Irony.

EM cutting rates in attempts to ameliorate global recession -> UST comparative strength -> DXY strength -> everything priced in dollars more expensive -> EM debts more expensive -> global recession intensifies.

Hopefully the bond crash is just a long-squeeze for all the bond traders expecting Kamala win and reverses soon. Otherwise, Treasury market blowing up.

Also, $DXY 105 is the danger zone - staying here long tends to put a damper on, well, almost everything priced in dollars.

Lots of sell signals going off. Sold half my BTC, took profits on several alts, sold entirely, moved stops up.

$BTC still looks decent if it holds 69.5k. No hold, no bueno. Looking at 66.5k as first stop if no rebound.

Next week might be bumpy.

Looking at next week’s #election, if one side wins and the other concedes, all good, #markets rip to end of year (just different elements leading based on who wins).

If the losing side won’t concede, I’m going to cash.

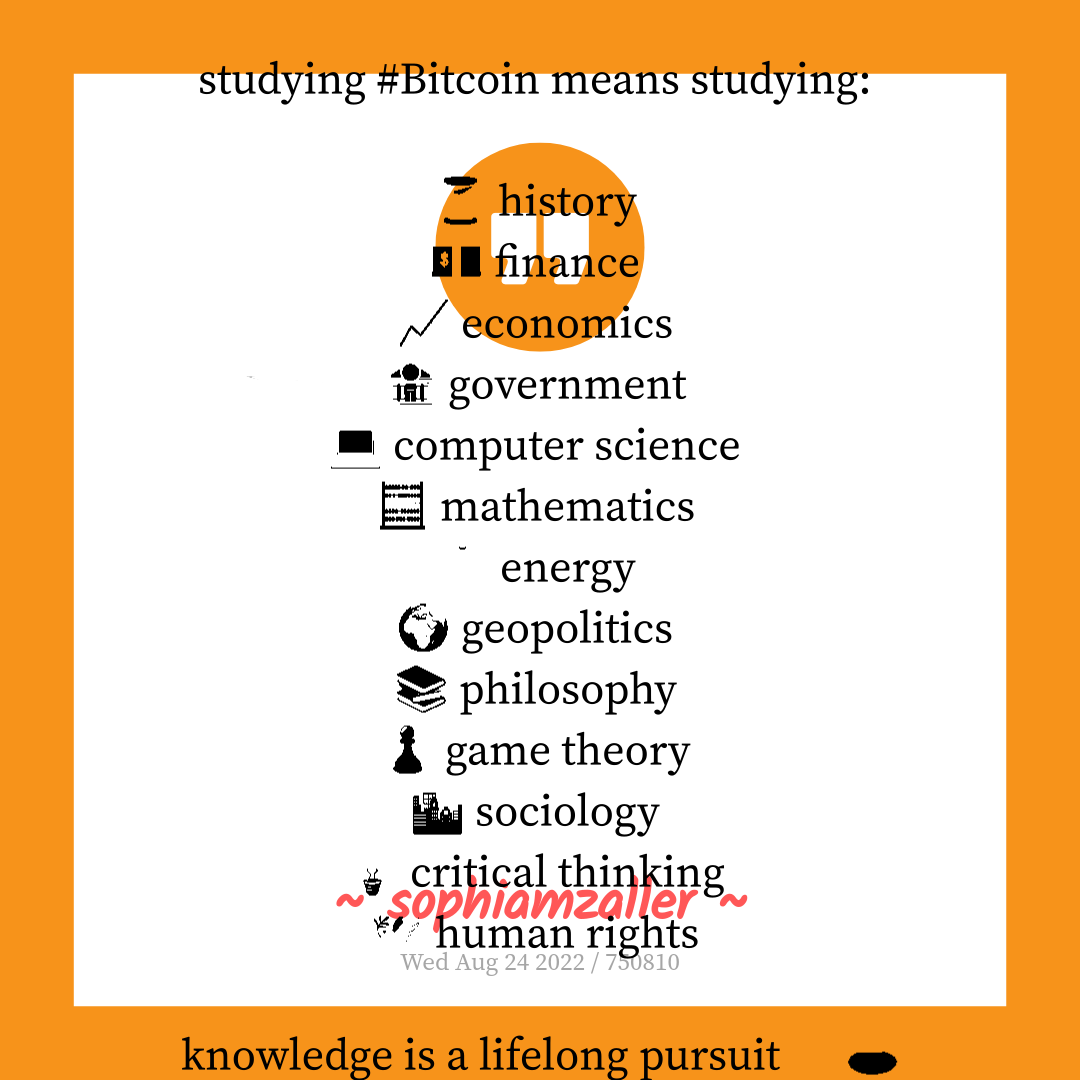

studying #Bitcoin means studying:

⏳ history

💵 finance

📈 economics

🏦 government

💻 computer science

🧮 mathematics

🔋 energy

🌍 geopolitics

📚 philosophy

♟️ game theory

🏙️ sociology

💡 critical thinking

🕊️ human rights

knowledge is a lifelong pursuit ⚡️🕳️

- nostr:npub1kg99upx4nqreveeas49lx7vdms0zn63q7z3hrkgkwu332r6cgahsnqnvj4

#BitcoinTwitter

COVID extremes led me to rabid consumption of all of these things whereas only a couple were even on my radar prior.

