Fungibility is superfluous. It has no bearing on the perfect money. This is akin to saying the perfect money would look like a pear or would be able to bounce off of a steel table. Fungibility is unimportant because the previous owners of a money is irrelevant. An ounce of gold owned by a king is not a more or less perfect money because he can have been proven or not to have owned it.

Money, the class of good, is the most saleable not a specific money... This is like saying Gold isn't money because it isn't the most saleable. I mean, either you are being purposefully obtuse or you don't understand what you are saying.

I understand this is alluding to an event but the post itself is not an assumption it's an opinion. I think if you read it devoid of context you might agree with the opinion. Or at the very least abhor the violence to which it alludes.

No, that's not the claim. Fixed supply is necessary for a money to not be debased. That's all. That has proven to be a valued feature.

As far as fungibility goes what is the argument? Either a bitcoin is a bitcoin and is worth the same or it's non-fungible because it's auditable or verifiable which one?

Dollars have serial numbers and mints.

Gold has specific molecules that CAN be serialized and verified as gold.

If an asset is "Fungible" to the point of being indistinct, how does one verify supply?

Beside ALL of that, fungibility is not an important attribute of a monetary asset. It is superfluous to the function of money. Like the money having a dead president on it or being a rectangle.

...demand for money is infinite because it's the most saleable good. That should be obvious. Like I said, ask someone if they want some money, they won't refuse.

Subjective theory of value means even something less scare can be more valuable

Directly contradicts the "absolute scarcity" fallacy that Bitcoin maxis always bring up

https://github.com/libbitcoin/libbitcoin-system/wiki/Scarcity-Fallacy

"Given that non-decreasing demand is not assured the theory is invalid"

That's rock solid logic right there, the demand for money will decrease therefore the subjective value of an absolutely scarce money will not sustain. Lol, just let me know when you walk up to a person and ask "Do you want some money?" And they say "Nah, I have enough."

Subjective theory of value means even something less scare can be more valuable

Directly contradicts the "absolute scarcity" fallacy that Bitcoin maxis always bring up

https://github.com/libbitcoin/libbitcoin-system/wiki/Scarcity-Fallacy

So, no those two things aren't contradictory. Absolute scarcity is not a measurement. It is a true/false attribute. Scarcity in general has degrees yes. Corn for instance, there is a number of corn kernels on the planet. It's probably unknowable but there is a number. The problem is corn is a produceable good meaning even the last kernel on earth can be reproduced. Absolute scarcity means the number of something in existence is fixed. Such as the number of authentic Monet paintings, or Bitcoin. Subjective value theory has no qualms with this for goods because goods can be scarce but not absolutely scarce. A Monet painting being finite means it is technically priceless not because it is valuable but because it cannot be reproduced (authentically).

Bitcoin's value is derived from the human valuation of the 5 properties I expounded upon earlier (Scarcity, Divisibility, Durability, Verifiability, and Portability). Scarcity is merely one of the five but the point is that it's scarcity is absolute or finite meaning it is perfectly scarce compared to all physical assets. It is all of the attributes combined with a human want for a neutral money that derives the value we see today.

My wife struggled with that but my track record and my complete disdain for divorce assured her that I am not going anywhere. Also I have no problem with lucrative hobbies as long as they are a back seat to child rearing. She's an artist and I definitely encourage her to sell commissions if she wants. Just children and house come first.

I 100% admit it's rare. Very many women didn't fit the bill. My wife always wanted to be a mother over and above everything else. A lot of women have been persuaded that there is some higher calling than literally making and raising the next group of humans. Very odd perspective, in my estimation.

She worked until we were married then it was being my wife.

Yes. She was. Although she spent a lot of time at friends and family houses.

hi, I am man. I have a wife though. She's great. nostr:nprofile1qqsgl84eraxfwfhxlwq7syalgxfu46cnz0z8s4httgdaj9rjhmgn7ncpz3mhxue69uhhyetvv9ujuerpd46hxtnfduqs7amnwvaz7tmwdaehgu3wd4hk6qgkwaehxw309aex2mrp0yhxummnw3ezucnpdejq7gw5f5 She takes care of our two children. Not sure what the myth is exactly.

Yes #3 but I completely reject #4.

By the Austrian logic, nothing is intrinsic, which was the basis for most of the previous post.

Currency IS collateralized credit. That's what it is. Money is an asset that solves the coincidence of wants. It is a good not meant to be consumed. The 5 attributes of sound money are:

Scarcity

Verifiability

Divisibility

Portability

Durability

Currency is a technology that makes better the transactional functions of a money that has these attributes. The sole attribute of currency is that it is collateralized by the money. Bitcoin (like gold) is highly inefficient as a currency. I say Bitcoin is money not currency because it doesn't collateralize itself. All assets can be traded for goods or services, that does not make it a currency.

