Bitcoin in Middle School Update: Our first semester of the 'Intro to Bitcoin' elective for 6th-8th graders had a rocky start. Initially, no students enrolled, but just before the deadline, two based kids signed up - game on!

By the end of semester one we learned kids:

• Love CypherPunks and permissionles FOSS everything

• Can create and restore a Green Wallet on iOS

• Can install and configure Bitcoin Core, Umbrel and Start9 types of nodes

• Can open lightning channels between our class nodes, thanks nostr:npub1rxysxnjkhrmqd3ey73dp9n5y5yvyzcs64acc9g0k2epcpwwyya4spvhnp8, and hate high fees

• Can absolutely understand "not your keys, not your coins"

• Are getting the "stay humble and stack sats" - middle school humble - baby steps.

Exponential Growth?? - Now in semester two, our class size is blowing up a MASSIVE 100% to 4 students (ok with one returning)! At this growth rate, I'm pretty sure eleventy billion kids will be in that class soon - to the moon yo!

Shout out to nostr:npub17u5dneh8qjp43ecfxr6u5e9sjamsmxyuekrg2nlxrrk6nj9rsyrqywt4tp and nostr:npub1e0z776cpe0gllgktjk54fuzv8pdfxmq6smsmh8xd7t8s7n474n9smk0txy for donating Testnet bitcoin for the kids to play with - I was going broke trying to demonstrate transactions on main net in a 40 min class - get off my lawn you stinking mempool clogging JPEGS!! 😄

aw yesss!!! 🙌

about to head into this week's Lightning Pulse @lightningpulse

forgets to drink coffee; decides her life is just pain now; spends the weekend fighting caffeine withdrawal 😭

all the advice says to taper but im incapable of following a schedule 🪦

become a regular at a fancy restaurant , a dive bar, and/or a standup comedy club

