As the democrats are jumping on the bitcoin train, let's look at the relationship between AML and social justice.

Power asymmetries emerge more easily where consent is easiest to coerce. As long as we can manufacture opinion to an extent that serves our needs – such as the widely held belief that dragnet financial surveillance is necessary to maintain liberal democracy – dominance is imminent, particularly when it goes unnoticed.

This ignorance is AML’s superpower - so much so that a party vowing to end inequality can reconcile its commitments to policies that exacerbate the divide it allegedly aims to overcome.

AML is the systematic rounding up of entire groups of people for collective punishment for the doings of a few; in political philosophy, we call this fascism. AML is the opposite of social – and it definitely isn’t just.

84% of people view homelessness a very or fairly serious problem - but if you don’t have a home, you can’t get a bank account, and if you can’t get a bank account, you can’t get a home. Yet democrats continue to rally behind increasing AML/CFT regulations.

Last year, US financial institutions reported compliance costs of $85 Billion. Eight in ten democrats believe that efforts to ensure racial equality have not gone far enough, but the reason for racial inequality in banking – and therefore much of the rest of life – are increasingly exorbitant compliance costs raising minimum account requirements, keeping millions of households unbanked.

Politicians talking about Bitcoin may excite you, but we shouldn’t lose track of why we’re excited about Bitcoin.

Subscribe for free or read all issues online:

https://www.therage.co/rage-weekly-on-aml-and-social-justice/

GM, FATF has issued a new report claiming that „Virtual Assets are increasingly used by terrorist groups“.

The only problem: Their statement is directly contradicted in their own report and lacks any corroborating data to back it up, while highlighting that *a lack of data* – particularly for peer-to-peer transactions – remains a main challenge to FATF compliance.

Of course, that doesn’t stop FATF from recommending that all jurisdictions „act rapidly“ to implement the FATF Travel Rule, which requires ‚VASPs‘ and financial institutions to „obtain, hold, and transmit specific originator and beneficiary information immediately and securely when transferring Virtual Assets“ to address the „emerging and increasing risks“ which, again, cannot be corroborated by the report itself.

It is unbelievable that an organization with *such* low standards is being taken seriously at all, never mind allowed to guide the implementation of AML/CFT around the world.

Full Story:

https://www.therage.co/fatf-report-finds-virtual-assets-increasingly-used-by-terrorist-groups/

nostr:note13hxu9zvjkt5htrx9yf9wvht9pmkgxmndlv00m5kyzm0trhnecr3q9kev8a

GM, FATF has issued a new report claiming that „Virtual Assets are increasingly used by terrorist groups“.

The only problem: Their statement is directly contradicted in their own report and lacks any corroborating data to back it up, while highlighting that *a lack of data* – particularly for peer-to-peer transactions – remains a main challenge to FATF compliance.

Of course, that doesn’t stop FATF from recommending that all jurisdictions „act rapidly“ to implement the FATF Travel Rule, which requires ‚VASPs‘ and financial institutions to „obtain, hold, and transmit specific originator and beneficiary information immediately and securely when transferring Virtual Assets“ to address the „emerging and increasing risks“ which, again, cannot be corroborated by the report itself.

It is unbelievable that an organization with *such* low standards is being taken seriously at all, never mind allowed to guide the implementation of AML/CFT around the world.

Full Story:

https://www.therage.co/fatf-report-finds-virtual-assets-increasingly-used-by-terrorist-groups/

In case you missed it, nostr:npub1tr4dstaptd2sp98h7hlysp8qle6mw7wmauhfkgz3rmxdd8ndprusnw2y5g did a great interview with Andy Yen of nostr:npub18q57qr3t07qljnapzqldaqa7ru2qwfpfnjdrwvhk327n3sc82f0qqwrs6f discussing the design decisions behind Proton Wallet. Check it out:

