Great book, one chapter dives into how Clinton and GOP were spooked when Perot won such a large % of popular vote. They addressed the debt with paygo, and also (not in book) made lots of changes to how debates happened and thresholds, worked with media to disincentivize platforming 3rd parties, and putting effort into making silly things (like not knowing “Aleppo”) a bigger deal than they are.

The duopoly does not want more competition or democracy, they want power and will go to great lengths to keep it.

She’s beautiful, but the charge on my fenix 6 still makes it a full weekend before recharge… so I gotta wait to get mine 😭

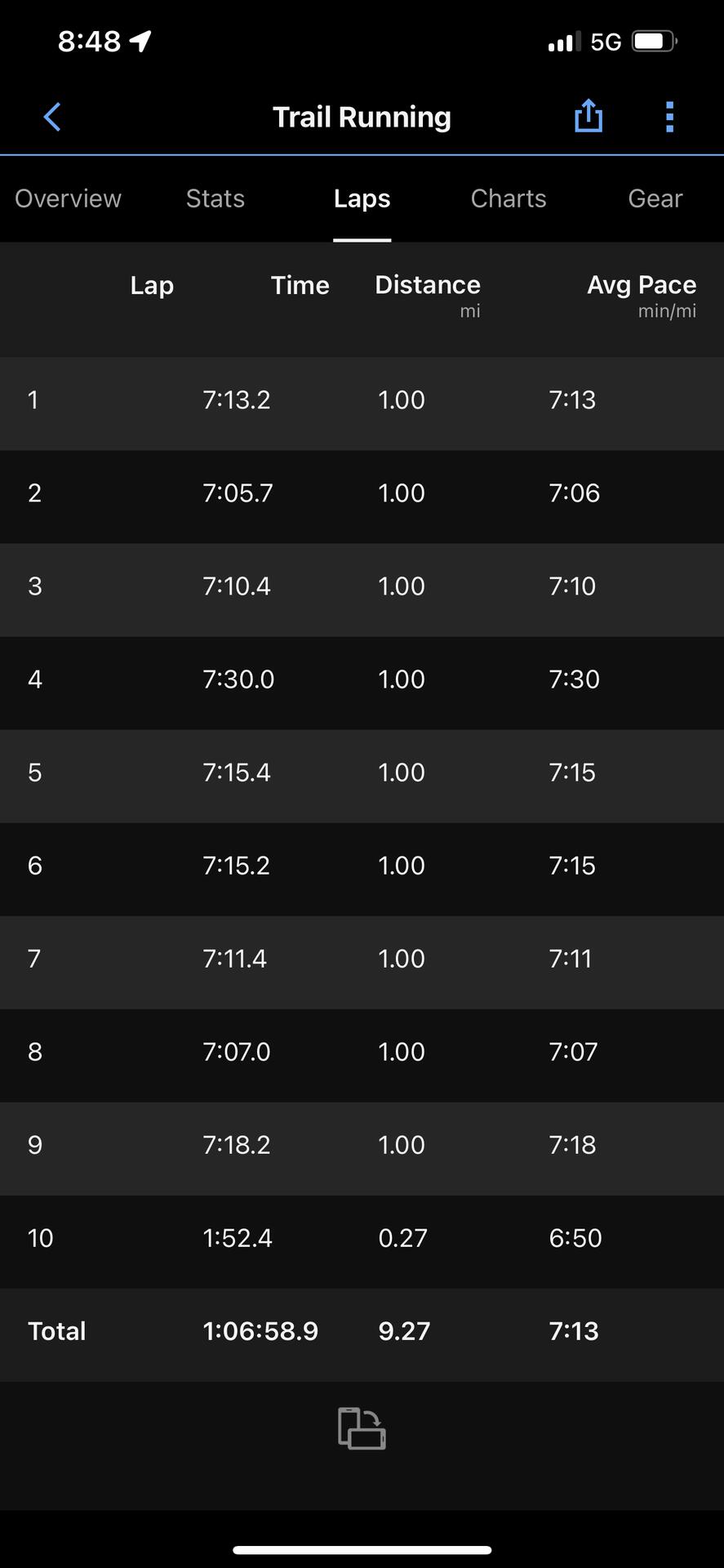

Killed my goal pace of 7:30 at the hot chocolate 15k today; honestly shocked myself. I thought it was aggressive… beat it by 16 seconds every mile 😳

Three freedoms from David graeber- to relocate, to say no, and to form social relationships.

If you cant relocate you are not free. To me that’s the saddest part of Palestine, a good smart person has no chance to participate because n a meritocratic competition, they’re stuck where they are born at birth.

If we watch a movie together, are you checking your phone during the movie?

Rather curious 🤔

#asknostr

Depends on the movie, anything somewhat entertaining I put my phone down. But if nothing is happening and I hate the characters and they won’t die then I’m off to Nostr

Salmon- so easy and good!

Put oil in a pan, some seasoning, drizzle with honey and cut up some oranges, put on top. Cook at 350 for about 20 min (internal temp should be 145). Done right it taste like candy

Strong agree, and I think there are very few bitcoiners aligned with us. It might matter in a decade, but so long as the us is the “best house in a bad neighborhood” our debt is going to be in demand.

Give the landlords and 401k millionaires a scare in their assets and many will look for safety in 4-5% bonds, even if it doesn’t keep up with inflation.

