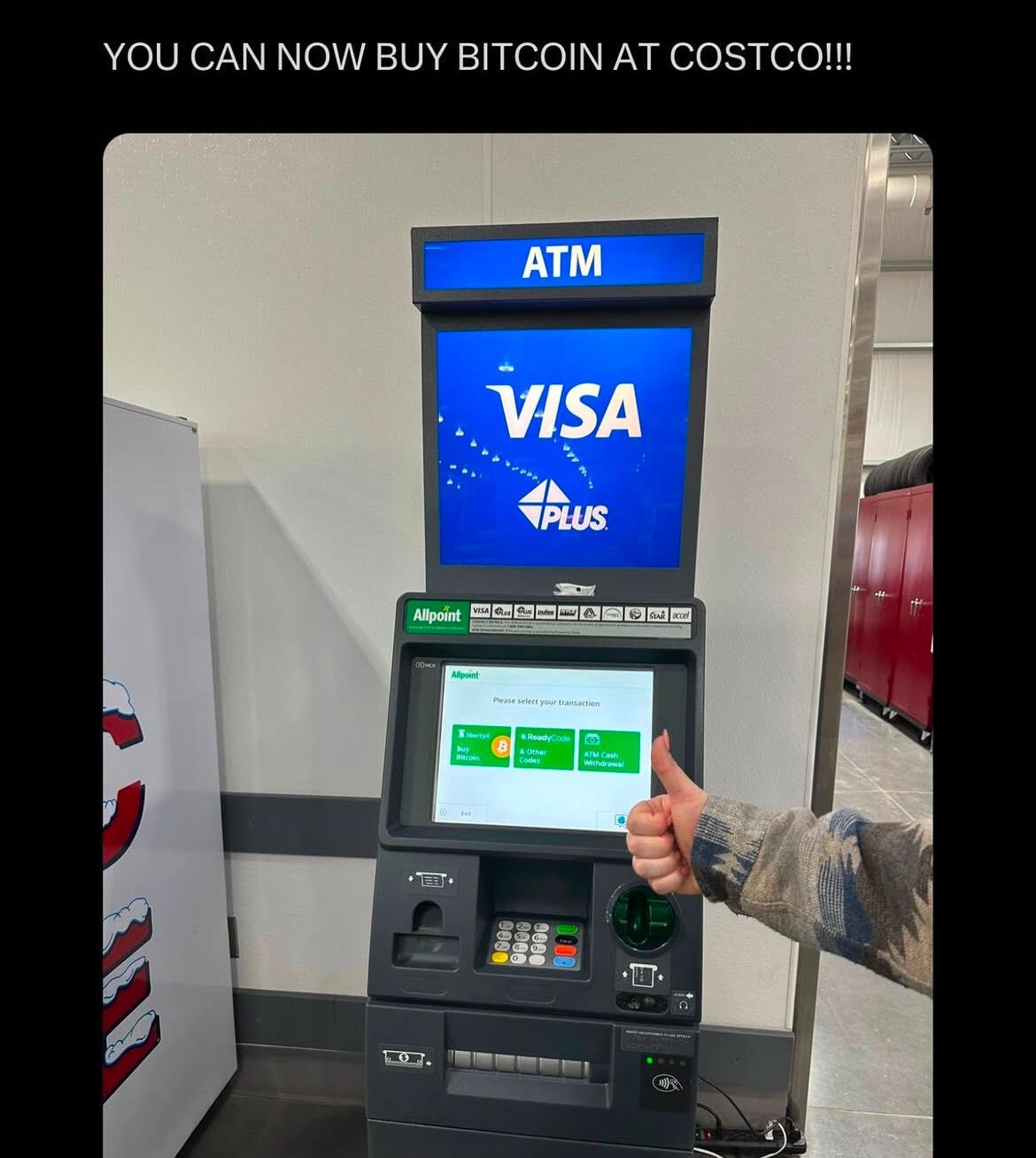

Cool, now accept BTC to pay for the groceries!

#bitcoin

Let's goooooooo!!!!!

It’s done!!!!!

Well, I guess today is officially day one, right? 🤣🤣🤣🤣🤣 Yesterday was the inaugural day?

#freerossdayone #bitcoin

Wtf they are going to do ? 🤣🤣🤣 not sell us the bacon ? 🤣🤣🤣

The future is ₿right ! 🇺🇸

#bitcoin

nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak is completely mistaken about @JMilei

Based on my notes from the masterclasses and books by Professor @juanrallo , I believe that most of the points in this opinion article are highly debatable and not well-founded in the deep and complex reality of Argentina.

1. Claim: “Money supply measures under Milei have grown at astonishing rates (M0: 209%, M1: 133%, M2: 93%, M3: 123%), dwarfing previous administrations.”

This rapid money supply growth indicates Milei’s policies are fueling inflation and economic instability, undermining his free-market promises.

Counterargument: Context Matters in Money Supply Expansion

From an Austrian perspective, money supply expansion cannot be judged in isolation but must be contextualized:

• Productive Growth vs. Monetary Manipulation: Austrian economists emphasize that if money supply increases to match real economic growth (e.g., expanding markets or productive capacity), it does not necessarily lead to inflation. Conversely, if driven by government deficits and central bank printing without real backing in goods and services, inflationary distortions arise.

