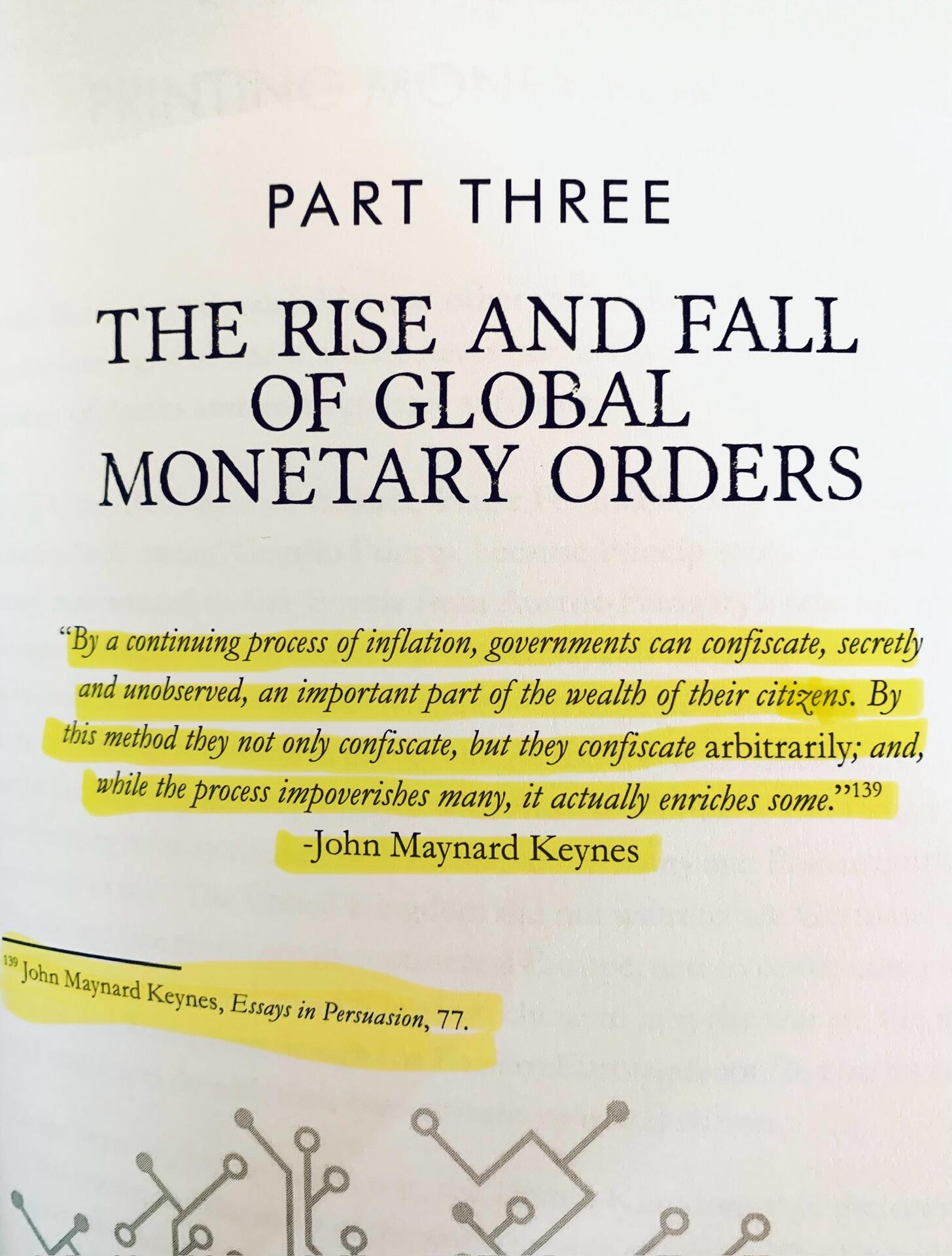

… one of the founders of MMT, also

referred to as Keynesian economics, admits that inflation is theft! Bitcoin doesn’t have inflation. There will only ever be 2.1 quadrillion sats. You know what percentage of the total monetary value you own and it doesn’t change unless you buy more or sell some of your sats.

Thank you Lyn Alden for writing your book “Broken Money.”

Another great episode of Block Rewards with Scott and Aleks Svertski discussing Aleks’ new book. I pre-ordered the book and am looking forward to reading it.

Thanks Scott and Aleks.