So many easily avoidable mistakes made.

NEVER take a photo of your seed phrase

NEVER enter your seed phrase online

Also don't use a Hardware wallet that has online support that can "supposedly" access your bitcoin "account"

Do your research and understand what you hold.

Okay, so my custom configuration of For was giving Amethyst the business. I just selected a preset and things started working.

Nope, I reset it three times and I can't even zap you now. (I also can't seem to use the usual media servers.

Yeah, I did all the steps. Just when I go to zap it hangs or says people (that I have zapped from other clients) don't have connected wallets.

Do I just suck? I can attach my NWC to Snort, Iris, Primal, NoStrudel, and 0xChat. Why doesn't Amethyst like me? nostr:nprofile1qqsyvrp9u6p0mfur9dfdru3d853tx9mdjuhkphxuxgfwmryja7zsvhqpzamhxue69uhhv6t5daezumn0wd68yvfwvdhk6tcpz9mhxue69uhkummnw3ezuamfdejj7qgwwaehxw309ahx7uewd3hkctcscpyug Did I offend you?! Please let me zap my friends!

I never even thought about the strip clubs... Wow.

Having someone you trust feed you is better that having a faceless corporation feed you and probably better than feeding yourself for non-health experts.

Seems a little absurd from my perspective, but I would be a health expert in this scenario.

Although I see pretty much every real health expert saying "You can do this yourself by taking these steps"

So maybe the onus is on the bitcoiners to teach the laymen better than the faceless corporations, eh?

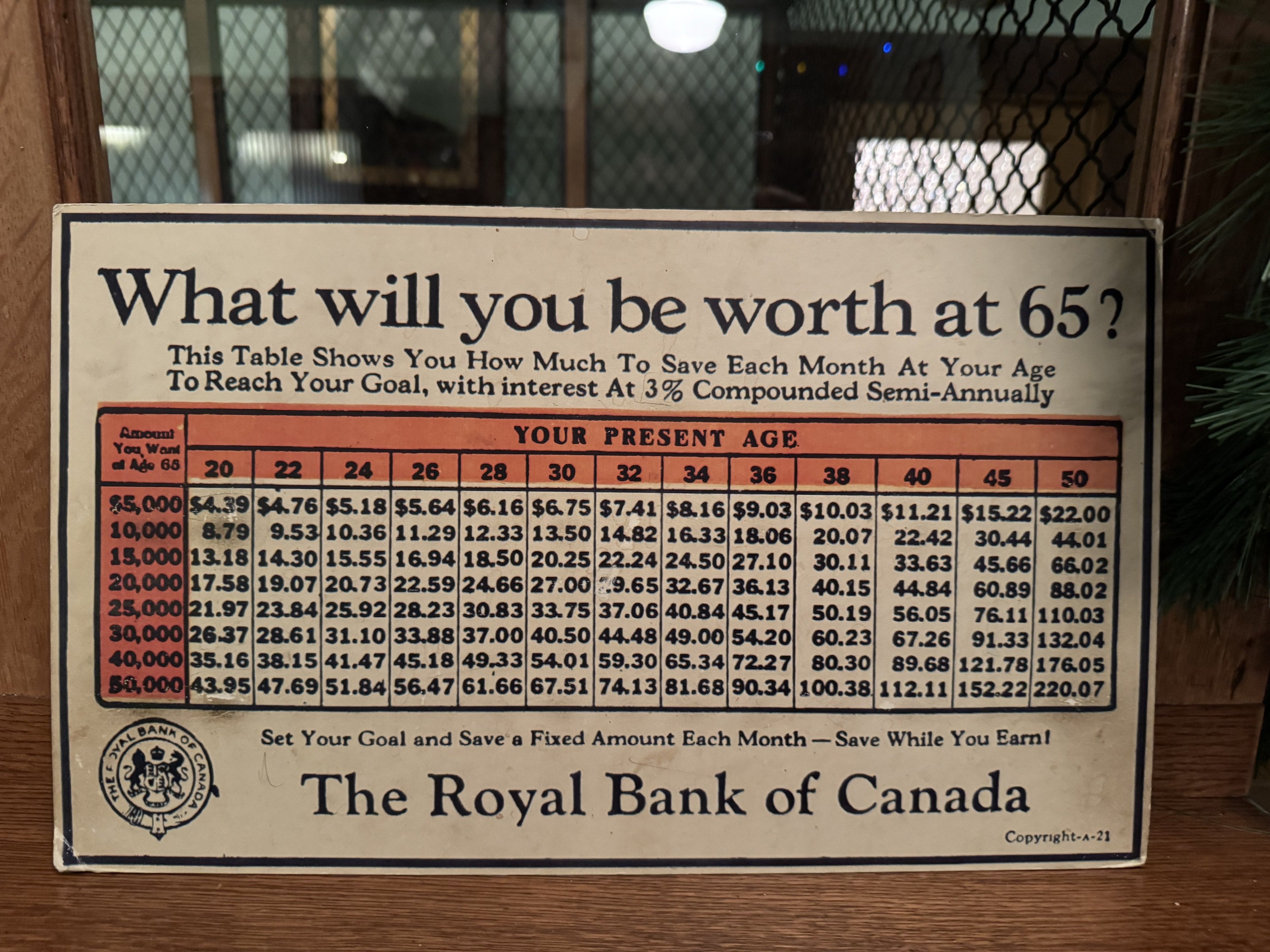

Started doing this in bitcoin at 30 at the $100,000 rate, I'm 36, I'm 60% of the way there. Happy stacking.