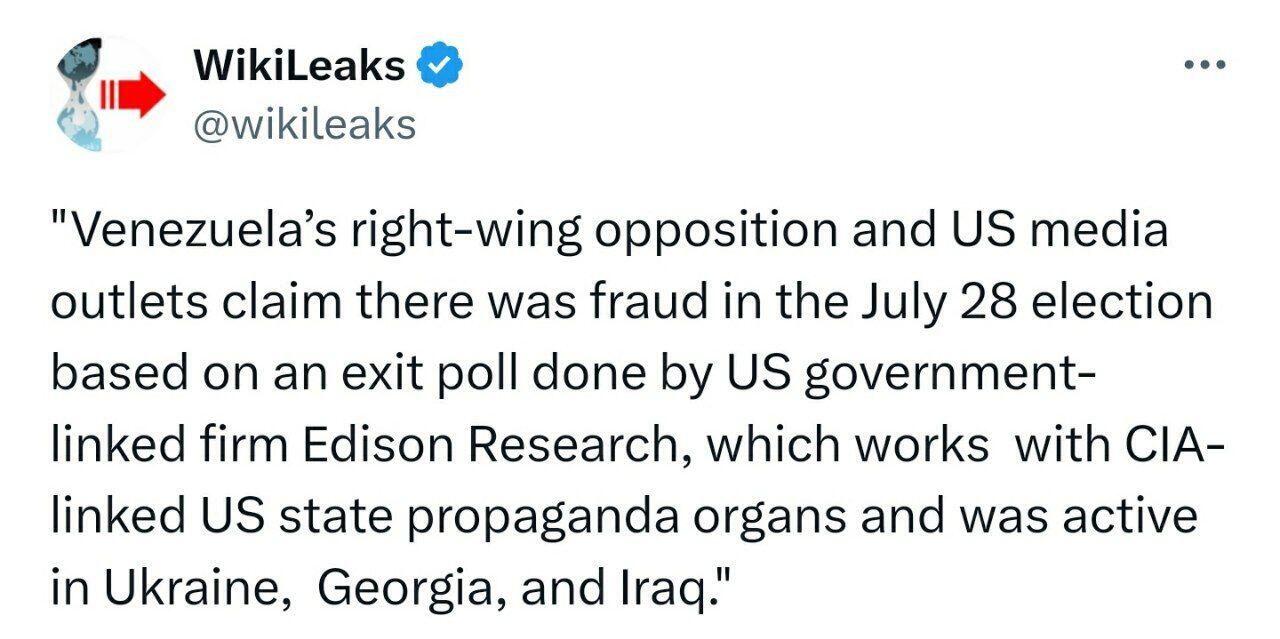

Congratulations to the CIA for winning the elections in Venezuela! https://video.nostr.build/64b09c279faa6c03144d26c6e68a4d7a734e03f0b6fb11c67c142a000dc80dfd.mp4

GM fellow money launderers, let’s start the week with some great news.

The House has passed the „Financial Technology Protection Act of 2023“, which will establish an „independent working group“ consisting of representatives from the CIA, the Department of Homeland Security, and the FBI as well as representatives from „Blockchain Intelligence“ to report on and propose regulation and legislation to combat the use of „digital assets and other relating technologies“ in money laundering and terrorist financing.

The Bill aims to „provide a forum for engagement between federal law enforcement and intelligence professionals, and private sector technologists and researchers“ – It’s primary concerns lie "with digital asset platforms that have 'substantially deficient' anti-money laundering programs that operate outside of the U.S.".

In case it isn't clear, the Financial Technology Protection Act is the fox guarding the hen house. If the Bill becomes law, we should all get ready for some extraordinarily „independent“ findings on the use of Bitcoin in money laundering and terrorism.

Full Story:

In my educated opinion your presidential elections are a joke

Those of you who have paid close attention to Trump's speech at Bitcoin 2024 may have noticed that the former President – accidentally or intentionally – appears to have given away a lot more on his plans for the future of Bitcoin than meets the eye.