• Argentina’s Context: Historically, Argentina’s monetary expansions were driven by unproductive government spending and deficits. However, Milei may have strategically expanded the money supply to address pre-existing distortions, such as servicing unsustainable debt or stabilizing the economy during transition periods.

• Short-Term vs. Long-Term: Austrians argue that short-term monetary interventions can be justified during periods of systemic adjustment, provided they aim to enable market-oriented reforms.

The claim overlooks the nuanced reasoning behind money supply growth. The central issue lies not in absolute growth but whether it facilitates productive investment or exacerbates distortions.

2. Claim: “Public debt increased from $370 billion to $442 billion in six months (19.4%), signaling fiscal irresponsibility.” Milei’s borrowing mirrors the populist strategies of his predecessors and mortgages Argentina’s future.

Counterargument: Differentiating Productive and Unproductive Debt

Austrian economics distinguishes between debt types:

• Productive Debt: If debt is used to finance productive investments (e.g., infrastructure, reducing transaction costs, or stabilizing markets), it can lead to economic growth that exceeds the cost of borrowing.

• Unproductive Debt: Borrowing to fund consumption or sustain inefficient government programs creates a burden without future returns.

• Argentina’s Situation: Given Milei’s libertarian platform, it is plausible that this debt is transitional, aimed at restructuring liabilities or stabilizing reserves to facilitate long-term reform. The article fails to provide evidence that the debt was used for unproductive purposes.

Without deeper analysis of the debt’s purpose, the criticism lacks substance. Austrians emphasize how debt is used, not merely its magnitude.

3. Claim: “Milei abandoned his campaign promise to abolish the central bank, revealing his inconsistency and statist tendencies.”Failure to shut down the central bank perpetuates inflation and economic instability, betraying Austrian principles.

Counterargument: Practicality and Transitionary Reform

• Institutional Realities: Austrian economists like Ludwig von Mises and Murray Rothbard acknowledge that dismantling entrenched institutions, such as central banks, requires gradual reform. Immediate abolition could cause severe disruptions, particularly in a fragile economy like Argentina’s.

• Strategic Transition: Milei’s shift likely reflects a pragmatic approach to avoid political backlash or economic collapse while setting the stage for eventual reform. This aligns with Austrian recognition of real-world constraints.

• Intermediate Goals: Stabilizing inflation, reducing deficits, and cleaning up central bank balance sheets could be necessary prerequisites to abolition.

While ideological purity is ideal, Austrian economics recognizes the need for strategic pragmatism. Milei’s decision may reflect a calculated approach rather than a betrayal of principles.

4. Claim: “Milei’s refusal to default on public debt perpetuates generational debt slavery.” A Rothbardian solution would involve defaulting on unsustainable debt, freeing Argentina from creditors.

Counterargument: Default Risks and Strategic Alternatives

•Austrian View on Default: Rothbard supports defaulting on unpayable debt to reset the economy. However, Austrians also acknowledge the severe consequences of default, including loss of creditworthiness, banking crises, and capital flight.

•Strategic Non-Default: Milei may have opted against default to maintain investor confidence, access global markets, and avoid immediate economic collapse. Austrian principles emphasize long-term market trust, which default might undermine.

•Restructuring as an Alternative: Using IMF loans or similar mechanisms to restructure debt, rather than adding to it, aligns with Austrian strategies of restoring solvency.

While default might align with Austrian theory in theory, the pragmatic approach of restructuring debt may better serve Argentina’s long-term stability.

5. Claim: “Raising taxes betrays Austrian principles and fuels government intervention.” Tax increases contradict Milei’s libertarian stance and illustrate his drift toward Keynesian policies.

Counterargument: Temporary Taxation for Transition

• Austrian Tax Critique: Austrians oppose taxes as they distort market signals and reduce individual freedoms. However, transitional taxation could be justified to stabilize fiscal deficits while implementing long-term reforms.

• Key Question: Are these taxes financing productive restructuring or perpetuating government inefficiency? If they aim to bridge short-term fiscal gaps while reducing long-term dependence, they align with Austrian pragmatism.

Conclusion: While inherently negative, taxation can serve as a transitional tool if it ultimately reduces government intervention.

6. Claim: “Shipping gold reserves to London for yield continues Argentina’s inflationary legacy.” Selling gold undermines Argentina’s monetary independence and security.

Counterargument: Strategic Asset Management

• Gold as Reserve Asset: Austrians value gold for its role as sound money and hedge against inflation. However, utilizing gold to improve liquidity or stabilize debt can be a strategic move if it reduces inflationary pressures or strengthens reserves.

• Argentina’s Unique Position: Given Argentina’s history of inflation and fiscal mismanagement, using gold to secure immediate stability could outweigh long-term theoretical losses.

While counterintuitive, gold sales could reflect a strategic move to restore fiscal stability in the short term, aligning with Austrian emphasis on sound monetary policy.

Milei’s Critique of Hoppe:

1. Personal Insults and Professional Criticism:

* Milei refers to Hoppe as an “imbecile,” arguing that although Hoppe may be knowledgeable in political philosophy and libertarian theory, his understanding of economic theory, particularly monetary policy, is flawed. Milei’s criticism extends to Hoppe’s proposition of shutting down Argentina's Central Bank without addressing the consequences of such a move.

