“And when it comes to Bitcoin, the sooner you react, the better. So whether you're a country or a corporation or an individual person, you get to find out if you're proactive or reactive when it comes to Bitcoin right now.”

From Unblocking Crypto: Episode 148 - Privacy for the win in Tornado Cash trial, Dec 3, 2024

https://podcasts.apple.com/us/podcast/unblocking-crypto/id1616682485?i=1000679102354

This material may be protected by copyright.

I don’t understand why you would be selling Bitcoin right now.

Looks like its still available, maybe just the link changed for some reason:

https://soundcloud.com/junsethsworld/interview-with-a-social-engineering

A tough listen. Kid is ruining people’s lives and doesn’t understand how hard it is for most people to save money. Hopefully he goes to jail soon.

nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy‘s podcast is like medicine if you get a touch of the bear flu. The path to $500k is more clear than the path to <$20k. Next 24 months will be wild. #Bitcoin

https://podcasts.apple.com/us/podcast/tftc-a-bitcoin-podcast/id1292381204?i=1000638310370

The risk of NOT having a position if a sovereign player enters the market...

Tick Tock Next Block #Bitcoin nostr:npub1uyz4w2w4rcphk0q5arzkutrecgscxwzajj4dkvh9mjyqjtxslm6qea8632

Every entity has a successful mentor this bull market. Counties have El Salvador, Corporations have Microstrategy, every person with money knows someone with Bitcoin in profit. Let’s go!

https://podcasts.apple.com/us/podcast/unblocking-crypto/id1616682485?i=1000637680480

Every entity has a mentor going into this bull run. https://podcasts.apple.com/us/podcast/unblocking-crypto/id1616682485?i=1000637680480

Over an hour at the bank and a $40 fee to set up a wire for that won’t go through until tomorrow morning.

#Bitcoin is already better than the legacy system for some transactions. Can’t wait for widespread adoption.

Is there a better way to attack the US than to release a pandemic -> force inflation / debasement -> start some foreign wars -> force inflation / debasement?

A 10% price jump based on a bullish tweet based on a message on a Telegram channel from a deleted user is exactly what the SEC has been saying about manipulation of the underlying asset.

A little taste of what will happen when the ETFs are approved and financial advisors start putting people into Bitcoin. When the largest shareholders of news media outlets want people to buy Bitcoin. Price escalation is going to bring other people on the sidelines in with a Venturi effect.

Then the halving will hit. nostr:note1a5md5ch2d7hvj524djnc48rhjz3fmvw3wxe99pmnm43m05543nysuafl6u

nostr:npub14mcddvsjsflnhgw7vxykz0ndfqj0rq04v7cjq5nnc95ftld0pv3shcfrlx host nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe and George Gammon debate the future on a bitcoin standard. Seemed like Jeff’s Time Machine was able to go a little further into the future compared to George’s.

Changing the money is a changing a linch pin variable, so being predictive is wildly difficult, but plenty to think about here.

They debated, but it’s easy to agree with both of them. I lean more toward George’s side, Jeff’s seems too idealistic and would take longer and thus be less probable. Essentially George has Bitcoin as a store of value and a medium of exchange, though not exclusive. Jeff has all that plus unit of account. It feels like a bitcoin unit of account is very far away, but store of value and medium of exchange are just out of reach today.

I tried watching the Republican debate tonight and turned it off. Unwatchable. These two are way more intelligent and professional than anything on the political debate stage.

Love it when you zoom out.

