Met nostr:nprofile1qqs0renpxauhyp5u7202jed436v6h6ycsm8pgvccxwnqqufmvevqwmgpr3mhxue69uhkummnw3ez6an9wf5kvtnnd3hhg6re9emkjmspz3mhxue69uhkummnw3ezumpsxpczummjvufvzvjn today at a market - asked him to write me a poem about Bitcoin - check it out! Also got him on nostr:nprofile1qqs9xtvrphl7p8qnua0gk9zusft33lqjkqqr7cwkr6g8wusu0lle8jcpp3mhxue69uhkyunz9e5k7qg4waehxw309ajkgetw9ehx7um5wghxcctwvsrrnrxl ! Send him some ⚡ ! #introductions

https://blossom.primal.net/e30fc45c808520413f1615a06b909ceb9d1843b627eaaedba644fbac238fd309.mp4

He needs to accept the orange coin.🧡

He doesn’t reply much.

I doubt you will be going back my way though. Enjoy Austin and safe travels.

If I had known you were traveling from Mobile to Austin you could have stopped by and said hello. 🧡

😂

Where have I heard this before? 🧐

Charles Schwab CEO confirms that only $25 billion (.23%) of their clients $10.8 trillion in wealth is currently invested in Bitcoin.

Bullish

That’s why God gave us 2 ears and only 1 mouth.

Bitcoin Realized Cap just crossed $1 trillion in value for the first time ever. 🚀

Shitcoin season has arrived. 🤮

You are a brave one sister!

Blackrock’s IBIT has taken in over 25,500 BTC alone over the past 5 trading days.

People keep saying retail isn’t here yet. Retail has been here since the ETF’s launched. It’s just been a different type of retail investor.

The retail people are looking for are largely going to ape into shitcoins. Seems that trend began this week.

Wow! Didn’t know sub 1 was even possible.

Damn. But why mempool so empty?

$120k broken and shorts are getting destroyed. 🔥. Up we go. 🚀

New All-Time high on a Sunday Fun Day $119,340. 🚀

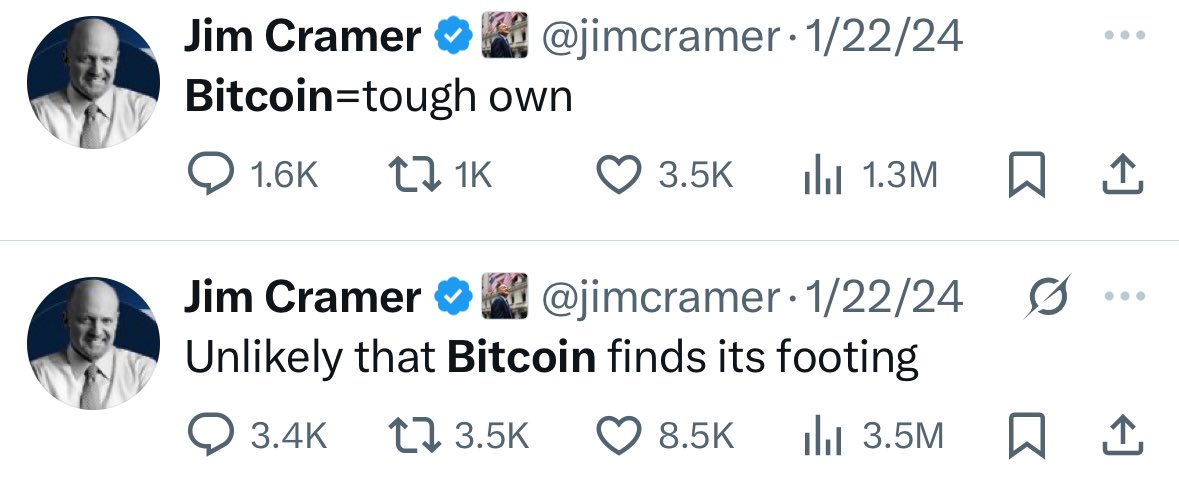

Thanks for your service, Jim.

The Cramer Indicator never misses.

Shared via https://pullthatupjamie.ai

Wall Street shill.

True. If Powell steps down inflation will go through the roof.

Inflation through the roof once Jerome is gone.

The new Samourai Wallet indictment truly is a phenomenally disingenuous piece of garbage 👇

https://www.therage.co/samourai-wallet-new-indictment/

Likely filed to reflect that the Government is no longer pursuing federal licensing violations – the new indictment removes all references to “unlicensed,” except one – SDNY seems to have taken the opportunity to make their indictment even more confusing to the judge.

Entire paragraphs are moved around, language is changed, and most importantly, the new indictment seems to make zero distinction between Samourai Wallet the entity and Samourai Wallet the software.

Take these two paragraphs for example, the first from the original indictment, and the second from the new one:

"The cryptocurrency is 'cut down'", and leftover funds "are placed in a separate address and provided back to the Samourai user."

"Samourai 'cut down' the cryptocurrency into correct sizes for a chosen pool," and "Samourai returned back to the user any leftover funds from this transaction that were too small to enter the Whirlpool by replacing them in a separate address.”

So instead of correcting their technical inaccuracies, SDNY chose to double down on them.

Imo, this means that prosecutors either somehow managed to get even more stupid over the past 1.5 years, or that SDNY is intentionally attempting to mislead the judge on how the Samourai Wallet software worked, making it look like the developers had more control over funds than they did in reality.

They call this “justice,” my guys.

Fuck SDNY

There are some bitter, hateful people on #nostr.

Stay happy my friends. Dont take life too seriously.

🧡🧡

Wait and see mode for me, but I’m skeptical.