Some people will spend hundreds of dollars on BitAxe or variant, achieving less than 5 TH/s, when they could have a used miner with 10-20x the hashrate.

2.5TH/s for € 400,00 for NerdQAxe+

https://www.gobrrr.me/product/nerdqaxe/

1.2TH/s for 220.00 CAD for BitAxe Gamma

Buy 2, to get 2.4TH/s combined for about $300 USD

https://d-central.tech/product/the-bitaxe/

93TH/s for $300 for Avalon Miner 1246

https://kaboomracks.com/product/used-avalon-miner-a1246-93t/

Some providers of used S19s

https://www.asicprices.com/en/miner/antminer-s19

Note: This is not a testimonial for any of these vendors or products. Buy at your own risk. DYOR. DYOK.

I think it's more of a cost of operation analysis. At 15-17 J/TH 20w for 24 hours= 480w that's a 3rd to a 5th of the power consumption for 1 hour with an Avalon. Meaning the overall hash comes to 207,360 TH(with the Bitaxe) versus 69,120 TH to 115,200 TH for the same power consumption. Now you'd run you bitaxe for longer for that total but it is more efficient and cost effective.

How funny would it be if I just said "K"

To be honest, a lot of what you said is kind of gobbledygook. The bitcoin/ monero comparison is just kind of opinion stuff that we just simply disagree. Monero has all the 5 attributes of money I have stated before, no contention there.

As for assets, mediums of exchange, and a money being TOO valuable, I dunno it's a lot to kind of break down and there are again definitional issues.

Assets are goods, objects, or just property in general. Saying you are focused on medium of exchange not assets is kind of misunderstanding what the difference between a monetary assets and currencies are. The medium of exchange is a currency that is redeemable for the reserve asset. Focusing on a medium of exchange without establishing the reserve asset is exactly what fiat currency is. Gold not being redeemable for dollars is what makes dollars not a medium of exchange. It is the misapprehension that dollars are backed by an asset that keeps everyone in this delusion.

Also the problem isn't the rate of currency expansion, it is the mere ability to increase it arbitrarily.

As for bitcoin being too valuable, the fact that it is divisible kind of makes that a non issue. It's not as if you have to use bitcoin in whole numbers. So, I'm not really sure what that issue is. I mean "losing a bitcoin" is kind of a "well, don't do that" type situation. If you lost your car somewhere that isn't an argument against using a car.

As to your assertion that cryptocrurrency's (a moniker I despise BTW) goal is to solve a value problem, I don't see that as the issue exactly. Value is subjective so it's a very difficult thing to "solve" I think bitcoin, lightning specifically solves the debasement problem. (The arbitrary expansion of currency supply). The prominent currency of bitcoin, (not bitcoin itself) lightning, is smart contract tied in a 2/2 multisig contract. It is programmatically assured to be redeemable for bitcoin on chain. This is the solution to the fiat problem. Bitcoin is the solution to the technological problem of having the reserve asset be gold. Gold is heavy, not infinitely divisible, and can be hard(expensive) to verify with certain metallurgical tricks.

As far as the custodial nature of Lightning, it's just not true. People are lazy but it is not a barrier to entry to not have a custodian. You literally just run a computer. It's not insurmountable.

Boy, these discussions are a slog. I swear Mises and Rothbard wrote a lot of this stuff down already. (Minus the bitcoin that is) They might have mentioned Monero though.

Yeah, I think a lot of people use recognizable instead of verifiable. It just always sat with me as too ambiguous.

I mean, I hate to be pedantic yet again(sike I love this shit) but, a reserve asset is just an asset that is the preferred collateral for financial use. Global would be preferred by the world. If either weren't a global reserve asset they, by definition, wouldn't be preferred by the world and thus unimportant.

You do want monero to be important as I want bitcoin to be important. Reserve status is kind of the goal of all monies.

You don't debate facts. You debate opinions.

As to fungibility you are making a classification error. I can say: "All mammals have a nose."

This however does not mean that if an animal has a nose, that it is a mammal. The same goes for money. Many monies have a fungible nature. Not having this feature does not preclude it from being money. However if it is not:

Scarce, durable, divisible, verifiable, and portable, it can not be money.

You don't debate facts. You debate opinions. Facts are things that exist in reality. Opinions are interpretations of reality. I am fine with facts. I don't care what people use as money. If you look through the thread I spend about 99% of it defining terms that seem to not be clear to the counterpart. I have no Ill will nor do I have an incentive to pump any bags, I am doing just fine with my own financial strategies. I find monero memes funny and you guys fairly smart and privacy conscious people.

That being said, I do think that several factors like first mover advantage, network multiplier effects, absolute scarcity, adoption, auditability, and invested capital put Bitcoin in a better position to be a global reserve currency. I've said many times monero is neat. It is just in a very disadvantaged position to become a global reserve. That's all. That last bit is my speculation read: opinion. So you can debate that all you'd like.

It seems that at every turn you would like to debate facts. I am not really interested in doing that.

Okay so, you don't understand the phrase "Money is the most saleable good"

It means things that are money are more saleable than nonmonetary goods like soy beans. Money is a classification of goods that are used, not to be consumed but, primarily to be traded for consumable goods and services. This is called monetary premium.