1. Monetary Theory and Inflation:

* A central point in the debate is the treatment of the Argentine peso, which Milei emphasizes is a liability or "passive" of the Central Bank. This is a critical insight because many within the Austrian school of economics, including Hoppe, have failed to recognize that the money issued by central banks is, in fact, a debt obligation.

* Milei criticizes Hoppe for not understanding basic monetary principles, particularly the distinction between stocks and flows. In essence, if you shut down the Central Bank without addressing its liabilities (the pesos in circulation), the money would lose all value, resulting in hyperinflation.

1. The Condition of Transversality and Hyperinflation:

* Milei expands on a concept called the "condition of transversality" which, in simple terms, means that people demand money for its purchasing power, or "real balances." Over time, however, if people believe the money will lose its value, they will seek to spend it immediately rather than hoard it. This leads to inflationary pressures.

* Milei implies that Hoppe’s suggestion of closing the Central Bank without addressing the debt (the pesos) would lead directly to a collapse in the value of money, precipitating hyperinflation, where prices rise uncontrollably.

1. Strategic Political Considerations:

* Milei also critiques Hoppe’s approach from a strategic political perspective. He argues that Hoppe's proposal to create hyperinflation would have led to a massive social upheaval, similar to the crisis that led to the 2001 economic collapse in Argentina. According to Milei, such a scenario would have set the stage for a return of Peronism, with a shift toward left-wing policies and more state intervention, destabilizing the country for decades.

* Milei emphasizes that hyperinflation as a solution would have been politically suicidal, leading to the discrediting of libertarian ideas and the return of Peronist leadership, similar to how Néstor Kirchner's administration followed the 2001 crisis.

Key Points of Milei’s Defense:

1. Monetary Policy Understanding:

* Milei demonstrates a deeper understanding of monetary policy than Hoppe by acknowledging the role of the Central Bank as a crucial institution for managing a country’s money supply and the implications of shutting it down without resolving its liabilities.

1. Political Strategy:

* Milei shows shrewd political awareness, arguing that pursuing an inflationary policy as Hoppe suggests would have resulted in widespread social unrest and allowed Peronism to regain power, which would have been disastrous for the long-term future of Argentina.

1. Practical Considerations:

* Milei’s approach involves carefully managing the money supply and focusing on monetary reform in a way that avoids the kind of catastrophic outcomes Hoppe suggests. For example, Milei works to “clean up” the Central Bank’s balance sheet to manage the currency issue without triggering hyperinflation.

The debate between Milei and Hoppe underscores the tension between theoretical purity and practical application in economics and politics. Milei argues that while Hoppe's libertarian ideals may be valuable in certain contexts, his economic proposals are misguided and could have catastrophic consequences for Argentina. Milei not only defends his position with sound economic reasoning but also demonstrates political acumen in his strategy to avoid the mistakes that could have led to further instability in Argentina’s already fragile economy.

Milei’s response highlights the importance of understanding both economic theory and political strategy to navigate the complexities of governance. While Hoppe may offer theoretical insights on libertarian philosophy, Milei presents a more nuanced and pragmatic approach to managing Argentina’s economic crisis.

Strengths of Saifedean Ammous ’s opinion:

•It identifies key economic indicators (money supply, debt, and inflation) and critiques inconsistencies in Milei’s policies.

•The critique aligns with Rothbardian ideals of minimal government and sound money.

Weaknesses of tSaifedean Ammous ’s opinion:

•Lack of Context: The article fails to account for transitional measures necessary in a politically and economically unstable environment.

•Overemphasis on Ideological Purity: Austrian economics allows for pragmatism in achieving long-term goals, which the article overlooks.

•Insufficient Evidence: The critique assumes bad faith in Milei’s decisions without analyzing their underlying rationale.

While Saifedean Ammous ’s opinion raises valid concerns, it oversimplifies complex economic realities. From an Austrian perspective, Milei’s policies can be seen as transitional measures designed to stabilize Argentina’s fragile economy while laying the groundwork for market-oriented reforms. Dismissing these efforts as failures without understanding their context undermines the nuance of Austrian economics.

