Re: the OpenTimestamps grant request, the problem is right now while the protocol scales in theory, the backend does not. It would be quite easy for a bad actor to DoS attack OpenTimestamps out of existence because I simply can't throw servers at the problem: the backend code just doesn't scale.

I need funding to put in a bunch of hours to fix this. So far, no luck in finding that; OpenSats is one of a few sources I've tried.

Frankly, I suspect that there isn't actually much interest in time-stamping.

Heh, I applied for a $20k grant to do a proper analysis of Nostr's decentralization on Saturday. Same idea (and similar cost) as my recent L2 Covenants article. Only took them one business day to reject it (took them 6 weeks to reject my grant request to keep OpenTimestamps running).

I'm not surprised. I strongly suspect there isn't much good to say about Nostr's decentralization and I hear OpenSats is funding a bunch of Nostr. Nostr needs a serious redesign.

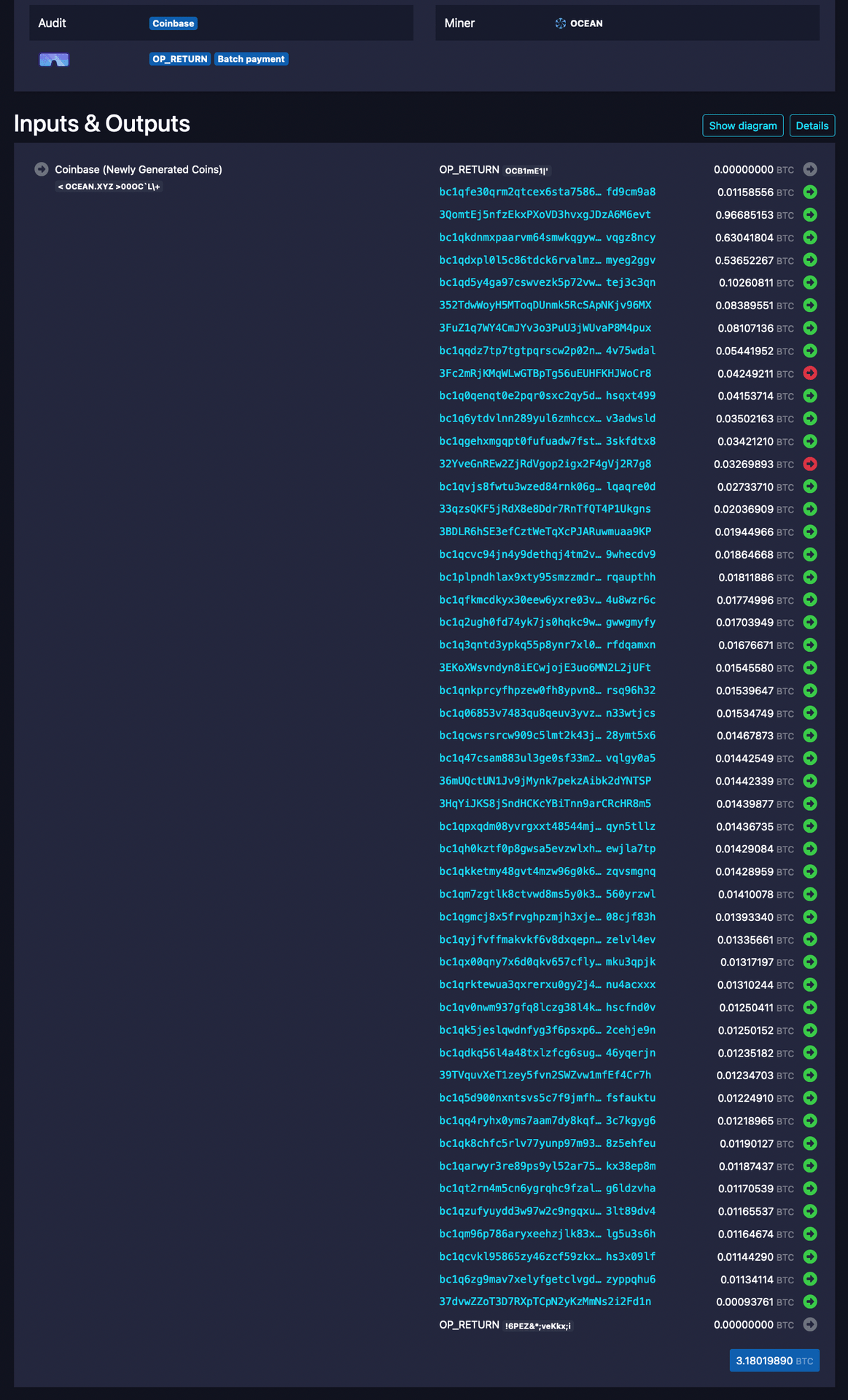

Who care? Coinbase payouts are a way to avoid custody risks. They don't make a pool decentralized. If anything they increase the cost for a pool's hashers to be decentralized as during high fees they're wasteful.

