On a grocery run… representing #Bitcoin. 🔥🔥

UPDATE: From Sep 13th - Sep 20th

US net liquidity roughly DECREASED by -$134.3B.

Fed balance sheet: -$74.7B

ORR: -$59.2B

TGA: +$118.8

Definitely no stealth #QE over the past week. Rather liquidity contraction. Net negative for risk assets, all things being equal.

DYOR

Unpopular opinion: The US debt spiral doesn’t matter nearly as much today as many people think it does.

Even at these higher interest rates.

Someday, it will matter very much. But we are YEARS away from that moment.

For now, it is business—nay, borrowing—as usual.

🇺🇸

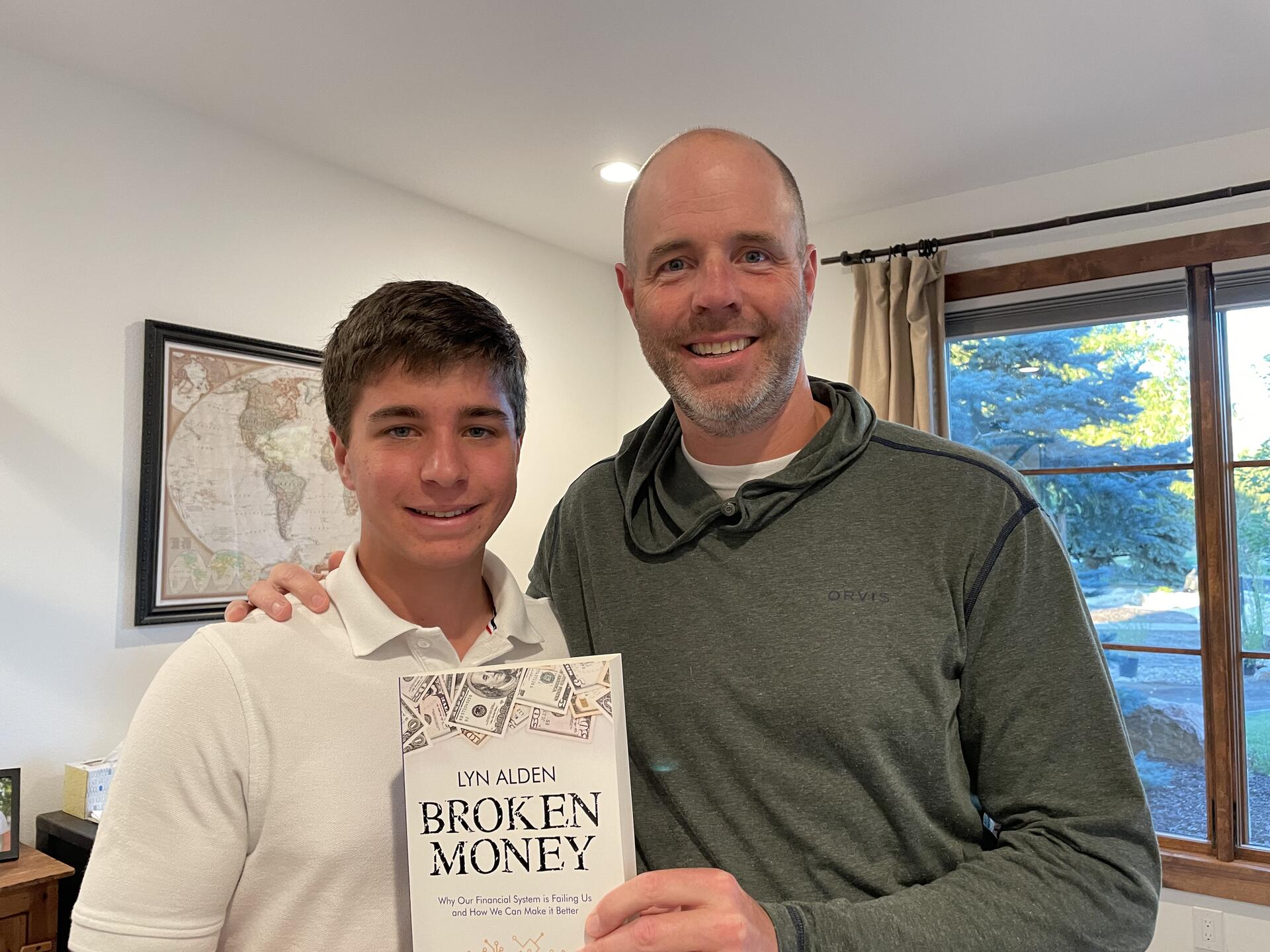

Look what just arrived! 👀

Can’t wait to dig into “Broken Money” by nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a after nostr:npub1593cfkv5cyx8srdp8exuz524uvkdk0p4y2tek6mwa22j6v4plv0smyn7nm finishes reading it. 🔥

I have the sneaking suspicion that it will become an instant classic.

Layer 1 is the rock solid, decentralized and secure distributed ledger and store of value.

Layer 2 is the medium of exchange infrastructure. This, obviously, still has a long way to go, but it will eventually provide a viable and (I believe) much better alternative to the current Eurodollar standard.

#Bitcoin

Why?

Government fiat is currency of the government, by the government, and for the government.

Bitcoin is sound money of the people, by the people, and for the people.

Definitely possible.

But I think they are unlikely to outperform over the long run.

#Bitcoin is clearly better money for a better world. This is obvious for anyone who spends time studying what money is and what makes some forms of money better than others.

Question:

Are there actual good, sustainable, profitable business models built on and around Bitcoin?

- Exchanges are one model, which have shown minimal success and sustainability to date.

- Lending models don't work nearly as well as they do on a fiat currency base--given the differences between depreciating (fiat) and appreciating (bitcoin) assets.