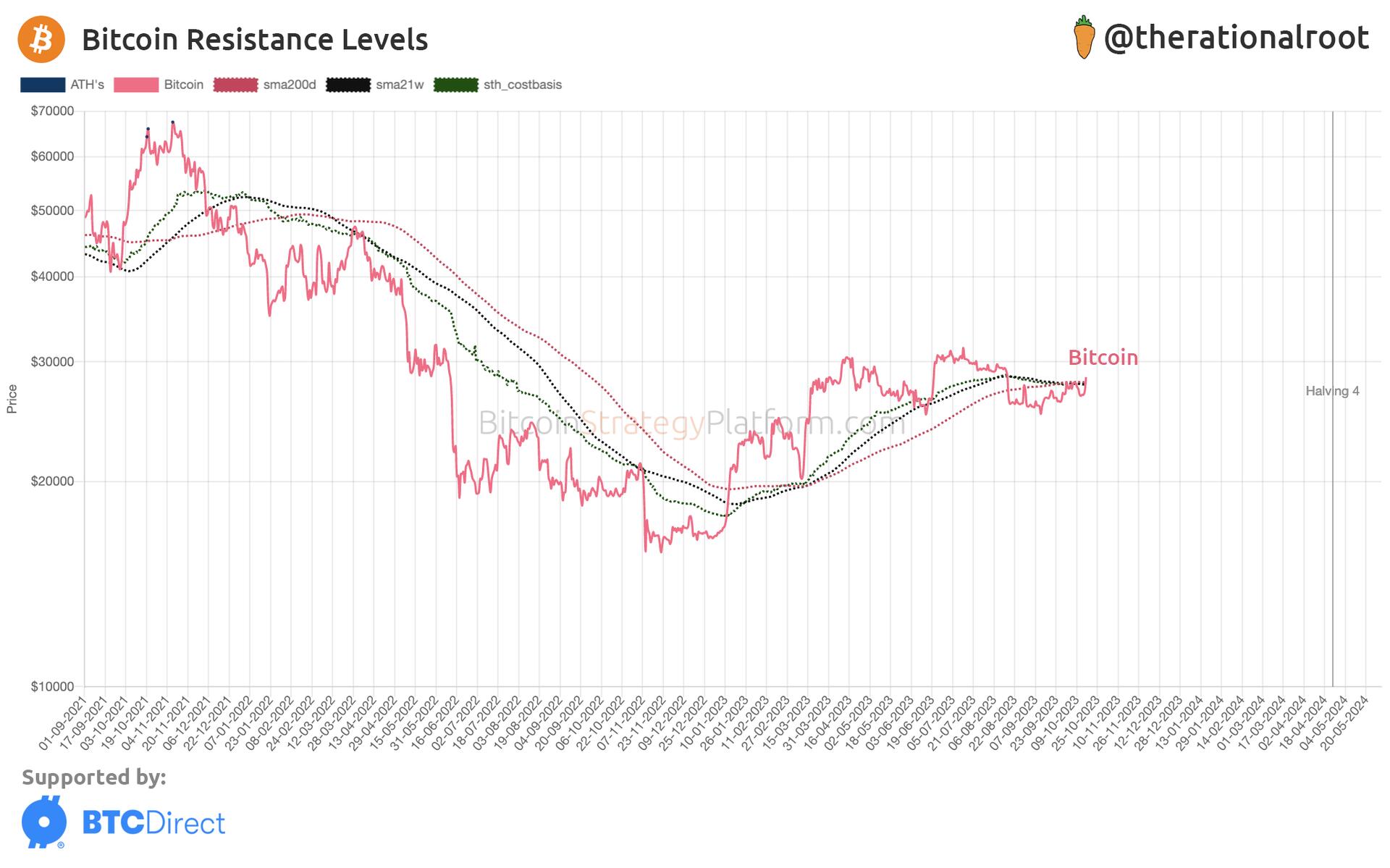

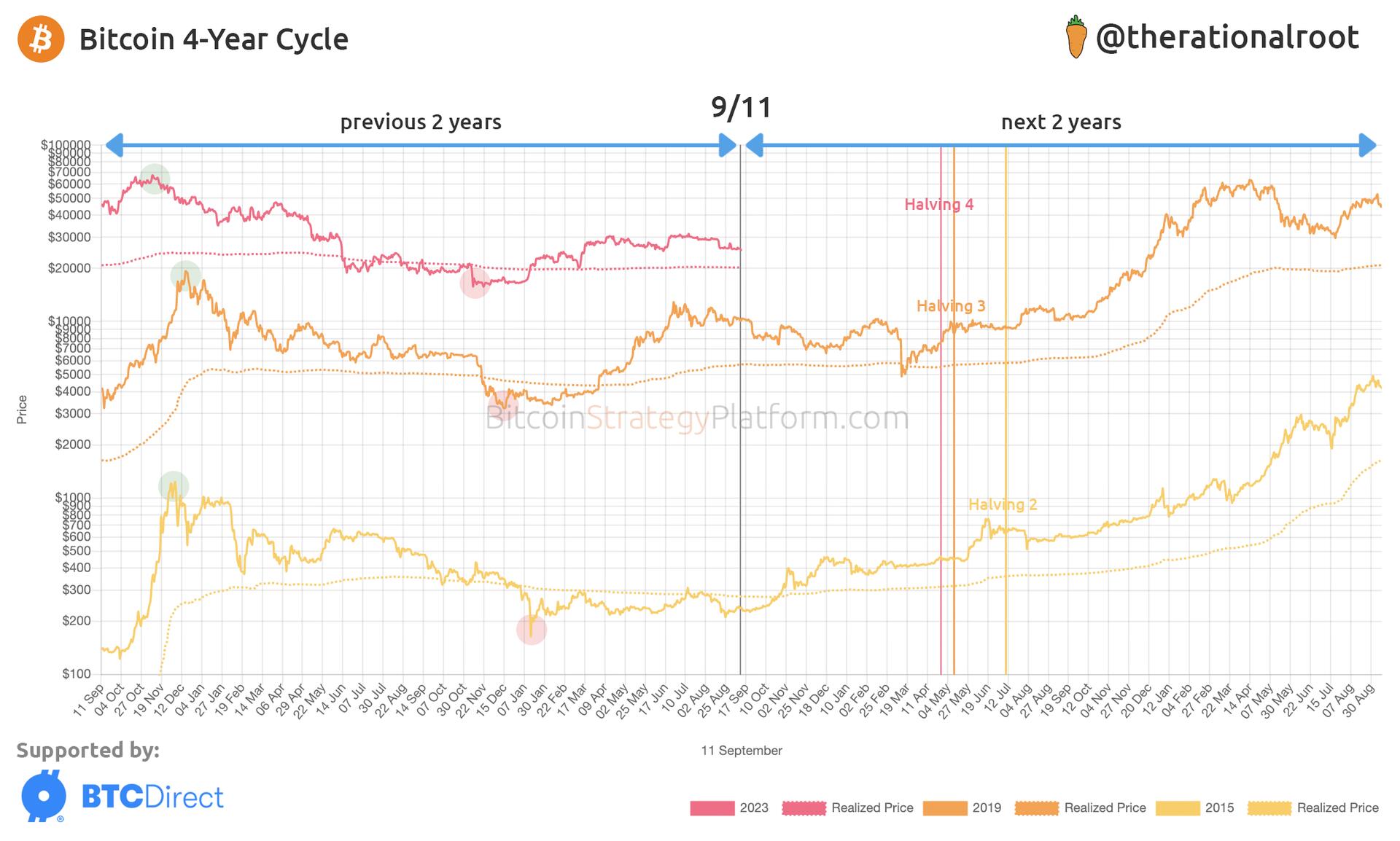

Last cycle had headwinds and essentially went from ~$10k in the last 15% of time before the halving to $60k. ~6x.

If cycles continue and we only get 6x this time around, that’s $150k-$180k per bitcoin.

With some tailwinds like the spot ETF and FASB accounting rules, could be a fun ride. nostr:note18xg4mxexuw499mxhl3c9l5rfhcc2ar9jk4k2sasx2972jysmlkpqv9uaue

Agree with this: the clowns that pull the levers are still pulling the same levers. They aren’t even aware that there’s a smoldering problems.

I do think that it is accelerating, but still a long way to go before we run off the cliff, then we have to actually look down before we fall. nostr:note1hfn9j05y96hfzf3emk7n0k9aelrdyu3hra2fs3r0crqtgzdwdpasndg2gk

Thanks!

First zap received!

If I can figure out how to go on Nostr, connect a wallet, etc, it will quickly be easy enough for 80% of people to do it.

Yes, something like that, and the reason that most people have been able to vastly outspend their means is the ~0% interest world we lived in. Now that it’s more punitive to get a loan, buying behavior has to change or if people aren’t running the numbers, they are going to erode their personal financial positions.

“Gradually, then suddenly” was Hemingway describing bankruptcy. When debt gets harder to refinance, lots of people are going to suddenly realize their position.

https://podcasts.apple.com/us/podcast/bitcoin-audible/id1359544516?i=1000627953798

I agree that while a car is necessary, the number of people that could/would buy $80k cars is WAY less than what we are seeing. They are paying $100k including interest that they would never pay if they couldn’t get 60 or 84 month terms.

So, probably the same amount of steel, fabric, etc in a $40k car and nearly all the utility compared to an $80k car, but the debt based lifestyle makes the decision strange.

Same for $200k humanities degrees, $600k townhouses, etc.

Just listened to Bitcoin Audible #765 with nostr:npub1h8nk2346qezka5cpm8jjh3yl5j88pf4ly2ptu7s6uu55wcfqy0wq36rpev and something finally clicked at the extent of the Ponzi. There is no market for houses or cars without borrowing against your future earnings. The market for $80k cars (if everything is paid in cash) isn’t enough to support production. But, the market for a $1250 per month for 60 months car payment is there.

