Yo nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf, can you explain to me why $RIOT has been such a piece of white dogshit stock on the trailing 1y?

We’re talking 115% underperformance relative to BTC. I don’t get it.

Afaik professional investors have to carefully read all of the SEC filings to already know the answers to those questions before purchasing securities.

One of the reasons I’m focused on BTC as savings technology.

nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf how hard was it to not speak up when this guy showed his cookies? 🤣

“Never interrupt your enemy when he's making a mistake” 😂

I love the early episodes! From time to time I go back and listen to some of them.

Same for the noded podcast. nostr:npub1j4u5gjzjyggr3h96x3gjy4akdgwxuk7mgvumv72gym2qyje7fn5s47d6x9 and nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf did so much for the community.

Thank you 🙏

I agree there are good arguments to avoid getting into debt, I just don’t think “I have to persuade the lender to buy bitcoin instead of lending fiat” is a good argument.

At the University of Wyoming’s Blockchain Stampede conference we did a deep dive on the value of Bitcoin, the role of mining, and how it balances electricity grids.

Thank you Matthew Skrlac for the invitation to speak and for organizing a great conference!

“Free” was something I pushed for at Kraken, it simplifies for users, abuse can be detected, and routing fee revenue is greater than cost. nostr:note1cftkjsu2g9mpu90wzn57m4etht7y96vfs0awq2ttcunvpymdckaspjpqe5

I have no concrete knowledge but that seems to be implied based on public information

nostr:npub1hxwmegqcfgevu4vsfjex0v3wgdyz8jtlgx8ndkh46t0lphtmtsnsuf40pf if you still know anyone there, can you ask them to issue a press release specifically for this? It would make political actual a lot easier.

I don’t have any insider info, but it seems like they had to outsource deposit/withdrawal functionality to a third-party due to regulations, and it seems like that third-party happens to not support Lightning. I don’t know if the lack of support is for regulatory reasons or just not a business priority.