Been thinking about all the massive hedging going on in #stocks. If downside #vol erupts, #hedges will minimize it. If upside vol erupts, covering hedges will amplify vol. Actually more “risk” of crash up than down?

So unless something extreme happens (no certification, mass violence and destruction , false flag, 1 month resolving close election, states denying results, #WW3) then downside should be minimal.

Liquidity from US government spending and China #stimulus plus bond revolt worldwide signaling realization of worldwide debt-based currency #devaluation putting large tailwind behind asset prices.

Plus professional investors expecting 2024 recession chasing into year end and massive corporate buybacks - unless downside shock is so large it overrides all that (crisis), upside looks immense goin mg into Q1 2025 at least as Treasury spends down into budget brink.

Also 2022 less was falling stocks = falling tax revenue (majority of taxes are paid by top 10% and most of their income is capital gains) - government knows stocks down = revenue down = even worse deficits…

Rotating profits into FH portfolio at great RR.

Picked up $BTC, $BONK, $TAO, $FET, $INJ, $XMR, $WIF

A bit of $XRP and $AVAX since RR so good even if slow horses.

Took some profits on $BTC and several alts hitting OBs/resistance. Move SL up.

Tradfi and #Bitcoin overbought. Pullbacks likely in near-term, but dip is almost certainly for buying.

#BITCOIN looks like breakout imminent. I’d love for my system to give my entries for the profits I took hitting resistance earlier this week before alts dropped. Trump being priced in as favorable to markets, global liquidity cycle turning up, bullish divergences, RTY strength, seasonally strongest period for markets, buyback windows opening, China stimulus (at least the narrative of it), reports of institutions quietly taking BTC positions at whatever size they can pull off - if BTC is going to ATH this looks like the push to me.

Could bounce back to 64k before final attempt or just grind sideways here edging at the breakout point, but if this isn’t it, then 40ks is probably next stop.

Scouring charts looking for any entries to re-allocate profits currently. This may be the last dip.

Most cryptos tagging key resistances. Took some profits and waiting to see if follow through or need another HL.

Eyes on RTY, if it can break out, $BTC can likely retest ATH as well.

Glad I bought the last dip. Yesterday’s rally triggered many “triple buy” signals on my indicators. This has fired 11 times in #Bitcoin ‘s history. 9/11 led to major rallies in the next few weeks.

Other #Crypto with triple buys firing: $DOGE, $UNI (last week), $LINK and $ARB (if today closes strong), $ETH, $CLOUD, $JLP, $JUP.

I’m back to 95% allocated after adding more BTC, JUP, JLP, DOGE to bags yesterday.

Not a huge fan of how the pump from Thursday’s lows for most of #crypto crashed into Monday’s highs and stalled out. Taking some minor profits and moving stops to break even.

Maybe nothing, maybe everything needs to test #Bitcoin 57.5k make-or-break point.

What does “trading 5% from invalidation mean?”

Take spot trades near OBs, wicks, critical S/R levels where a trade is highly likely to reverse. Set SL 5% past entry.

It’s a self-made option where you’re getting $100 worth of exposure for $5. Loss capped, upside unlimited.

Trading with an options-like mentality without the other complexities of options.

Some stops were hit including #BTC, re-bid many close to new invalidation levels. Many of these are “last stop on the bullish train” levels. It starts going up soon or there’s a lot more down incoming.

Bought back a few bags for near invalidation, including #Bitcoin, $AAVE, $BEAM, $ADA, $LINK, $ARB, $JUP, $BONK.

$VIX and credit spreads still concerning, but buying things that are “cheap” but bullish #crypto unless 57.5k is lost.

Credit spreads expanding by 7% in pre-market. With $VIX > 20, many sell signals; looks like a correction is immanent.

#stocks likely down. #Bitcoin's been highly correlated with market corrections; retest of lows incoming unless VIX and credit spreads reverse.

VIX ominously high considering how close stocks are to ATHs. Bond market front-running Fed cut led to sell the news. CPI/PPI comes in low or stocks likely to take the elevator.

Many alts giving up last week's gains, some clinging to major supports. BTC holds 57.5k or...

Now max long. Invalid if #Bitcoin loses 57.5k. 65k retest next, then 67-68k. Rejection there looks like a 4-handle but get past and it’s time to test ATH.

#Bitcoin low in? Closes below 57.5k say time to go much lower; so long as it holds, seasonality suggests up until end of year.

Bough SOL, JUP, XMR, XRP, DOT, AVAX, POPCAT, TRX as all were within 5% of invalidation (high potential R:R).

Can’t see how there wouldn’t be at least one more pullback before the election: the closest, most contentious election in modern history and #markets are going to YOLO into its teeth?

Anything is possible, but doesn’t seem probable.

#Election looks like a singularity to me - probably (hopefully) goes as normal, non-zero probability it breaks the US.