Lightning payouts are much more important than to hashing decentralization, as they make it possible for large numbers of small miners to get paid on time.

BREAKING: Bitcoin mining centralization.

OCEAN reaches 56% of unique miners receiving newly generated coins.

Our latest block paid out 50 unique Bitcoin addresses from the coinbase, meaning 50 people received bitcoins directly from Bitcoin itself, not from a middle man.

Over the past six months, 174 addresses have received bitcoin payouts direct from the blockchain.

97 of these were miners mining on OCEAN.

This is the way. Join the revolution. https://image.nostr.build/  d92872452c388990787660e1ff890c9e30df6e615506d020fd83df189819e93e.png

d92872452c388990787660e1ff890c9e30df6e615506d020fd83df189819e93e.png

This is not a great decentralization success story.

What we actually have is a pool mainly used by a small number of relatively large hashers. A real decentralization success story would be if the number of individual hashers was so large, coinbase payouts were completely impractical, and almost everyone was getting paid by Lightning.

Fact check: drinking exclusively kool-aid that you make for yourself is the best way to ensure a charasmatic cult leader hasn't poisoned it.

https://petertodd.org/2024/covenant-dependent-layer-2-review

“Soft-Fork/Covenant Dependent Layer 2 Review”

I've finally published my big article sponsored by Fulgur Ventures, analyzing all the main covenant proposals, and the L2 proposals that would use them.

tl;dr: Ark is pretty cool, and CTV is a good way to get it.

Someone made an audio book of my L2 article! Crazy.

Sure. But that's an upper bound. Hell, it's not even the real upper bound, due to non-btc protocols.

We just don't know without an economic analysis, which I was not trying to do. And economics isn't exactly all that scientific.

Nope.

Think of it this way: the ASP is loaning you money. But when they get the money back is not at the end of the next V-UTXO expiry: it's when the current V-UTXO expires.

amazing and comprehensive article by nostr:npub1ej493cmun8y9h3082spg5uvt63jgtewneve526g7e2urca2afrxqm3ndrm.

The only thing that I would add is that the analysis of how many channel openings or splicing are possible in a year is not so relevant.

The biggest limit is distribution of wealth, which is likely to follow a power law, which means that ~80% won't be able to afford an UTXO.

nostr:note1num4zp4qefrxtehc6gn8e7p0n43pcaawmkd0cctslvjz58lcvdqs5euxr9

Fees aren't proportional to UTXO value. So it's really hard to know at what price point will people be priced out.

All we can know with this kind of analysis is what is technically possible.

If the V-UTXO is about to expire, the ASP will get their liquidity back soon; if they're borrowing liquidity they don't need to borrow it for very long.

https://petertodd.org/2024/covenant-dependent-layer-2-review

“Soft-Fork/Covenant Dependent Layer 2 Review”

I've finally published my big article sponsored by Fulgur Ventures, analyzing all the main covenant proposals, and the L2 proposals that would use them.

tl;dr: Ark is pretty cool, and CTV is a good way to get it.

They just need to identify that you might have a Twitter account, and then show that you've been using a VPN. Which given their judicial standards, probably won't be hard...

Also, good chance they move on to banning VPNs outright anyway.

Detecting VPN usage is really easy. Most VPN protocols and services are trivial to detect based on packet analysis.

Banning VPNs is an extremely serious threat to a free society.

😂

Hardly anyone uses that term in that sense.

Legal immigration with high standards is fine, at least for the country allowing immigrants in. Arguably it's a bad thing for the world as it tends to lead to brain drains, depriving poorer countries of their talented people.

Obviously letting in millions of poor people with few skills, low intelligence, and violent cultures is a terrible idea.

Alternatively, Canadians. 😂

In a place like Canada they get called immigrants. At least they used too, when legal immigration had high standards.

Productive foreigners don't get called "migrants" or "illegals"