I wrote this just over a year ago, about a year after I left CIA. This was a very different time for Bitcoin on the policy front, when the policy environment in Washington was hostile and anti-Bitcoin forces across the government were emboldened and making moves. What a difference a year makes.

As we anticipate the arrival of a pro-Bitcoin president, it's also the right time for a whole of government reset on how we think about Bitcoin's future role in the economic and national security future of the US - and maybe the world.

Going to spend some time this weekend thinking about this piece, everything I've seen and learned over the past year, and put pen to paper with updated thoughts. We're on the precipice of a new era for Bitcoin. I want to make sure my former colleagues are able to see it.

nostr:npub1sk7mtp67zy7uex2f3dr5vdjynzpwu9dpc7q4f2c8cpjmguee6eeq56jraw nostr:npub1szn2v4mha08f7lvupml8rg4e4wcqdu5mqlc6nlspjlpj65m2jl3qq69297

naddr1qvzqqqr4gupzpd28npxevk9t2lykgcm43k87dw0t8yeu8e52g7qdwvt97p2r5y8kqy88wumn8ghj7mn0wvhxcmmv9uq3wamnwvaz7tmjv4kxz7fwwpexjmtpdshxuet59uqsuamnwvaz7tmwdaejumr0dshszrnhwden5te0dehhxtnvdakz7qghwaehxw309aex2mrp0yh8qunfd4skctnwv46z7qqkge5kuerfdenj6snfw33k76tw94hnwvrhdd6sc3xv4u

GM!

AM I HEARING FAINT BUT RISING BELLS OF FREEDOM TOLLING AGAIN?

Thank you nostr:npub180cvv07tjdrrgpa0j7j7tmnyl2yr6yr7l8j4s3evf6u64th6gkwsyjh6w6 !

nostr:note10h97u2w657hdmmpklkf79c3l5rnmp6gg4jasphrjdjs3qv7weqkqs98frd

Sorry to hear about your father's struggle. I wish him, you, and your family the very best.

GM💪

NOSTR MUST SUCCEED!

https://news.grabien.com/story/2024-election-free-speech-s-final-stand-supercut

Their arguments almost actually rise to that level of absurdity - I can’t buy it because the sun will likely be extinguished in a billion years, so ultimately Bitcoin is destined to fail.

I hear this from friends - what if the internet goes down? What about quantum computing? All not realizing that if any or all of these things happen, bitcoin can still survive. Their banks…not so much.

This is a test of US, not Israeli resolve. The messaging that the possible attack will not come before the election is clear. Should this attack happen, it will necessarily be escalatory. Iran certainly does not doubt Israeli resolve and understands that Israel’s degradation of their air defense capabilities during late October operations puts sensitive targets at risk. Carrying out operations from a third country - Iraq, Syria, or Lebanon - also risks expanding the scope of the conflict. Iran also understands that a successful severe attack against Israel risks eliciting a direct U.S. response. My initial reaction is that is an effort to encourage US pressure on Israel to wind down operations in Lebanon and Gaza, allowing Iran to back down from these threats having gained concessions.

The risk is, of course, the more chips players throw on the table, the higher the stakes.

Agreed. Just looks like a massive debt swap. They’ve also been dumping big amounts of copper on international markets, definitely not an indicator they are ready to grow again.