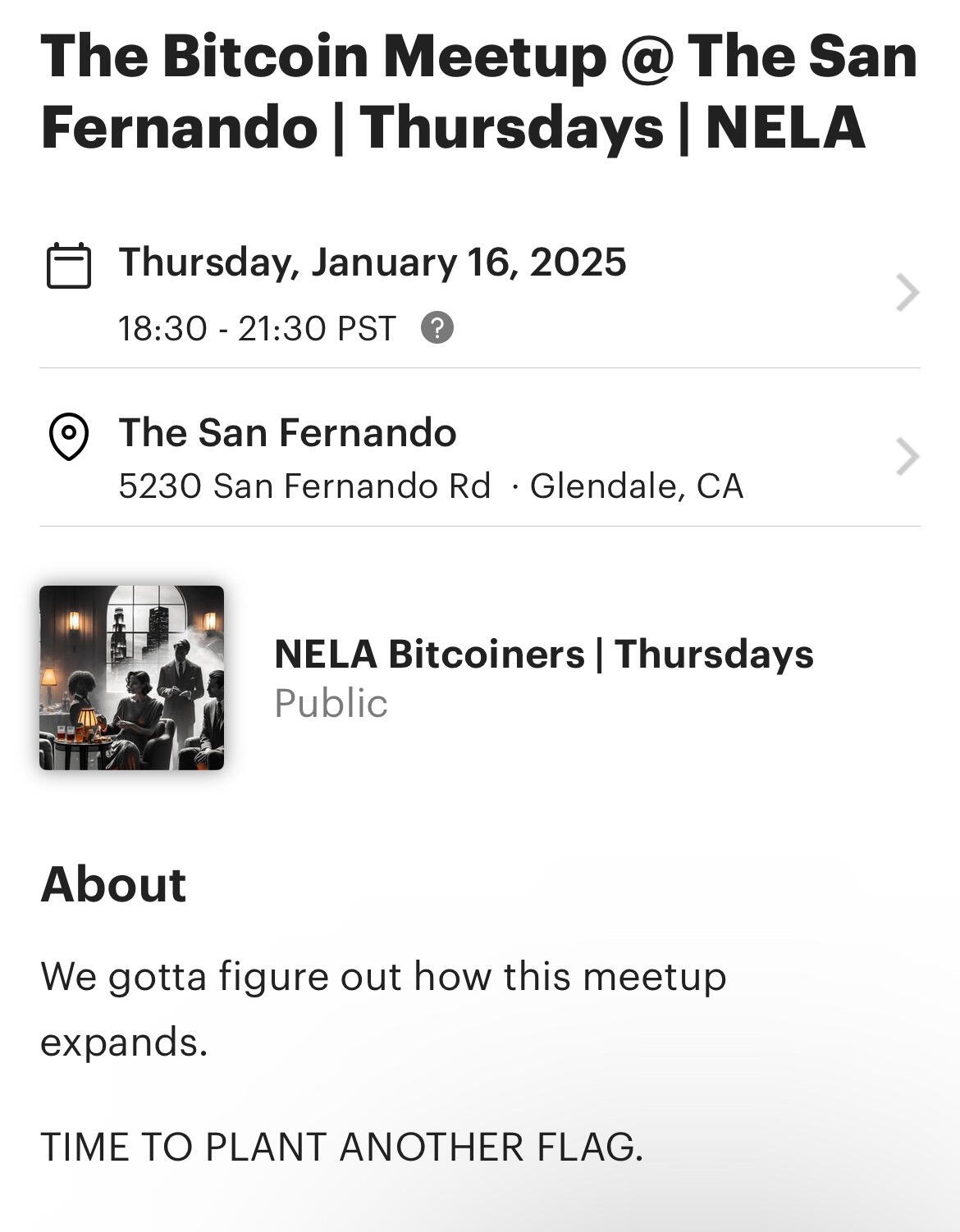

🚨TODAY !! #bitcoin #nostr

Meetup: Join me at The Bitcoin Meetup @ The San Fernando | Thursdays | NELA https://meetu.ps/e/NMyDH/Xnrp6/i

