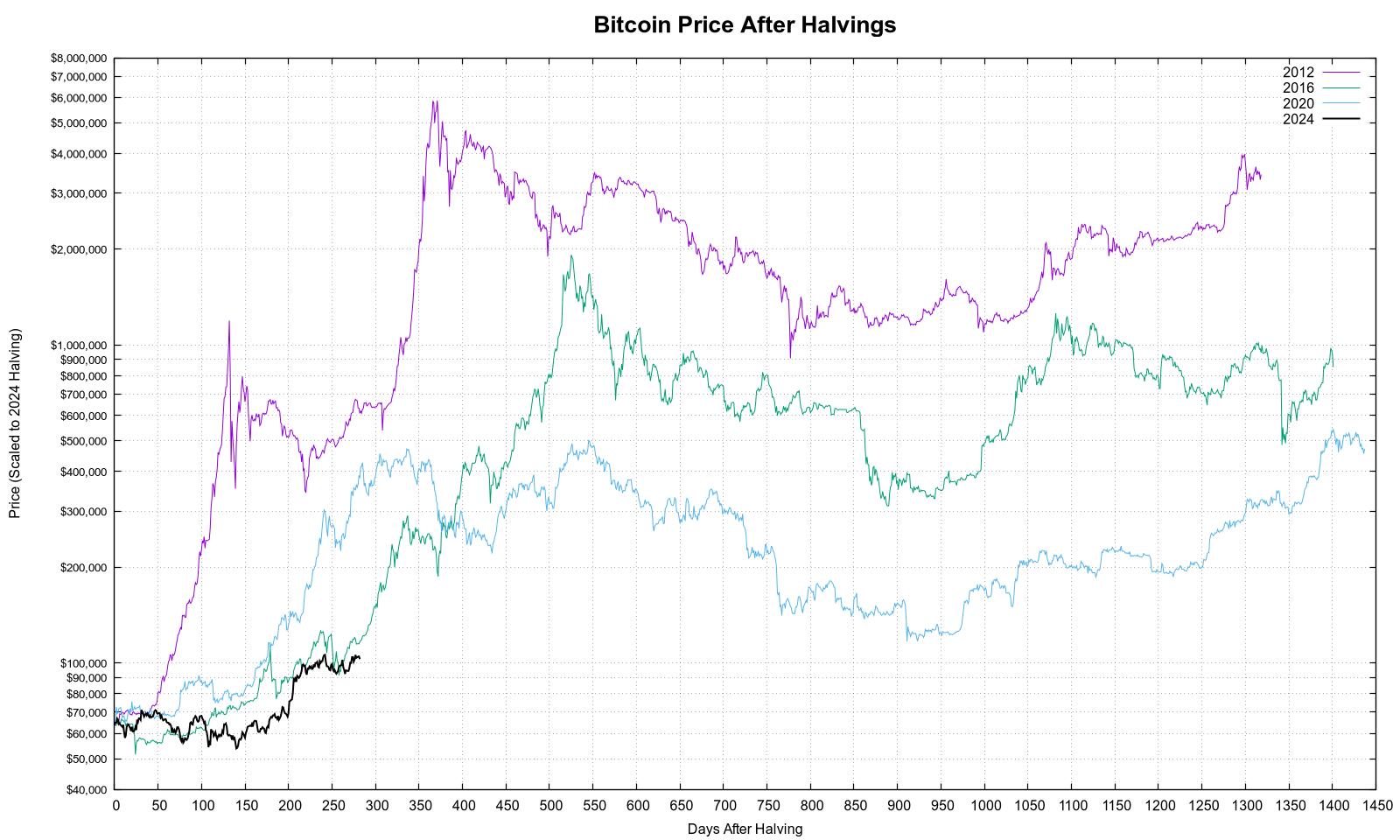

Worst bitcoin bull run, ever.

This is an incredibly bad take. One does not just generate 10% global oil supply from existing conventional oil & gas production sources. If 10% came off the market, it would take awhile to ramp up the Canadian oil sands and American shale oil to close the gap. Oil would get crippling expensive in the intermediary many, many months.

Somewhat related: is there a source where plebs can find the 4-year sharpe ratio of bitcoin? Willy Woo had a chart with this information but it has stopped updating in 2022.

There is no profit in AI …

How many people lost bitcoin following David Bailey’s advice? Irresponsible. nostr:note1rhl2zas5730xt52yejtp65u7xrt7c2qjc2l4zjnvymk48dfwqfxqg72guv

Negative cost of supply. Often times come from added production (more crude production if a producer can handle the natural gas) or increased efficiency (gas turbine operates at design capacity rather than a throttled back capacity to meet grid restrictions).

There is more value created by paying someone to take energy from you.

These opportunities usually happen in smaller pockets (1-20 MW), not mega scale mining operations.

Once we see the bitcoin on the blockchain, then we can worry about the liability question.