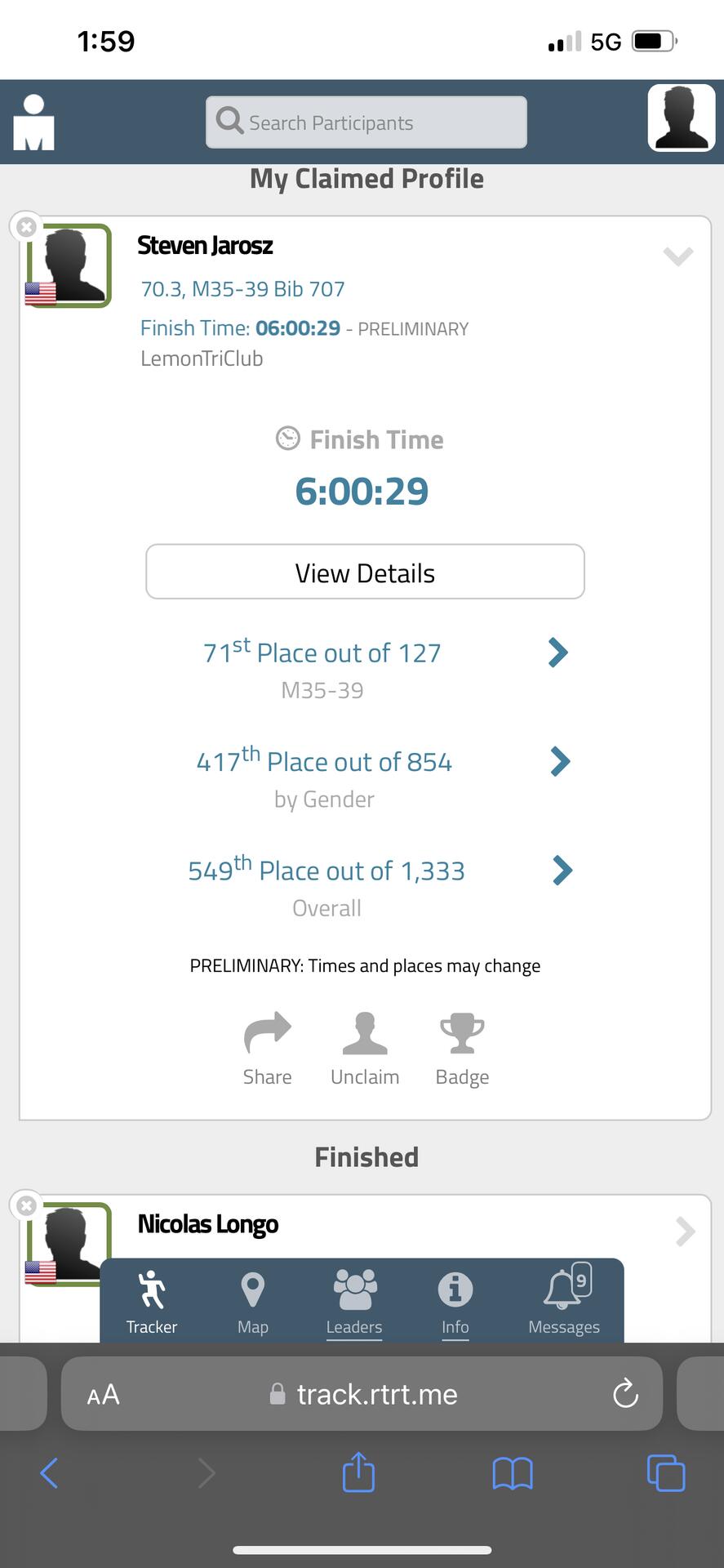

#ProofOfWork - the goal was a 6 hour half-Ironman. I was way ahead of pace till the last 7 miles of the run, when my hamstring and then my caves cramped up.

The mantra for today was “every second counts”- and 6:00:29 rounds down to 6 hours even. A perfect day; next time I will focus a bit more on nutrition and transitions, keep on improving g.

Oh, and this does beat my previous PR by about 40 minutes

🏊♂️🚴♂️🏃♂️

Frustratingly, was 0.06 miles short of my goal today of 3 miles in 20 minutes, second time I missed it. Hopefully 3rd times a charm; considering the 3rd lap was at a 6:20 pace I know I can do it if I pace better early on.

#ProofOfWork

Close! Heading up to Madison for a Half Ironman excited but nervous about my goal time. If weather cooperates I’m going to beat 6 hours

Boom. My new book, Broken Money, is now available on Amazon:

https://www.amazon.com/dp/B0CG83QBJ6

I will formally announce it later today, so I guess this is the initial Nostr exclusive. It’s not even searchable on Amazon yet since it is still being incorporated into their wider database. But if you have that link, it is ready for purchase.

The ebook, audiobook, and other print distribution partners will be rolled out over time.

Thank you everyone for your support! This has been a wonderful project to work on, and it will hopefully educate more people about the current problems in the global monetary system and the solutions that Bitcoin has to offer people around the world.

Phew, was worried but it went thru on second try. Can’t wait to read it!!

Great points. I enjoyed Kelton’s book about MMT, how it accurately describes the paradigm as it currently exists, but what kills me is she calls out the problem where we use it to find Boeing and oligopolies- hand waves “but it doesn’t have to be that way, we could use funds for good!”

Yes, we could and should. But we don’t and haven’t for a very long time. Therefore we should have stronger money and more accountability, less debts and deficits, until we show an ability to spend more productively.

Looking forward to seeing Oppenheimer, haven’t had a chance yet tho.

#ProofOfWork - can’t do it to the letter as my priority is training for a triathlon in September; but I’m putting in the work