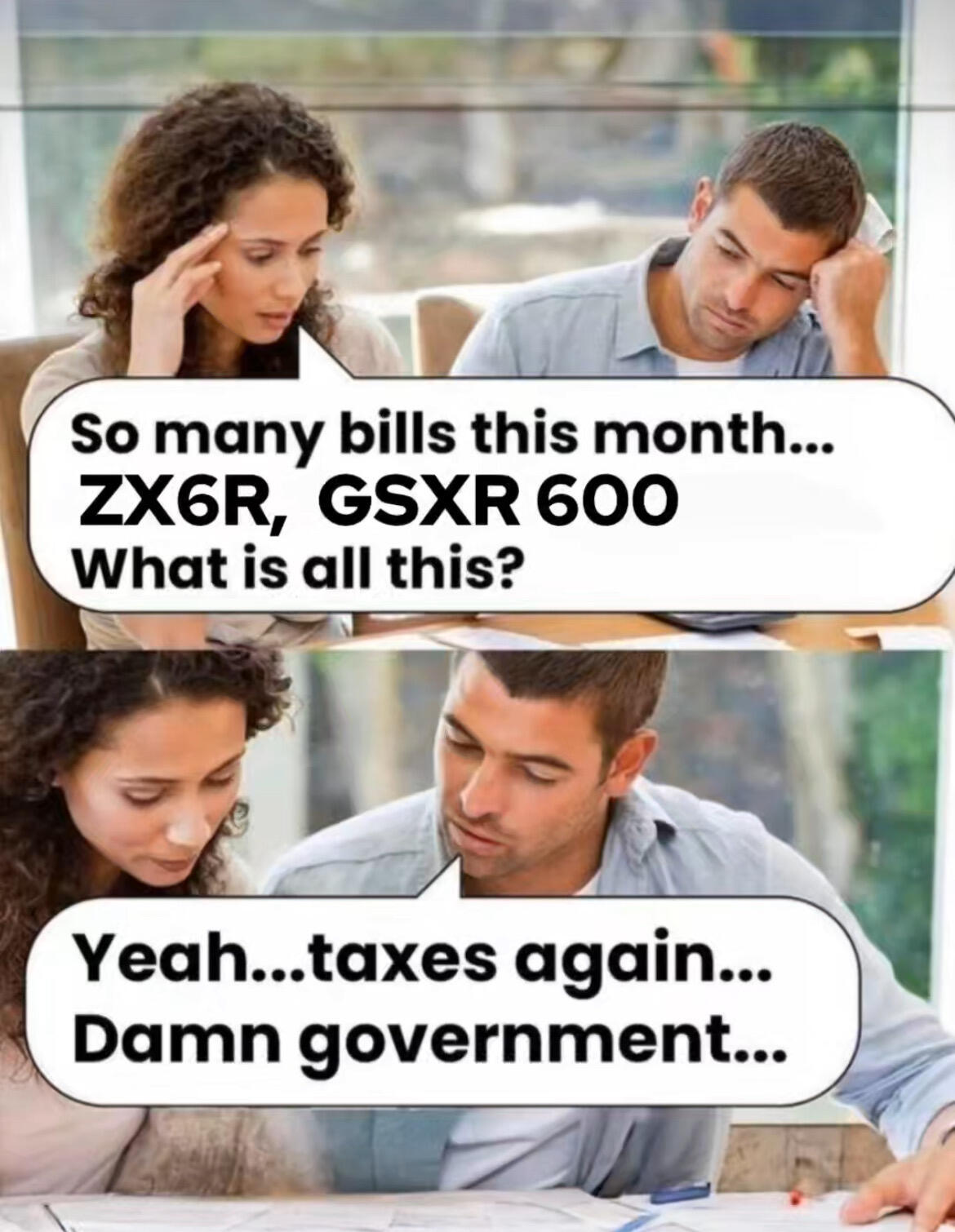

Damn Government !!!

#bitcoin #nostr #motorcycles

Giga-Chad Milei 🇦🇷

#bitcoin #nostr #hola

Who is John Galt?

#bitcoin #nostr

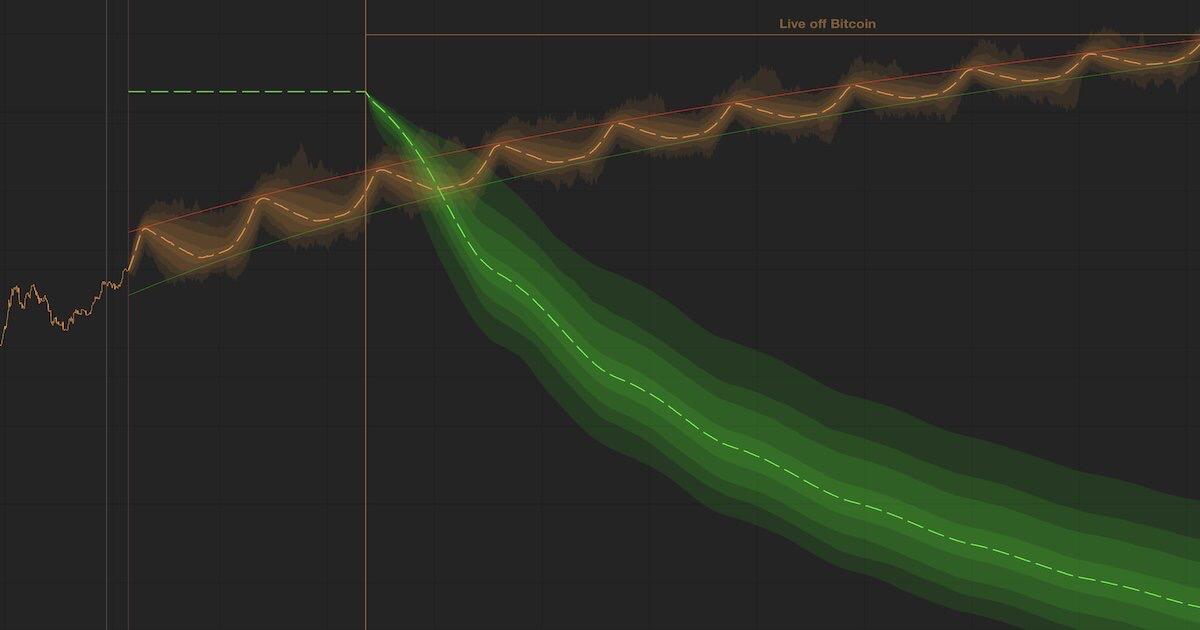

Excited to share Stack Math, an open-source Bitcoin modeling tool developed by a brilliant member of the NELA Bitcoin group nostr:npub1z39nfdx8g07n23un3j282jst0yhheavy3gpegc9wsljx65wgr3pqul7kv7.

Combining ergodic theory & Monte Carlo simulations, it bridges the gap between theoretical models & real-world financial planning.

This is f*** cooollll!!!!!!

