[Rant]

If you're going to sell stuff and go "Bitcoin Only" as payment method, I'm -never- giving you any sats if you generate your invoices dynamically based on the BTC/FIAT rate.

The only way to have any credibility when going "Bitcoin Only" for payments is to have a price in BTC, period.

You can always adjust it manually when markets are volatile and (once a month or so), but otherwise pegging your BTC price to FIAT is just virtue signaling, so there's no point to not also allow fiat payments.

[/Rant]

Spent some time with my family.

Farmed some fiat.

Spoke with friends.

Lifted some weight.

Read some interesting stuff.

Played some BG3.

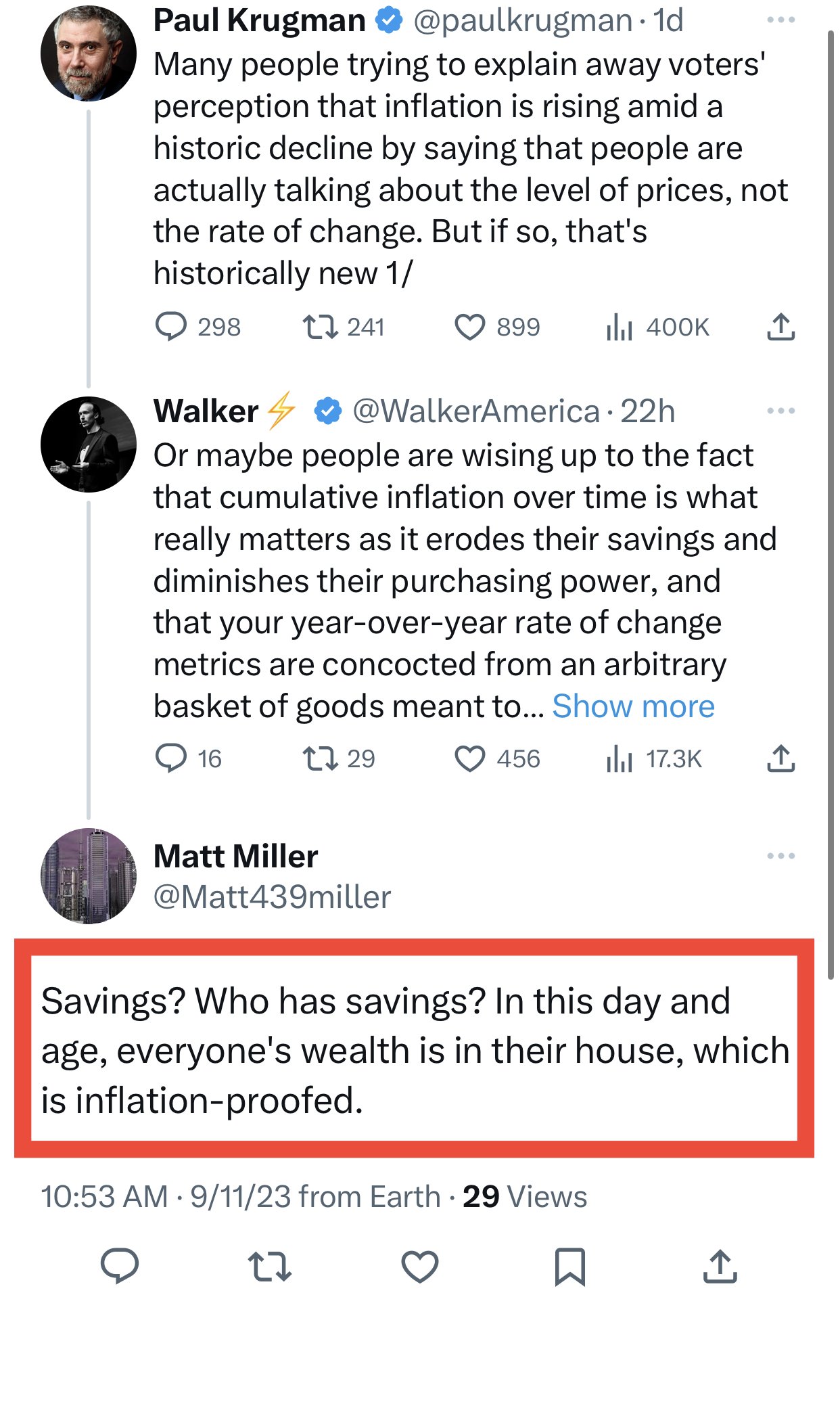

“Please Walker, buy a door handle from my house, I need to go get inflation-proofed groceries.”

-The guy with all his wealth in his house.

All up to date with my vaccines.

The Covid experimental stuff, on the other hand, I have no clue.