The entire debt based economy is just pulling forward future demand, so it’s a matter of time before it gets out over its ski’s and falls forward into recession.

People make better decisions in a sound money economy. This helps explain why so many people are making so many bad decisions.

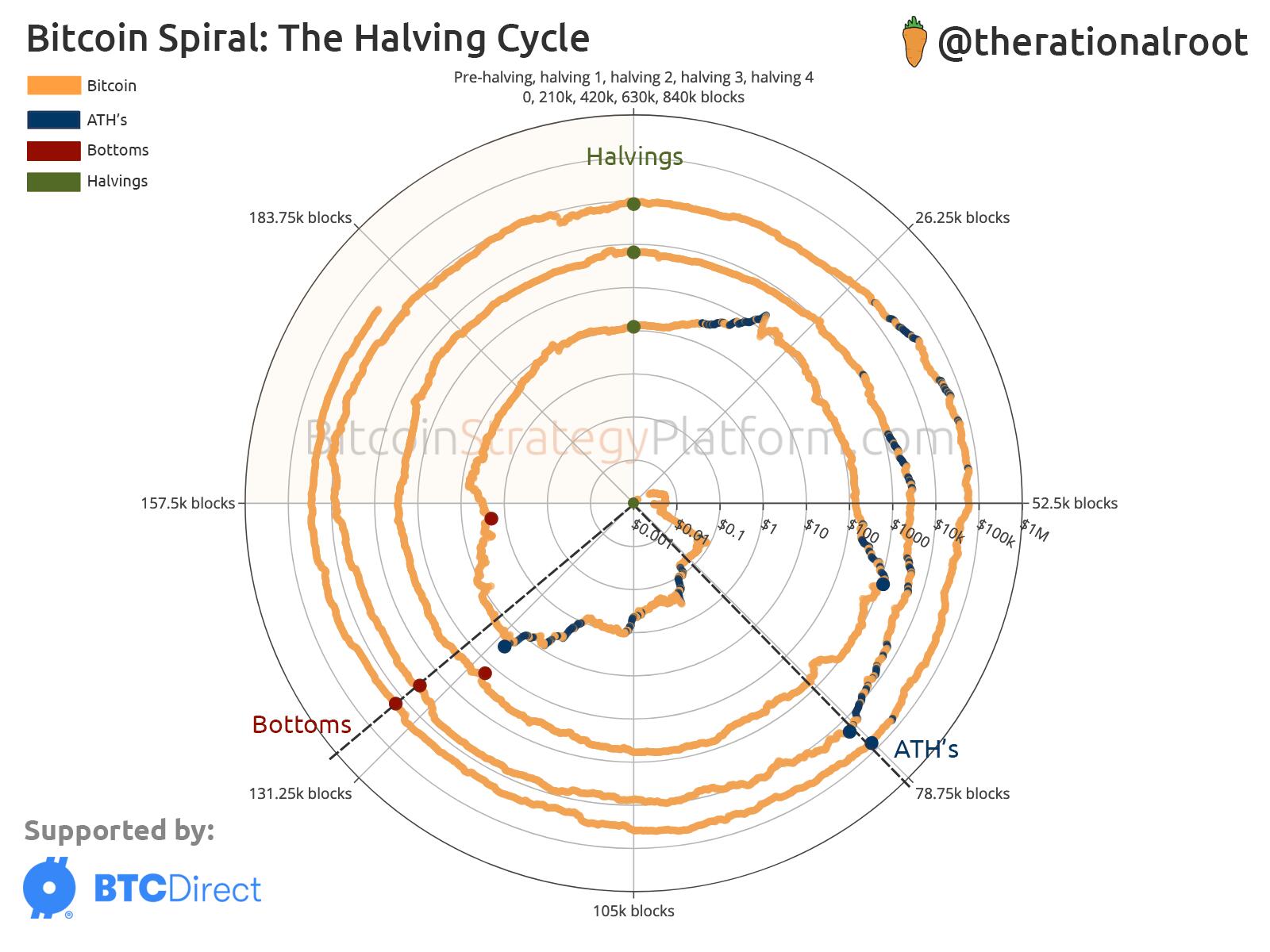

Wild how the cycles work. Looks like 1 more buying opportunity before this thing takes off again.