🔗 Try it out: https://stackmath.xyz

#bitcoin #nostr #economy

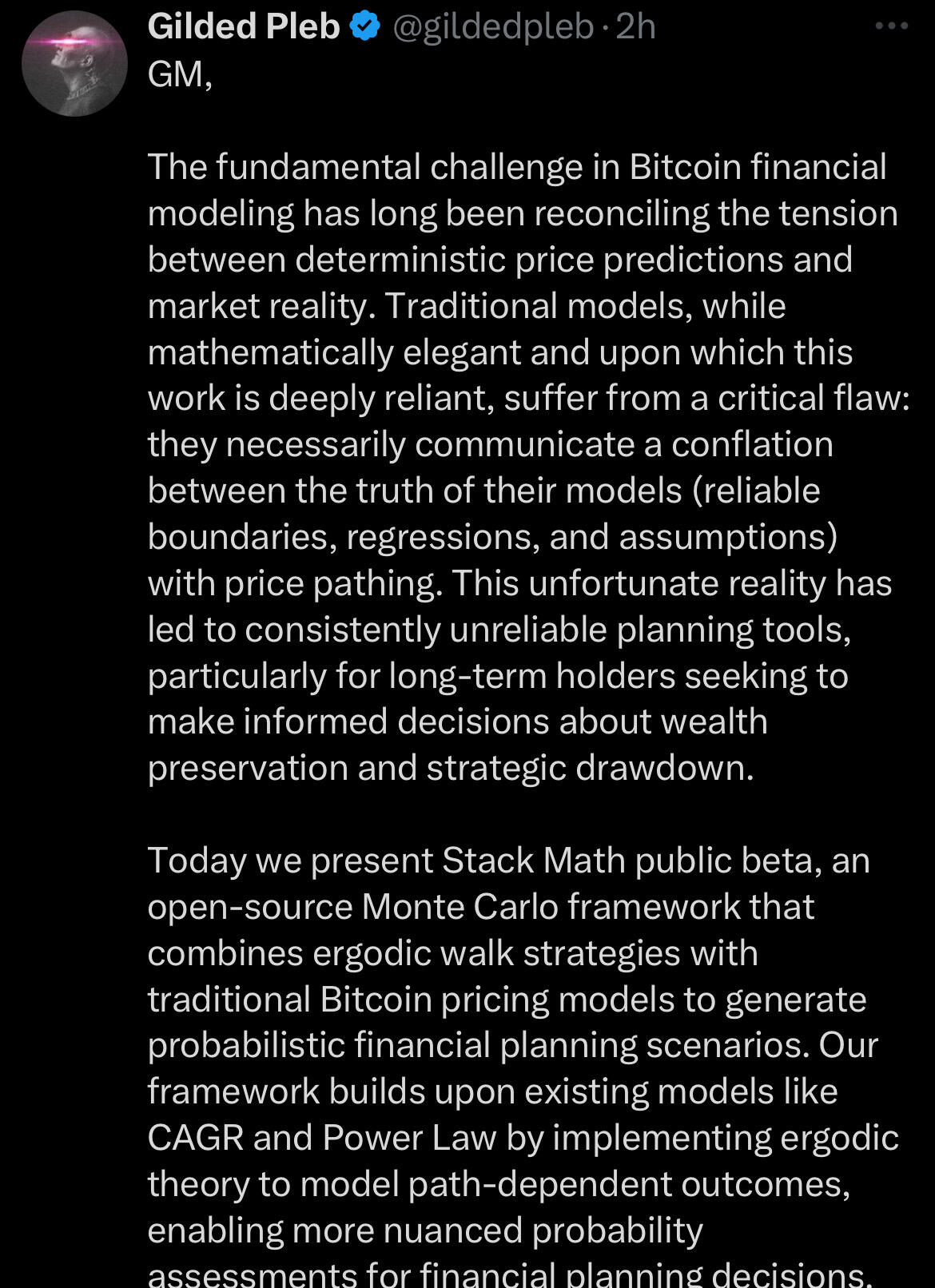

I came across an old gem from 1995 that I think you’ll appreciate, it’s a magazine called Extropy, this is the issue 15 and I found interesting the article about “Introduction to Digital Cash”

#bitcoin #nostr

🥷Chill ride in the canyons ! #motorcycle #nostr #kawasaki #ninja #speed #ZX10R #motorsports nostr:note16u9raypmau6trt4z5yxv8cl7zzn7usl5jfna2jxghhsjht5pylfqpdqlgz

❇️🥷 Kawasaki Ninja ZX10R

#kawasaki #ninja #ZX10R #ZX10RR #motorcycle #nostr https://video.nostr.build/6d8bb2643806ed33b6c4ace44b9a50fc7f75215f76cdc829e23f7193a29ecef2.mp4

Have you ever asked what is the root of money?

Money is a tool of exchange, which can’t exist unless there are goods produced and men able to produce them. Money is the material shape of the principle that men who wish to deal with one another must deal by trade and give value for value. Money is not the tool of the moochers, who claim your product by tears, or of the looters, who take it from you by force. Money is made possible only by the men who produce. Is this what you consider evil?

When you accept money in payment for your effort, you do so only on the conviction that you will exchange it for the product of the effort of others. It is not the moochers or the looters who give value to money. Not an ocean of tears not all the guns in the world can transform those pieces of paper in your wallet into the bread you will need to survive tomorrow.

