The question is if we were in their same seats, would we have done the same?

‘Grats Pete! Cafes change the world!

There’s still a lot of situations where not having a mediator might make commerce, think overseas vendors etc.

Don’t get me wrong I hate rent seekers like visa/mastercard and they need to go, but their networks actually minimize trust required with unknown vendors.

Immutable payments has trade-offs.

Having dispute moderating intermediaries is probably inevitable in many ways, it is a valuable service and does deserve a financial reward.

If your uber driver drops you off in the middle of nowhere or your airbnb guest trashes your place, these disputes have to be moderated somehow.

I think at some point there will be bitcoin payment escrows to facilitate commerce and we will likely pay for that service.

Strategic grift reserve

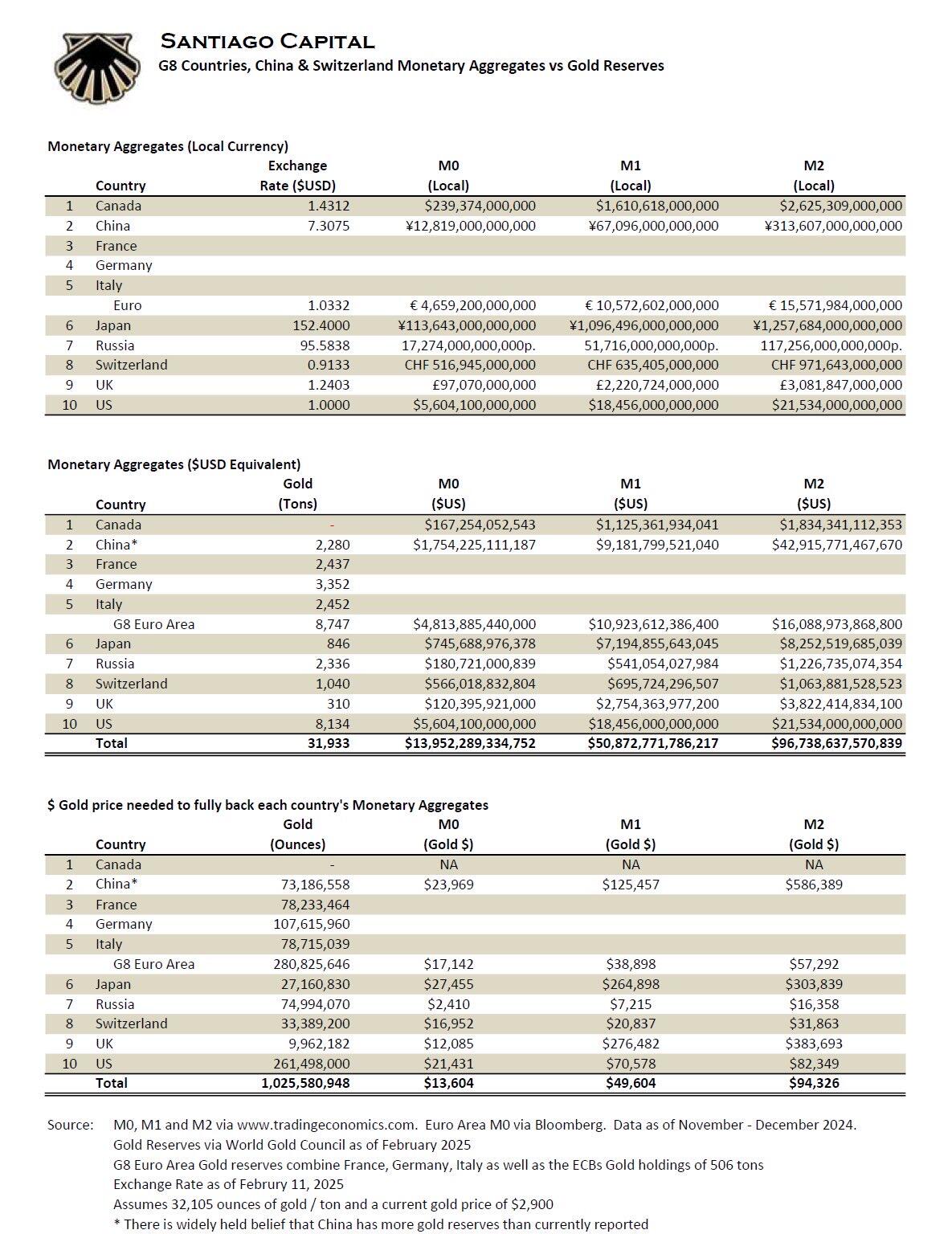

Canada’s selling off all of its gold in 2016 is pretty glaring, at the very least we consistently run a trade surplus which backs our economy, but one can’t help think of the long term ramifications and that we sold the bottom here.

GN

The Bear is the best series on TV right now.

Hi folks we've been experiencing some disruptions over the past couple days as we've been working to mitigate against an attacker who found and exploited a vulnerability in our system that allowed them to get password reset codes for accounts that didn't belong to them.

Using this exploit they were able to gain access to a number of accounts that they shouldn't have had access to and withdraw funds.

We've patched the issue and believe we've revoked the attacker's access to the compromised accounts by invalidating their JWT authentication tokens and NWC secrets.

We've instituted system-wide withdrawal limits as a precautionary measure while we work to fully restore and migrate the payment records of affected accounts.

If you are seeing a blank screen when you visit the Coinos site, you may need to visit https://coinos.io/logout or clear your browser cache. If you have Coinos installed as a PWA you may need to uninstall it and re-add it to your homescreen.

About 80 accounts had their passwords reset by the attacker but only a handful were actively stolen from. If your account was compromised you may be missing some recent transactions. We do have backups and will be writing scripts to find and restore those payment records over the coming days.