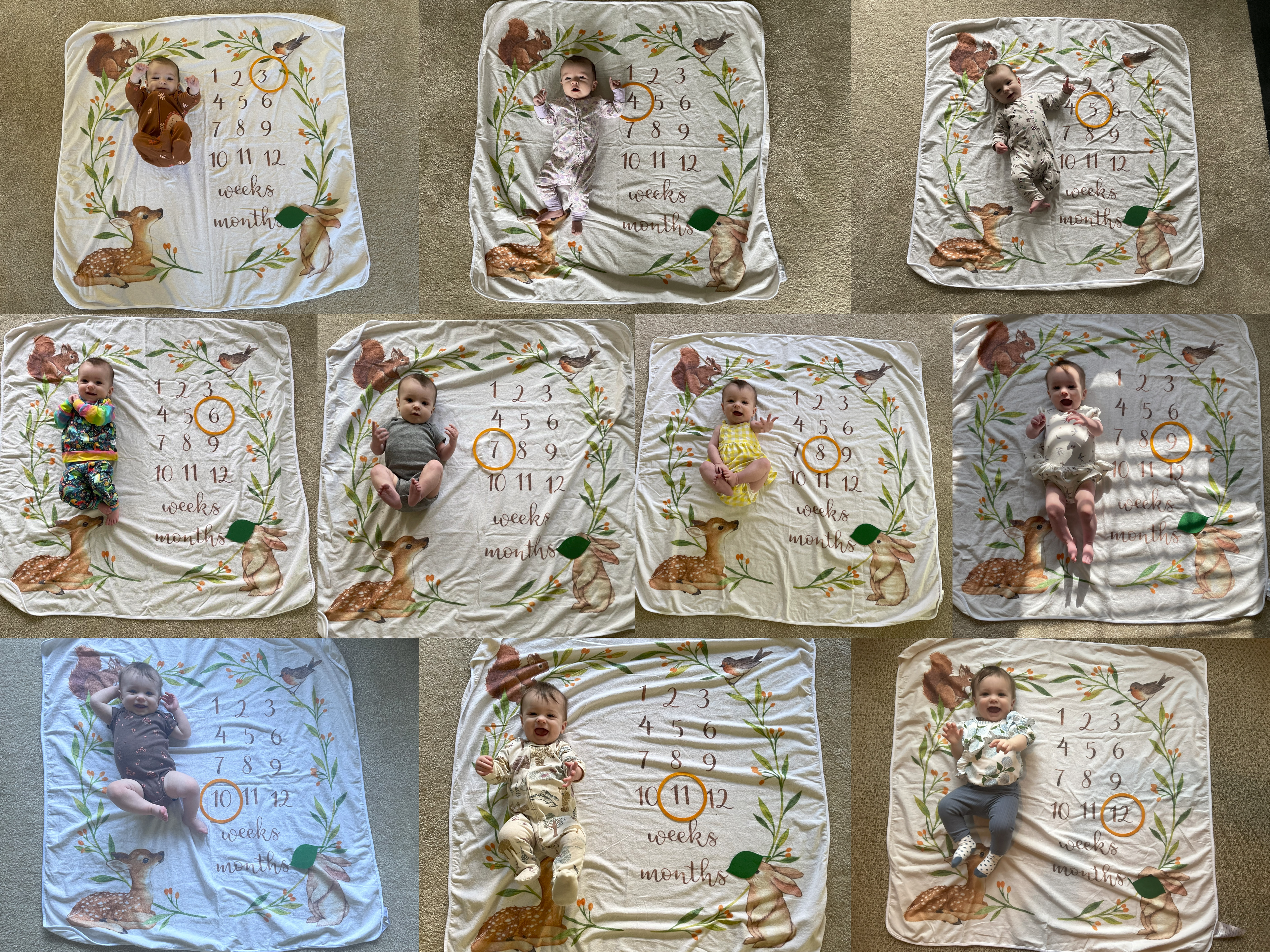

nostr:npub1e2rd2k45ym2jmctnysfadxumrvrr57vqj69ck6trt2y62c40r0kqs9lx8t and my little one is one year old today! I'm so grateful that I have an amazing wife who thought to take pictures all the way through, it's been the best year ever! 🥰

#cute #baby #nostrbaby #family #love

Wonderful!

Bitcoin as a global reserve asset? A brief look….

Is the dollar’s global reserve asset status threatened? Although commonly discussed in bitcoin circles, the topic grabs general attention in and around BRICS summits, the latest having been held in late October in Russia. The BRICS discussion that seems to get the most attention is the possibility of a BRICS currency, overtly intended to lower US dollar dominance – and hence Washington’s ability to weaponize those dollars against member states (I use “dollar” for brevity, which includes Treasuries and other dollar denominated assets). Is a BRICS currency a reasonable possibility, and what would that mean for Bitcoin?

The case for the gradual decline of the use of the dollar as a global reserve asset is strong (note this is not the same as the dollar’s use as a global reserve currency). A brief snapshot of the world during the early acts of the post-war US-led global financial system reveals how US dominance at that time was inevitable. In 1960, US global share of GDP was 40%; today it is 24%. In 1960, the United Nations had 99 members; today that number stands at 193. In 1960, many countries had yet to fully recover from WWII, a war that left US infrastructure essentially undamaged and primed manufacturing. In short, the world has changed…a lot.

In addition, a 1,000% increase in the US’ use of sanctions since 9/11 makes it reasonable to believe countries that see themselves as potential targets would seek to derisk. There is obviously more to it, but it’s easy to see how the US-led order emerged and how those circumstances have changed. So, will there be a BRICS currency as a result? I don’t think so.

If BRICS countries are united in their desire to see an alternative to the US-led system emerge, there are also numerous bilateral challenges among members that leave their willingness to tie their monetary futures together a la the euro in doubt. A brief tour:

China and India

A recent agreement to lower tensions in disputed areas reveals concerns that long-simmering territorial disputes risk escalation. Both countries control territory claimed by the other, and these disputes have been occasionally violent over the past several years. Additionally, a quick look at a map will reveal how China’s construction of ports in Pakistan (India’s historic adversary) and Sri Lanka (India’s perceived sphere of influence) could easily create the feeling of encirclement.