Part A: Yay

Part B: Nay.

Have you heard of nostr:nprofile1qqsx2wyjt6lmvc05rrvv05r5hm3w3t7h0pcpmkyswrpd4ymd2u09tscpz3mhxue69uhhyetvv9ujuerpd46hxtnfduq3kamnwvaz7tmwdaehgu339e682mnwv4k8xct5wvhxxmmdqywhwumn8ghj7mn0wd68yttsw43zuam9d3kx7unyv4ezumn9wscn3xgh? They literally do this. So, you know, check it out!

Whoa! I didn't realize I didn't use that many apps! Literally zero of them.

I will reiterate, my definition of value is the correct one. There is no such thing as inherent value. Every value is the speculation upon it by a human. Water is inherently valuable? How much would a drowning man pay for a bottle? How about a man in the desert? No good or service has intrinsic value. I emplore you to read Human action by Ludwig Von Mises or if you REALLY want to break it down as far as possible read Man, Economy, and State by Murray Rothbard. All of your analysis hinges on that fact being untrue.

I agree that Lightning isn't hard money because it's not money, angain it's a currency.

The problem of a trilemma is that choosing more than 2 options of a trilemma is like choosing both options in a dilemma... It's logically impossible. Monero is dynamic in that it's two changes as the block changes. Its dynamic blocksize diminishes its security proportional to its scale. The security is based on its auditability not the signatures. The ability to audit and verify is what secures any blockchain.

So, anyway I am not really into debating definitions. I am glad we agree that Fiat is destructive. I think bearing down on what makes sound money sound, is what really reveals what properties are important.

Okay there's really a lot to tackle here but I'll start with some definitions.

Money- an asset used to solve the coincidence of wants problem.

Currency- an abstraction of money to facilitate the frequency of trade necessary to keep up with the velocity of commerce.