I understand proof of reserves isn’t perfect, however it is better than “just trust me, bro”

The counterparty I am most concerned about is Coinbase. Whether or not MSTR and their auditors are comfortable with a certain amount of fractional reserving from Coinbase is also a question.

But I want to see the bitcoin addresses. Like River. Like El Salvador. Seems like an obvious compliment to the MSTR bitcoin strategy. Only adds confidence (therefore value) in the fiat markets.

Imagine being nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m - a bitcoin maxi - and trusting these clowns at Coinbase with your bitcoin. The literal value of your entire company is partially stored with a facilitator of shitcoins. This will end well.

As a MSTR shareholder, I believe MSTR should be using a bitcoin only custodian - like Unchained or Onramp - in addition to Fidelity. nostr:note1ftkaf96a3ukcy7xlrt8gmxy2ks36f8l84tv25m4sh3hmlldzdlaquv2kf4

How the Trump administration is making so much noise and yet none of it mentions, let alone is specific to, bitcoin speaks volumes.

Smaller “big” cities … much smaller.

The current capacity of cities is incredibly overbuilt and the service costs are enormous. When the cost of capital goes up, the maintenance of much (if not most) of that capacity will be abandoned.

Hyper-local, quality focused enterprises. “Scaling” as we think of it today will not be profitable.

Communities build up around resource density. Supply chains become incredibly efficient.

More leisure time…true leisure time. Less on the social calendar. Fewer restaurants, more functional homes for hosting and cooking.

The future is *dramatically* different thanks to bitcoin appreciating 20-50%+ annually for the next 2-3 decades.

Yeah, this guy is evil. I thought (think) Elon is evil but they’ve rebooted Elon with less visible autism, less mainstream accomplishment, and more disdain for the human condition.

This dude needs to be as far away from power and influence as possible.

Don’t understand how we have all these new demand sources and mainstream advocates and the supply shock hasn’t shown up.

Voices I respect say “soon” … it’s gotta be

Y’all should read ‘Ways and Means’ by Daniel Lefferts to understand the lengths the federal government is willing to go to fund itself without a clear mechanism to do so. Amazing to think of what would be possible 160+ years after the Civil War.

Exhibit 1: Market manipulation nostr:note1sdmpkxfj0pqu3c0xvf5psaf3x9wwu894yr5qkkdhkyewgestkuysceuvjr

I’m more concerned with Coinbase than MSTR specifically. Corporate and government custody has the potential to become a daisy chain of risk spreading…just like the banking system.

I’d like to see more of an effort to leverage these unique attributes of bitcoin to show the market that they actually have claim to a fully-reserved stockpile.

If I was Saylor, I also would believe the markets I am targeting would only value my entity more if I could show (on the blockchain) where my reserves sat. Regardless of the liabilities.

But I’m simply a toxic maxi wanting a bitcoin standard. Maybe I am wrong for barking up this tree. But I’m not gonna stop barking until this gap is addressed.

They’re claiming they are literally buying an entire year’s worth of new bitcoin issuance. More incoming. Their legitimacy matters.

Is it better than an open-ended promise? Especially for an entity that will likely hold the significant portion of their reserves in perpetuity (or at least very long duration)?

I see how technically your answer is valid however I still like to see blockchain verification behind the public announcements. Don’t let perfect stand in the way of good.

Love nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z and nostr:npub1rtlqca8r6auyaw5n5h3l5422dm4sry5dzfee4696fqe8s6qgudks7djtfs and nostr:npub1cn4t4cd78nm900qc2hhqte5aa8c9njm6qkfzw95tszufwcwtcnsq7g3vle … and I agree with the theory MSTR is espousing. When will y’all use your platforms and relationships with nostr:npub15dqlghlewk84wz3pkqqvzl2w2w36f97g89ljds8x6c094nlu02vqjllm5m to push for blockchain verified proof of reserves?

If El Salvador can do it, so can MicroStrategy. If nostr:npub1xkere5pd94672h8w8r77uf4ustcazhfujkqgqzcykrdzakm4zl4qeud0en can do it, so can MicroStrategy.

cc: nostr:npub14pymadh04lt8tl3lv93yr3vnlxw39s3ahdvmhvlu6u27fve8umfqa9zd6m nostr:npub1qny3tkh0acurzla8x3zy4nhrjz5zd8l9sy9jys09umwng00manysew95gx nostr:npub1sg6plzptd64u62a878hep2kev88swjh3tw00gjsfl8f237lmu63q0uf63m nostr:npub10uthwp4ddc9w5adfuv69m8la4enkwma07fymuetmt93htcww6wgs55xdlq nostr:npub1guh5grefa7vkay4ps6udxg8lrqxg2kgr3qh9n4gduxut64nfxq0q9y6hjy nostr:npub1s05p3ha7en49dv8429tkk07nnfa9pcwczkf5x5qrdraqshxdje9sq6eyhe nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a nostr:npub1gdu7w6l6w65qhrdeaf6eyywepwe7v7ezqtugsrxy7hl7ypjsvxksd76nak