Those pieces of paper, which should have been gold, are a token of honor–your claim upon the energy of the men who produce. Your wallet is your statement of hope that somewhere in the world around you there are men who will not default on that moral principle which is the root of money. Is this what you consider evil?

Have you ever looked for the root of production? Take a look at an electric generator and dare tell yourself that it was created by the muscular effort of unthinking brutes.

Try to grow a seed of wheat without the knowledge left to you by men who had to discover it for the first time. Try to obtain your food by means of nothing but physical motions–and you’ll learn that man’s mind is the root of all the goods produced and of all the wealth that has ever existed on earth.

But you say that money is made by the strong at the expense of the weak? What strength do you mean? It is not the strength of guns or muscles. Wealth is the product of man’s capacity to think.

Then is money made by the man who invents a motor at the expense of those who did not invent it? Is money made by the intelligent at the expense of the fools? By the able at the expense of the incompetent? By the ambitious at the expense of the lazy? Money is made–before it can be looted or mooched–made by the effort of every honest man, each to the extent of his ability.

An honest man is one who knows that he can’t consume more than he has produced.

To trade by means of money is the code of the men of good will. Money rests on the axiom that every man is the owner of his mind and his effort.

Money allows no power to prescribe the value of your effort except the voluntary choice of the man who is willing to trade you his effort in return. Money permits you to obtain for your goods and your labor that which they are worth to the men who buy them, but no more. Money permits no deals except those to mutual benefit by the unforced judgment of the traders.

Money demands of you the recognition that men must work for their own benefit, not for their own injury, for their gain, not their loss–the recognition that they are not beasts of burden, born to carry the weight of your misery–that you must offer them values, not wounds–that the common bond among men is not the exchange of suffering, but the exchange of goods.

Money demands that you sell, not your weakness to men’s stupidity, but your talent to their reason; it demands that you buy, not the shoddiest they offer, but the best that your money can find. And when men live by trade–with reason, not force, as their final arbiter–it is the best product that wins, the best performance, the man of best judgment and highest ability–and the degree of a man’s productiveness is the degree of his reward. This is the code of existence whose tool and symbol is money. Is this what you consider evil?

But money is only a tool. It will take you wherever you wish, but it will not replace you as the driver. It will give you the means for the satisfaction of your desires, but it will not provide you with desires. Money is the scourge of the men who attempt to reverse the law of causality–the men who seek to replace the mind by seizing the products of the mind.

Money will not purchase happiness for the man who has no concept of what he wants: money will not give him a code of values, if he’s evaded the knowledge of what to value, and it will not provide him with a purpose, if he’s evaded the choice of what to seek. Money will not buy intelligence for the fool, or admiration for the coward, or respect for the incompetent.

The man who attempts to purchase the brains of his superiors to serve him, with his money replacing his judgment, ends up by becoming the victim of his inferiors. The men of intelligence desert him, but the cheats and the frauds come flocking to him, drawn by a law which he has not discovered: that no man may be smaller than his money. Is this the reason why you call it evil?

Only the man who does not need it, is fit to inherit wealth–the man who would make his own fortune no matter where he started. If an heir is equal to his money, it serves him; if not, it destroys him. But you look on and you cry that money corrupted him. Did it? Or did he corrupt his money? Do not envy a worthless heir; his wealth is not yours and you would have done no better with it.

Do not think that it should have been distributed among you; loading the world with fifty parasites instead of one, would not bring back the dead virtue which was the fortune. Money is a living power that dies without its root. Money will not serve the mind that cannot match it. Is this the reason why you call it evil?

Money is your means of survival. The verdict you pronounce upon the source of your livelihood is the verdict you pronounce upon your life. If the source is corrupt, you have damned your own existence.

Did you get your money by fraud? By pandering to men’s vices or men’s stupidity? By catering to fools, in the hope of getting more than your ability deserves? By lowering your standards? By doing work you despise for purchasers you scorn? If so, then your money will not give you a moment’s or a penny’s worth of joy.

Then all the things you buy will become, not a tribute to you, but a reproach; not an achievement, but a reminder of shame. Then you’ll scream that money is evil. Evil, because it would not pinch-hit for your self-respect? Evil, because it would not let you enjoy your depravity? Is this the root of your hatred of money?

Money will always remain an effect and refuse to replace you as the cause. Money is the product of virtue, but it will not give you virtue and it will not redeem your vices. Money will not give you the unearned, neither in matter nor in spirit. Is this the root of your hatred of money?

Or did you say it’s the love of money that’s the root of all evil? To love a thing is to know and love its nature. To love money is to know and love the fact that money is the creation of the best power within you, and your passkey to trade your effort for the effort of the best among men. It’s the person who would sell his soul for a nickel, who is loudest in proclaiming his hatred of money–and he has good reason to hate it.

The lovers of money are willing to work for it. They know they are able to deserve it.

Let me give you a tip on a clue to men’s characters: the man who damns money has obtained it dishonorably; the man who respects it has earned it.

Run for your life from any man who tells you that money is evil. That sentence is the leper’s bell of an approaching looter. So long as men live together on earth and need means to deal with one another–their only substitute, if they abandon money, is the muzzle of a gun.