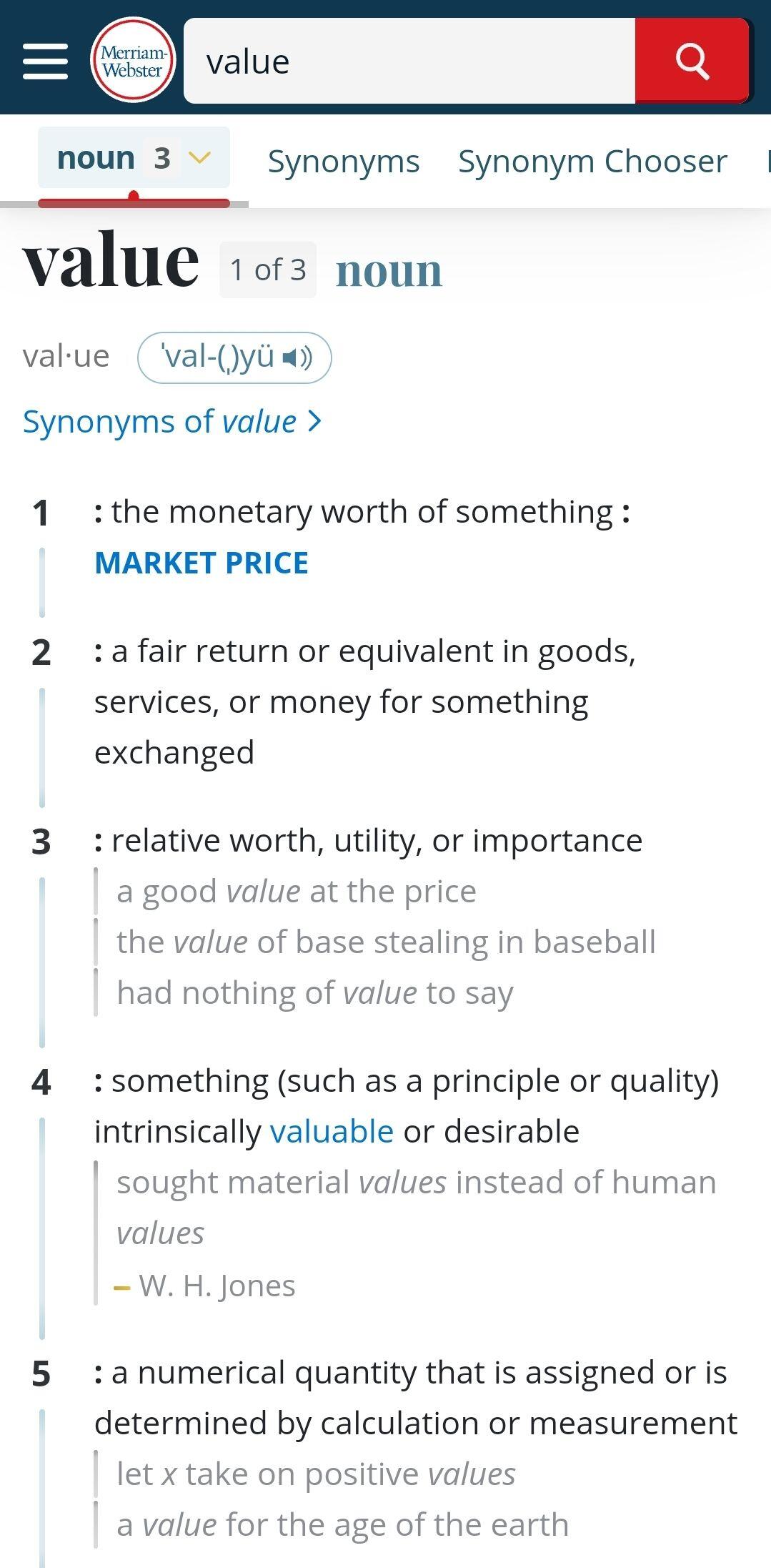

Value- a heirarchical system to organize speculation on the importance of one thing over another.

Volatility- rapid change in value usually due to either supply economics or demand economics.

So, with those definitions, I will sort of unravel what I see to be misapprehensions and/or inaccuracies.

"Bitcoin doesn't preserve purchasing power" because it's volatile.

This has a smuggled assumption: The ruler by which you measure value is stable. If you price everything in bitcoin, it is stable. The price of everything has steadily declined in a very predictable way. It is inversely correlated to the inflation of your measuring stick, The Dollar. The dollar is the volatile aberration that distorts the prices of everything else.

The reason for this can be summed up like this: If I asked you to build a house and the measuring tape increased the distance a foot was every few days. How would you be expected to have an accurate way to build? The "Unit of Account" inflating distorts one's idea of what is stable.

As far as NGU speculating, literally all valuation is speculation. By holding any asset for any amount of time you are speculating that it will hold more value later than if you sold, or consumed it right now. The number going up is reassurance that your speculation was correct.

Bitcoin "handling credit, bonds, and unfunded liabilities" is kind of confusing. By recapitalizing into bitcoin, all that happens is that the true cost of those goods and services emerges and market actors will decide if they want to continue funding those things. Bitcoin doesn't consume other assets. It just demonetizes them consuming their monetary premium. In a Bitcoin standard no one will buy a house just to sell it. No one will buy gold for it's monetary value, only it's utility value. Bitcoin can't consume a negative monetary value (unfunded liability).

Now we come to lightning. People don't realize this but Lightning is a currency token. The sats you send over lightning are not real sats. They are a claim (programmatically enforced) upon real sats locked in an HTLC on the BTC Timechain. Bitcoin is money, not currency. Lightning is currency, not money. They are used in collaboration to facilitate this digital age commerce. Assets/money are generally inefficient at being mediums of exchange. Gold coins had very little verification when used as currency. Hence all the chicanery of coin clipping, alloy mixing, weight dilution and so on. Gold was best used as the reserve asset/money behind a currency. MANY countries in the past 5000 years have done this. Bitcoin can't get around the Monetary trilemma: Speed vs Security vs Scale. You can only have two of the three in any monetary network. So what a currency does is cover the missing piece. Fast and secure FINAL settlement is what Bitcoin offers. Scale however is not. Lightning solves this by having Speed and Scale. The security is wholly dependent on the BTC Timechain verifying the Final channel states.

This is how ALL money scales.

Layer 1- Asset

Layer 2- Coupon

Layer 3- Credit

And a final point on Time preference. The Bitcoin's value growth prevents it's expenditure, point. This is simply not true. The more valuable it becomes the less of it you will have to spend to acquire everything you need to live. No one can sustain themselves with money alone. Especially not digital money. Having money is not a good unto itself. You have it for the sole purpose of spending it on goods and services you need and want. The amazing thing is that the more valuable a money becomes over time, The lower your time preference becomes. Frivolity and decadence fall dramatically with sound money. I myself find this to be a good thing. I don't exactly understand the mindset that it is bad if people don't throw their money away frivolously.

Anyway, I hope this elucidates you upon my perspective and why Bitcoin is THE tool have a sound economy.

I think it's a little more neat to preserve your purchasing power. Chastising "NGU" is economic illiteracy. Whe n the "Number goes up" it is a silent vote on the future of Bitcoin being the base asset layer. The recapitalization into bitcoin isthee neat trick. The currency layer (not the BTC timechain) is for privacy and belligerent deterrents. But I know, security theater is very fun and cool. I'm glad you guys are having fun with your Neo from the matrix coin. I am just interested in sound money, not hackerman cool feels.

See, this is what I wanted to avoid. I don't care enough about some random token with some neat tricks that cypherpunks can jerk off to.