Indeed it has, and it almost certainly will again. Poorly informed noobs will see the performance of the last 2 years as irresistable as it continues to climb early this year and the price will hit mania phase before beginning its crash of 80% or so just as it did in 2013/2017/2021. The average mining cost is the tether to reality. If the purchase price is significantly higher than the cost to mine, like 3 - 5x the mining cost, then mania is present and it's probably a good idea to buy dollars since they're cheap so you can sell them when they are worth more Bitcoin a year later.

No, due to fungibility and universal availability of the assets the price will always be around the cost to produce coins. Think about if you have something brand new that is highly desirable and doesn't have a high production volume, like a new in box PS5 during its launch year, you could easily sell it at the inflated price it costs to buy a new one because the one you offer is the same as the new ones produced.

The miners will always need to make a profit, the difficulty adjustment ensures it's not too easy or too difficult to do so for the average miners. Humanity will keep adding to the mining network, and the halving will keep occurring, which will continuously increase the cost to create coins and the value of all coins on the open market will follow.

Bitcoin is not a cryptocurrency.

It is the only cryptomoney.

What matters here is that the amount of energy input through mining continues to exponentially grow about 15% a year, while the amount of Bitcoin given in exchange exponentially decays when it gets cut in half every 4 years. These are 2 exponentials that combine to give an even larger exponential growth in real value represented by Bitcoin units.

The reason the cycle occurs is due to the fact that the bear market low is an oversold price, usually around half the average mining cost, about a year before the new halving. Over the next year the price recovers to around its average mining cost meaning the price in FIAT grew more than 100%. Then the halving occurs where the shift in value is reflected by a delayed, but quicker than average, rise in fiat price again of over 100% for the second year in a row.

Technically at that point (where we are today) the network is fairly priced and can sustain the 15% annual growth of the energy input, but the 2 previous years of massive growth draw above average attention which causes the price to rise further and FOMO develops. It then ends up over bought during the bull peak as people believe this momentum is different from previous cycles when it's really not, and then it crashes again and the cycle starts all over.

The only site I know that reports this is this one: https://en.macromicro.me/charts/29435/bitcoin-production-total-cost

I'd love to hear if anyone knows of another site that reports the same data.

Bitcoin's FIAT price this year will reach 5+ times the average production cost to mine a Bitcoin globally before the major correction phase begins. The ratio between the FIAT price and the production cost reveals to us that it is in fact Bitcoin's FIAT price that is inflated. This price inflation is due to the mania phase of the cycle and not that the dollar is collapsing. It could be argued that buying lots of dollars at that point when they're cheap would be advantageous, as when the correction occurs they could be used to acquire much more Bitcoin and help stabilize the price long term.

But if Bitcoin's FIAT price and average production cost both go up equally, then that is the indicator that it is the dollar collapsing and not Bitcoin being overpriced. If the price of both rise quickly, and at the same rate, it is highly likely that every asset is doing the same. HODL as hard as you can in this case because this is FIAT collapse.

Just also be prepared for the inevitable correction in 2025/2026.

The ability to truly be yourself requires one to be without fear of losing your ability to support yourself. Bitcoin frees everyone from the chains of the current system in multiple ways.

I choose option 1. I'd love to have a 50 year marriage with 50 Bitcoin!

(Explanation: They're both option 1, so I'm choosing that option 😂)