Despite his assurances to protect open source development and self-custody in the US, Trump is first and foremost a national security president, highlighted by his remarks on terrorism and immigration. A loosening of AML/CFT laws, which currently see several open-source developers under indictment, seems unlikely (though a democrat law enforcement officer in the White House may arguably not do us any better).

During Trump's past presidency, the US passed the Anti-Money Laundering Act of 2020 as part of the National Defense Authorization Act, which increased penalties for AML/CFT offenses and established beneficial ownership requirements for LLCs to FinCEN.

While Trump vetoed the NDAA, it appears that he did not do so due to the AMLA2020, but rather because the NDAA kept Trump from his crusade to repeal Section 230 of the Communication Decency Act, which protects Internet Service Providers from liability for information hosted and transmitted.

According to Trump, Section 230 is a "national security risk" which "will make our intelligence virtually impossible to conduct".

If you had hoped that a Trump presidency would reduce the risks of developers being held liable for "illicit activity", you may do best in thinking again – "Broadcasting" 'illicit transactions' is precisely what Samourai Wallet currently stands accused of, which would hardly be arguable under the striking of Section 230.

Between incoherent ramblings on god, AI, and electric cars, Trump essentially used his 50-minute speaking slot to introduce The Bitcoin Dollar between the lines: a CBDC alternative to expand US hegemony beyond the petrodollar system directly into consumer wallets across the planet.

Don't forget that the vast space between your ears is intelligence's field of play. For Trump, Bitcoin is merely a tool to "extend the dominance of the US Dollar to new frontiers all around the world", and if his speech showed us anything, its that you are nothing more than another pawn at the end of the identity politics chessboard, where a banner hangs that reads: Congratulations, you’ve been played.

This Rage Weekly is out featuring a full opinion on the much anticipated Trump speech at Bitcoin 2024. Subscribe for free or read all issues online:

That's a really good point. I wonder if the state isn't already effectively outsourcing penal law to financial institutions – since the closure of an account is effectively a penalization, and in the case of AML without due recourse for the consumer – and what laws/legal exceptions would govern the export of government duties to private institutions.

Hi, thank you! Afaiu whats novel about their suggested approach is that they propose for this data to be fed into a ML algorithm shared across institutions (and likely jurisdictions) to build a „behavioral map“. Something like Palantir‘s Gotham comes to mind, which has been penalized/ruled unconstitutional in several EU jurisdictions as it recycles data collected for specific purposes. If you ever want to talk, my DMs are open ;)

Bitcoin 2024, summarized: cheering on politicians wanting to confiscate private property and build Billion dollar bitcoin reserves financed by your tax money. Who's the communist now, dumbfucks.

We all need to be very aware that what nostr:npub1sn0wdenkukak0d9dfczzeacvhkrgz92ak56egt7vdgzn8pv2wfqqhrjdv9 is describing here is not some distant dystopian future. It's our dystopian reality.

In May, Elliptic, together with researchers from MIT and IBM, developed a dataset to identify "the shape of money laundering" on the blockchain.

This dataset attempts to predict money laundering activity that has "not yet been labeled" by distinguishing between what the dataset defines as "anomalous signatures" and Bitcoin transfers between "licit services".

Falling out of these clusters deemed normal by intelligence financed corporations already leaves you penalized. Avoid KYC services? Flagged. Can't tie your transactions to a bank account? Flagged. Frequent user of coinjoins? Flagged.

You are already being debanked because a computer program has decided that you are a money launderer – not because you did something illegal, but because your transactions are deemed abnormal – and you have no legal recourse as suspicious activity reports swear financial institutions to absolute secrecy.

It's the full on criminalization of privacy in finance. The future is here, and it's Orwellian.

Back to our regularly scheduled content, here's your daily reminder that not even the Financial Crime Enforcement Network is convinced that AML measures are useful.

"I don't see how you store that much data securely, let alone analyze this amount of data. In this committee's conversations with former FinCEN leadership, they agree the data is overwhelming, and they called into question whether the Bank Secrecy Act reporting framework is useful at all."

You will be surveilled, and you will be happy.