Other than holding bitcoin as a reserve asset on a corporate balance sheet--which I believe to be extremely wise--what business model exists (or could exist) that may actually outperform the long-term price performance of bitcoin itself?

Government grows ever larger and more powerful by “legally” stealing your purchasing power via taxes and inflation.

People can slowly defund and diminish this nefarious scheme by exchanging their fiat currencies for #Bitcoin, which is designed to preserve and grow purchasing power over time in a decentralized and secure manner.

Don’t hate the Bitcoin Crab market.

Take advantage of it.

It’s counterintuitive to many, but tech stocks typically perform well during periods of stagflation.

They generally perform poorly during periods of combined slowing economic growth and disinflation or deflation.

If/when we get a deflationary bust… watch out. 👀

$QQQ

BREAKING:

CPI data... crabby for longer. 🦀

Fed: Crabby hawkish for longer. 🦀

Interest rates: Crabby for longer. 🦀

Net liquidity: Crabby for longer. 🦀

Asset prices: Crabby for longer. 🦀

Crab on.

🔥🦀🔥

On investing:

“Understanding the distinction between risk control and risk avoidance is truly essential for investors."

- Howard Marks

US net liquidity has been rangebound, chopping sideways since late-April 2022.

There is no reason to have high expectations for US based risk assets until something materially changes.

In short, stay crabby.

🔥🦀🔥

Just realized that my last update mixed up the ORR and TGA values. Here’s the corrected version for anyone who cares:

UPDATE: From Aug 30th - Sep 6th

US net liquidity roughly INCREASED by +$71B.

Fed balance sheet: -$20B

ORR: -$91B

TGA: $0 (no significant change)

Stealth QE since mid-August. Primarily from ORR drainage. 👀

DYOR

Dream of doing great things--banding together against seemingly insurmountable odds--to rebuild a better world for the benefit of all people.

UPDATE: From Aug 30th - Sep 6th

US net liquidity roughly INCREASED by +$71B.

Fed balance sheet: -$20B

ORR: $0 (no significant change)

TGA: -$91B

Stealth QE since mid-August. 👀

DYOR