So now we can go back to saying that nobody is *forced* to take bitcoin. I'm okay with that. And they're taking the IMF's money and pumping it into bitcoin. Sounds good.

That's great news. Thank you!

I say Pleb Mining with private energy sources like coal, wood, solar.

It doesn't even have to be profitable; just less expensive than the fees at the least expensive bitcoin ATM.

"Back in 2023- 2024 we were struggling to find EU bitcoiners who wanted to participate in the advocacy in defense of FreedomTech Bitcoin mining. We got support of few Czech, Italian, UK and American bitcoiners and grateful for our FreedomTech angels. [...] When you fight for your rights, you get results and rewards. [...] Our role was to share with Czech Parliament why and how the new technologies play important role in defense of human rights, elections , stabilization of the #grid, reducing pollution and building new energy infrastructure thanks to #freedomtech #bitcoin.

So instead of the EU commission’s approach to limit innovation in the #EU, we call to learn more, support its developers, miners and end-users."

This afternoon, I had an in-depth conversation with a local business owner who runs a long-standing, respected retail business. He barely made it through lockdowns, and now is getting crushed by inflation. His input costs have risen 3-5x. He's been saving in Bitcoin, personally, and now wants to do so for his business.

We're getting him started using nostr:nprofile1qy2hwumn8ghj7enjv4h8xtn4w3ux7tn0dejj7qg4waehxw309aex2mrp0yhxgctdw4eju6t09uqzpzkc78mcers3je3y9c520js4eymtyw5en40mjxl7fez89ckkat64azpmc6 to trial accepting Lightning payments. His 'Why' is crystal clear. Now it's just a matter of how.

I expect to see a lot more of this.

Is bitvora KYC? I just tried to create an account but it requires at least a verified phone number (I stopped at that step).

As long as he'll be using something custodial, might as well go for coinos.io and enable the automatic withdrawals with a low threshold.

Swiss Bitcoin Pay is also good (up to about 5000 USD per year without KYC).

Zaprite handles all the invoicing is non-custodial (and can also be connected with coinos.io (which is custodial)).

If he's just doing retail payments, he could just use his phone with Green. He might also use the Bullbitcoin app or Aqua (which can take lightning payments but convert them to liquid in the background).

The best is probably btcpayserver if they can run their own server or get technical help.

I would like that as well. I'm just not sure how it would happen. I can only go by my personal experience. I'm not tempted to buy quality things. If anything, I would be tempted to *make* quality things, but not buy. Health (and safety) are different though. For that, I'll splurge. Nothing worse for your freedom than being incapacitated or sick.

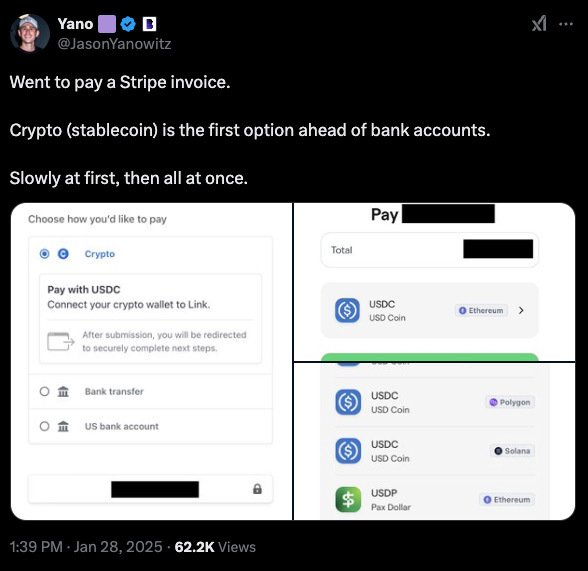

Stablecoins are the real CBDCs that the Parasites always dreamed about. I'm not surprised that stripe would treat shitcoins better than Bitcoin. And stripe is a middle-man. Bitcoin cuts through that. We can focus on simply having people use btcpayserver.

That's one of the problems I'm having now. Using nostr, I'm finding interesting content I want to share, but I then have to copy-paste that on simplex. Using something built on nostr would be more convenient. I just don't know how good of a job was done on the security and privacy of 0xChat and Keychat.

Not sure. I splurge on healthy food but for everything else, I tend to prefer cheap things because I know that by the time they break, my sats will be worth so much more that I can just buy another.

0xChat vs Keychat vs SimpleX ?

Any opinions on which one has the best security and privacy?

Spent the last six months putting people on SimpleX. If 0xChat or Keychat are better, I could try to convert some people. I told everyone that SimpleX was simply the best tool at the time but privacy apps built on Nostr might be better later. Are we there yet?

My understanding is that with Keychat, one needs to pay sats to chat. I'd be willing to do that if it's the best security and privacy model. But not sure how well that would go when introducing normies. It seems to me like it would slow down adoption. People can just run their own simplex relays for their private group so I'm not sure the economic sustainability argument by Keychat checks out. Dunno.

Opinions?

#asknostr

Anna’s Archive : https://annas-archive.org/

" 📚 The largest truly open library in human history. ⭐️ We mirror Sci-Hub and LibGen. We scrape and open-source Z-Lib, DuXiu, and more. 📈 42,295,586 books, 98,401,812 papers — preserved forever. All our code and data are completely open source. "

If you know anyone who has cancer, do them a favor and look up ivermectin and fenbendazole.