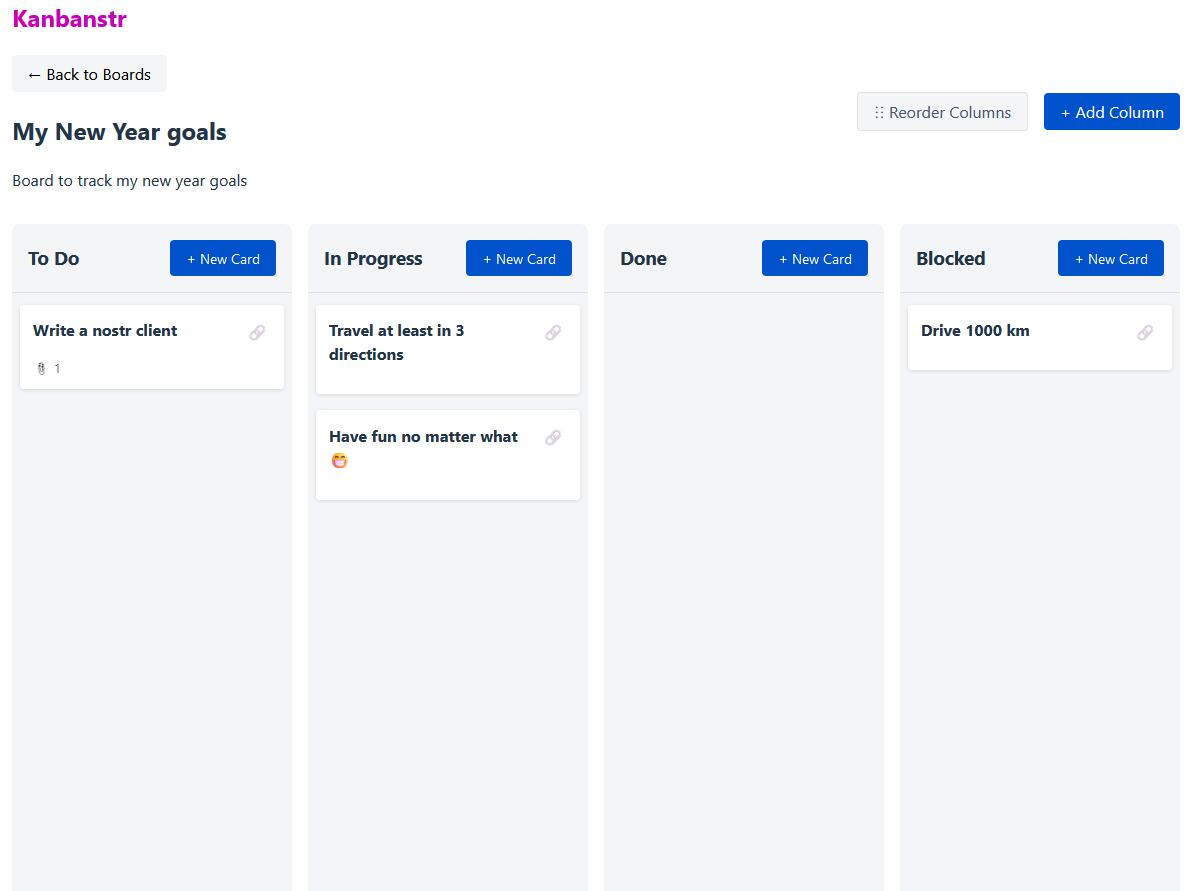

📢📢📢ANNOUNCING KANBANSTR - A NEW NOSTR CLIENT

❓What if we could power the Gig economy through #nostr?

❓What if we could use #nostr to track our work and also personal tasks?

❓What if we could #zap people for completing tasks instead of paying them monthly or weekly?

Introducing Kanbanstr - An opensource nostr client [BETA obviously]

You can do the following as of now:

☑️ Login using nsec, npub, NIP-07 - Done

☑️ Create Boards with multiple columns - Done

☑️ Create cards in boards - Done

☑️ Add/Delete/reorder columns in boards - Done

☑️ Markdown description in cards - Done

☑️ Cards automapped to columns using EXACT status = column name - Done

☑️ Cards assigned to people using 'zap' tags - Done (This is for people to get paid when the card is zapped)

What is yet to be done?

⌛ Programmatic - Yet to do

⌛ Zap a card - Yet to do

⌛ Anything that you want to implement

Code is available at https://github.com/vivganes/kanbanstr

This was done with the #NDK as a supporting framework (thanks, nostr:npub1l2vyh47mk2p0qlsku7hg0vn29faehy9hy34ygaclpn66ukqp3afqutajft )

You can play around with the app now at https://www.kanbanstr.com/

Beware of bugs though! You can report bugs to me or volunteer a PR too :)

BTW, I have also submitted a PR to NIP repository for the same - https://github.com/nostr-protocol/nips/pull/1665

Happy new year, folks! 🥳

Does the data you input into this show publicly? If not, is the data stored locally?