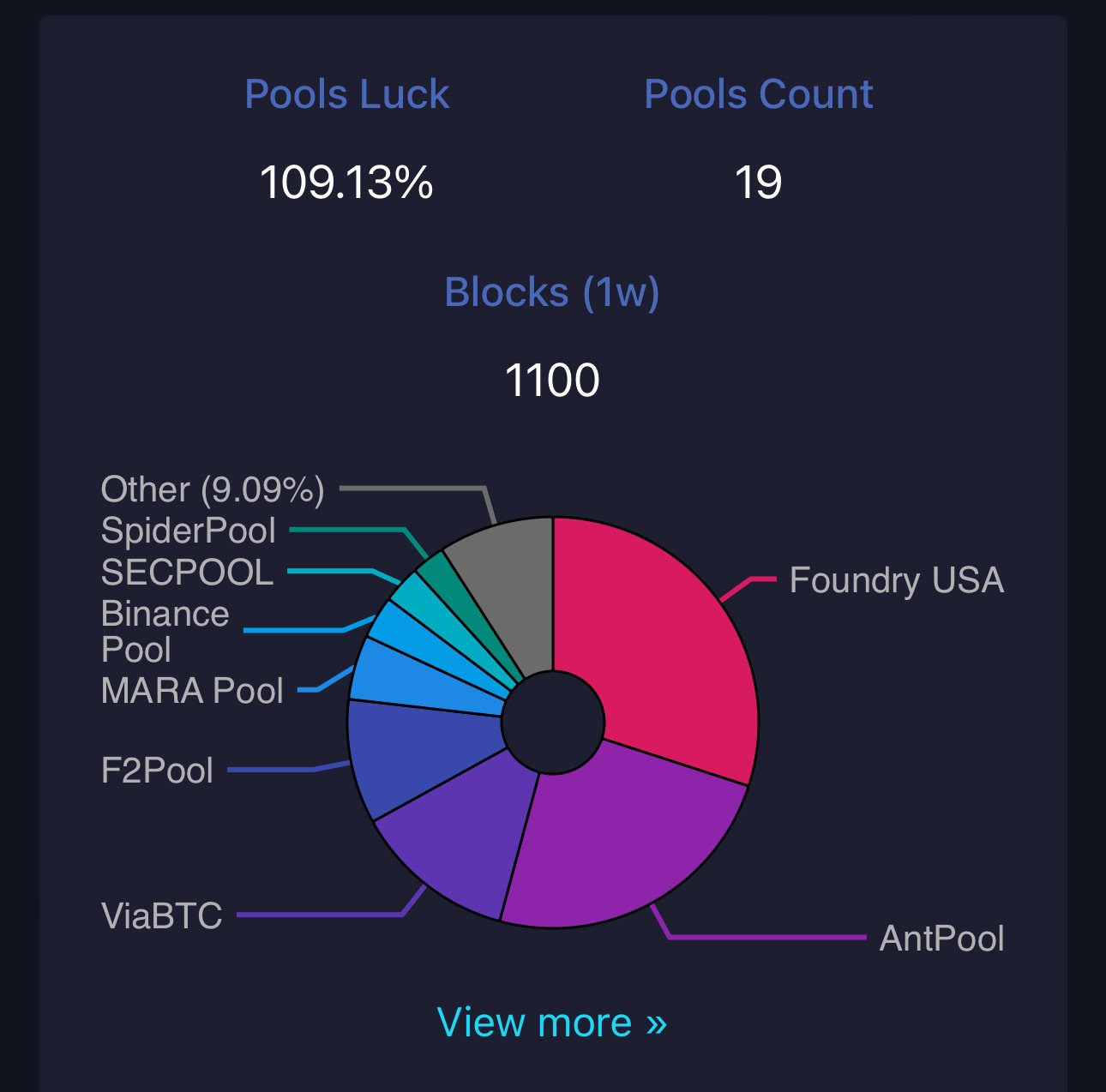

nostr:npub185h9z5yxn8uc7retm0n6gkm88358lejzparxms5kmy9epr236k2qcswrdp you were (are?) extremely concerned about mining centralization and the risks it poses to Bitcoin. Pierre doesn’t seem terribly concerned.

Would you review this thread and help me better understand both of these view points?

If I recall you even suggested a nuclear option of changing to another hashing algo if we cannot fix the situation.

Pierre, I respectfully disagree with your position.

Your claim was “Until further notice, Bitcoin is NOT censorship resistant.” I think you’ve appropriately backed off that claim to a more nuanced “there’s a risk of Bitcoin maybe not being censorship resistant in the future”

If you’re right they’ll get attacked, and if I’m right they will decentralize in response to that attack. That’s what I mean by anti-fragility of censorship resistance.

You’re welcome to pour resources into pre-emptively tilting at windmills, but I have to pushback when someone claims that Bitcoin is not censorship resistant when they have no censored transactions as evidence.

Transactions being censored is a hypothetical problem.

Mining can’t be monopolized, it’s the most competitive industry in the world.

Anyone can fabricate arbitrary centralization metrics and declare a hypothetical of theoretical censorship-resistance, for example 100% of hashrate is on planet Earth.

There’s a lot of hypothetical problems to be solved

Might just take longer to accumulate censored transactions in the mempool

I’m not good at price predictions 😂.

Game theory seems to be that censors won’t bother because the fee to overcome would be relatively low.

Censorship resistance is a dynamic, anti-fragile process, not a static feature. If there is censorship, people will pay higher fees to overcome it.

The metaphor is incorrect, because if a txid is censored, it just sits there in the mempool. Bitcoin is not destroyed, it’s not over, the transactor can simply CPFP/RBF until greedy miners defect.

You said it’s not censorship resistant, can you point to a txid that is currently being censored?

Ok, censor a transaction

Today I recorded a podcast episode with nostr:npub1r8l06leee9kjlam0slmky7h8j9zme9ca32erypgqtyu6t2gnhshs3jx5dk - be sure to subscribe and give it a listen when it comes out!

We discussed a wide range of topics: savings technology, Lightning, government strategic reserves, and life philosophy

I still remember when I first saw a Max Keiser clip in 2011, he was talking about silver and JPM.

I never would have guessed that a decade later we would be together at the inauguration gala of El Salvador’s President. Hugely grateful for Max’s energy and humor, a hero of bitcoin!