Steve Kirsch, Jan 23, 2025 : "In California, we've vaccinated more elderly people with the COVID vaccine than there are elderly people in the state"

"And we're not the only state to have accomplished this feat. New Hampshire is the US leader vaccinating 50% more people than there are people!"

https://kirschsubstack.com/p/in-california-weve-vaccinated-more

Yes, good point, Mullvad VPN. I would install the software and make sure to use the "kill switch" and "lockdown mode" options in the settings to make sure nothing leaves the computer without going through the VPN. I would also suggest using its multihop setting so you can choose different entry and exit servers.

Here are some privacy friendly browsers :

Brave

Librewolf

Tor Browser

Mullvad Browser

It really depends on what you're planning to do with the computer. How versatile do you need it to be, are you planning to generate keys with that computer, for how much money, etc. Depending on that, what you need to do will change.

However, usually, no matter what, I would choose full-disk encryption (during the installation, not only the home folder).

Afterwards, I would make sure it's up to date.

On ubuntu and related distros :

sudo apt update

sudo apt upgrade

Then I would check to make sure I don't have open ports that I don't use. For example, if you won't be printing, you don't need "cups". You can look at which ports are open with :

sudo netstat -lntp

Those are some pretty basic but important steps.

For anything major in the bitcoin world, you can either choose to use in combination with a hardware wallet or go with a disposable computer that will never go online and use it only with a live-dvd linux distribution.

I haven't seen the claim that it is a backdoor. Could you please point me to where you read that?

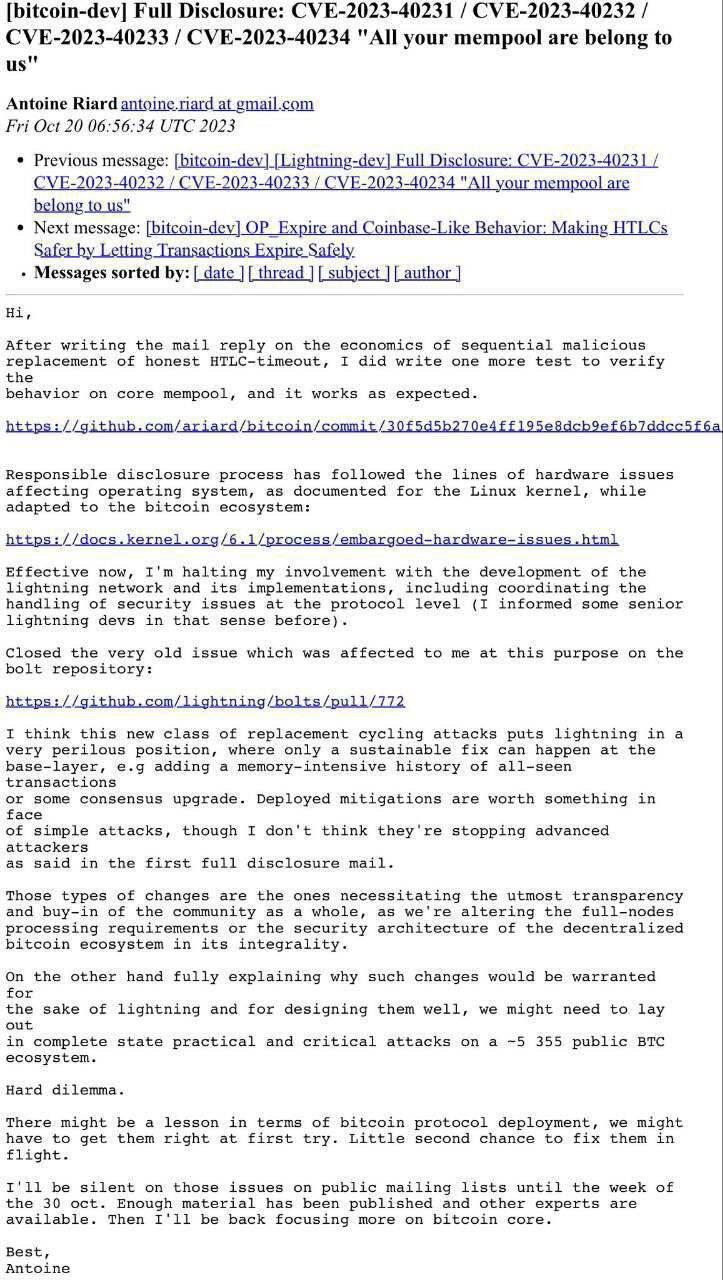

My understanding is that he has found out about a potential way of attacking the lightning network which the current mitigation strategies that have been implemented recently don't fully cover.

I don't know how much of a problem those attacks really are.

I believe they are discussing that option. (However, I've personally had a spotty experience with simplex with some messages never coming through. It's still pretty new.)

I would like that, but only when the devs have had time to figure out how to fix the following problem (and "staab" listed many proposals in his July 31st comment) : https://github.com/nostr-protocol/nips/issues/107