All my close relatives either said no, or stopped at 2 doses and admitted they got conned.

Some not so close relatives are going along with the program, but I don’t care about it tbh, so no idea if it’s 2/3/4 or more doses …

Welcome to … 80% of the world ?

As seen with the Covid Hysteria (and in plenty other subjects), the vast majority of people are just choosing the default option for anything in their lives.

I had thought that with matters of health, life and death, people would step up and actually think before making a decision.

But alas, even then the huge majority just complied with whatever was served to them.

Let’s hope the recent lesson awakened at least a few of them.

Not worried about either.

Last time I checked, ASICS chips were fillers for chip makers.

There are already plenty of ASICS plugged and unplugged, and I don’t see how any actor could:

A) pay enough the chip makers to get in the front of the line of production/deliveries, as they are competing with the like of NVidia and AMD.

B) find enough cheap energy to plug all these hypothetical ASICS

C) do it covertly enough so there are no repercussions, whether it’s social or economical.

And no, I don’t see how any country could justify politically to do this, unless they go full Bitcoin Standard, which has 0 chance to happen in any country that would have enough economical power to pull it off.

My Damus keeps crashing if I like a note with another emoji (long press like, then select -> crash). Anyone else?

nostr:npub1xtscya34g58tk0z605fvr788k263gsu6cy9x0mhnm87echrgufzsevkk5s

Nope (1.6 (17))

People should just ignore them. If enough people stop caring about what dystopian bullshit politician say, then their words have no power.

The faux-stuff made with poisonous substitutes like “seed oil solid paste posing as butter” is the very worst.

I don’t care about people eating what they want, but don’t sell me a food called by it’s historical name when what you serve me has basically no molecules in common with what you called it.

That’s the best monetary incentives under certain circumstances, however in todays market, when you compare nostr vs the “big players”, there are huge roadblocks to bring more creators :

-Scale: just look at the size of the reach people get on YT, Twitter, Etc. And look at the size of the checks they get either directly from the platforms, or from their sponsors (who pay for exposure)

-Bitcoin: as you rightly pointed out, not many people understand Bitcoin, or want to deal with the hassle to juggle with any currency other than their home fiat currency. And I’m not even going into the technical aspect for creators to learn, understand and apply self custody… What should be a strength is currently a weakness, imho.

-Big tech reliance : as we’ve seen with Damus and a few Bitcoin apps getting hassled by Apple regarding zaps, there’s nothing guaranteeing us that Apple and friends won’t use any bullshit excuse to remove the main nostr clients from their store if/when they decide having a true free market of speech with zaps (where they can’t get a cut) isn’t good for them, or getting tapped on the shoulders by government because “there are too much wrongspeak on nostr”.

Sure, there will always be the option to use nostr with a web-based client, however that’s another thing that gets in the way of mass adoption.

I could go on but you get my point.

If we rely on organic growth, I don’t expect it to takeoff until 10+ years (unless we roll out tons of features much quicker than I think is possible, without sacrificing relays’ reliability).

But I’ll ever stay bullish nostr just for the fact that’s it’s a protocol that could save our lives if/when governments decide to definitely kill free speech on the mainstream platforms.

Nostr is very good as it is.

The crux of the issue will always be : how are we bringing more users here ?

I agree with “If we build great stuff, people will come.”

However it’s very hard to compete with other platforms giving monetary incentives to content creators.

Most people will come if/when their favorite creator comes here.

So along with a better UX, I think we need to spend more energy/money purple pilling people with big followings if we want nostr to keep growing.

The fake accounts are coming to nostr, be careful.

First one I spotted is one for nostr:npub1xtscya34g58tk0z605fvr788k263gsu6cy9x0mhnm87echrgufzsevkk5s

If something moved/muscle strained, a good chiro with a couple of days of active rest should do the trick.

It’s fine Lyn, you can just use the profits from copies 1.000.000-1.100.000 for the Lambo.

This goldbug clearly didn’t even read the book, but that doesn’t stop him from crying the loudest and continuing to propogate “the solution” that leads to the perpetual break-down in society since time immemorial.

BTW, nostr:npub1a2cww4kn9wqte4ry70vyfwqyqvpswksna27rtxd8vty6c74era8sdcw83a’s book is my favorite read of the year if you haven’t noticed by now. If you’ve read it, or once you’re done, help her out, but more importantly help spread the Bitcoin message by countering idiots like this guy (review below). I think her book has the potential to reach a very broad audience and in a way that destroys many financial mantras since Bretton Woods.

I mean, look at this clown's reviews.

He even calls Saifedean, the author of the Bitcoin Standard, "Jeff".

You can picture him in his living-room, listening to Schiff's podcasts, polishing his gold and silver coins, while waiting for the world to come back 500 years backwards.