“But money demands of you the highest virtues, if you wish to make it or to keep it. Men who have no courage, pride or self-esteem, men who have no moral sense of their right to their money and are not willing to defend it as they defend their life, men who apologize for being rich–will not remain rich for long.

They are the natural bait for the swarms of looters that stay under rocks for centuries, but come crawling out at the first smell of a man who begs to be forgiven for the guilt of owning wealth. They will hasten to relieve him of the guilt–and of his life, as he deserves.

Then you will see the rise of the men of the double standard–the men who live by force, yet count on those who live by trade to create the value of their looted money–the men who are the hitchhikers of virtue. In a moral society, these are the criminals, and the statutes are written to protect you against them.

But when a society establishes criminals-by-right and looters-by-law–men who use force to seize the wealth of disarmed victims–then money becomes its creators’ avenger. Such looters believe it safe to rob defenseless men, once they’ve passed a law to disarm them.

But their loot becomes the magnet for other looters, who get it from them as they got it. Then the race goes, not to the ablest at production, but to those most ruthless at brutality. When force is the standard, the murderer wins over the pickpocket. And then that society vanishes, in a spread of ruins and slaughter.

Do you wish to know whether that day is coming? Watch money. Money is the barometer of a society’s virtue.

When you see that trading is done, not by consent, but by compulsion–when you see that in order to produce, you need to obtain permission from men who produce nothing–when you see that money is flowing to those who deal, not in goods, but in favors–when you see that men get richer by graft and by pull than by work, and your laws don’t protect you against them, but protect them against you–when you see corruption being rewarded and honesty becoming a self-sacrifice–you may know that your society is doomed. Money is so noble a medium that it does not compete with guns and it does not make terms with brutality. It will not permit a country to survive as half-property, half-loot.

Whenever destroyers appear among men, they start by destroying money, for money is men’s protection and the base of a moral existence. Destroyers seize gold and leave to its owners a counterfeit pile of paper. This kills all objective standards and delivers men into the arbitrary power of an arbitrary setter of values. Gold was an objective value, an equivalent of wealth produced. Paper is a mortgage on wealth that does not exist, backed by a gun aimed at those who are expected to produce it.

Paper is a check drawn by legal looters upon an account which is not theirs: upon the virtue of the victims. Watch for the day when it bounces, marked, ‘Account overdrawn.’

“When you have made evil the means of survival, do not expect men to remain good. Do not expect them to stay moral and lose their lives for the purpose of becoming the fodder of the immoral. Do not expect them to produce, when production is punished and looting rewarded. Do not ask, ‘Who is destroying the world? You are.

You stand in the midst of the greatest achievements of the greatest productive civilization, and you wonder why it’s crumbling around you, while you’re damning its life-blood–money.

You look upon money as the savages did before you, and you wonder why the jungle is creeping back to the edge of your cities. Throughout men’s history, money was always seized by looters of one brand or another, whose names changed, but whose method remained the same: to seize wealth by force and to keep the producers bound, demeaned, defamed, deprived of honor.

That phrase about the evil of money, which you mouth with such righteous recklessness, comes from a time when wealth was produced by the labor of slaves–slaves who repeated the motions once discovered by somebody’s mind and left unimproved for centuries. So long as production was ruled by force, and wealth was obtained by conquest, there was little to conquer, Yet through all the centuries of stagnation and starvation, men exalted the looters, as aristocrats of the sword, as aristocrats of birth, as aristocrats of the bureau, and despised the producers, as slaves, as traders, as shopkeepers–as industrialists.

To the glory of mankind, there was, for the first and only time in history, a country of money–and I have no higher, more reverent tribute to pay to America, for this means: a country of reason, justice, freedom, production, achievement.

For the first time, man’s mind and money were set free, and there were no fortunes-by-conquest, but only fortunes-by-work, and instead of swordsmen and slaves, there appeared the real maker of wealth, the greatest worker, the highest type of human being–the self-made man–the American industrialist.

If you ask me to name the proudest distinction of Americans, I would choose–because it contains all the others–the fact that they were the people who created the phrase ‘to make money.’ No other language or nation had ever used these words before; men had always thought of wealth as a static quantity–to be seized, begged, inherited, shared, looted or obtained as a favor.

Americans were the first to understand that wealth has to be created. The words ‘to make money’ hold the essence of human morality.

“Yet these were the words for which Americans were denounced by the rotted cultures of the looters’ continents.

Now the looters’ credo has brought you to regard your proudest achievements as a hallmark of shame, your prosperity as guilt, your greatest men, the industrialists, as blackguards, and your magnificent factories as the product and property of muscular labor, the labor of whip-driven slaves, like the pyramids of Egypt.

The rotter who simpers that he sees no difference between the power of the dollar and the power of the whip, ought to learn the difference on his own hide– as, I think, he will.

Until and unless you discover that money is the root of all good, you ask for your own destruction. When money ceases to be the tool by which men deal with one another, then men become the tools of men. Blood, whips, and guns–or dollars. Take your choice–there is no other–and your time is running out.

- Francisco d’Anconia

Ayn Rand “Atlas Shrugged”

THE MORE CORRUPT THE STATE, THE MORE NUMEROUS THE LAWS.

- TACITUS

#nostr #bitcoin

Picking up my car today 😂 #bitcoin