Egypt and Ethiopia

The Nile River is core to Egypt’s cultural and economic identity. While the river is typically associated with Egypt, it roots run deep into central Africa, flowing north from Khartoum where the White Nile and Blue Nile join. Some 350 miles south of Khartoum, Ethiopia constructed the Grand Ethiopia Renaissance Dam, the primary purpose of which was to address Ethiopia’s acute energy shortages. Dependent on the Nile River for survival, Egypt views this dam, with its ability to control the flow of Nile waters north, as an existential risk to its security. Ethiopia views construction of the dam as well within its rights and crucial for its development. In short, a very difficult dispute to solve.

UAE/Egypt and Iran

The tensions between these countries are well known. The most recent manifestation of colliding regional interests is Yemen. The UAE and Saudi Arabia fought a failed multi-year war attempting to prevent a Huthi takeover of Yemen, a group that remains dependent on Iran’s patronage. The war included Huthi drone and missiles strikes in UAE territory. Today, Huthi attacks against international shipping have restricted maritime traffic in the Red Sea and through the Suez Canal, costing already economically strapped Egypt some $6 billion in lost revenue.

China and Russia

It is doubtful that Russia could persist in its invasion of Ukraine were it not for China’s support. One might suggest that Russia’s ability to prosecute this war is nearly dependent on that support. While that dynamic serves Russia’s interests today, a client/patron relationship with China is almost certainly not on Russia’s list of desired outcomes. The two countries share a 2,600-mile border that snakes toward regions both would like to see as part of their sphere of influence. This is also a border that nurtured tensions that provoked China’s desire for rapprochement with the US in the early 1970s. The two currently share interests. Interests evolve.

None of the issues I describe, as well as many others unmentioned, prevent BRICS countries from building trade ties, introducing favorable banking reforms that would simplify transacting in their own national currencies, and even collaborating on political issues of common interest. But on monetary matters, will China or the UAE want to subsidize the purchasing power of poorer members? Will smaller members be comfortable swapping subordination to a dollar system for another system with different dominant players of unknown reliability? There are a lot of unknowns, but I’m confident that the answer to both questions is “no.”

So back to the question, Bitcoin as a global reserve asset? It’s not hard to get to “yes.” I think the dollar system will remain resilient. But for countries (BRICS members or not) looking for a truly neutral asset, one with increasing purchasing power, that they can unilaterally hold and use at their will, Bitcoin’s attractiveness only has room to grow.

#bitcoin #brics #reserveasset nostr:npub1sk7mtp67zy7uex2f3dr5vdjynzpwu9dpc7q4f2c8cpjmguee6eeq56jraw

I’m a former government guy, still live and work in the DC area. Despite those inevitable collisions with the political process that kind of proximity creates, I’ve promised myself not to take it personally. After all I’m a bitcoiner, and as things stand, both available political paths lead toward a similar destination, if only maybe at different speeds.

But that doesn’t stop me from having opinions, usually only shared with close friends to prevent being hit by the train of unhinged delusion people who feel personally invested in the process send your direction if you happen to disagree with them.

I have a long running chat group with college friends, usually reserved for shit-talking, planning annual get togethers, that sort of thing. As of late it has become impossible to comment on anything, frankly to even read. Otherwise balanced, centered, grown-ass men becoming unhinged whenever anything political pops up. The best examples tend to tilt to one side, but my general observation stands.

Not sure why people don’t see what I see. Maybe it’s the fact that I was part of it all for so long that I just intuitively understand the deep moral corruption that the political process entices otherwise balanced, sane people to wade into.

I look forward to being past this election, even knowing the day after will likely look a lot like today. If nothing else, maybe the most unhinged of my friends of will find validation in something they can actually affect or control…and chill out a bit.

My version of Bitcoin 101 that nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle did in Madeira. I present it in 7.5 hrs. GN

https://docs.google.com/presentation/d/1O4SInNm32EpARrjG2pU_dMRuB2fQy5Y9F27_Tqt3gFY/edit?usp=sharing

Looking forward to hearing how they receive the message!

GREAT CHAT WITH nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z ABOUT BITCOIN AND NOSTR.

CATCH THE FULL RIP ON HIS YOUTUBE AND PODCAST FEED.

https://cdn.satellite.earth/e2ae887229fff0722f3f50282b6718f78eba1a8e8867db7a49bdc79548e36e97.mp4

I’ve been listening to you on a variety of platforms for some time now. You’ve always been a leader in this space, but listening to this discussion…you’ve moved to next level eloquence. Your descriptions of Nostr and ecash, your explanation of why opensats matters, even how you handled the nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m discussion…you’ve leveled up. Only way to say it.

Hopefully this comes across as neither obsequious nor paternal. It’s just how I see it.

https://cdn.satellite.earth/9a1b6533ee42e081b4c169464c6efa9b200fe67ca7b9538e9a2c5e8f6bab335b.mp4

nostr:note1a8aaaukf9ul4j590ays7relp4ukgm68csg82wg89hmcmwkafyx6slqxz6p

Made my day!

I'm trying to be that friend to my no-coiner friends!