If you were using Coinos via NWC your NWC connection string secret may have changed in which case you will need to re-connect Coinos to your Nostr apps.

We'll be reverting unsolicited withdrawals and covering all losses ourselves to make all our users whole. Thankfully we caught the attack relatively quickly and managed to take corrective action before the attacker had time to fully drain our wallets.

Coinos is essentially a volunteer effort and one-man show on the tech front so please be patient as it's going to take me a few days to restore everything back to normal.

This incident has not shaken my resolve, only strengthened it.

Sincerely,

Adam Soltys

Cheers to the transparency, and thank you for the work that you do.

To those who don’t know, Coinos does have a self custody option to be able to pull down your sats on-chain which should be resistant to these kind of attack.

Hanging out nostr:npub19mf4jm44umnup4he4cdqrjk3us966qhdnc3zrlpjx93y4x95e3uq9qkfu2 Edmonton today cooking up ideas.

Yep, they’ve constantly been adding new features, ecash, NWC, self custody.

We use it for our POS at the cafe and it’s easily the best option out there.

So what’s all the hoopla about DeepSeek and why is it breaking everybody’s brain right now in Ai?

I’ve been doing a dive for a couple of days and these are the main deets I’ve pulled together, will have a Guy’s Take on it soon, so stay tuned to the nostr:npub1hw4zdmnygyvyypgztfxn8aqqmenxtwdf3tuwrd44stjjeckpc37q6zlg0q feed

DeepSeek ELI5:

• US has been hailed as the leader in Ai, while pushing fears that we need to be closed and not share with China cuz evil CCP and they can’t figure it out without us

• ChatGPT and “Open”Ai is poster child, eating up retarded amounts of capital for training and inference (using) LLMs. Estimates say around $100 million or more for ChatGPT o1 model.

• In just a couple of weeks China drops numerous open source models with incredible results, Hunyuan for video, Minimax, and now DeepSeek. All open source, all insanely competitive with the premiere closed source in the US.

• DeepSeek actually surpassed ChatGPT o1 on most benchmarks, particularly math, logic, and coding.

• DeepSeek is also totally open with how its thought process works, it explains and shows its work as it runs, while ChatGPT makes that proprietary. This makes building with, troubleshooting, and understanding with DeepSeek much better.

• DeepSeek is also multimodal, so you can give it PDFs, images, connect it to the internet, etc. it’s a literal full personal assistant with just a few tools to plug into it.

• The API costs 95% LESS than ChatGPT API per call. They claim that is a profitable price as well, while OpenAi is bleeding money.

• They state that DeepSeek cost only $5.6 million to train and operate.

• Capital controls on GPUs and chips went into effect in the past year or two trying to prevent China from “catching up,” and it seems to have failed miserably. As it seems China was able to do 20x the results per dollar with inferior hardware.

• The US model of Ai, its costs, its capes structure, and the massive demand for chips has been the model for assessing the valuation, pricing, and future demand of the entire Ai industry. DeepSeek just took a giant dump on all of it by out performing and spending a tiny fraction to achieve it while also dealing with lack of access to the newest chips.

All of this together is why people are freaking out about a plummet to Nvidia price, reevaluation of OpenAi, and the failure of US to stay dominant or even the legitimacy of staying proprietary as it may just cause us to fall behind rather than lead. All after a $700 billion investment was just announced that now just kinda looks like incompetent corporations wasting horrendous amounts of money for something they won’t even share with people, that you can’t run locally, and is surpassed by a few lean Chinese startups with barely a few million.

Even though it’s China, it feels bullish for open-source AI and by proxy, decentralization and humanity.

Great take.

I think another issue I took with her is that everyone she speaks about is a bad actor rather than (mostly) good actors working within broken incentives.

This deepens the hopelessness she spreads.

Part way through setting up my new nostr:npub12ctjk5lhxp6sks8x83gpk9sx3hvk5fz70uz4ze6uplkfs9lwjmsq2rc5ky #mk4 #coldwallet via nostr:npub1rxysxnjkhrmqd3ey73dp9n5y5yvyzcs64acc9g0k2epcpwwyya4spvhnp8 tutorial. While going through nostr:npub17cyatz6z2dzcw6xehtcm9z45m76lde5smxdmyasvs00r4pqv863qrs4ml3's pre-release limited edition workbook!

Didn’t realize I needed an SD card 🤦🏻♀️

Kudos to #BTCALLCAPS for being on standby.

You don’t technically need an SD card if you use NFC with Nunchuk wallet on your phone.

Ladies and gentlemen, your financial system:

We don’t “already use digital money”.

We use a spaghetti mess of antiquated systems duct-taped together of each other protected by monopolies and regulatory capture.

Bank drafts in Canada provide zero advantage to a personal cheque and are subject to the same hold time (5

business days)

Domestic wires take about 2-3 business days.

There is no way for an individual to transfer large amounts of funds (~$20,000+) without two days settlement.

In twenty twenty fucking five……

This is what we’re competing against 😂

I actually expected to be able to buy cheap sats in this scenario but I guess not.

I’m generally opposed to severe non-violent prison time, but it seems like consensus is that Ross’ sentence was disproportionately harsh and #FreeRoss day 1 is obviously the right thing.

I’m skeptical.

Similar cases (e.g., Le Roux) have received comparable sentences (life without parole). Reducing or going straight to parole might make sense, but a free pass based on time served might be an overcorrection.

Bitcoiners argue he advanced BTC viability and he’s a hero for this, which I don’t disagree with, but these contributions don’t erase wrongdoing in the eyes of the law.

Thoughts??

GN