wtf when did hacker news get on nostr

nostr:note1f7msxzmh38h5wvjxwlqph3my4dl8cm8z34yafprmrm4tsc2j43vq4cdmqv

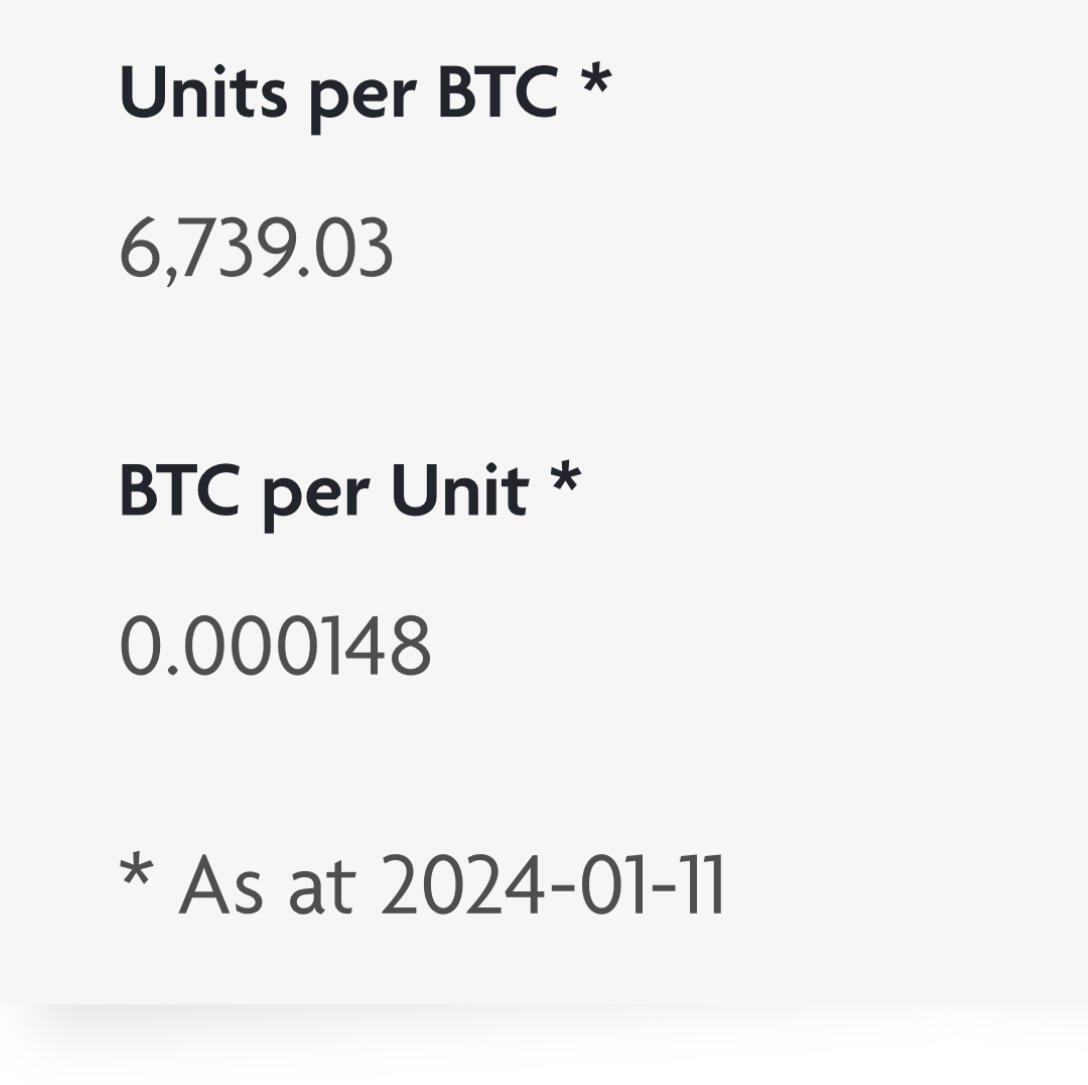

correct me if im wrong but im pretty sure there’s no guarantee how many sats a share in these etfs are worth

on a dollar value, they’ll do fine but on a per sat basis investing into an etf in a bull day dilutes the per share sats value of everyone else in the fund

the reverse happens on bear days, afaict. here’s the lil scenario i walked through to convince myself of this dynamic.

100 shares, 100k sats. current price is $2/sat. $200k total NAV

ea share worth 1k sats

lets say the price moves up, to

$4/sat, $400k NAV, 100k sats

i buy 10 shares, $40k in, buys 10k sats

110 shares, $440k/110k sats

1k sats/share

market moves: day price is $5. $40k buys 8k sats

110 shares, 108k sats

989sats/share

market moves: day price is $2. $40k buys 20k sats

110 shares, 120k sats

1.09k sats/share

the big question is: is the price per share sold updated for the sats they acquire? or do they just accept money at price X, buy as many sats as they can at day-end and that’s what gets added to the fund?

thanks angela! understanding mining def took me a long time to fully get. will think about how to explain it 🤔

hm good question. i don’t use Docker. what’s the user experience that having it containerized gets you? 🤔

so glad you're here terry!

would love to hear if this mempool vid i made fills in any gaps (or whats still missing if not?) https://youtu.be/uJXNWoqF8ds?si=LnNQhe3PmrB2oaxa

any time i have a concrete project to ship, i struggle 🤔

the gold market was thousands of years old 😉

looks like the gold etf took about 6y before really getting volume. source: https://www.marketwatch.com/story/how-gold-etfs-have-transformed-market-in-10-years-2013-03-29

no idea if the Bitcoin IPO will be similar, but generally speaking most IPO launches tend to spike, then fall flat/underperform for 6-12mo

donno if this helps with expectations at all, but may be good to keep in mind

Honestly i hate saving money but love watching my sats stack grow 🤔 nostr:note1e7xu4pxnaxyswjcn5d3g05lyhelcfdcj98mu25yfahtau6h0xmwqatdnq5

can someone explain to me why the ETF is more attractive to investors than the GBTC? like why is this a bigger deal than the GBTC listing?

one possible option for the nostr:npub1vmpf90hq56wzyxht6teg3llpa74rzcepw9suj5unxl3tph24zd4qgtxhm7 LARP boxes arrived today, wdyt?? 🍊

turned every head at nostr:npub1an84q6c03wml5lf0uwcqcr20ydwv0t0lvv0xktlcfs9seattef8sdhz6yg with that color https://video.nostr.build/ef1aa0be1be7efd832b8e7119081680f7e734662cd6298b4422938dbe57821e7.mp4