Profile: dfa94a58...

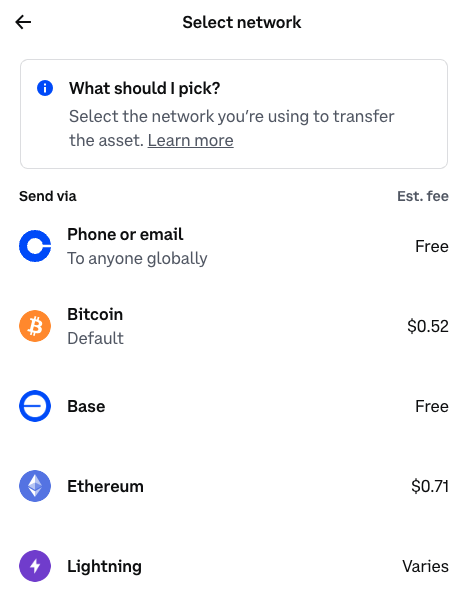

LN costs are a function of bitcoin network costs, as we saw during the jegs frenzy. LN became unaffordable to the unbanked. Bitcoin network costs will keep rising as demand increases on a fixed commodity. Will LN make the grade ?

This is extremely important. For 500 years mercantile plunder of the resources rich developing countries was unstoppable. When the jackals were called in a frigate or aircraft carrier arrived off the coast and the dissenting country was bombed back to the stone age. Relatively cheap missile tech, available to almost everyone, puts a stop to this. Brave new world, indeed. Now the mercantilists go bust.

I have to send a written , hand signed, id imaged , request to unlock my bank account, but I have to fax it !!! I literally cannot find a fax machine and can't be bothered with a software hack.

I think they're trying to tell me "you cannot unlock your acct" , without them actually saying it.

Btc self custody fixes this BS.

Treasury bill, or short-term US debt paper, has historically ranged between 15% and 20%. In recent months, this percentage of T-bill of total US debt has broken above 20% and it might well be on it‘s way to 25% (or even higher).

As institutions like pension funds are starved from getting long-dates securities, other have been buying the short end. Who? Banks, credit providers as well as the infamous US stablecoiner provider Tether.

Why is this significant?

This is covet yield curve control or yield supression because it supresses the long-end of the curve.

As a matter of fact, the yield of long-dated treasuries should actually be higher, about 100 basis points by conservative estimates.

The question we need to ask is how will the US get investors back into long-dated treasuries?

-Bring down short-term policy rates (significantly) to make long-end debt more attractive.

-Push for a recession to create save haven demand for long-term treasuries (beat steepener). Rather improbable, no?

-Go new ways. For example, as nostr:npub1s5yq6wadwrxde4lhfs56gn64hwzuhnfa6r9mj476r5s4hkunzgzqrs6q7z has explained, what if the US Treasuries were to back long-dated bonds with a Bitcoin component. Could this be enticing enough for regular investors to buy into long-end Treasuries?

40 year bond bull has turned. No finessing it. Years , maybe decades bear or even collapse.

Finititude of life ? Energy is neither created or destroyed, we are energy. We are forever. Just try and be decent.

Reading, resting, thinking, listening, watching, imagining , are those constraints ? Because whatever they are , they can bring great happiness.

In a geometrically expanding debt system where interest on debt owed on one loan must be paid from new debt, it is not possible to stop the debt expansion , except for some very temporaryy moments, unless you want to crater the economy. The choice is inflate to be moon ,and eventually hyperinflate, or crater the economy.

Holding a debt free instrument like bitcoin, you just have to be patient. Wait and the value will come to you.

Gradually , then suddenly. We are far closer to suddenly than gradually.

Rust must certainly be better than the current bitcoin dev language C++ . Linus Torvalds, inventor of linux and with kernel development, he is using Rust ! Linus is a legendary stickler for simplicity, efficiency and accuracy and reckons C++ is a nightmare that he wouldn't a touch.

One common complaint we hear from Nostr haters is that there is no economic incentive to run relays or that the network will be centralized in a few central big relays. These claims often come from confusion or misunderstandings.

I think this 40s video will clear all the matters and answer all the criticisms: https://cdn.satellite.earth/8e48f90f4889d6d8def300e9d843b9b353375426212f6b6253a8ee6aaaefcf07.mp4

If anyone doesn't understand or has a problem with this answer, please, I would like to hear it.

Well, well , well. Look familiar ? Bittorrent's bleep. It died , I think because the feds took over the bittorrent company and then killed off this idea. Probably too much if a threat ? There may be open source forks out there ?

"With BitTorrent Chat, there aren't any "usernames" per se. You don't login in the classic sense. Instead, your identity is a cryptographic key pair. To everyone on the BitTorrent Chat network at large, you ARE your public key. This means that, if you want, you can use Chat without telling anyone who you are. Two users only need to exchange each other's public keys to be able to chat. "

https://engineering.bittorrent.com/2013/12/19/update-on-bittorrent-chat/

Why can't torrents be used for social media ? We need intelligent clients using vast amounts of data moved around the network. The former is not the problem and torrents alread achieve the latter. Torrents also achieve storage redundancy giving resilience and state.

P2P can scale. Bittorrent. Massive.

Put the grunt work on the clients, let the relays/nodes just route and transfer the data.

I think his is correct. Everyone is a node/relay by default. Meshtastic meshnet radio works like this.

What about xmpp, bittorrent as base p2p network ? Proven for decades to be able to move tons of data. Bitrrorrent for years was more than 1/2 of all internet traffic. Still huge

How do xmpp nodes/relays work?. That seems to have held up quite well for years maybe decades moving rich data. I have wondered if xmpp should not be the decentralized rich data base standard. Or bittorrent ? Bitorrent moves vast amounts of data. We have proven , distributed tech. Caveat : I am no expert on this.

I like much of what Thatcher stood for, however, we should never forget that during her (and Reagan's) financial Big Bang they sold off many public utilities to their mates in Walls St and London, probably for pennies, and their deregulations set the stage for derivatives to go ballistic. To the point that they are now a systemic risk.

In principle, unless we have central directories, relays that are run decentrally by anyone with an interest in securing the peer to peer network , should be good

No ? I don't know the exact functionality of these relays. That functionality may be the problem.

All centralized media is now a waste of time. And extremely dangerous. We have to build the bittorrent/bitcoin of social media. I hope nostr is the start.

Starting a new , parallel market of economy, ideas, money, education and in the process defunding the current oligopoly IS the solution. Fighting a head to head war is the dumb option with no resolution except the deaths of billions.

Tim May knew :

https://theanarchistlibrary.org/library/timothy-c-may-crypto-anarchist-manifesto

How are relays different from nodes ? Bitcoin has nodes.

Social security is a huge Cantillon scam. The govt and their fascist cronyies on wall st get your money today at full value and give it back to you as inflated , devalued money sometime in the future. They throw you some bones from interest and investment returns, but the big returns go to Wall St. Anyone relying on Social Security when they retire is screwed.