High energy:

E-book patient Zero (a Joe ledger novel)

Podcast: Rick Glassmans's Take your shoes off

Low energy:

E-book Anatomy of the state Murray rothbard

Podcast: "what is money" by Robert breedlove

The only thing I do is thank them for the prorata donation. (Also, I don't think we are staying at 8 decimal places forever)

Man, I would love to quote d'anconia's speech from atlas shrugged but it's like 2 pages long and I am lazy but suffice it to say being selfless isn't really the goal most think it is.

Oh shoot! Are we supposed to tell everyone when you do that? Damn, I missed all the glory.

Just be careful. If they aren't above administering a poison to millions to combat a flu. They are certainly capable of releasing a pathogen that could kill millions. Be smart about your non-compliance.

Sure, I will try to write one up this weekend. I will look into the submission process soon to see how welcome to descent BM is.

You said it is currency, it is not, definitionally. Also this isn't a narrative. It is a fact based observation. Bitcoin literally cannot handle the financial transaction load unless abstracted to another layer. Money is an asset and capital. There's not distinction in kind between the two.

Haha, exactly.

Michael Saylor thinks #bitcoin is #capital, not #currency, and would like to see the world adopt the digital U.S. dollar as #money instead.

I vehemently disagree with his perspective.

My latest for nostr:npub1t8a7uumfmam38kal4xaakzyjccht4y5jxfs4cmlj0p768pxtwu8skh56yu.

https://bitcoinmagazine.com/takes/michael-saylor-doesnt-understand-bitcoin

Yeah, there's a bunch of misconceptions in this article. But a good heuristic for you might be that if someone is LITERALLY more invested in something than you, they might understand it better than you think.

The semantic "iT dOeSn'T sAy CaPiTaL in ThE wHiTe PaPeR?!?" argument is just a fundamental misunderstanding of money, capital goods, currency and financial systems.

Assets and capital are what determines final settlement. Is bitcoin settlement, final settlement? Yes? Then it's capital. Is lightning utilized as a medium for timely exchange to ease the use of the underlying asset? Yes? Then it's currency. Is there a promise to repay in exchange for interest or equity? Then it's credit. This is how money works.

MEGA '25: How Trump Can Make Ethereum Great Again In 2025

https://www.zerohedge.com/crypto/mega-25-how-trump-can-make-ethereum-great-again-2025

Ewwww

Michael Saylor thinks #bitcoin is #capital, not #currency, and would like to see the world adopt the digital U.S. dollar as #money instead.

I vehemently disagree with his perspective.

My latest for nostr:npub1t8a7uumfmam38kal4xaakzyjccht4y5jxfs4cmlj0p768pxtwu8skh56yu.

https://bitcoinmagazine.com/takes/michael-saylor-doesnt-understand-bitcoin

Bitcoin is a capital asset. It needs a currency to meet it's transactional demands. This is beyond debate. A digital dollar is stupid. A currency pegged to bitcoin is not stupid. Lightning, Liquid, and e-cash are currencies built on bitcoin.

If someone knows exactly where your bitcoin is, and your physical body is. It is easier to get that bitcoin. Research executive order 6102.

https://video.nostr.build/8809b0e0be76d98e9b447de11dac6d87e623573eeb54d3b47710bc246bf5fd69.mp4

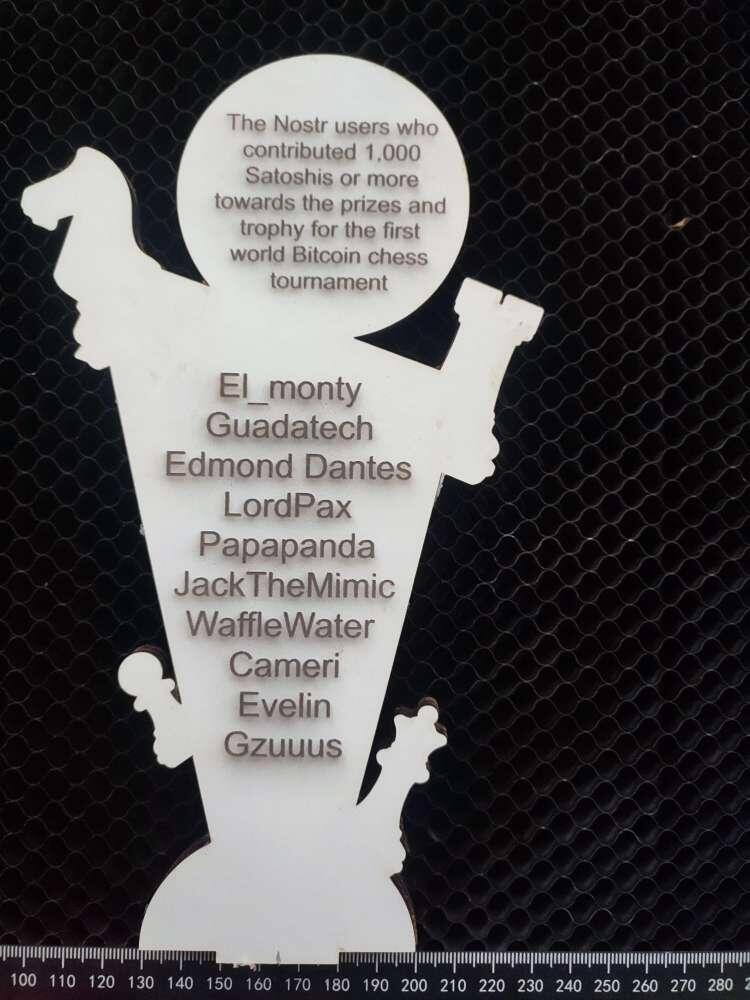

Recognizing the support of the nostr users who have made posible the first Bitcoin Chess Tournament in history

Cool. Happy to help.

Well, fiat is an "uncollateralized coupon." That's what make them so dangerous to use as a currency. Collateralized coupons are things like goldbacks or the lightning bitcoin tokens. Things redeemable for the underlying monetary asset.

She's making a classification error. You AREN'T holding any bitcoin when you have shares of an ETF. But single SIG is not the best hodling solution, but you own 100% more bitcoin than anyone with shares of an ETF.

Elon Musk Suggests Cognitive Testing For Elected Officials

https://www.zerohedge.com/political/elon-musk-suggests-cognitive-testing-elected-officials

Tests are a bad idea because of the ability to make partisan criterion.

No, money doesn't scale any other way. Collateralized coupons are how you use an asset most efficiently. Surveillance is up to you. Do you want a layer 2 coupon with a custodian? Then you've chosen surveillance. You use liquid or e-cash you have a multi-custodial model reducing surveillance. You use lightning you have the least surveillance and most control. Base layer assets can either be secure or a fast medium of exchange, not both.

That applies to anything though. So, don't give anything to your wife on Christmas and see how that does for your marriage.

Their names are Thunder and Lightning. Whether in dutch "Donder & Bliksem" or in German "Donner & Blitzen" just anglicized pronunciation. It's whatever is most heartwarming to you.

nostr:note1cjgp273ufmn30km0cgwda2gck67k9vpw7kgx59w4nhr9vdr0q34qpjvrpt

nostr:note1cjgp273ufmn30km0cgwda2gck67k9vpw7kgx59w4nhr9vdr0q34qpjvrpt